Reconciliation Unlikely to Produce $600 Billion in Dynamic Revenue

Policymakers are claiming their $3.5 trillion reconciliation package will be fully paid for by counting on $600 billion of dynamic feedback on top of $2.25 trillion of revenue increases and $700 billion of drug savings. However, we expect official estimates are likely to find much less in dynamic gains, and possibly even dynamic losses.

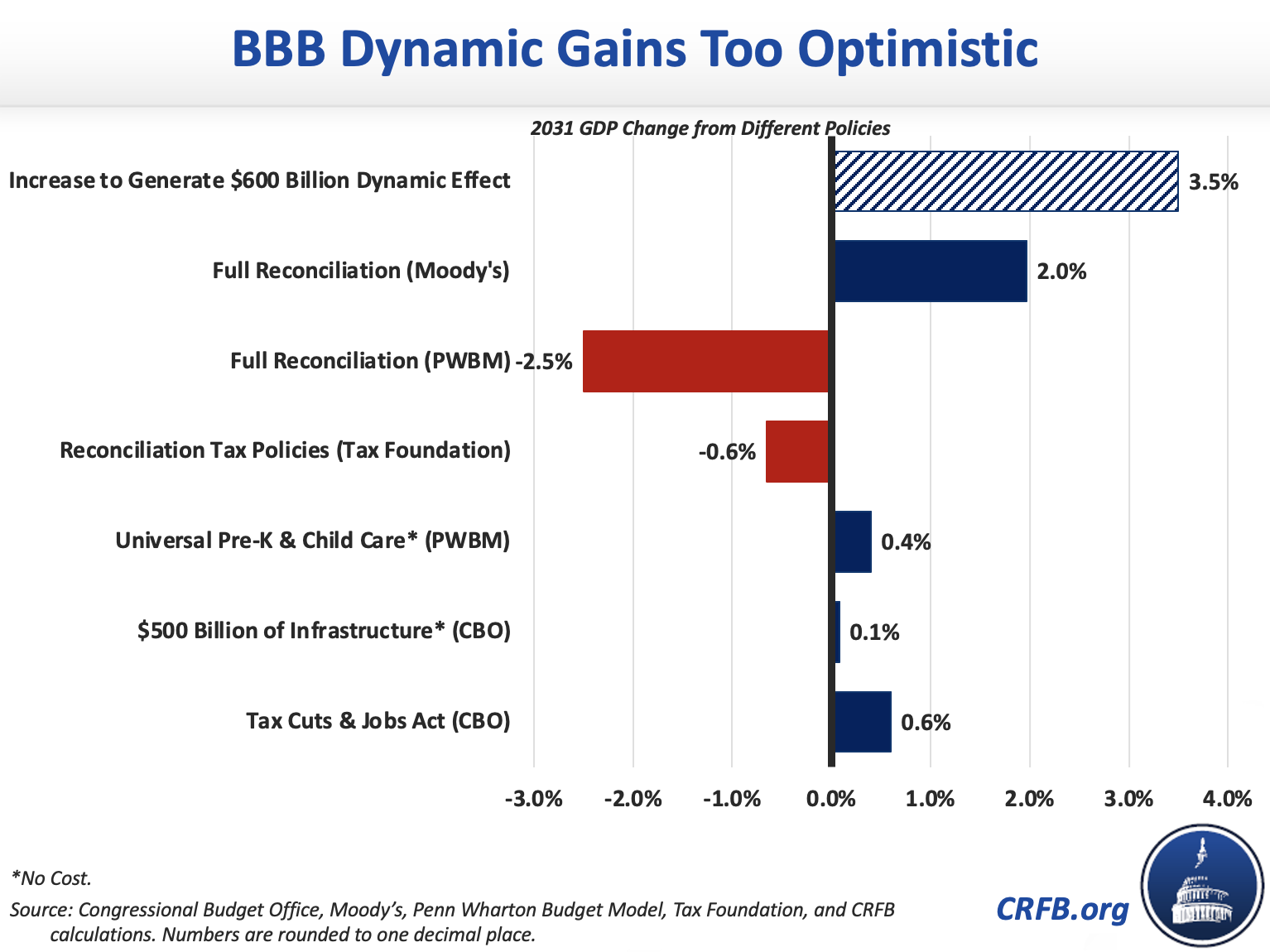

To generate $600 billion of dynamic feedback, we estimate the reconciliation legislation would have to boost output by roughly 3.5 percent by 2031, assuming steady growth. Existing estimates have found the package might increase output by as much as 2 percent or reduce output by up to 2.5 percent.

What Does Dynamic Scoring Mean for Reconciliation?

Dynamic scoring is a process where estimators incorporate the macroeconomic effects of legislation and how they affect the federal budget. For example, legislation that boosts employment, output, and interest rates might lead to more tax revenue and higher federal interest payments.

Neither the Congressional Budget Office (CBO) nor Joint Committee on Taxation (JCT) has estimated the dynamic impact (nor conventional impact) of the reconciliation package, and they are unlikely to do so in the near-term. However, we expect the positive dynamic gains from new investments will be relatively modest in size and partially or perhaps fully offset by the economic costs of borrowing and tax increases.

In the past, many current advocates of the reconciliation package have (rightly) questioned the use of unrealistic dynamic scoring to justify tax cuts. They should heed their own advice, and work to pay for the legislation without counting on rosy and highly uncertain dynamic assumptions. Any use of dynamic scoring should be based on estimates from official scorekeepers, and dynamic gains that do materialize should ideally be used to slow the growth of our high and rising national debt.

New Investments Will Produce Modest Dynamic Gains

The reconciliation package currently under development includes several pro-growth policies. For example, affordable child care and universal pre-K will help boost labor force participation among parents and earnings potential among children. Tuition-free community college and other higher education spending can further increase earnings and output by generating what economists call human capital. Meanwhile, infrastructure funding can boost output by increasing capital stock, while policies to promote clean energy and technology can reduce the economic costs of climate change.

However, the overall effect of the new spending on the economy and budget are likely to be limited for several reasons.

First, the economy is already supply constrained and projected to exceed its long-term potential, leaving little room for near-term stimulative effects. This leaves supply-side effects to impact growth, which tend to be smaller and phase in gradually.

For example, CBO’s recent projections show $500 billion of deficit-neutral infrastructure spending would boost output by only 0.08 percent by 2031, and produce only $11 billion of dynamic feedback over a decade. Similarly, the Penn Wharton Budget Model (PWBM) has estimated that universal pre-K and child care together would boost the level of output by about 0.4 percent after a decade under their most generous cost-free scenario.

Second, many of the new spending and tax breaks in the reconciliation package are not output-boosting investments, and some may even weaken the economy on the margins. Expanded Medicare benefits for seniors, for example, would do little to improve incentives to work, save, and invest.

Finally, revenue gains from greater economic growth are partially counteracted by higher spending on Social Security, Medicare, and interest payments on the debt. CBO estimates that every $3 of revenue raised from faster productivity generates less than $2 of net deficit reduction, once spending effects are factored in.

Financing Will Erode Dynamic Gains

The gains generated from new investments will be at least partially offset by the tax increases and borrowing used to finance them.

Higher debt has been shown to push up interest rates and reduce income, resulting in higher spending and less revenue. Based on CBO’s dynamic estimates of paid-for and debt-financed investments, we estimate $600 billion of new borrowing would shrink the economy by roughly 0.07 percent after a decade, reducing dynamic gains by about $16 billion.

On the revenue side, higher effective marginal tax rates on wages and capital are likely to negatively impact labor supply and capital investment (before accounting for the revenue). For example, the Tax Foundation recently estimated that the revenue proposals in the House Ways and Means Committee’s portion of the reconciliation package would reduce long run Gross Domestic Product (GDP) by 0.98 percent, including a 0.65 percent reduction in 2031. They estimate it would lose nearly $260 billion over a decade from dynamic scoring. Even if the effect is only a fraction as large, it would still offset at least some of the economic gains from new investments.

The Overall Economic Impact is Unclear

With investments that will (mostly) improve economic growth and financing that will (mostly) slow growth, the net effect of the reconciliation legislation is unclear.

Both Moody’s Analytics and the Penn Wharton Budget Model (PWBM) have attempted to estimate the full effect of the reconciliation package, based on only very limited information of what would be in the package. The Moody’s estimate – which is likely at the high end of all possible outcomes – finds the plan would boost output by nearly 2 percent after a decade. The PWBM estimate, which is likely closer in construction to CBO’s models, estimates the plan would shrink output by 2.5 percent after ten years.1

Neither Moody’s nor the Penn Wharton Budget Model provides a dynamic score based on their growth estimate. But assuming steady productivity growth using CBO’s rules of thumb, a 2 percent output boost would generate about $350 billion of dynamic gains over a decade while a 2.5 percent output reduction would lead to $450 billion of dynamic losses (Note the Moody’s estimate assumes growth will be front-loaded, but this outcome is unlikely given current employment and inflation dynamics).

Replacing Dynamic Revenue With Real Offsets

Rather than relying on dynamic gains that might never materialize, policymakers should ideally work to fully offset the cost of the reconciliation package on a conventional basis.

In Five Ways to Improve the FY 2022 Reconciliation Package, we discuss a number of ways to improve the package. Many of the policies are themselves pro-growth – for example closing the stepped-up basis loophole, lowering overall health care costs, or scaling back some of the spending policies so they are better targeted to promote economic growth.

As recently as 2017, many proponents of the current reconciliation bill described dynamic scoring as fake math, voodoo economics, and a gimmick that requires CBO to “[count] the chickens before they hatch.”

Certainly, there is a place for dynamic scoring. It is important to understand how legislation will affect the economy and what that will mean for the budget; and policymakers should pursue pro-growth reforms whenever possible.

But if dynamic feedback is included, it should be based on estimates from the official scorekeepers. Ideally, these gains would be used not to offset new spending and tax cuts, but to help address the nation’s unsustainable fiscal outlook.

Read more options and analyses on our Reconciliation Resources page.

Note: A previous version of this analysis presented Tax Foundation's long-run GDP change estimate, as opposed to the change in GDP by 2031.

1 Assumes all new spending continues at similar growth rates beyond 2031