SCOTUS Tariff Ruling Could Add $2.4 Trillion to the Debt

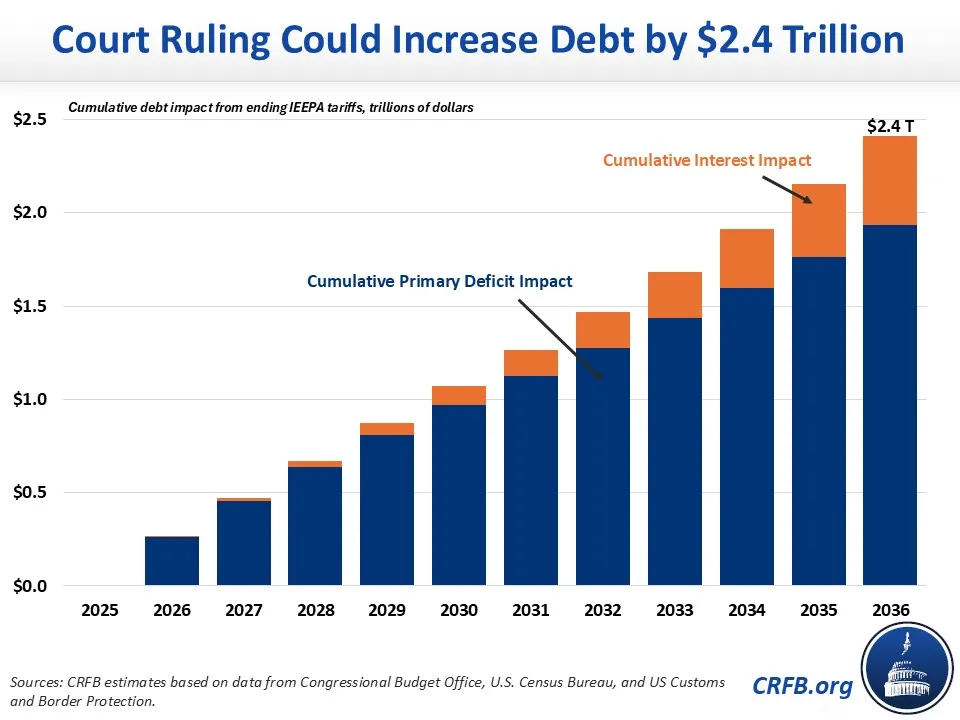

Today the Supreme Court ruled that the International Emergency Economic Power Act (IEEPA) does not authorize the President to impose tariffs. We estimate this will reduce revenues on net by $1.9 trillion through Fiscal Year (FY) 2036 and increase debt by $2.4 trillion over the same period, on a conventional basis, assuming past tariffs are refunded and none of the revenue is replaced.

The President has indicated intention to impose a 10% global tariff using authority provided by Section 122 of the Trade Act of 1974. We will provide an estimate of the fiscal implications once further details are announced.

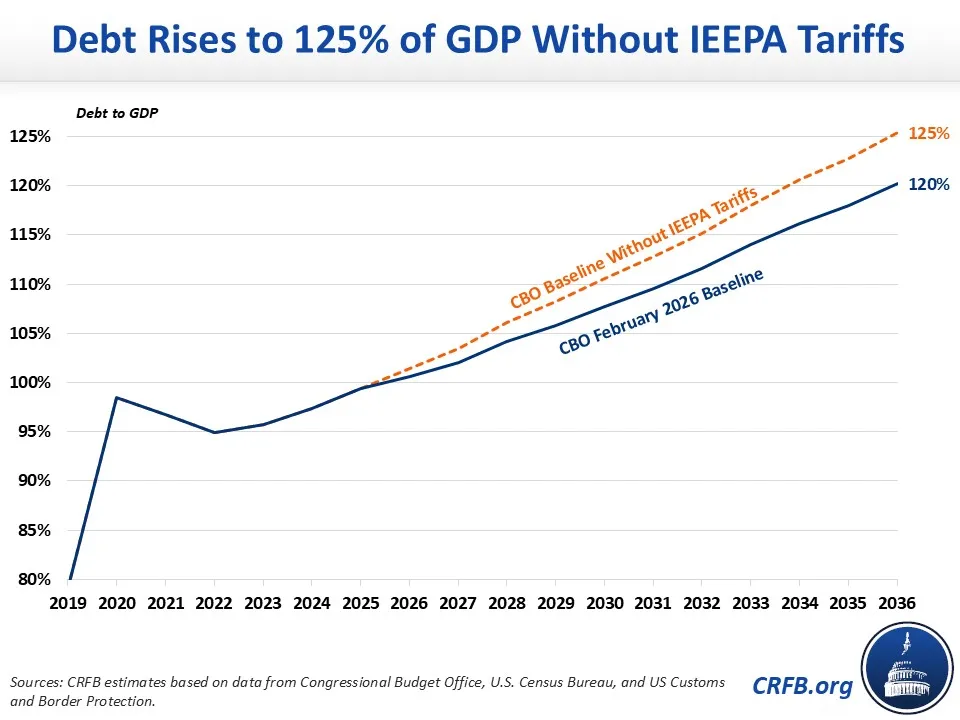

With the Supreme Court ruling these tariffs illegal, debt could rise to 125% of Gross Domestic Product (GDP) by 2036, compared to 120% under the Congressional Budget Office’s (CBO) latest baseline. Deficits could rise to 7.2% of GDP by 2036, compared to 6.7% under CBO’s baseline.

Importantly, our estimates assume that already-collected IEEPA tariffs will be refunded. However, the Supreme Court did not weigh in on this decision, only saying the “The United States may be required to refund billions of dollars to importers who paid the IEEPA tariffs,” and acknowledging that the process is likely to be a “mess.” Absent these refunds, we estimate the court decision would increase projected debt by $2.2 trillion through 2036.

Other estimates of the fiscal impact of the ruling are similar but somewhat lower than ours. Through 2035, we estimate the court ruling will reduce projected revenue collection by $1.8 trillion. Over that same time period, Yale Budget Lab estimates the Court ruling will decrease federal revenue by $1.5 trillion and Tax Foundation has estimated that IEEPA tariffs would have increased federal revenue by $1.5 trillion.

While CRFB’s IEEPA estimates are higher, this is likely due to our modeling differences and adjusting for data from U.S. Customs and Border Protection (CBP) that shows the share of IEEPA tariffs may be higher than what models suggest. For example, CBP data shows “Section 232” tariff revenue as roughly a quarter of combined IEEPA and Section 232 tariff revenue so far this fiscal year.1

Conventional Estimates of Net Tariff Revenue Impact through 2035

| IEEPA Tariffs | Legal Tariffs | Total Tariffs | |

|---|---|---|---|

| CRFB | $1.8 trillion | $0.7 trillion | $2.5 trillion |

| Yale Budget Lab | $1.5 trillion | $1.2 trillion | $2.7 trillion |

| Tax Foundation | $1.5 trillion | $0.7 trillion | $2.2 trillion |

Sources: Committee for a Responsible Federal Budget, Yale Budget Lab, Tax Foundation. Note: Estimates reflect new tariffs enacted by the current Administration. Yale Budget Lab estimates do not include 2025 for “Legal Tariffs”.

Importantly, the Administration could potentially use other authorities to replicate much of the IEEPA tariffs, such as Sections 122, 201, or 301 of the Trade Act of 1974; Section 232 of the Trade Expansion Act of 1962; or Section 338 of the Tariff Act of 1930. Though it remains uncertain whether, how quickly, and to what extent such authorities will be deployed. Congress could also enact the tariffs legislatively, or replace lost revenue with other tax or spending alternatives.

The fiscal situation was already unsustainable under CBO’s latest baseline, but the outlook is now materially worse following the Court’s ruling on IEEPA tariffs. Lawmakers should act quickly to replace this loss of revenue and begin reducing deficits; they have plenty of options.

1 Based on CBP data as of December 14, 2025.