CBO Estimates $120 Billion from IRS Funding Boost

Today, the Congressional Budget Office (CBO) published an estimate of the revenue effects of President Biden’s proposal to increase Internal Revenue Service (IRS) funding by $80 billion over ten years in an attempt to reduce the tax gap and improve tax compliance.

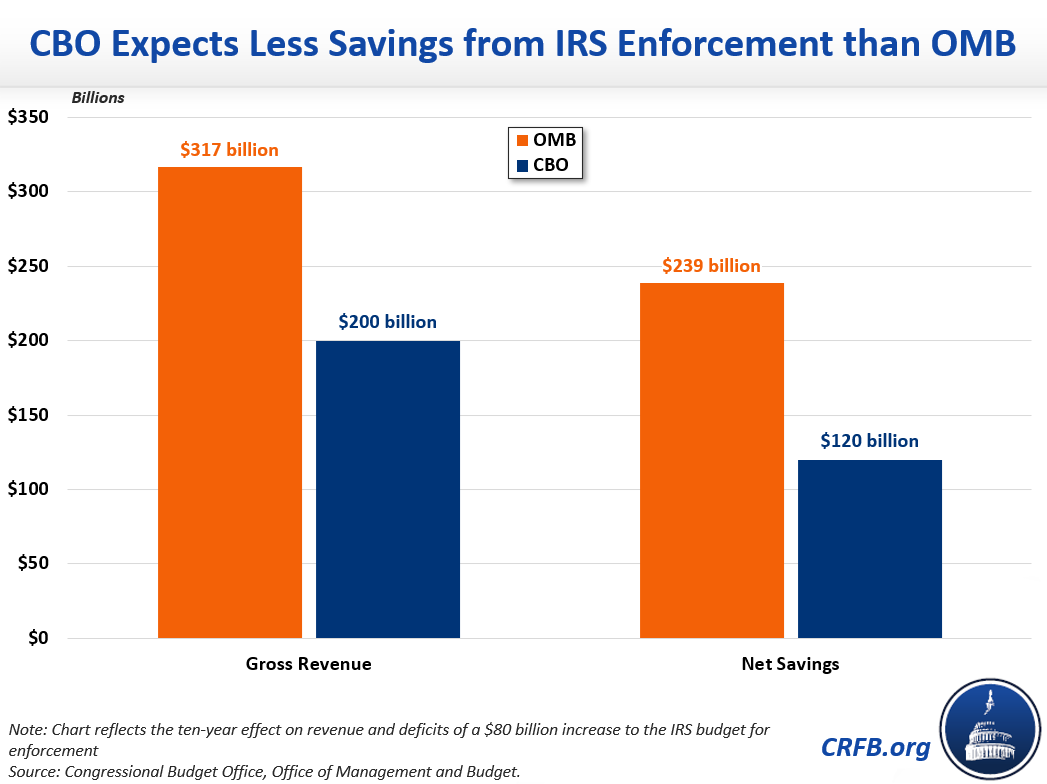

According to CBO, the President’s proposed $80 billion increase in IRS funding (with roughly $60 billion for tax enforcement) would yield approximately $200 billion of additional revenue over a decade, or $120 billion of net savings. This is about half the $240 billion of savings estimated by the Office of Management and Budget (OMB) in the President’s budget, which projected $320 billion in additional revenue.

Though CBO cannot technically “score” the revenue effects of an increase to the IRS enforcement budget, this estimate will allow Congress to understand the full fiscal implications of an IRS funding boost.

This estimate suggests an average return on investment (ROI) of 2.5-to-1 for every additional dollar spent on enforcement, which is lower than OMB’s overall ROI of 4-to-1. CBO’s estimate also incorporates various indirect effects of increasing IRS enforcement funding, such as more efficient revenue collection, fewer refunds due to audits, and a higher rate of voluntary compliance.

CBO’s overall 2.5-to-1 ROI estimate is substantially lower than its 7-to-1 estimated ROI from current enforcement activity. The difference is due to several factors, including the time it takes to train new agents, the likelihood that taxpayers would adapt, the reality that enforcement funding would suffer from diminishing returns, and that fact that not all new proposed spending would go toward enforcement.

Importantly, CBO’s estimate does not incorporate the direct budgetary effects of any other tax gap proposals included in the President’s budget request, most significantly the expansion in information reporting requirements for banks. However, CBO does assume this proposal would be in effect at the time of the IRS funding increase, and therefore does account for the small but positive interaction effects.

Read More

- FY 2022 Reconciliation Resources

- Primer: Understanding the Tax Gap

- Chartbook: Reducing the Tax Gap

- Republican and Democratic Presidents Support Reducing the Tax Gap

- Biden Tax Gap Proposal Deserves Bipartisan Consideration

- Group of Senators Introduce Bill to Narrow the Tax Gap

- Breaking Down the Proposals in the President's FY 2022 Budget

- What's in President Biden's American Families Plan?