American Rescue Plan Could Set Stage for $4 Trillion of Debt

The American Rescue Plan Act is estimated to cost over $1.9 trillion through 2031, but the ultimate price tag could be twice as high if some of the policies in the bill are extended beyond their current expiration dates. The bill includes several extensions of tax credits that supporters have previously proposed on a permanent basis and several temporary economic relief measures that are slated to end before the economy has fully recovered. If the tax credits were made permanent and these relief measures were extended for the duration of the crisis, it would raise the total cost of the bill to $3.8 trillion through 2031, or $4.1 trillion with interest.

| Policy Change | Cost Through 2031 |

|---|---|

| American Rescue Plan Act | $1.9 trillion |

| Continue economic relief through the crisis | $300 billion |

| Make tax credit and other expansions permanent | $1.5 trillion |

| Subtotal | $3.8 trillion |

| Interest | $350 billion |

| Total Potential Cost | $4.1 trillion |

Source: CRFB calculations based on Congressional Budget Office data. Numbers may not add up due to rounding

Several measures in the $1.9 trillion American Rescue Plan Act that provide temporary relief are likely to be extended past their expiration dates. Most significantly, expanded unemployment benefits would expire at the end of August (though that may soon be changed to September), after which all unemployed workers would lose the benefit supplement and many would lose benefits entirely. In addition, a 15 percent increase in Supplemental Nutrition Assistance Program (SNAP) benefits would end in September, after which benefits would immediately snap back to their previous level. Other smaller relief efforts also end abruptly. Extensions of these policies are likely in our view. While the actual cost would depend on the length and nature of those extensions, we believe a reasonable extension and phase-out scenario could cost roughly $300 billion.

More substantially, the American Rescue Plan Act includes one- or two-year versions of several longstanding policy priorities of President Biden's or Congressional Democrats'. It includes over $100 billion for a one-year expansion of the Child Tax Credit (CTC), which increases the credit from $2,000 to $3,000 (or $3,600 for children under age 6) and makes it fully refundable. The bill also includes a $15 billion, one-year expansion of the Earned Income Tax Credit (EITC) for childless workers that many have been seeking for years, and an $8 billion expansion of the Child and Dependent Care Tax Credit (CDCTC), which closely matches President Biden's campaign proposal to increase the maximum credit from $2,100 to $8,000 and from covering 35 percent of expenses to 50 percent of expenses. Finally, the legislation includes a $35 billion, 2-year increase in Affordable Care Act premium subsidies that closely matches a similar proposal in President Biden's campaign plan and $10 billion in small Medicaid expansions that last five years.

Making the expanded CTC permanent would cost an additional $1.1 trillion, assuming the expiring provisions in the Tax Cuts and Jobs Act (TCJA), which boosted the credit from $1,000 to $2,000 and eliminated the dependent exemption, are eventually extended or the policy is modified after 2026. Relative to current law, we estimate this would cost more like $1.5 trillion.

Meanwhile, making the EITC and CDCTC extensions permanent would cost over $200 billion, and making the health care provisions permanent would cost about $250 billion.

Altogether, we estimate these potential extensions would cost $1.9 trillion before interest, boosting the overall cost of the bill to $4.1 trillion when interest is included.

Ten-Year Cost of American Rescue Plan Act With Extensions

| Provision | American Rescue Plan Act Cost | Extension Cost | Total |

|---|---|---|---|

| Prevent SNAP benefit cliff | $5 billion | $50 billion | $55 billion |

| Extend and phase down unemployment benefit expansion and other provisions | $295 billion | $250 billion | $545 billion |

| Subtotal, Temporary Extensions | $300 billion | $300 billion | $600 billion |

| Permanently extend child tax credit expansion | $110 billion | $1.1 trillion | $1.2 trillion |

| Permanently extend EITC expansion | $10 billion | $125 billion | $135 billion |

| Permanently extend child and dependent care credit expansion | $10 billion | $80 billion | $90 billion |

| Permanently extend ACA subsidy expansion | $35 billion | $250 billion | $285 billion |

| Permanently extend Medicaid expansions | $10 billion | $10 billion | $20 billion |

| Subtotal, Permanent Extensions | $165 billion | $1.6 trillion | $1.7 trillion |

| Other Provisions | $1.5 trillion | N/A | $1.5 trillion |

| Interest | $225 billion | $125 billion | $350 billion |

| Total | $2.1 trillion | $2.0 trillion | $4.1 trillion |

Source: CRFB calculations based on Congressional Budget Office data. Numbers may not sum due to rounding.

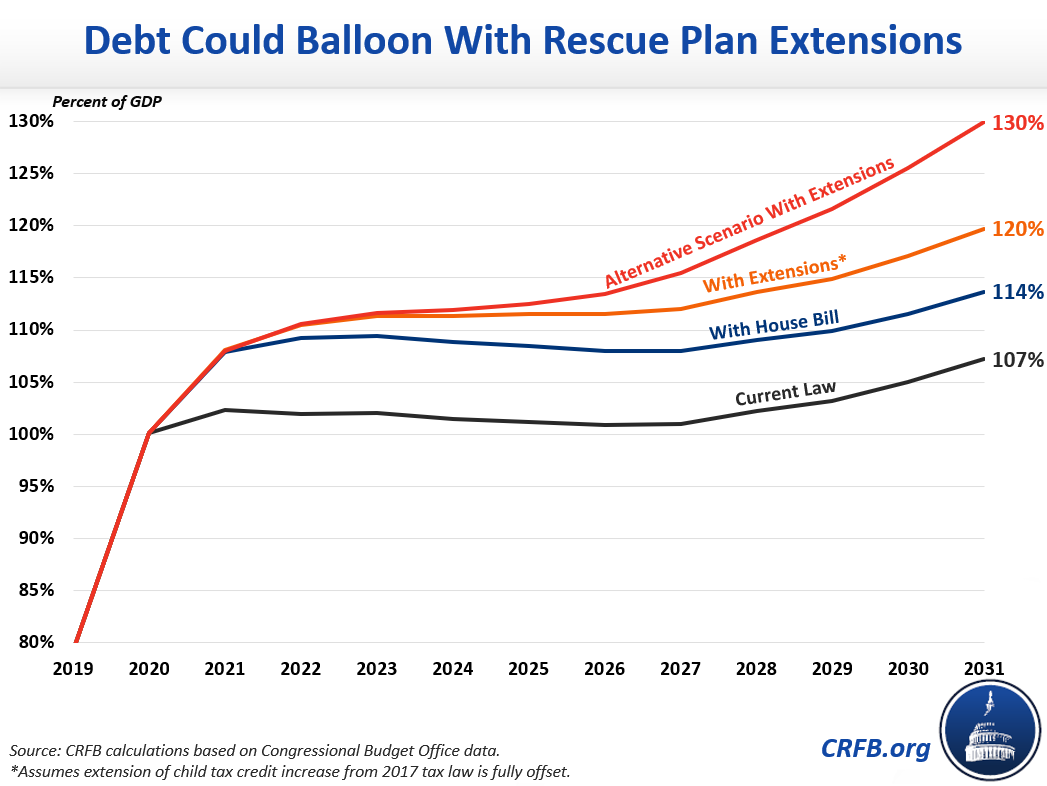

These extensions would substantially increase deficits and debt. Under current law, CBO projects debt to rise from $21.9 trillion today to $35.3 trillion (or 107 percent of GDP) and deficits to reach $1.9 trillion (or 5.7 percent of GDP) by 2031. Passage of the American Rescue Plan Act alone, excluding any dynamic effects, would boost 2031 debt to $37.4 trillion (or 114 percent of GDP) and deficits to $1.9 trillion (or 5.9 percent of GDP).

Assuming these extensions are enacted (but that extension of the CTC expansion from TCJA is fully paid for), we estimate debt in 2031 would reach $39.4 trillion (or 120 percent of GDP) and deficits would total $2.2 trillion (or 6.6 percent of GDP). If policymakers also extend expiring tax cuts and grow discretionary spending with the economy instead of inflation, debt would reach $42.8 trillion (or 130 percent of GDP) and deficits would reach $2.9 trillion (or 8.7 percent of GDP) in 2031.

The bottom line is that temporary policies in the American Rescue Plan Act could become much more expensive if they are eventually extended over the longer term. Any policies in the American Rescue Plan Act that lawmakers intend to make permanent should be offset, and future extensions should certainly be fully offset with tax increases or spending restraint.