Senate OBBBA Violates House Budget Instructions

The latest Senate version of the One Big Beautiful Bill Act (OBBBA) would likely add roughly $4 trillion to the national debt, including interest.1 The Senate bill would also violate the House reconciliation instructions, which require either $2 trillion of gross savings or dollar-for-dollar reductions in tax cuts.

In this piece, we estimate:

- The House-passed reconciliation bill meets the House reconciliation instructions, exceeding the required spending cuts and tax cut adjustments by $400 billion.

- The original Senate reconciliation bill would violate the House reconciliation instructions by about $100 billion.

- The latest Senate reconciliation bill appears to violate the House reconciliation instructions by more than $500 billon.

- All versions of the bill would add trillions of dollars to the debt, with the current Senate version increasing borrowing by roughly $4 trillion before extensions.

The Fiscal Year (FY) 2025 concurrent budget resolution includes instructions to individual committees, including $4.5 trillion in allowed borrowing for the House Ways & Means (tax writing) Committee and a combination of minimum savings and maximum borrowing levels from ten other committees.

But the House also includes an aggregate floor for spending cuts, which requires that the seven committees with deficit-reducing instructions generate at least $2 trillion in combined savings, or else instructs the Chairman of the Budget Committee to reduce the allowable Ways & Means borrowing dollar-for-dollar.

Effectively, this means that the difference between gross savings (mainly spending cuts) and Ways & Means borrowing (mainly tax cuts) can be no higher than $2.5 trillion – the amount the budget resolution has incorrectly claimed it can achieve from faster economic growth. $1.5 trillion of spending cuts allow for $4 trillion of tax cuts, $1.6 trillion of spending cuts allow for $4.1 trillion of tax cuts, and so on, up to $2 trillion of spending cuts for $4.5 trillion of tax cuts.

This rule and adjustment mechanism was included in the concurrent budget resolution that passed both chambers of Congress, and over 30 Members of Congress twice affirmed their support for it in two letters conditioning their support for the bill on adherence to these instructions.

Although the House-passed reconciliation bill would add far too much to the debt, it not only satisfied but overachieved on its instructions. The House bill includes $3.8 trillion in tax cuts and $1.6 trillion in gross spending cuts, for a net impact of $2.2 trillion. It also includes an additional $0.2 trillion of spending outside of this mechanism, bringing the total primary deficit impact to $2.4 trillion.

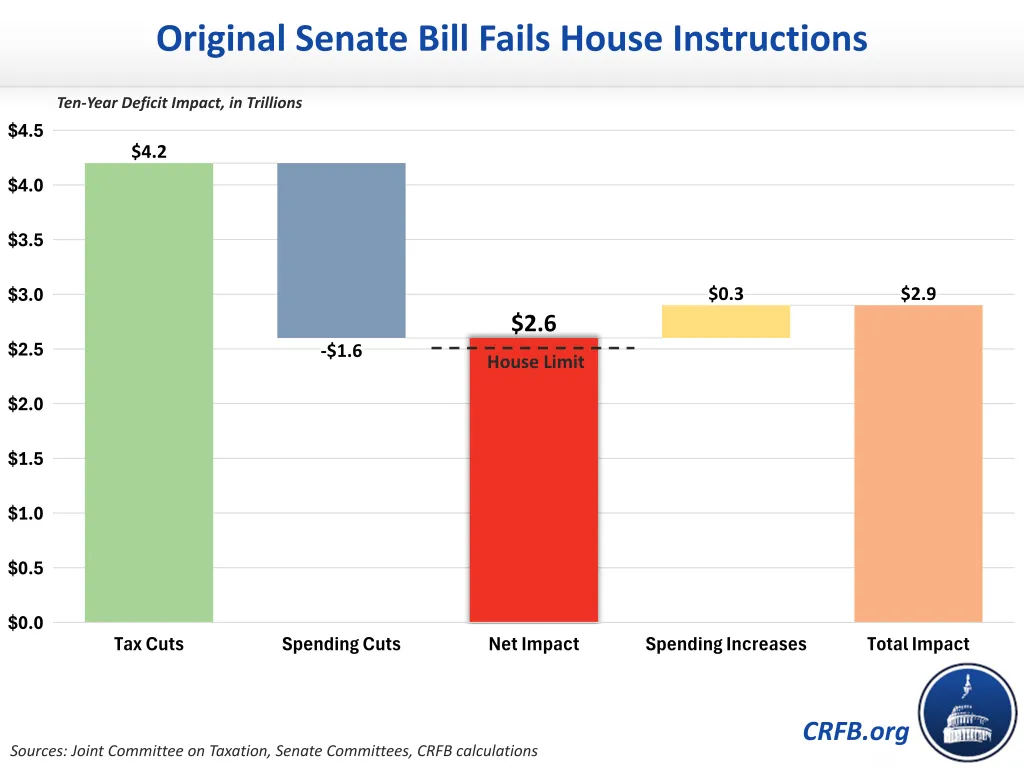

The Senate bill, however, would fall well short. We estimate that the original version included $4.2 trillion of net tax cuts within the Finance Committee and only $1.6 trillion of spending cuts. The net impact of $2.6 trillion is about $100 billion short of what is required – and the bill would increase primary deficits by $2.9 trillion after taking spending increases into account.

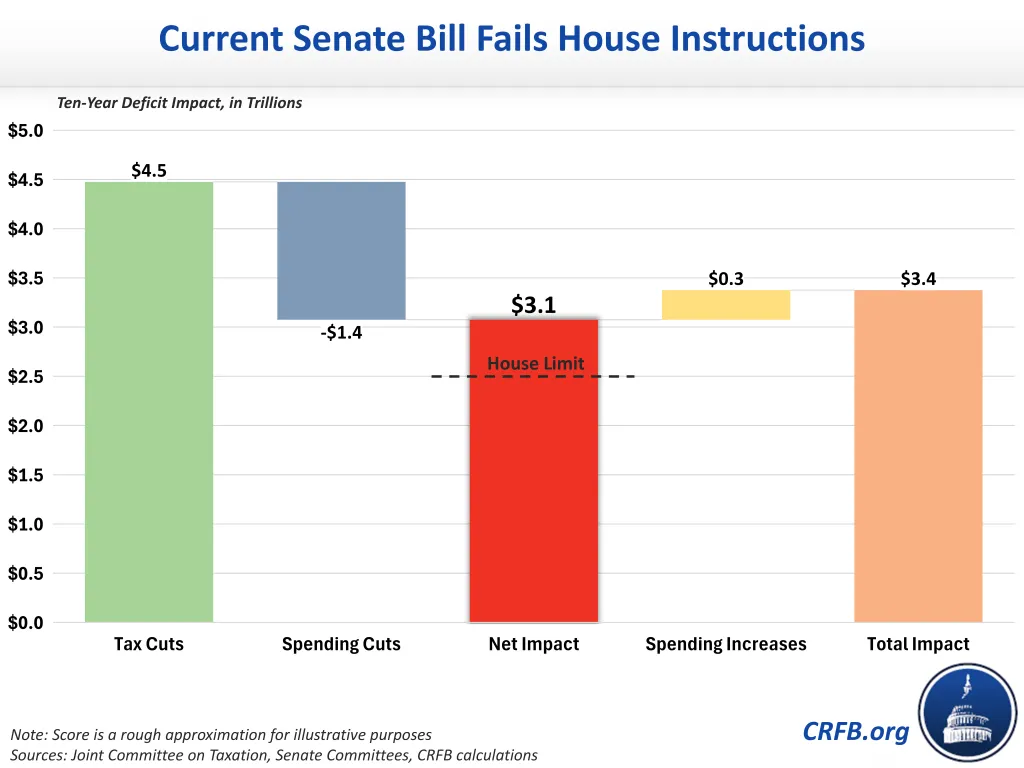

The latest version falls far shorter of the House instructions. Compared to the original version, it includes new tax cuts (such as an increase in the SALT cap) and fewer spending cuts (including overall health care savings). Although we are still conducting a full analysis of the bill, it appears to cut taxes by nearly $4.5 trillion and reduce spending by about $1.4 trillion. Although these numbers may change modestly as we continue to analyze the policies, the Senate bill likely violates the House instructions by $500 billion or more. Total primary deficits could rise by $3.4 trillion under the bill.

As currently written, the Senate bill would borrow hundreds of billions of dollars more than allowed under the House reconciliation instructions. The Senate should not pass such a massive amount of borrowing, and the House should not consider such an egregious violation of its rules.

1 We recently estimated that the original version would add $3.5 trillion to the debt and that a version that includes new rumored agreements and removes rather than modifies all provisions that violated the Byrd rule would add $4.5 trillion to the debt. Today’s legislation falls somewhere in the middle. $4 trillion is a rough estimate.