How Uncertain Are CBO's Long-Term Projections?

Any budget projections, including CBO's long-term outlook, are inherently uncertain, and it is important to understand how projections might change. The agency's usual ten-year projections are uncertain enough and can change based on any number of new developments. That problem only grows when looking out 25 or 75 years into the future.

For example, the Brookings Institution last year discussed the usefulness of long-term projections, how to convey uncertainty in those projections, and how policymakers could make the budget more responsive to changing conditions. In its long-term report, CBO addresses the latter two issues, spelling out a number of ways its projections could change and providing examples for how lawmakers could reduce budgetary uncertainty.

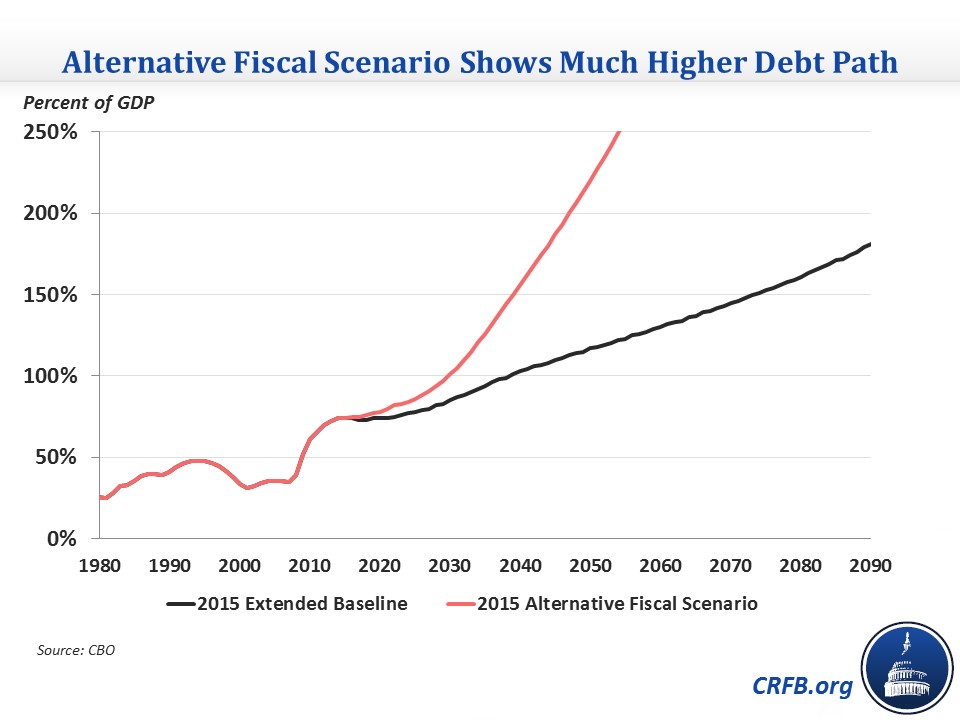

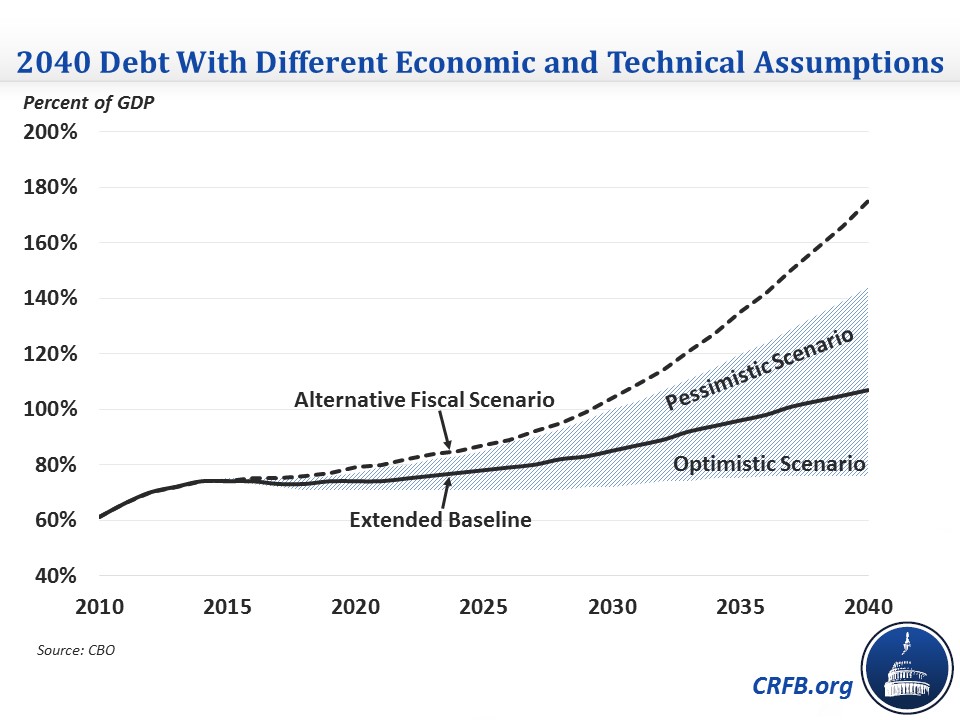

A main source of uncertainty is the actions of lawmakers. CBO's Extended Baseline assumes that Congress will not pass new laws (with some exceptions) to change deficits, allowing temporary policies to expire and keeping permanent savings in place. To illustrate a potential scenario where lawmakers add to the debt, the Alternative Fiscal Scenario assumes that lawmakers extend temporary tax breaks, repeal the sequester, prevent revenue from rising as a share of GDP, and raise non-health care/Social Security spending to its 20-year historical average. Under this scenario, debt exceeds the size of the economy ten years earlier than in the Extended Baseline and in 2050 reaches 250 percent of GDP, twice the Extended Baseline level.

Outside of legislative uncertainty, several economic and technical factors could influence projections.

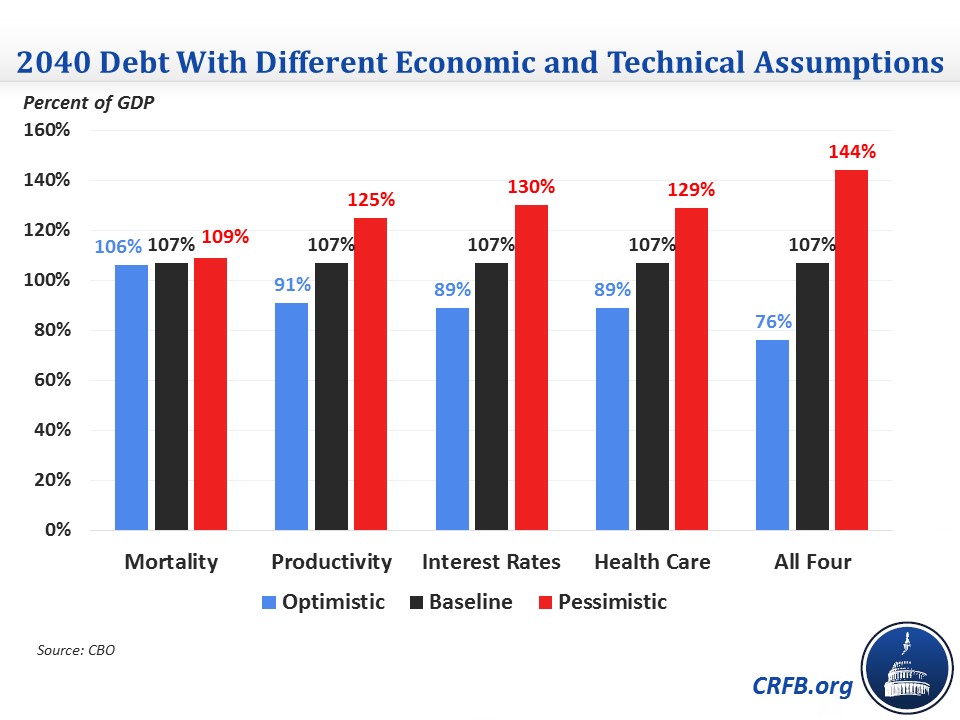

CBO highlights four: mortality rates, productivity growth, interest rates on federal debt, and health care cost growth. It calculates the effect on debt of altering these factors over the next 25 years, and that amount of uncertainty would only grow -- particularly for mortality since the full effect on benefits takes time to materialize -- the further the timeframe is.

Mortality

CBO's baseline assumes that mortality rates will decline by 1.2 percent per year. Varying this decline by 0.5 percentage points in either direction – or about a one-year change in life expectancy by 2040 – would change Social Security, health care spending, and tax revenue. A change in mortality rates would make little change by 2040: longer life expectancy (faster decline in mortality rates) would result in debt being 109 percent of GDP, while shorter life expectancy would result in debt of 106 percent of GDP, compared to the default of 107 percent. However, CBO says that these effects would have a much greater effect as they compound over the longer term.

Productivity

Along with labor supply growth, productivity growth is the other determinant of long-term economic growth. CBO projects productivity growth of 1.3 percent over the long term, in line with the 1.4 percent average since 1950. Different productivity growth rates would change GDP, revenue, and interest rates. CBO shows 0.5 percent faster or slower productivity growth resulting in 2040 debt being 91 and 125 percent of GDP respectively, compared to the 107 percent default. The report notes that these numbers do not account for potential changes in the distribution of income, which could also affect revenue and spending levels.

Interest Rates

CBO has frequently revised down both its short-term and long-term interest rates on debt as Treasury rates have remained low since the Great Recession. Over the past two years, CBO has revised down its long-term average interest rate on debt from 5.2 percent to 4.4 percent, so significant changes in interest rates are clearly possible. For the two scenarios, CBO increased or decreased by 0.75 percentage points the interest rate spread between Treasury securities and private interest rates (signifying that the change in interest rate is specific to the federal government and not caused by broader economic changes).

When the spread narrows, (federal interest rates are higher), 2040 debt increases from 107 percent of GDP to 130 percent and interest spending increases from 4.7 percent of GDP to 6.9 percent. When the spread widens and Treasury rates are lower, 2040 debt drops to 89 percent of GDP and interest spending drops to 3.2 percent.

Health Care Cost Growth

Excess cost growth is the extent to which health care spending per person exceeds GDP growth. This growth has been relatively slow in recent years, leading CBO on a few occasions to revise down its long-term projections of excess cost growth. CBO uses a 1.5 percentage point range for cost growth, consistent with the variance over the past half-century. When excess cost growth is 0.75 percentage points lower or higher, 2040 debt changes from 107 percent of GDP to 89 percent and 129 percent, respectively.

All Four Factors

CBO also combines variations on these four factors, in effect creating an uncertainty band for economic and technical assumptions. Because it's not as likely that all four factors would be at the optimistic or pessimistic range simultaneously, they assumed each parameter would vary by 60 percent of the amount as in the individual estimate (e.g. mortality and productivity change by 0.3 percentage points). The optimistic scenario shows debt stabilizing around 75 percent of GDP, while the pessimistic scenario has debt rising to 144 percent by 2040.

These are, of course, not the only sources of uncertainty. CBO specifically cites demographic changes affecting the labor force, state decisions about Medicaid eligibility, disasters, severe economic downturns, large losses in credit programs, and climate change as other factors that could significantly affect the budget. But CBO's analysis gives an idea of the magnitude of change that could result from changes in main determinants of the long-term fiscal picture.

The long-term outlook also provides ways that lawmakers can reduce the impact of uncertainty on the budget, a topic we covered last year. These ways include indexing different factors (like retirement ages or payroll taxes) to longevity, lengthening the average maturity of federal debt, and putting health care spending in a budget.

The ultimate solution, however, is to put debt on a downward path as a share of GDP, which would provide fiscal space for the federal government to withstand adverse changes in projections and have the flexibility to respond to changing conditions.

This blog is part of a series examining aspects of CBO's 2015 Long-Term Budget Outlook. Click here to read our 6-page summary of CBO's paper, or here for other blogs in the series.