Mid-Session Review Shows Worse Outlook for President's Budget

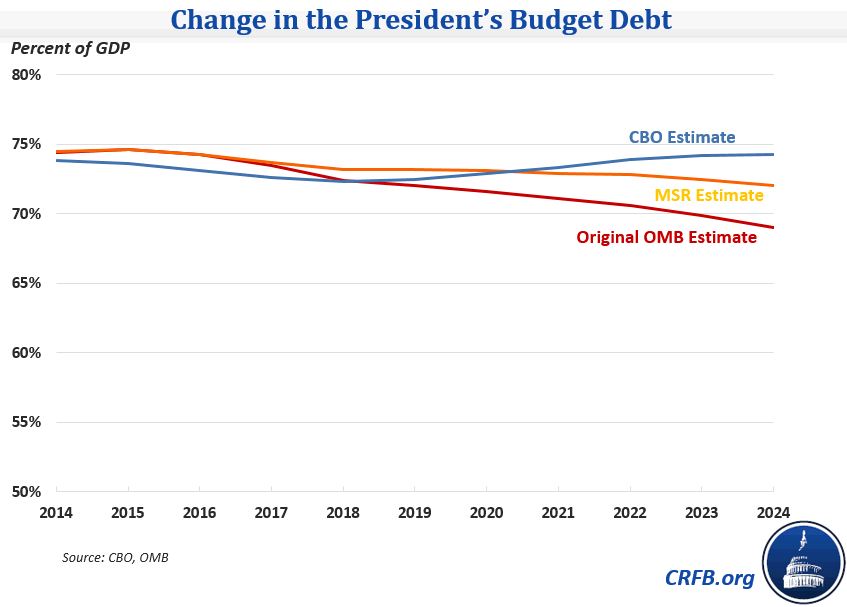

The Office of Management and Budget (OMB) this afternoon released the Mid-Session Review, updating its budgetary and economic estimates for the President's budget. The MSR shows a worse outlook for debt, reaching 72 percent of GDP in 2024 instead of 69 percent as originally estimated, although debt is still on a downward path (albeit a shallower one) as a share of GDP. Ten-year deficits are about $600 billion higher, while GDP is $400 billion lower in 2024 than previously estimated.

Driving this change is a $760 billion downward revision to revenue, about three-quarters of which is due to economic changes. The remaining revision comes from technical changes in OMB's current law baseline, in particular lower-than-expected corporate tax revenue. Changes to the estimates of the budget's proposals are basically a wash.

Outlays were also revised down by about $170 billion. Some of the largest reductions in projections went to Medicare and Medicaid ($56 billion), unemployment benefits ($27 billion), and the child tax credit ($20 billion). Other programs experienced upward revisions such as health insurance subsidies ($35 billion) and the Earned Income Tax Credit ($26 billion).

Even though OMB has revised its budgetary and economic projections downward, it is still somewhat more optimistic than CBO on the budget. CBO had debt on an upward path at the end of the ten-year window and debt reaching 74 percent of GDP by 2024.

Along with CBO's analysis of the budget, the MSR confirms our original concerns that the budget may have been relying on overly optimistic economic projections to make its numbers look better. It is better to be prudent with estimates to make sure that policymakers don't overshoot debt targets.

We will have a more in-depth blog on the MSR looking at the reasons behind the changes next week.