CBO Offers Approaches to Reduce Commercial Health Prices

The Congressional Budget Office (CBO) recently released a report discussing different policy approaches to reducing the prices paid by commercial insurers for hospital and physician services. These high prices, and high commercial insurance spending, have a large impact on the federal budget through its many subsidies for health insurance.

The government directly pays for insurance in the individual insurance market through the Affordable Care Act (ACA) marketplace premium and cost-sharing subsidies, while it also subsidizes employer-sponsored insurance (ESI) for almost half the U.S. population through the ESI tax exclusion, where health insurance is provided tax-free from employers to employees. When rising prices cause health care costs to grow, employers and employees spend more on insurance rather than collecting taxable wages, resulting in less tax revenue for the federal government. CBO projects the ESI tax exclusion will cost $330 billion in Fiscal Year (FY) 2023 and $4.7 trillion over the next decade, while ACA subsidies are projected to cost $80 billion in FY 2023 and $965 billion over the next decade (assuming the Inflation Reduction Act enhancements are made permanent prior to their expiration in 2025).

We estimate that every $100 billion reduction in the cost of insurance premiums translates into upwards of $25 billion of income tax revenue. This means that efforts to reduce private insurance premiums ultimately reduce budget deficits both through greater tax revenue and a direct reduction in spending on ACA subsidies.

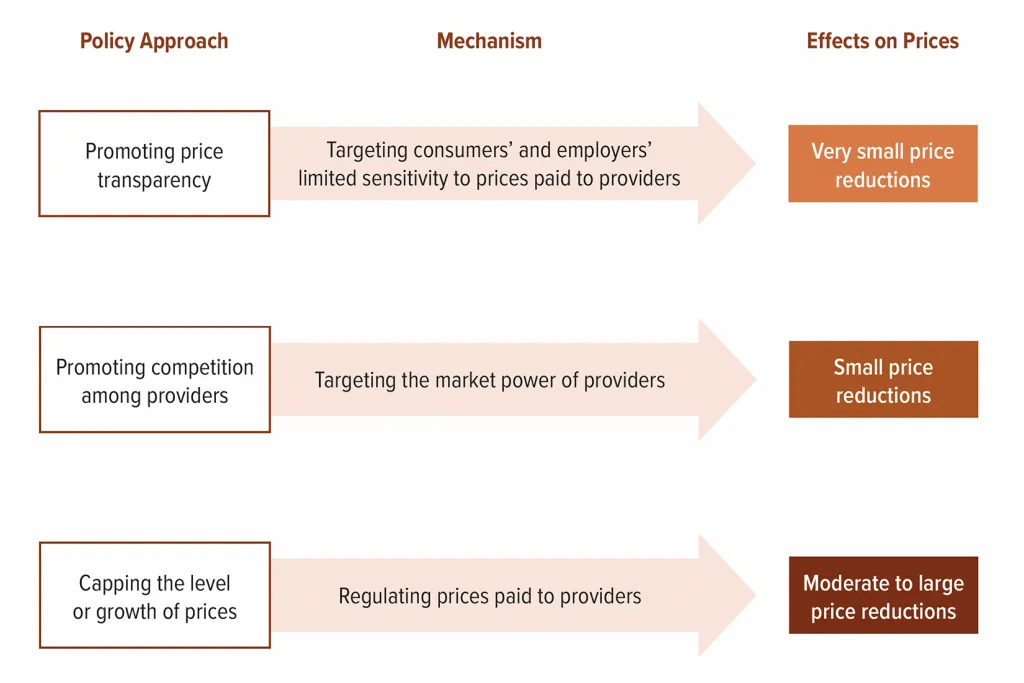

CBO examines three main types of policies to reduce the prices commercial insurers pay for medical services: promoting competition among providers, requiring price transparency for health care services, and capping the level or the growth of prices. Ultimately, policies to address high commercial prices would need to target providers' market power, increase the price sensitivity of consumers, and/or increase the price sensitivity of employers/insurers in order to prove effective.

Source: Congressional Budget Office.

CBO notes that promoting competition among health care providers can reduce their market power and lower prices. Some policy changes to accomplish this include increasing antitrust enforcement, reducing incentives to consolidation (like promoting site-neutral payment policies), easing providers' ability to change jobs by eliminating non-compete agreements, and banning anti-competitive contracts between providers and insurers that force the inclusion of higher-cost providers in insurance networks. CBO explains that these approaches would result in small price reductions within the first decade but larger price reductions thereafter.

The report also looked at promoting price transparency. Some changes could include expanding existing regulations that require price transparency for hospitals and insurers. For instance, there are already rules requiring hospitals to publish prices for common procedures. However, due to a lack of enforcement and minimal penalties, compliance has been underwhelming. In order to have a greater effect on prices, the Centers for Medicare and Medicaid Services would likely need to increase enforcement while penalties for non-compliance would need to be strengthened, for example by reducing Medicare reimbursement rates.

CBO mentions the possibility of establishing a federal all-payer claims database that included standard pricing information. This type of database is a reporting tool that would include services billed by providers to insurers and how much these services cost in order for businesses and their insurers to better understand where they need to bargain for better prices. All-payer claims databases are currently required in 18 states; however, there are limitations to which insurance products are subject to state legislation, and a national database would circumvent that problem. In general, CBO expects transparency approaches to lead to relatively minor price reductions in the first decade with possible larger reductions later.

The other major strategy reviewed by CBO was to cap either the level or the growth rate of prices administratively. This could involve setting maximum prices, capping the annual growth rate of prices, or taxing services when prices exceed a maximum amount. CBO cites the Health Savers Initiative policy option, Capping Hospital Prices, as one way to pursue this policy. This option examined the impact of capping commercial insurance prices for hospital services at 200 percent of the Medicare rate. Doing so would decrease commercial insurance costs by nearly a trillion dollars over a decade, leading to lower insurance premiums and beneficiary cost sharing while reducing federal deficits by over $200 billion.

Estimated Savings from Capping Hospital Prices at 200% of Medicare

| Savings (2021-2030) | |

|---|---|

| National Health Expenditures Reduction | $1,014 billion |

| Private Sector Savings | $987 billion |

| Premiums | $889 billion |

| Cost Sharing | $99 billion |

| Federal Non-interest Spending (ACA Marketplace Subsidies) | $26 billion |

| Federal Revenue (Taxation of Higher Wages) | $179 billion |

| Total Federal Budget Deficit Reduction (including interest) | $216 billion |

Source: Health Savers Initiative.

CBO also outlined numerous other ways that policymakers could reduce prices, including reducing the tax preferences for ESI (which could be done in a variety of ways) by capping the exclusion at income or payroll tax thresholds or eliminating the exclusion for the Medicare payroll tax.

Creating a federal public option for health insurance could also create competition in the individual marketplace and increase insurers' ability to negotiate lower provider rates, while other policies that would shift people from ESI towards the ACA marketplace would reduce average prices because plans in the individual insurance market tend to pay lower prices than employer plans.

The report also notes that expanding telehealth access through continued coverage and promotion of cross-state licensure can put downward pressure on prices. However, as we have written in the past, expanding telehealth coverage potentially increases utilization and therefore might offset any savings.

Lastly, CBO explains that prices could be lowered by increasing the number of physicians. The United States is currently in a physician shortage, which has driven up prices charged by physicians. However, because the majority of graduate medical education is financed by the federal government through Medicare, policies that increase medical residency slots might offset the savings of lower commercial prices without larger reforms.

With the rapid growth in private and federal health care spending, this CBO report offers policymakers a range of solutions that would result in lower federal spending and overall reductions in national health expenditures.