Everything You Need to Know About Student Debt Cancellation

Below are a few frequently asked questions about student debt cancellation and proposals around it.

- Whose debt has been cancelled?

- How much will Biden's debt cancellation cost?

- What were the other major student debt cancellation proposals?

- How much did the other student debt cancellation proposals cost?

- Does it really cost money to cancel student debt? Why does it cost money if the federal government already lent it out?

- How many people would be affected by debt cancellation?

- Is student debt cancellation regressive?

- Does student debt cancellation decrease the racial wealth gap?

- Would cancelling student debt increase inflation?

- Would cancelling student debt stimulate the economy?

- How long would it take for the total amount of student debt to return to its current level after cancellation?

- Can the executive branch unilaterally cancel student debt?

- Is it more progressive to continue the student loan payment pause instead of cancelling debt?

Whose debt has been cancelled?

The Biden Administration announced a plan to cancel up to $10,000 of debt for federal student loan holders and up to $20,000 of debt for all federal student loan borrowers who have received a Pell Grant. Only households earning less than $250,000 per year (or $125,000 for an individual) will be eligible. We estimate this will cancel approximately $525 billion in student debt.

How much will Biden's debt cancellation cost?

The Committee for a Responsible Federal Budget estimates that the announced debt cancellation plan will cost between $330 billion and $390 billion, with a central estimate of $360 billion. It will cancel about $525 billion of student debt. The cost of this cancellation is lower than the amount of debt itself because some of that debt was already projected to be forgiven through other forgiveness programs or not paid back in full.

What are the other major student debt cancellation proposals?

The three major proposals for student debt cancellation that were discussed before the Biden Administration's announcement were: cancelling all student debt, cancelling up to $50,000 worth of student debt for each borrower, or cancelling $10,000 worth of debt per borrower. The $50,000 proposal is favored by some in Congress, whereas President Biden proposed cancelling $10,000 per borrower during his campaign.

One additional wrinkle is what types of student debt should be cancelled. At least some versions include both student loans issued by the federal government and loans issued privately by banks. About 92 percent of all outstanding loans are federal student loans. President Biden's announced cancellation plan is only for federal student loans.

How much would the other student debt cancellation proposals cost?

The estimated costs of the three major federal student debt cancellation proposals are:

- All loans: $1.6 trillion.

- $50,000 per borrower: $950 billion. It could be as low as $675 billion and as high as $1 trillion.

- $10,000 per borrower: $250 billion. It could be as low as $210 billion and as high as $280 billion.

The estimated costs of cancelling $10,000 and $50,000 of debt are lower than the total amount of debt being cancelled. That’s because the federal government already expects some of that debt to be forgiven, and so it doesn’t count it as a “cost” to cancel the debt. However, the portfolio as a whole is expected to roughly break even, with some people paying a high enough interest rate to pay for the people who see their debt cancelled. As a result, cancelling all student debt would cost the same as the total amount of debt outstanding.

Does it really cost money to cancel student debt? Why does it cost money if the federal government already lent it out?

Yes, it really costs money. When the federal government lends out federal student loans, it calculates the lifetime cost of the loan in the year it is issued. On average, under federal accounting standards, the government expects to make about three cents for every dollar it lends. That’s because it expects most loans to be paid back with interest.1 If the loan is not repaid at all, it would cost money because the government was expecting the loan's funds back.

The ultimate cost of debt cancellation to the federal government is equal to the amount of debt that is cancelled plus any expected interest payments to the government, minus the cost of borrowing for the government, and minus any debt that would have been cancelled or not paid back anyway. To learn more about why cancellation costs money, check out this post.

How many people are affected by debt cancellation?

President Biden's announced cancellation plan will wipe out about $525 billion of debt. Roughly 20 million borrowers are eligible to have their entire debt wiped out, while another roughly 21 million borrowers are eligible to have part of their debt erased.

Cancelling all federal student loan debt would wipe out all $1.6 trillion of student debt for the 43 million borrowers that have it.

Cancelling $50,000 of debt per borrower would wipe out $1 trillion worth of debt. It would wipe all of the federal student loan debt for 36 million borrowers and reduce it for an additional 7 million borrowers.

Cancelling $10,000 of debt per borrower would wipe out $380 billion worth of debt. It would eliminate all federal student loan debt for 15 million borrowers and reduce it for an additional 28 million borrowers.

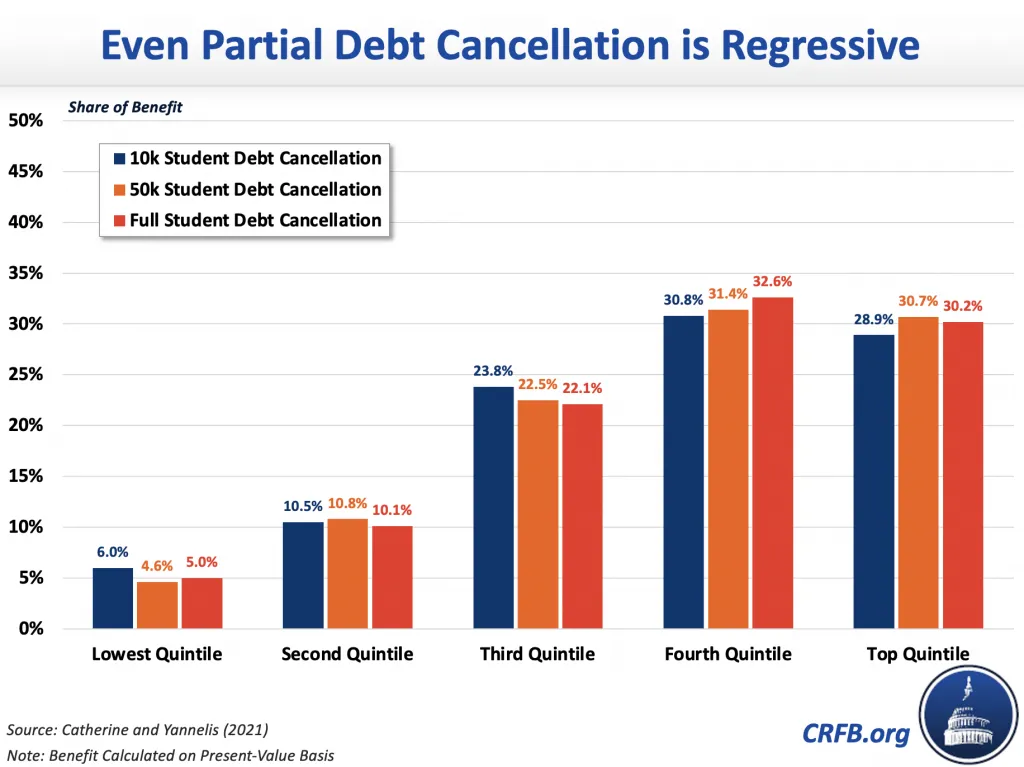

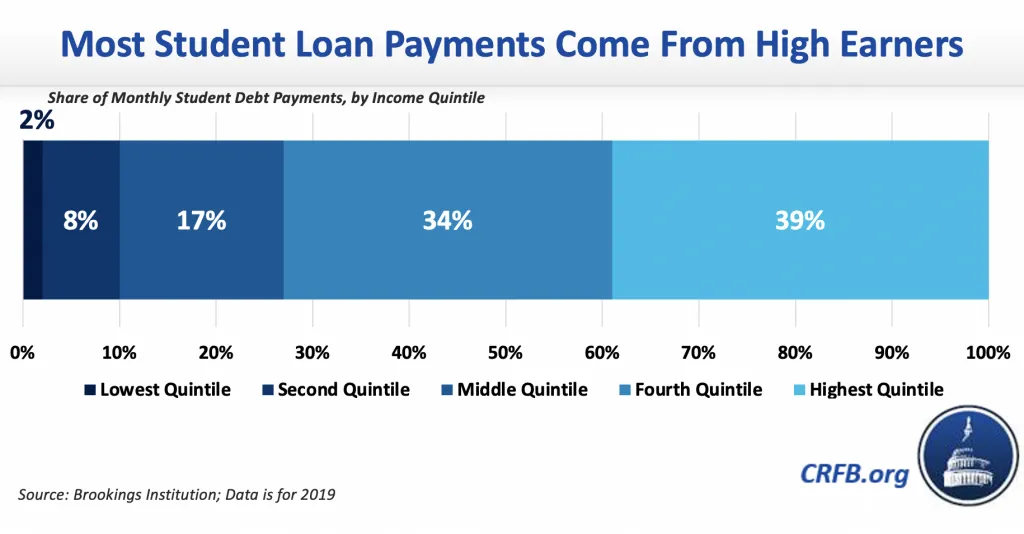

Is student debt cancellation regressive?

The student debt cancellation proposals that have previously been analyzed are regressive because they provide a disproportionate benefit to higher income and wealthier households. The main reason for this is that people who go to college and beyond are much more likely to earn high incomes and have high lifetime wealth compared to people who don’t go to college. However, President Biden's announced cancellation policy has not previously been studied and we don't currently know how regressive it is, though it is likely to be less regressive than previous proposals due to the higher cancellation for Pell Grant recipients.

When measured by income, the previously debated debt cancellation proposals gave a much higher proportion of its benefit to top earners. For example, a report from the University of Chicago showed that the top 10 percent of earners receive more from cancellation than the entire bottom 30 percent of earners. This is the reverse of progressive policy, where the majority of the benefit should go to the lowest earners.

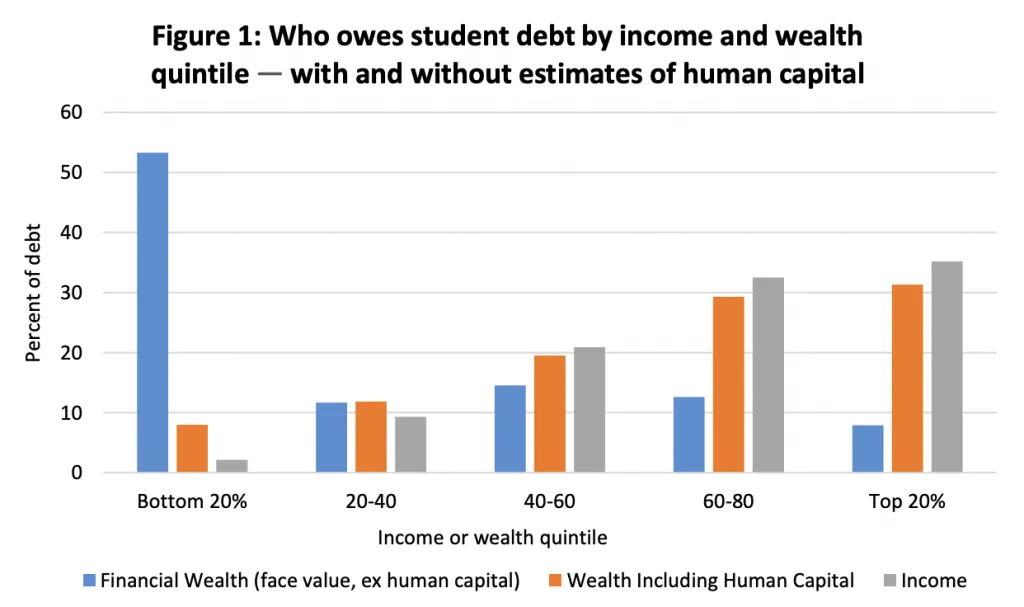

Student debt cancellation proposals are also regressive by wealth when properly measured. The most accessible report on this question comes from Brookings, which shows that when properly accounting for lifetime earnings student debt cancellation is highly regressive. Some advocates have claimed the opposite by including student debt without the potential payoff of debt, which makes doctors coming out of school look extremely poor compared to those who earned an Associate's degree. Once one accounts for the lifetime earnings potential of the doctor, what the author Adam Looney calls “human capital,” student debt cancellation is shown to be highly regressive.

Source: Brookings

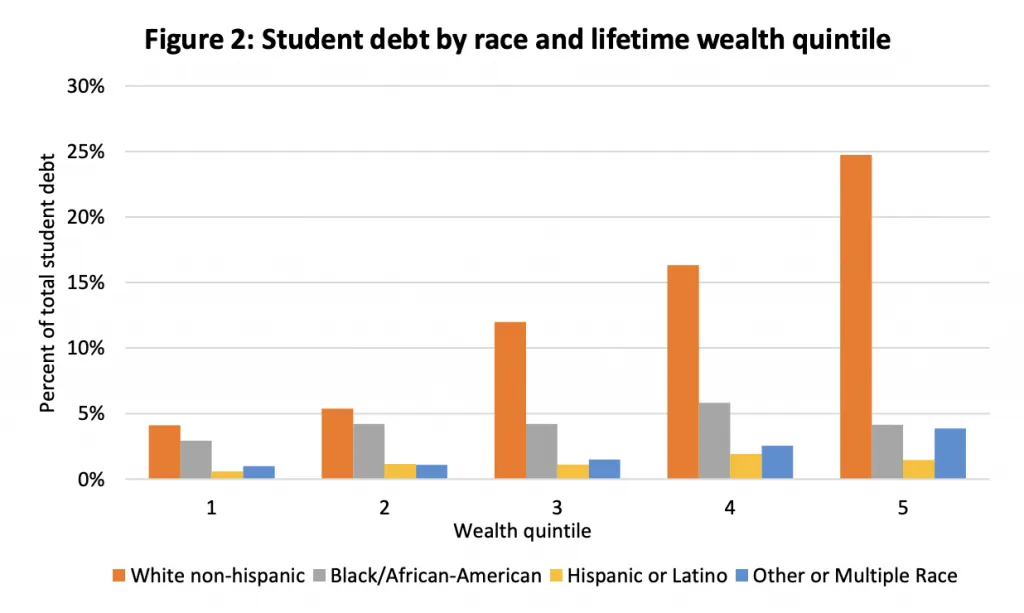

Does student debt cancellation decrease the racial wealth gap?

It's not clear at this time how the announced Biden cancellation policy affects the racial wealth gaps. For previously debated cancellation proposals, once one accounts for the lifetime wealth one will likely achieve, student loan cancellation does not significantly decrease the racial wealth gap. In fact, a recent Brookings paper on the topic shows that the top 20 percent of white non-Hispanic households by lifetime wealth hold 25 percent of all student debt and hold more student debt than all Black/African American households combined. This shows that debt cancellation disproportionately benefits white, wealthier households because those are the people most likely to owe and be paying down their debt.

Source: Brookings

Would cancelling student debt increase inflation?

Yes, debt cancellation will likely increase inflation. By reducing people's monthly payments and increasing their net wealth, debt cancellation will lead borrowers to spend more in an economy that is already demand-saturated and supply-constrained. We previously estimated that cancelling the entire portfolio would increase Personal Consumption Expenditure (PCE) inflation somewhere between 10 to 50 basis points -- likely closer to 50. We are currently in the process of estimating the inflationary effect of the announced Biden cancellation plan.

Would cancelling student debt stimulate the economy?

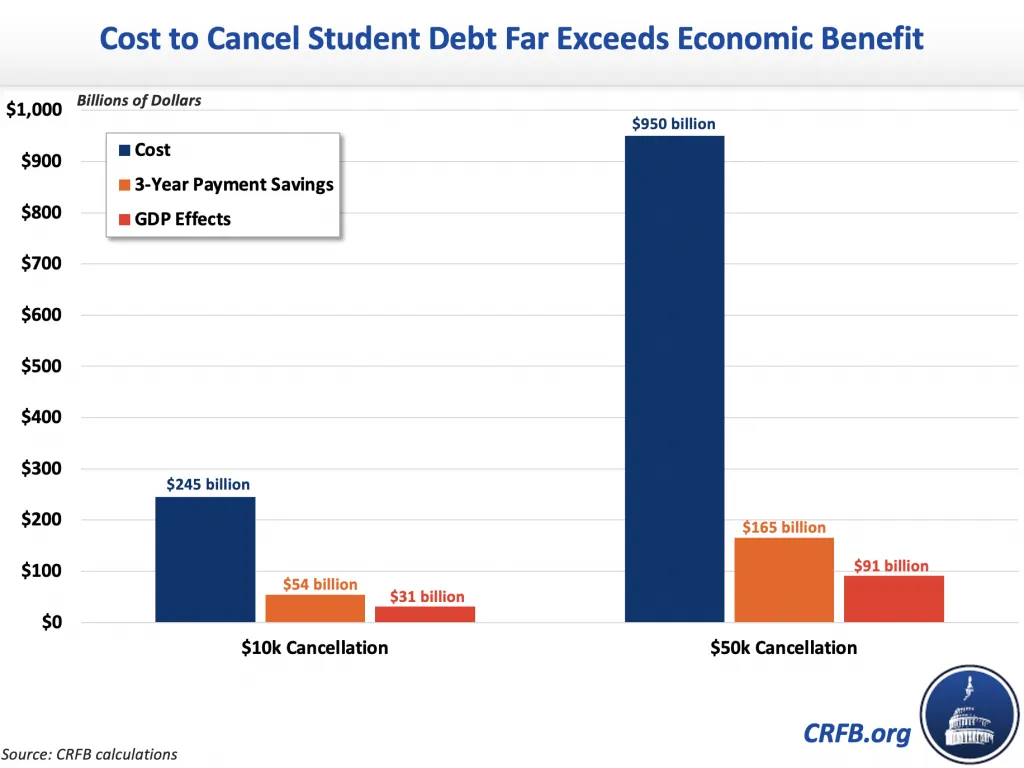

Cancelling student debt is a very ineffective way to stimulate the economy. Even when the economy was operating below potential, we found that student debt cancellation had a low economic multiplier, which means that it has a low bang for its buck given the cost. In an economy operating below potential, we estimated full cancellation would have a multiplier between 0.08x and 0.23x. That means for every dollar spent on cancellation, it would put eight to 23 cents back into the economy, which is a very low amount compared to other stimulus policies. For partial debt cancellation, we estimated a multiplier of between 0.02x and 0.27x when the economy is operating below potential. For $50,000 in cancellation, our central estimate was 0.10x, and for $10,000 in cancellation, our central estimate was 0.13x.

However, that is assuming the economy is operating below potential. Right now, the economy is operating above potential, with demand far outstripping supply and increasing inflation. Any additional dollar in stimulus will have less effect because much of it will feed through to inflation. That means cancelling student debt would have an even lower stimulative effect than our initial estimates.

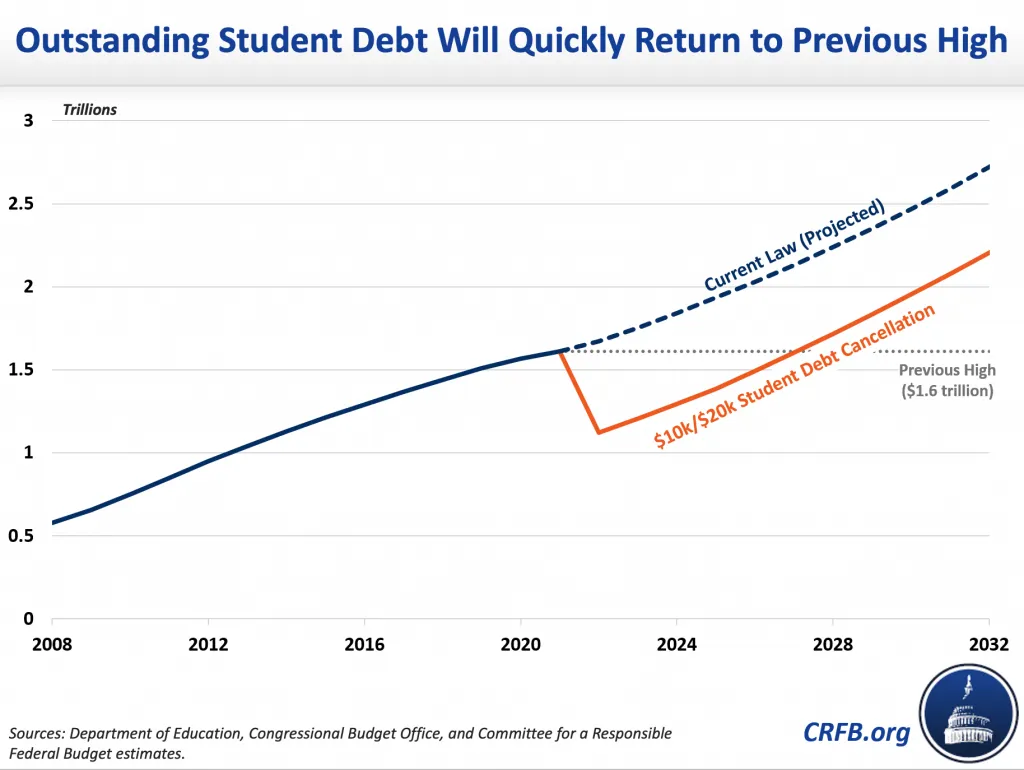

How long would it take for the total amount of student debt to return to its current level after cancellation?

The Committee for a Responsible Federal Budget estimates that the total amount of outstanding federal loan debt will return to its current level in 2028 if all eligible borrowers' loans are cancelled.

Can the executive branch unilaterally cancel student debt?

It’s unclear. Both the Justice Department and the Department of Education issued memos arguing that the Biden Administration has legal authority to cancel student debt. The Department of Education under the Trump Administration issued a legal memo arguing that it was not legal. The best breakdown of legal arguments can be found in this Harvard Law School brief. Another article in the Virginia Law Review questions whether anyone would have “standing" – that is, whether anyone would have the ability to successfully sue the government in the event of cancellation. The Wall Street Journal reported that the top lawyer for President Obama’s Department of Education recently produced a confidential legal memo that concluded it would be legally risky to broadly cancel debt via executive action.

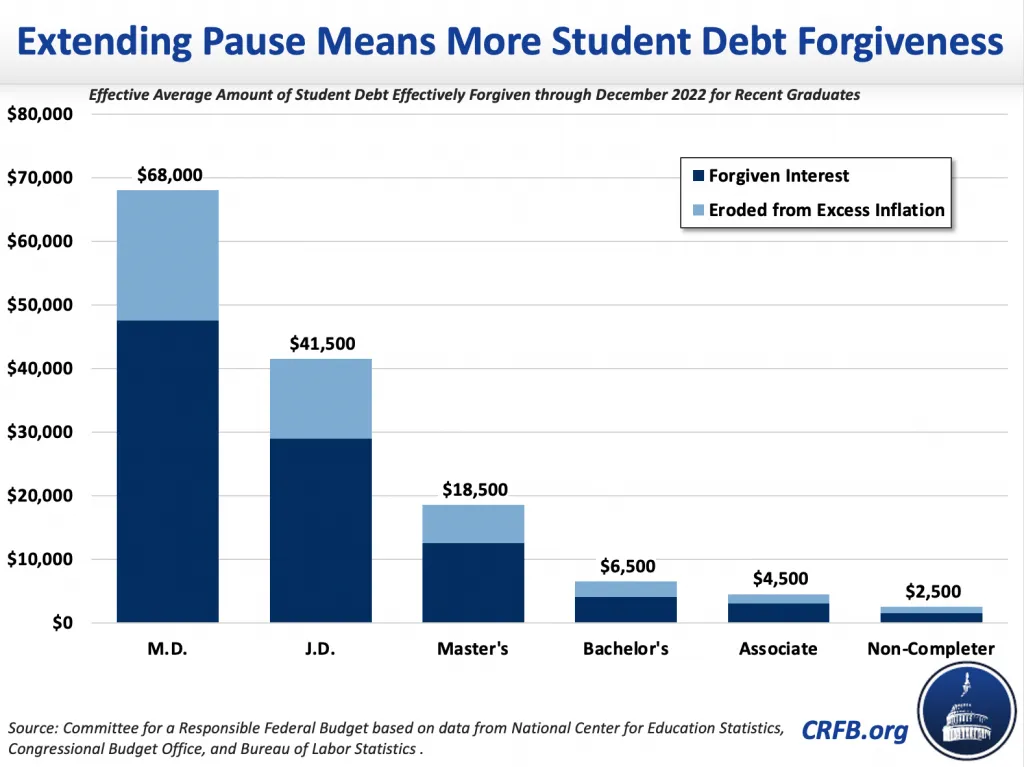

Is it more progressive to continue the student loan payment pause instead of cancelling debt?

No. The payment pause that has been in effect since the beginning of the COVID-19 pandemic is even more regressive than cancelling student debt. The people with the highest levels of debt and the highest monthly loan payments tend to be those with the highest earning potential. When the federal government forgives interest every month, it disproportionately benefits those doing well in the economy. The payment pause since the start of the pandemic will have cost $155 billion by the end of this year when it is set to expire.

Through December 2022, a recently graduated medical doctor will have had $68,000 of debt effectively cancelled due to the repayment pause, compared to $2,500 for someone who left college without a degree.

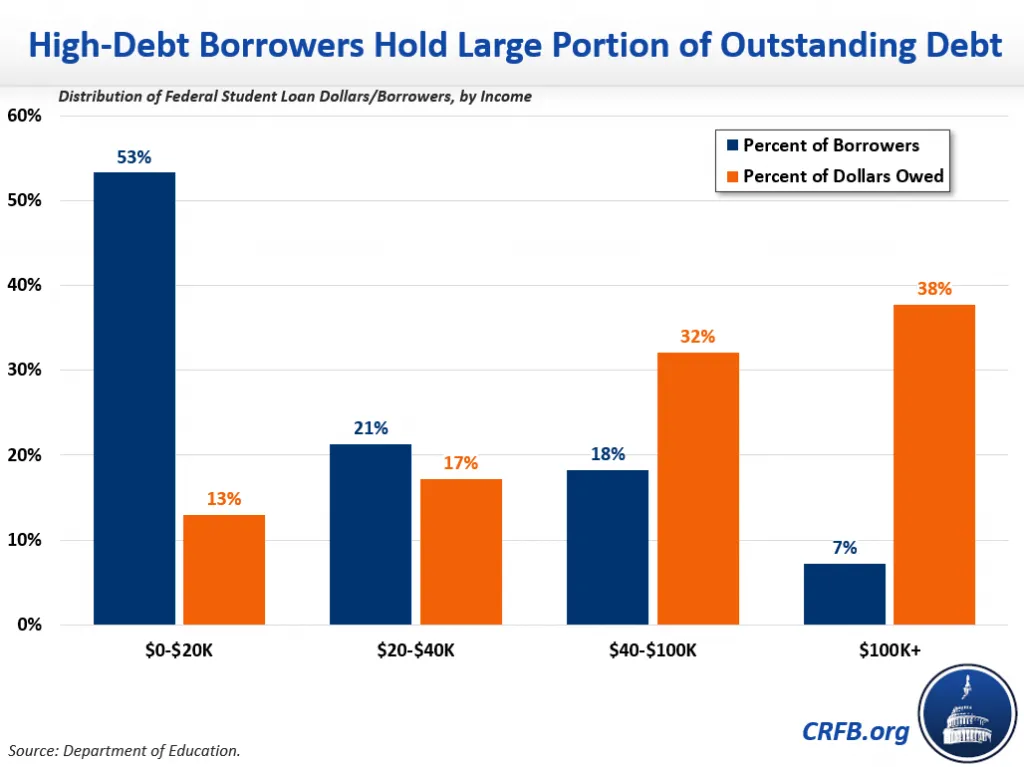

A very small percentage of borrowers account for a massive portion of the amount of federal student debt outstanding. Those with over $100,000 of debt outstanding (the majority of whom have master’s and professional degrees) account for 7 percent of borrowers but 40 percent of the amount of federal student loan debt owed.

Where can I learn more?

Check out our student debt cancellation resources page for links to relevant research and articles on student debt cancellation.

Updated (8/26/2022): Modified the number of eligible borrowers for debt cancellation and updated information of the payment pause extension.

Updated (8/25/2022): Updated to reflect the Biden Administration's debt cancellation announcement.

Updated (7/28/2022): Provided new estimates of debt forgiven due to a potential extension to the repayment pause.

1 There is debate among experts whether that is the correct way to measure the cost of student loans—an alternative measure favored by the Congressional Budget Office that accounts for “market risk” suggests that new student loans could cost about 20 cents for each dollar lent out. In that case, cancelling student loans would cost less, though it would still be extremely expensive. However, since that’s not currently how Congress accounts for the cost, it’s not the way we measure the cost to cancel student loans.