How Long Before Cancelled Student Debt Would Return?

Note: This analysis has been updated to reflect President Biden’s announced cancellation plan. You can read the original version here.

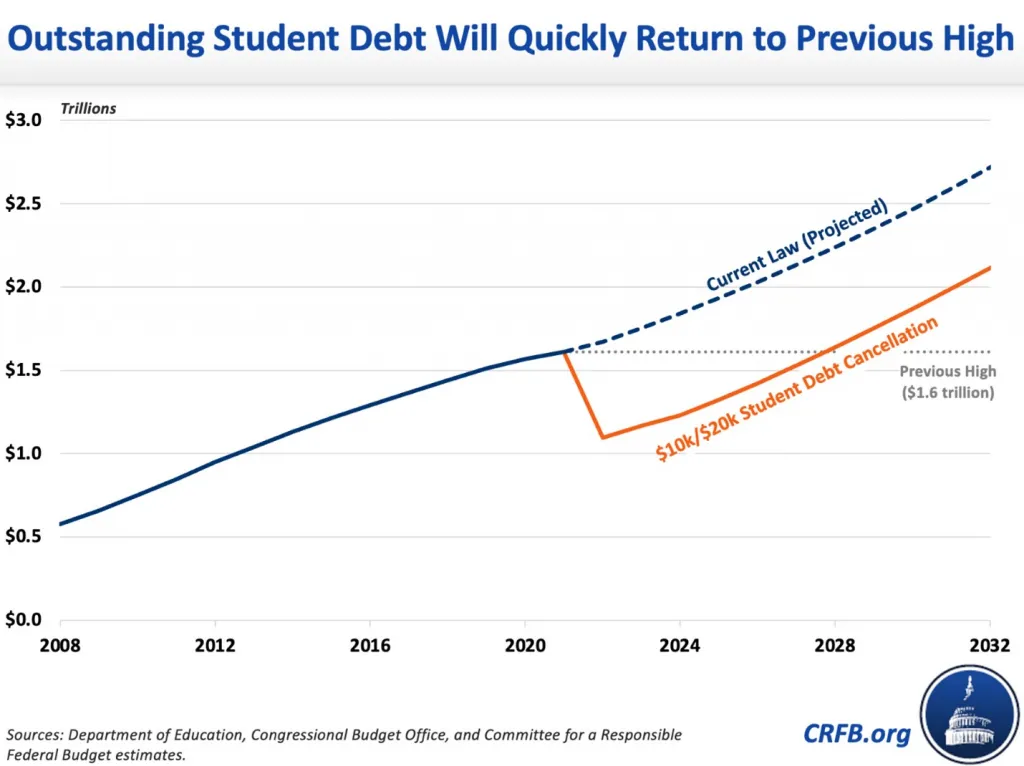

President Biden recently announced his plan to cancel up to $10,000 of debt for federal student loan holders and up to $20,000 for those borrowers who have received a Pell Grant. Only households who earned less than $250,000 in 2020 or 2021 (or $125,000 for an individual) will be eligible. We estimate that if all eligible borrowers receive debt cancellation, the overall student debt portfolio would return to its current level of $1.6 trillion in five and a half years – in 20281. In inflation-adjusted dollars, student debt would return to its current level in 2031.2

Importantly, these projections assume no change in borrower behavior. In reality, debt cancellation and the Biden Administration’s proposed changes to income-driven repayment (IDR) will almost certainly lead to increased borrowing, slower repayment, and larger tuition increases. Any behavioral changes would mean the portfolio would return to its current size even faster.

Projected Student Debt Growth After Cancellation

There is currently $1.6 trillion of total outstanding federal student debt. We estimate that if all eligible borrowers receive debt cancellation, the portfolio would fall to $1.1 trillion. But after cancellation, the loan portfolio would grow quickly and soon return to its current level in each scenario.

Two factors drive the rapid expected portfolio growth. First, lower balances resulting from debt cancellation would also reduce the pace of repayment relative to the current student loan portfolio. We estimate that the amount would drop from $85 billion (assuming payments restart in January) to a little under $60 billion in the years immediately following the cancellation and then will slowly build back up. There is a lag in the increase in repayments because the portfolio would be comparatively younger, with a higher proportion of debt held by borrowers in school or in a grace period compared to before cancellation.

The lower repayment amount would exacerbate the growth in the first few years because interest will still be accruing on the new loans that are not being paid back. Since a higher proportion will be accruing interest with no principal payments made, that means faster growth for the portfolio than during normal circumstances.

Secondly, new borrowing would continue to accrue at at least the previous pace (in reality, it would likely accrue faster due to moral hazard from debt cancellation and the new IDR program). We use the Congressional Budget Office's (CBO) loan growth estimates for the next ten years. CBO projects $85 billion will be borrowed in 2023 and will increase through the decade, resulting in $108 billion in borrowing in 2032. In reality, debt is likely to increase even faster than we project due to the moral hazard effect associated with debt forgiveness as well as a generous new IDR plan that could affect borrowing.

A Short-Term Fix to a Structural Problem

We estimate that President Biden’s cancellation plan will cost between $330 and $390 billion and that his full student debt plan will cost $440 to $600 billion. It would temporarily wipe out nearly a third of the student debt portfolio, but the sum of student debt will return to its current level in five and a half years, by 2028.

Instead of costly blanket loan forgiveness, should focus on policies that lead to less borrowing or better outcomes for borrowers, as opposed to policies that likely lead to more borrowing and higher tuition going forward.

1To arrive at this estimate, we used a combination of our estimates for repayment with CBO’s projected growth of loan originations in the coming decade. All calculations are in fiscal years.

2Real dollar estimate based on CBO 10-year economic estimates and CRFB modifications to the GDP deflator from CBO’s February 2021 long-term economic forecast.