Washington Should Commit to No New Debt in 2026

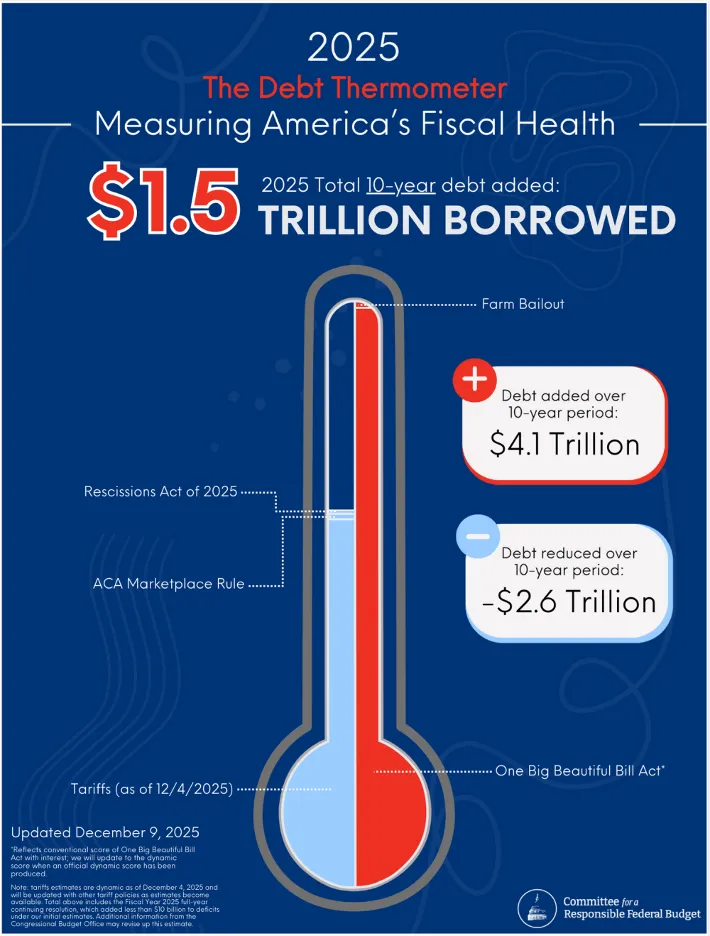

Policymakers have approved $1.5 trillion in net new ten-year borrowing in 2025, according to the Committee for a Responsible Federal Budget’s Debt Thermometer. This includes $4.1 trillion in new ten-year debt added through legislative and executive actions – almost entirely from the One Big Beautiful Bill Act (OBBBA) – only partially offset by $2.6 trillion in ten-year debt reduction, mostly from the Administration’s new tariff policies. This is the largest amount of debt approved since 2022.

The following is a statement from Maya MacGuineas, president of the Committee for a Responsible Federal Budget:

A year that began with promises of massive fiscal improvement instead ended up driving us deeper in debt.

Washington added over $1.5 trillion to the ten-year debt in 2025. It’s only thanks to the tariffs that President Trump put in place unilaterally that we didn’t add as much to the debt this year as in 2020 during COVID. And many of those tariffs may not even stick if the Supreme Court rules they are illegal.

Despite all the promises of cost-cutting, lawmakers keep making things worse. And on the horizon, there is talk of even more borrowing. Some want to enact and deficit finance:

- Enhanced Affordable Care Act (ACA) subsidies

- Health Savings Account (HSA) expansions

- The repeal of savings in the reconciliation bill

- Higher defense and non-defense discretionary spending

- Tariff repeals, rebates, or bailouts

- Weakening of the corporate alternative minimum tax

- Additional spending and tax breaks

Is it too much to ask for Washington to end the year with good fiscal news – the kind Americans were promised, and which future generations deserve? This is no way to run a country. If we’re to avoid a fiscal reckoning, we need to get a grip on our budget.

First and foremost, lawmakers should commit to stop adding to the debt – with a promise of “No New Borrowing.” We shouldn’t deficit finance any policies in 2026. If we’re going to do them, we need to pay for them – preferably twice over so we actually get some deficit reduction.

Lawmakers should extend the discretionary caps that generated savings under the Fiscal Responsibility Act and finalize spending for the remainder of this year without a government shutdown. Furthermore, they should pass a real budget for next year; adopt and pursue a reasonable fiscal target, like bringing deficits down to 3% of GDP; and they need to address the looming insolvency of the Social Security and Medicare trust funds as quickly as possible.

2025 was a terrible year for fiscal policy; we need to commit to making 2026 better.

###

For more information, please contact Matt Klucher, Assistant Director for Media Relations, at klucher@crfb.org.