Recent Fiscal Irresponsibility Will Double Deficits

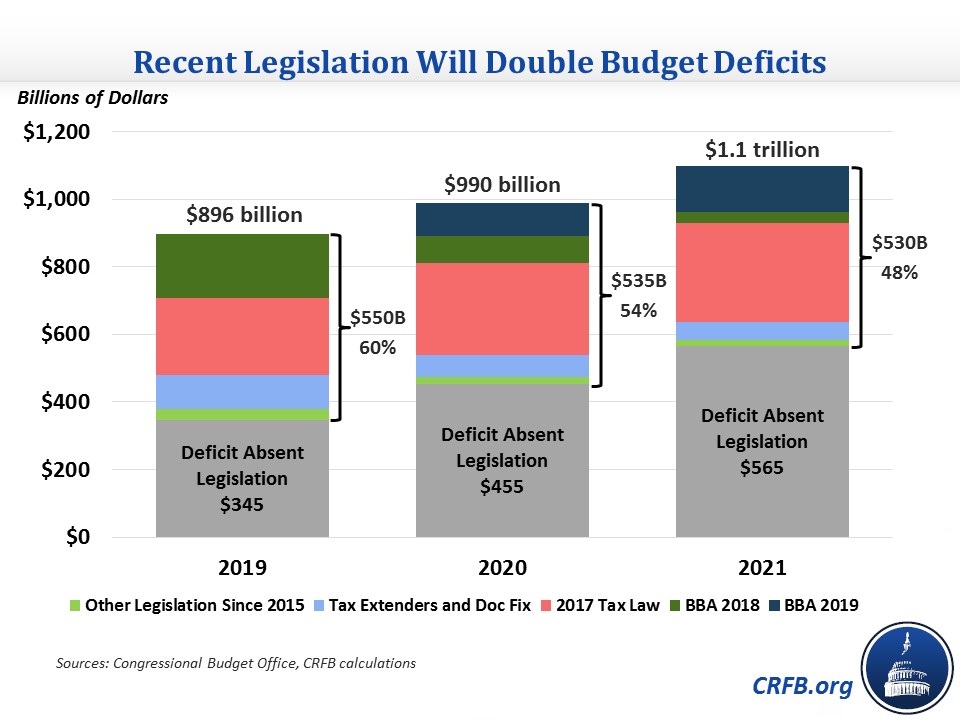

As deficits are expected to climb above $1 trillion in the coming years, it's worth noting that tax cuts and spending hikes passed just in the past few years will play a significant role. In fact, legislation enacted since 2015 could be responsible for more than half of the deficit in 2020 and 2021. In other words, recent policymakers are responsible for doubling near-term budget deficits.

As we've written before, the 2017 tax cuts, 2018 budget deal, and other legislation since 2015 are responsible for 60 percent of the $900 billion budget deficit projected for Fiscal Year (FY) 2019. If the Bipartisan Budget Act (BBA) of 2019 is enacted, recent legislation will be responsible for roughly 55 percent of the deficit in 2020 and 50 percent in 2021.

Specifically, we estimate deficits will total $990 billion in FY 2020, $535 billion of which is the result of recent legislation, and we estimate a budget deficit of $1.1 trillion in FY 2021, with $530 billion from recent legislation. Combined, legislation will be responsible for nearly $1.1 trillion, enough to more than double deficits, which would have otherwise totaled just over $1 trillion.

The share is falling somewhat over time but mainly as a result of rising structural deficits rather than a decline in added borrowing.

The largest deficit-increasing legislation is the 2017 tax law, which is expected to cost $565 billion in 2020 and 2021. The next most costly bill is the BBA 2019, which will cost about $235 billion in the next two years and rise to almost $350 billion in combination with the Bipartisan Budget Act (BBA) of 2018. The 2015 tax extenders and "doc fix" bills will add another $120 billion, and other legislation enacted since 2015, mostly occurring since 2017, will add $35 billion. As a percent of 2020 deficits, the 2017 tax law is responsible for over one-quarter, both BBAs are responsible for nearly one-fifth, and other legislation is responsible for about 10 percent.

Over the next decade, these bills will end up adding about $4.5 trillion to deficits, out of a total $13.1 trillion. That still represents 35 percent but is a smaller proportion due mainly to the fact that a large portion of the tax cuts are scheduled to expire and spending on health and retirement programs will continue to outpace revenue.

The nation's fiscal problems cannot be fixed by simply reversing or paying for recent legislation. But doing so would make a major dent in our debt outlook and would have prevented the massive trillion-dollar deficits we now face as soon as next year.