House Reconciliation Bill Barely Slows Spending Growth

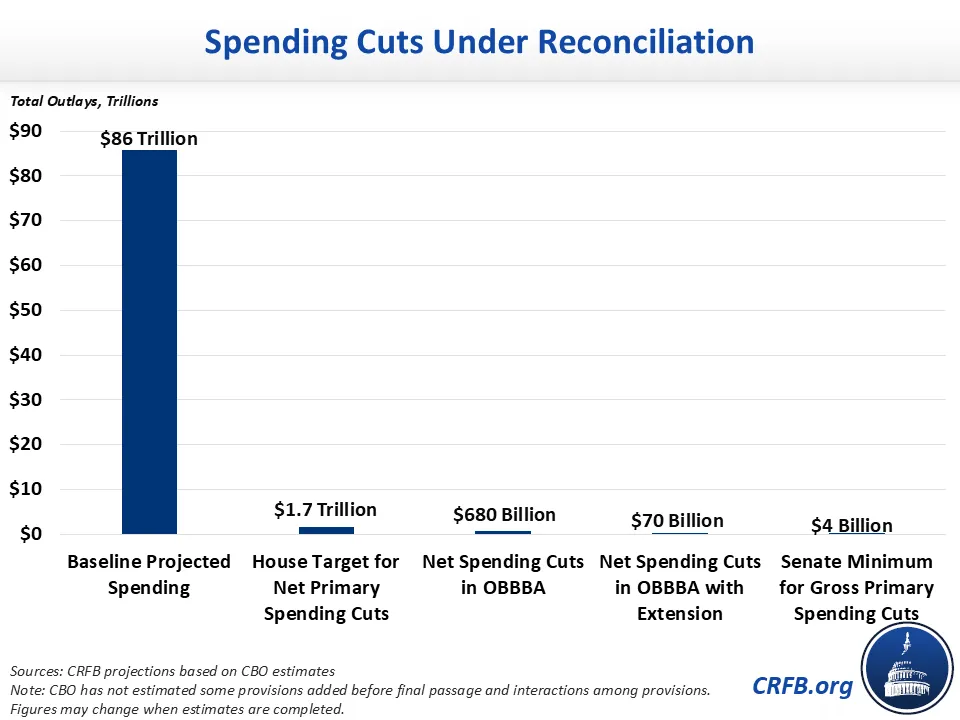

Although the concurrent budget resolution called for the House to cut mandatory spending by $2 trillion over the next decade, the House-passed One Big Beautiful Bill Act (OBBBA) would only reduce total projected spending by about $700 billion – about 0.8 percent of Gross Domestic Product (GDP) – and with the bill’s enactment spending would continue to grow rapidly to above $10 trillion by Fiscal Year (FY) 2034. Because the bill would significantly reduce revenue, it would add roughly $3 trillion to projected debt levels.

Although the Congressional Budget Office (CBO) has not scored the final version of the House bill, its score of a previous version – along with CRFB estimates – shows that:

- OBBBA would reduce net outlays by $680 billion below baseline through 2034, with $1.2 trillion of net primary spending reductions and $540 billion of higher interest spending.

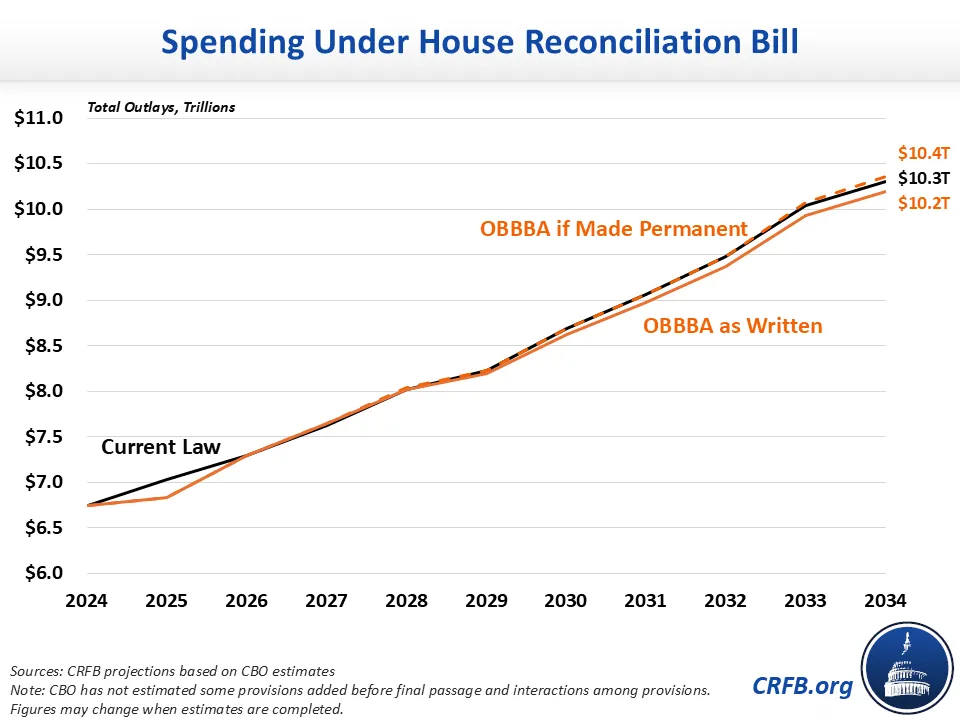

- Assuming enactment of the bill, nominal spending would grow by 50 percent from $6.8 trillion in 2024 to $10.2 trillion in 2034, compared to $10.3 trillion under current law.

- As a share of GDP, spending would grow from 23.4 percent of GDP in 2024 to 24.1 percent of GDP in 2034, compared to 24.3 percent under current law and a historical average of 21.1 percent.

- If temporary measures in OBBBA were made permanent, spending would rise to above current law projections by 2034 – $10.4 trillion (24.5 percent of GDP) – and would only be about $70 billion below current law projected spending over the ten-year window.

We expect total spending levels would be modestly lower under the House-passed version of OBBBA but are awaiting a full CBO score.

House Reconciliation Bill Would Only Modestly Reduce Projected Spending

The federal government is currently projected to spend a total of $86 trillion between FY 2025 and 2034. The concurrent budget resolution set an explicit goal “to reduce mandatory spending by $2 trillion over the budget window” – or 2.3 percent of total spending – under their reconciliation bill. The actual legislation is projected to reduce mandatory spending by a net $1.2 trillion and to reduce total spending by less than $700 billion. That’s less than a 1 percent reduction in projected spending levels.

The deficit-reducing committees would reduce primary (non-interest) spending by about $1.6 trillion through 2034. But spending from other committees – mainly related to defense, immigration, and border security – would increase spending by $330 billion. Interest costs as a result of higher debt caused by the substantially larger reduction in revenues would boost spending an additional $540 billion, bringing the net total cut to $680 billion. We estimate the spending reductions would shrink to $70 billion if temporary provisions – especially related to defense spending – were made permanent.

OBBBA Would Barely Slow Spending Growth

Under current law, spending is projected to rise from $6.8 trillion in 2024 to $10.3 trillion in 2034. Under OBBBA, spending would grow almost as quickly, to $10.2 trillion by 2034. And if certain OBBBA provisions are made permanent, spending would actually grow slightly more quickly to $10.4 trillion in 2034. In other words – nominal spending is projected to grow by roughly 50 percent, with or without enactment of OBBBA.

As a share of the economy, spending would rise to 24.1 percent of GDP under OBBBA as written and 24.5 percent of GDP if OBBBA were made permanent. That’s in line with current law projections, well above the 2024 high of 23.4 percent of GDP, and far above the 50-year historic average of 21.1 percent of GDP.

House Spending Cuts Don’t Cover Revenue Reductions

OBBBA does include a number of meaningful spending reductions and reforms, including thoughtful reforms to the student loan program, important limits on Medicaid state provider taxes and state directed payments, the reversal of several costly executive orders, new work requirements in Medicaid and SNAP, and other changes. However, much of these spending reductions are countered by higher spending on defense, border security, immigration enforcement, and interest on the debt. And they are far too low to cover the $3.7 trillion of revenue reductions in the bill as written, let alone the $5.1 trillion if OBBBA were made permanent.

Major Spending Changes in OBBBA by Committee

| Committee | OBBBA as Written | OBBBA with Extensions |

|---|---|---|

| Energy & Commerce | -$930 billion | -$930 billion |

| Education & Workforce | -$350 billion | -$350 billion |

| Agriculture | -$240 billion | -$240 billion |

| Natural Resources | -$20 billion | -$20 billion |

| Oversight & Government Reform | -$10 billion | -$10 billion |

| Financial Services | -$10 billion | -$10 billion |

| Primary Spending Cuts | -$1,560 billion | -$1,560 billion |

| Armed Services | $140 billion | $410 billion |

| Judiciary | $70 billion | $150 billion |

| Homeland Security | $70 billion | $100 billion |

| Transportation & Infrastructure | $30 billion | $30 billion |

| Ways & Means | $20 billion | $90 billion |

| Primary Spending Increases | $330 billion | $770 billion |

| Net Primary Spending Cut | -$1,220 billion | -$790 billion |

| Net Interest* | $540 billion | $720 billion |

| Net Spending Cut | -$680 billion | -$70 billion |

| Appendix | ||

| Net Spending Cut (% of Baseline Spending) | 0.8% | 0.1% |

| Net Spending Cut (% of Proposed Net Tax Cuts) | 19% | 2% |

| Total Debt Impact | ~$3 trillion | ~$5 trillion |

Source: Congressional Budget Office and CRFB calculations. Figures are rounded.

Note: Figures measure net spending changes by committee. Some committees include gross spending increases and cuts. Figures only include outlay impacts and count changes in outlays related to refundable tax credits.

*Incorporates interaction effects, partially estimated by CRFB.

As a result, OBBBA would not only keep spending levels high, but would also add $3 trillion to already high levels of national debt – or $5 trillion if extended. With debt already approaching record levels, this additional borrowing could prove very harmful. The Senate should work to improve the bill to expand the spending reductions, limit the revenue reductions, and ensure the bill reduces rather than adds to the national debt.