Analysis of CBO's March 2024 Long-Term Budget Outlook

The Congressional Budget Office (CBO) released its March 2024 Long-Term Budget Outlook today that projects the nation’s fiscal and economic future over the next three decades. CBO’s extended baseline paints a troubling but also relatively optimistic view of the long-term outlook, since it assumes various tax cuts and spending increases expire as scheduled and appropriations grow at a relatively slow pace. CBO’s long-term outlook shows:

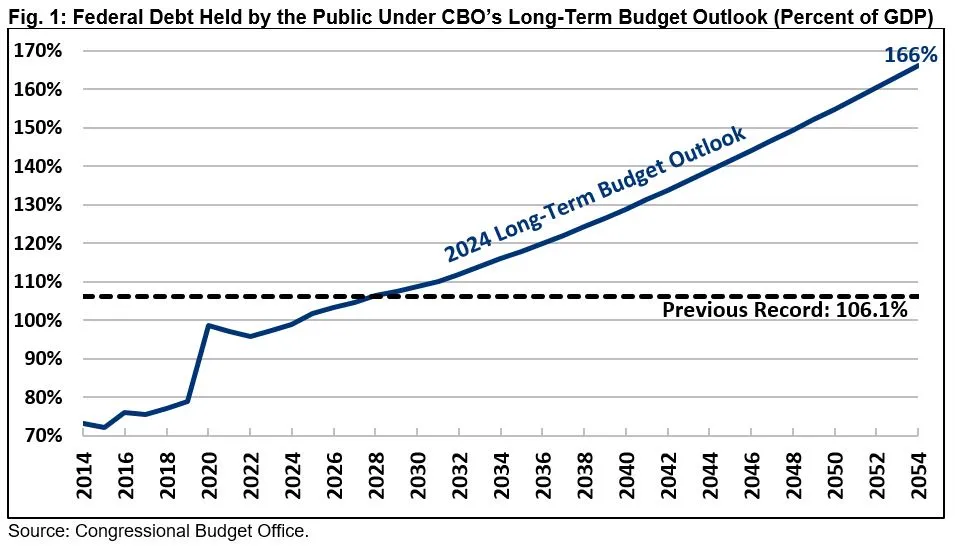

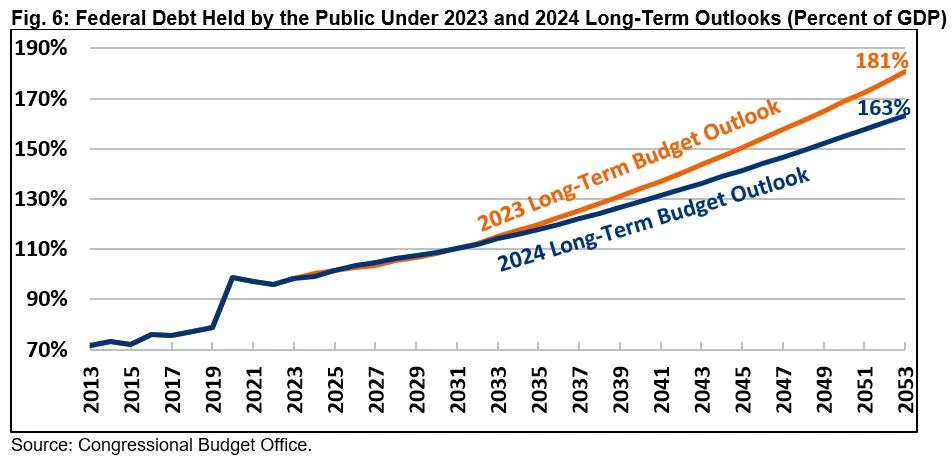

- Debt Will Surge Past Record Levels as a Share of the Economy, with federal debt held by the public rising from 97 percent of Gross Domestic Product (GDP) in Fiscal Year (FY) 2023 to a record 166 percent of GDP by 2054.

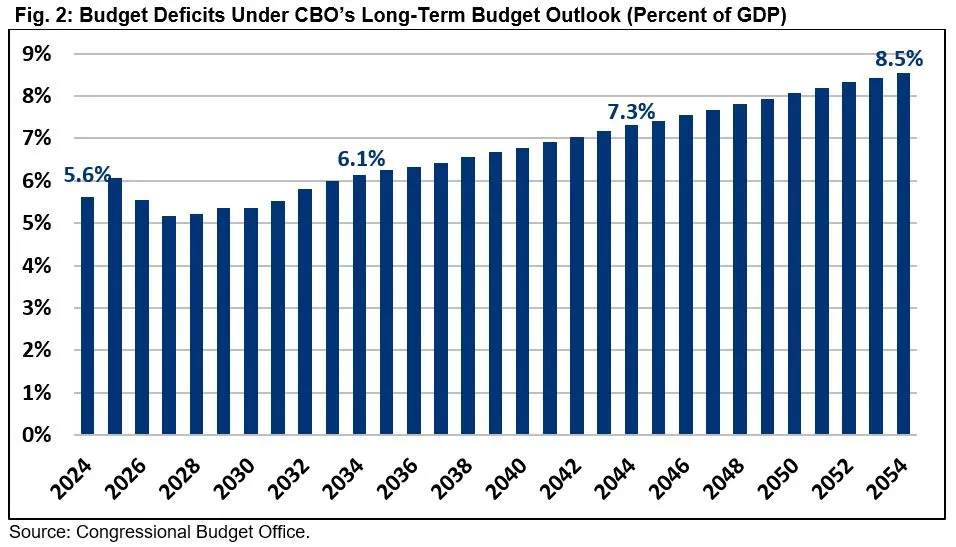

- Deficits Will Grow Rapidly, from an already-high 5.6 percent of GDP in FY 2024 to 8.5 percent of GDP by 2054. The 2054 deficit will be more than twice the 50-year historical average and higher than any time in modern history outside of World War II, the Great Recession, and the COVID-19 pandemic.

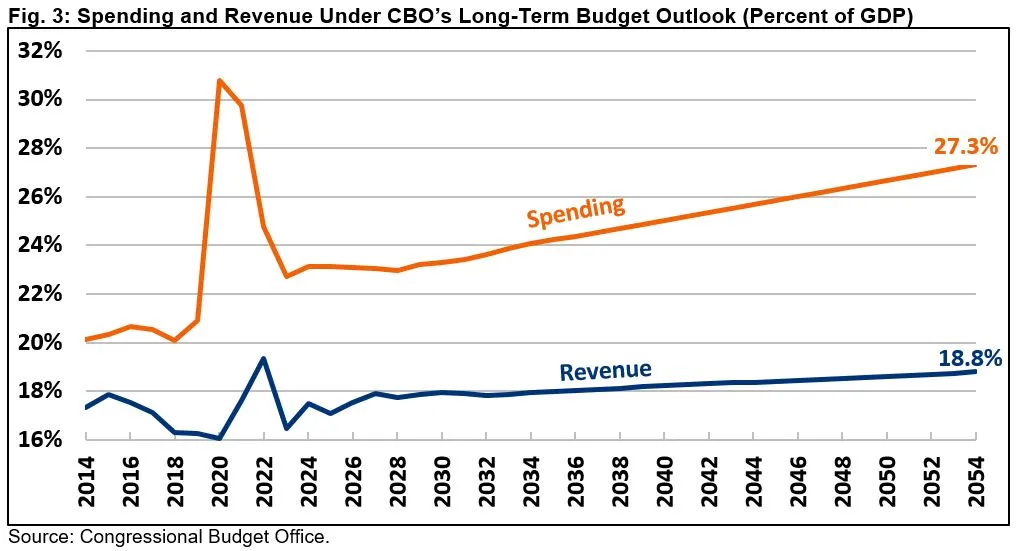

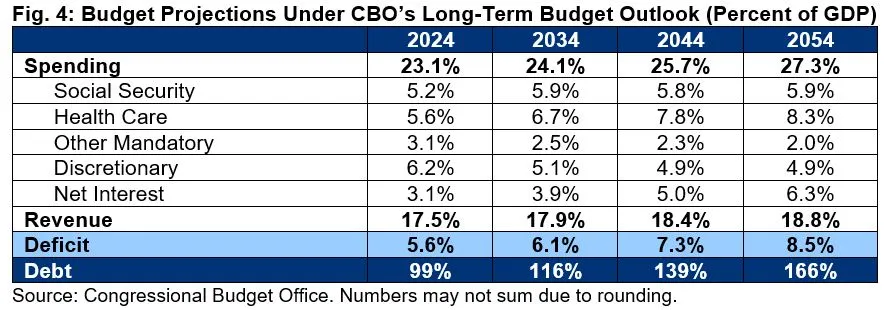

- Spending Will Grow Much Faster than Revenue, rising from 23.1 percent of GDP in FY 2024 to 24.1 percent by 2034 and to 27.3 percent by 2054. Interest costs will more than double from 3.1 percent of GDP in 2024 to 6.3 percent by 2054, while major health and retirement spending will grow from 10.7 percent of GDP to 14.1 percent. Revenue will also grow but much more modestly – from 17.5 percent of GDP in 2024 to 18.8 percent by 2054.

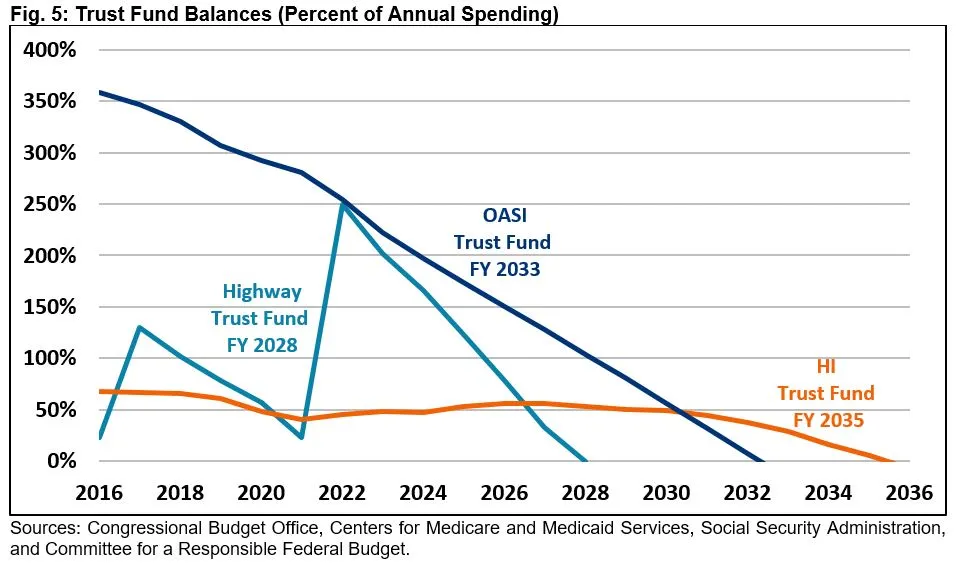

- Major Trust Funds Are Approaching Insolvency, with the Highway Trust Fund running out by FY 2028, the Social Security Old-Age and Survivors Insurance (OASI) trust fund exhausting its reserves by FY 2033, and the Medicare Hospital Insurance (HI) trust fund reaching insolvency by FY 2035. On a theoretically combined basis, the Social Security retirement and disability insurance trust funds will be insolvent by FY 2034.

- The Budget Outlook is Better Than Last Year’s but Still Troubling. CBO projects debt will total 163 percent of GDP by FY 2053, which is 18 percentage points of GDP lower than projected in last year’s extended baseline. This improvement is largely driven by higher immigration, stronger projected economic growth, and methodological changes.

High and rising deficits and debt pose a series of risks and threats to the budget and economy. High debt levels slow income and wage growth, increase interest payments on the national debt, put upward pressure on interest rates, reduce the fiscal space available to respond to an economic recession or other emergency, place an undue burden on future generations, and increase the risk of a fiscal crisis.

Debt Will Surge Past Record Levels

Under its extended baseline, CBO projects that federal debt held by the public will rise from 97 percent of GDP at the end of FY 2023 to a record 106.4 percent of GDP by 2028 and to 166 percent of GDP by the end of 2054. Projected debt in 2054 will be more than double the pre-pandemic level as a share of the economy and about 3.4 times the 50-year historical average of 48 percent of GDP. In nominal dollars, debt will grow by $114 trillion, from $28 trillion at the end of this year to $142 trillion by the end of 2054.

While CBO’s long-term projections are certainly troubling, they may prove to be overly optimistic since they assume policymakers will allow numerous tax and spending provisions – including many parts of the Tax Cuts and Jobs Act of 2017 – to phase out or expire as scheduled and restrict discretionary spending growth over the next decade. Under various constructions of “current policy,” debt could rise to between 200 and 300 percent of GDP by the end of FY 2054.

As CBO notes, rising debt and deficits carry significant risks and threats to the budget and economy. High debt levels hinder economic growth, threaten economic vitality, strain the federal budget by increasing interest payments on the national debt, create geopolitical challenges and risks, make responding to economic recessions or other emergencies more challenging, impose intergenerational imbalances, and increase the risk of an eventual fiscal crisis.

Deficits Will Grow Rapidly

CBO projects that budget deficits will grow steadily over the next three decades. In nominal dollars, the deficit will grow from $1.6 trillion in FY 2024 to $2.6 trillion in 2034, $4.4 trillion in 2044, and $7.3 trillion 2054.

As a share of the economy, the deficit will grow from 5.6 percent of GDP in FY 2024 to 6.1 percent of GDP in 2034, 7.3 percent of GDP in 2044, and 8.5 percent of GDP in 2054.

At 8.5 percent of GDP, the deficit in FY 2054 will be higher than at any time in modern history outside of World War II, the Great Recession, and the COVID-19 pandemic. It will also be over two times larger than the 50-year historical average of 3.7 percent of GDP.

Under current law, primary (non-interest) budget deficits will decline from 2.5 percent of GDP in FY 2024 to 1.9 percent in 2027 and 2028 before rising back to between 2.2 and 2.4 percent of GDP per year in 2033 and beyond. Interest costs will explode, growing from 3.1 percent of GDP in 2024 to 3.9 percent in 2034, 5.0 percent in 2044, and 6.3 percent in 2054.

Importantly, deficits would be far higher if Congress continues policies currently or recently in effect. The extensions of expired and expiring tax cuts alone would reduce revenue by about 1 percent of GDP. Holding discretionary spending to its current share of GDP would boost primary spending by another percentage point of GDP. These two changes together would be enough to nearly double projected primary deficits over the medium and long terms.

Spending Will Grow Rapidly and Outpace Revenue

Rising deficits and debt are driven by rapid spending growth in combination with only modest revenue growth. Specifically, CBO projects spending will grow from 23.1 percent of GDP in FY 2024 to 24.1 percent of GDP by 2034, 25.7 percent of GDP by 2044, and 27.3 percent of GDP by 2054. Meanwhile, revenue will rise from 17.5 percent of GDP in FY 2024 to 17.9 percent of GDP by 2034, 18.4 percent of GDP by 2044, and 18.8 percent of GDP by 2054. For comparison, the 50-year historical average is 21.0 percent of GDP for spending and 17.3 percent of GDP for revenue.

The projected long-term growth in spending is mostly driven by rising interest costs along with the growth of Social Security and health care. CBO projects interest costs will more than double from 3.1 percent of GDP in FY 2024 to 6.3 percent of GDP by 2054. By 2051, interest will be the single largest line item in the federal budget. Meanwhile, spending on Social Security and the major health care programs will grow from 10.7 percent of GDP in 2024 to 14.1 percent of GDP in 2054. Other spending would shrink as a share of the economy by 2.4 percent of GDP.

Major Trust Funds Are Approaching Insolvency

Several important federal programs are financed through trust funds. CBO projects that three of those major trust funds will be insolvent within the next 11 years. CBO projects the Highway Trust Fund will deplete its reserves by FY 2028, the Social Security Old-Age and Survivors Insurance trust fund by FY 2033, and the Medicare Hospital Insurance trust fund by FY 2035. The Social Security Disability Insurance (SSDI) trust fund will remain solvent through at least FY 2054. On a theoretically combined basis, where funds are shared between OASI and SSDI, the Social Security trust funds will run out by FY 2034.

Put another way, the Social Security retirement trust fund will run out of reserves when today’s youngest retirees turn 71 and the Medicare HI trust fund will run out when they turn 73. The Highway Trust Fund will exhaust its reserves – which were last replenished by the 2021 bipartisan infrastructure law – in just four years.

Upon insolvency, the law requires spending on these programs to be reduced to equal dedicated revenue. CBO estimates that if policymakers fail to restore solvency and the required cuts occur, Social Security benefits will be abruptly cut by 25 percent for all beneficiaries across the board. Upon insolvency, Medicare spending on hospitals will be cut by 13 percent and highway spending slashed by about 50 percent.

The Budget Outlook is Better Than Last Year's, but Still Troubling

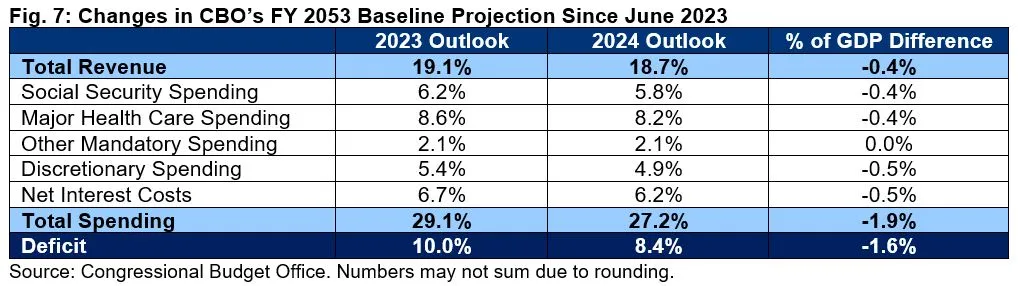

CBO now projects lower deficits and debt than in the June 2023 Long-Term Outlook. Specifically, CBO projects debt to total 163 percent of GDP in 2053, compared to 181 percent of GDP in its prior outlook; CBO projects deficits to total 8.4 percent of GDP, compared to 10.0 percent previously.

Lower deficits and debt projections are largely the result of higher projected output and methodological changes. By FY 2053, GDP is projected to be about 3.5 percent higher – largely due to an increase in the size of the population. At the same time, CBO adjusted its methodology to assume a smaller share of immigrants receive Social Security and Medicare. Discretionary spending is also projected to be lower under CBO’s latest outlook, as CBO no longer assumes permanent extensions of temporary infrastructure spending.

Due to a combination of higher projected output and lower projected spending, CBO projects that in 2053 health care spending will be 0.4 percent of GDP smaller than in last year’s estimate, Social Security will be 0.4 points smaller, discretionary spending will be 0.5 points smaller, and interest will be 0.5 points smaller. CBO also projects revenue will be 0.4 percentage points of GDP lower.

Conclusion

CBO’s latest 30-year projections show that despite policymakers enacting substantial deficit reduction in the past year – and despite some favorable economic and demographic news – the long-term fiscal outlook remains unsustainable. Under current law, CBO projects that federal debt held by the public will rise from 97 percent of GDP at the end of FY 2023 to 166 percent of GDP by the end of 2054 – more than twice the pre-pandemic level and 3.4 times the 50-year historical average.

At the same time, the budget deficit will reach 8.5 percent of GDP in FY 2054 – higher than at any point outside of World War II, the Great Recession, and the COVID-19 pandemic. Interest costs will also explode, more than doubling as a share of the economy by 2054 and becoming the single largest line item in the federal budget by 2051. And three major trust funds will run out of reserves in the next 11 years, starting with the Highway Trust Fund in just four years.

Unfortunately, the long-term outlook could be far worse than CBO projects. Under alternative scenarios that assume various tax and spending provisions are extended without offsets and discretionary spending grows with the economy, among other assumptions, debt could reach 200 to 300 percent of GDP by FY 2054 and continue to grow rapidly thereafter.

As CBO explains, high debt and deficits carry significant risks and threats to the budget and the economy. High and rising debt hinders economic growth by crowding out investments, pushes up interest rates, strains the federal budget through rising interest payments, creates geopolitical challenges and risks, makes responding to new emergencies more challenging, imposes burdens on future generations, and increases the risk of a fiscal crisis.

To address the nation’s long-term budgetary challenges, policymakers should build upon the substantial deficit reduction enacted in the past year by adopting reforms to lower health care costs, restore solvency to the major trust funds, raise revenue, reduce lower priority spending, and promote stronger economic growth.

What's Next

-

Image

-

Image

-

Image