CBO's February 2024 Budget and Economic Outlook

The Congressional Budget Office released its February 2024 Budget and Economic Outlook today, projecting the nation’s fiscal and economic future over the next decade. CBO’s latest projections update its May 2023 baseline to account for subsequent legislation and executive actions, recent trends in inflation, immigration, interest rates, and economic growth, and other factors. CBO’s latest projections show:

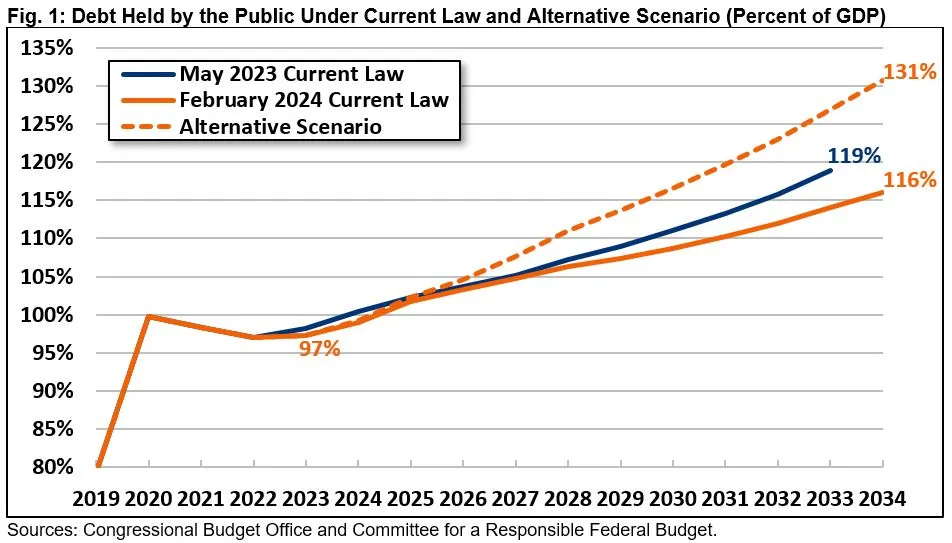

- Debt will reach a record 116 percent of GDP by 2034. Under current law, CBO projects that federal debt held by the public will grow by $21 trillion over the next decade, reaching $48 trillion by the end of FY 2034. Debt will grow from 97 percent of GDP in 2023 to 116 percent by 2034; it could grow to 131 percent of GDP by 2034 if policymakers extend various expiring policies.

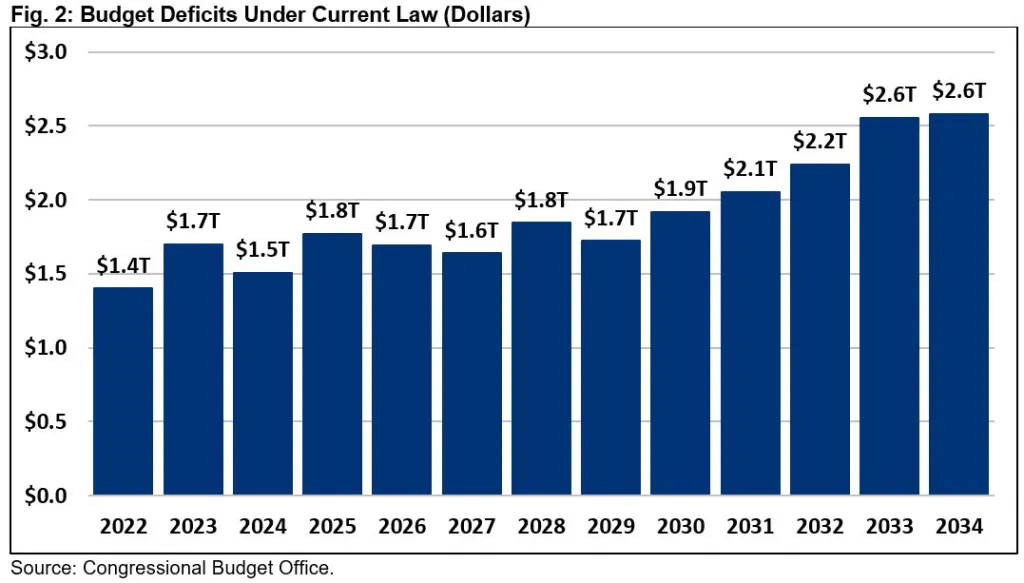

- Deficits will reach $2.6 trillion by 2034. Deficits will total 5.7 percent of GDP ($20 trillion) over the next decade and will reach 6.2 percent of GDP ($2.6 trillion) by 2034.

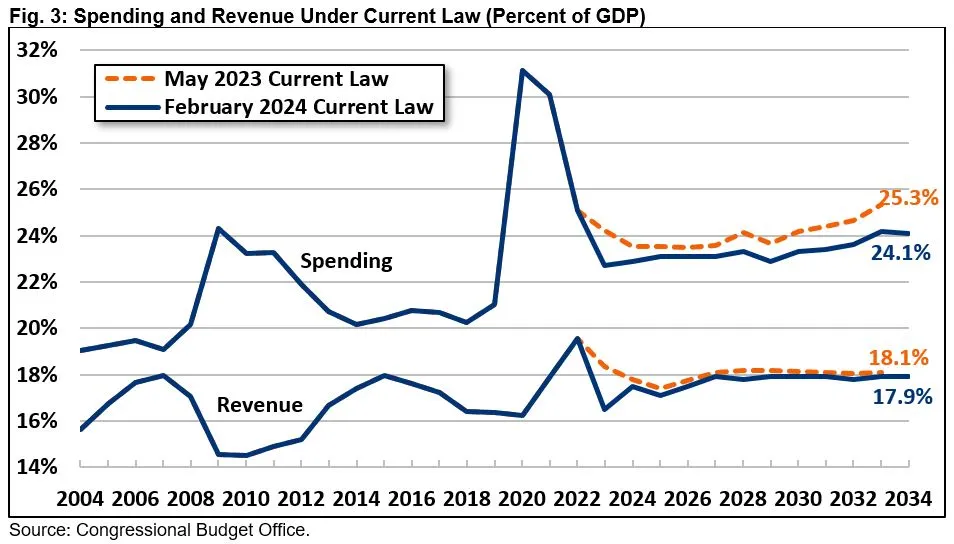

- Spending and revenue will remain far apart. Spending will grow from 22.7 percent of GDP in 2023 to 24.1 percent by 2034, while revenue will grow from 16.5 percent of GDP in 2023 to 17.1 percent in 2025 and then rise to 17.9 percent of GDP by 2034 after large parts of the TCJA expire.

- Interest costs will explode. After nearly doubling from $345 billion in 2020 to $659 billion in 2023, interest costs will double to $1.3 trillion by 2031 and reach $1.6 trillion – a record 3.9 percent of GDP – by 2034. Interest costs have already passed Medicaid and will exceed the cost of defense and Medicare this year.

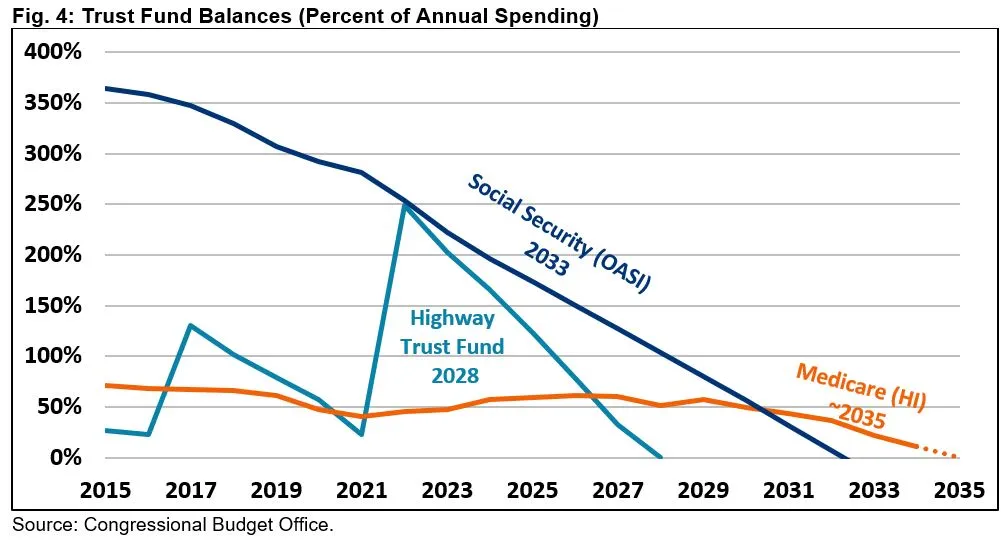

- Major trust funds are approaching insolvency. The Highway Trust Fund will deplete its reserves by 2028, Social Security’s retirement trust fund will be insolvent by 2033, and the Medicare Hospital Insurance trust fund will run out of cash by the mid-2030s. Upon insolvency, all three face across-the-board cuts.

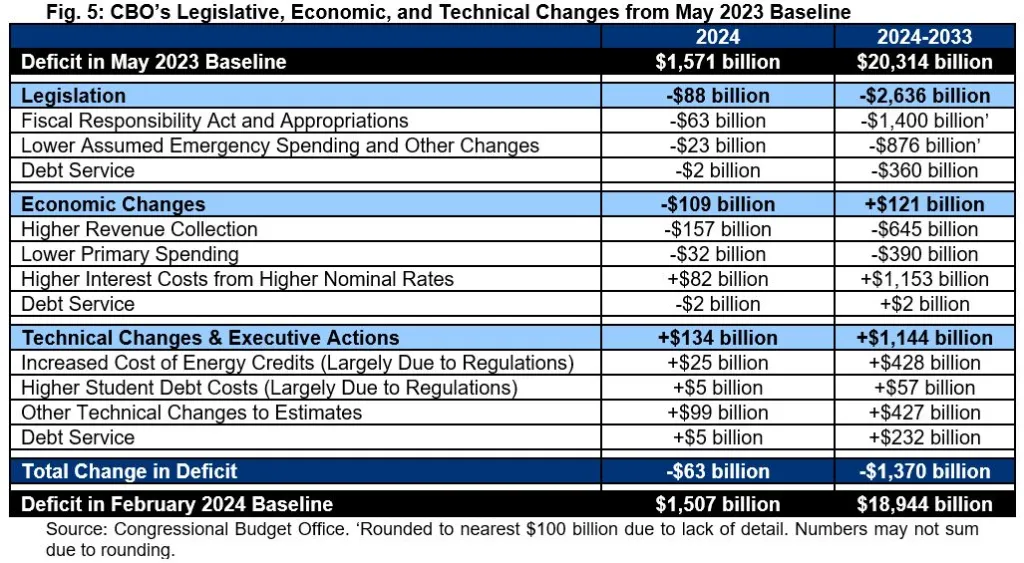

- The FRA improved the fiscal outlook. CBO now projects $1.4 trillion less borrowing between 2024 and 2033 than it did last May, due entirely to savings from the Fiscal Responsibility Act. Other factors, including higher interest rates and stronger economic growth, were largely offsetting.

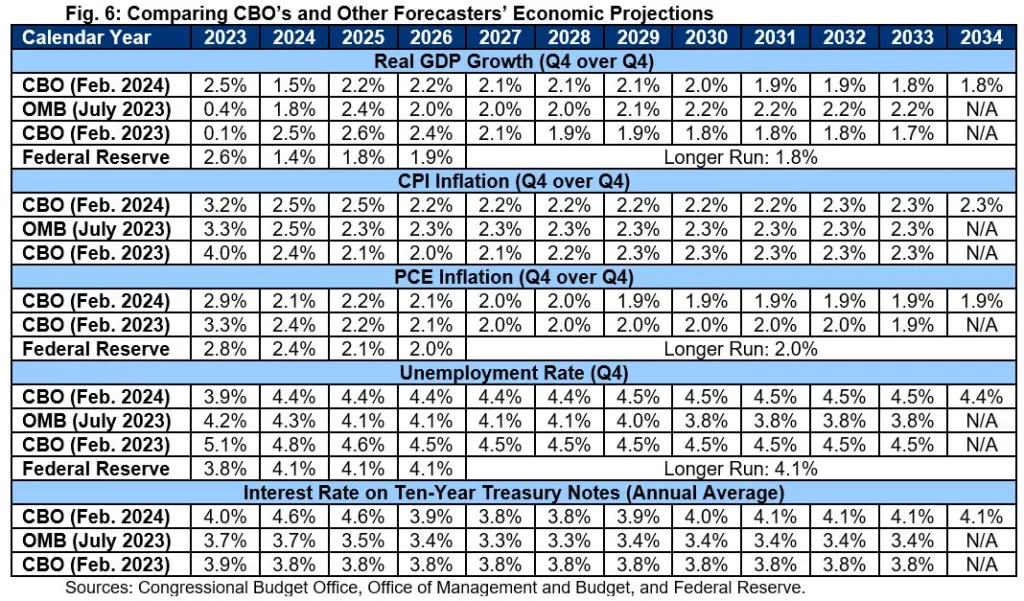

- The economy will normalize while interest rates remain high. CBO projects inflation will return close to its 2 percent target this year and unemployment will stabilize at about 4.4 percent per year. Meanwhile, interest rates will remain high, with ten-year Treasury yields at 4.1 percent by the end of the budget window.

With debt approaching record levels and interest costs exploding, lawmakers should come together to enact significant deficit reduction or support a special process to do so.

Debt Will Hit New Records

CBO projects that federal debt held by the public will grow by $21 trillion over the next decade, rising from $27 trillion today to $48 trillion by the end of Fiscal Year (FY) 2034.

As a share of the economy, debt will grow from 97 percent of Gross Domestic Product (GDP) in FY 2023 – twice the 50-year historical average of 48 percent – to a record 106 percent of GDP by 2028. It will continue to grow to 116 percent by the end of 2034. This is somewhat lower than projected in CBO’s May 2023 baseline, thanks mainly to the Fiscal Responsibility Act (FRA) but also to faster growth and thus larger GDP.

If policymakers choose to extend various policies that are scheduled to expire or change over the coming years and grow discretionary spending with the economy instead of inflation after the FRA expires, debt could be much higher. Our preliminary estimates of such an alternative scenario project debt could reach 131 percent of GDP by the end of FY 2034, largely due to extending parts of the Tax Cuts and Jobs Act (TCJA) slated to expire after 2025.

Such high levels of debt carry significant risks and threats to the economy and the nation as a whole. High debt levels put upward pressure on interest rates, discourage investment, slow economic growth, threaten economic vitality, place a strain on the budget through rising interest payments, create geopolitical challenges and risks, make responding to new emergencies more challenging, and impose intergenerational unfairness between current and future generations.

Deficits Will Total $2 Trillion Per Year

Deficits will total $20.0 trillion, or 5.7 percent of GDP, over the next decade under CBO’s baseline. After growing from $1.4 trillion in FY 2022 to $1.7 trillion in 2023, CBO projects deficits will fall to $1.5 trillion in 2024. CBO projects deficits will then grow to $1.8 trillion by 2025, breach $2.0 trillion by 2031, and grow to $2.6 trillion by 2034.

As a share of the economy, CBO projects deficits will fall from 6.3 percent of GDP in FY 2023 to 5.3 percent in 2024, and then grow again to 6.1 percent in 2025. Assuming large parts of the TCJA and other policies expire at the end of 2025, CBO projects deficits will decline to a low of 5.0 percent of GDP in 2029, before rising to 6.2 percent by 2034.

These deficits are extremely high by historic standards. At 6.2 percent, the FY 2034 deficit as a share of GDP will be one-third larger than in the year prior to the pandemic and about 70 percent larger than the 50-year historical average of 3.7 percent of GDP. In nominal dollars, the $2.6 trillion deficit will be 2.6 times as large as immediately before the pandemic.

Under an alternative scenario where expiring tax cuts and spending policies are extended without offsets and discretionary spending grows with output instead of inflation after the FRA caps end, deficits could be much higher. Our preliminary estimates suggest deficits would total $26 trillion over the next decade, or 7.4 percent of GDP, under that scenario. By FY 2034, deficits could reach $3.5 trillion, or 8.5 percent of GDP.

Spending and Revenue Will Remain Far Apart

Rising debt and deficits are driven by a disconnect between spending and revenue. Over the FY 2025 to 2034 budget window, CBO projects spending will total $82.7 trillion (23.5 percent of GDP) while revenue will total $62.6 trillion (17.8 percent of GDP). Put differently, projected revenue will only be enough to cover three-quarters of projected spending over the next decade and spending will exceed revenue by one-third.

CBO projects spending will rise from 22.7 percent of GDP ($6.1 trillion) in FY 2023 to 23.3 percent ($7.7 trillion) by 2028 and 24.1 percent ($10.1 trillion) by 2034. For comparison, the 50-year historical average for spending is 21.0 percent of GDP.

CBO projects revenue will grow from 16.5 percent of GDP ($4.4 trillion) in FY 2023 to 17.1 percent ($5.0 trillion) by 2025, and then rise to 17.9 percent of GDP ($7.5 trillion) by 2034, with the growth mainly attributable to the expiration of large parts of the 2017 tax cuts at the end of 2025. For perspective, the 50-year historical average for revenue is 17.3 percent of GDP.

Rising spending is driven by the growth of health, retirement, and interest costs. CBO projects that spending on Social Security and health care will nearly double between FY 2023 and 2034, growing from $2.9 trillion to $5.3 trillion and from 10.8 percent of GDP to 12.7 percent. Having nearly doubled to $659 billion between 2020 and 2023, CBO projects interest costs to double again by 2031 and reach $1.6 trillion – a record 3.9 percent of GDP – by 2034. Interest costs will exceed spending on both defense and Medicare this year, while Medicare will once again overtake interest in 2027 before being outpaced in the late 2040s.

Major Trust Funds Face Looming Insolvency

The Social Security retirement and Highway trust funds will run out of reserves by the end of the decade, CBO projects, and the Medicare Hospital Insurance (HI) trust fund will follow soon after.

The Highway Trust Fund will run out of reserves in FY 2028, at which point spending will automatically be cut roughly in half under current law.

Meanwhile, CBO estimates the Social Security Old-Age and Survivors Insurance (OASI) trust fund will be insolvent by 2033, when today’s 58-year-olds reach the full retirement age and today’s youngest retirees turn 71. At that point, all beneficiaries face an immediate 25 percent cut, regardless of age or need. We previously estimated a typical couple would face a $17,400 cut.

The Medicare Hospital Insurance (HI) trust fund, also known as Part A, will not be exhausted within the ten-year window under CBO’s projections, but it will likely be exhausted by 2035 or immediately after. At that point, trust fund spending would likely be cut by about a tenth, jeopardizing access to care for nearly 80 million beneficiaries.

CBO’s baseline assumes the trust funds will continue to spend beyond insolvency and that all three trust funds will run large cash shortfalls over the next decade. Under CBO’s baseline, the Highway Trust Fund will run $393 billion of cash deficits through 2034, the Medicare HI trust fund $252 billion, and the Social Security OASI trust fund a massive $3.7 trillion of cash deficits.

Together, the programs will run a combined $4.4 trillion in deficits – 1.2 percent of GDP – including $1.4 trillion beyond what they are authorized to spend from their trust funds.

The Fiscal Outlook Has Improved Thanks to the Fiscal Responsibility Act

CBO projects deficits will total $18.9 trillion between FY 2024 and 2033, which is $1.4 trillion lower than projected in May 2023. The difference can be entirely explained by the Fiscal Responsibility Act, which capped discretionary appropriations at reduced levels in 2024 and 2025 (CBO extrapolates these levels forward and assumes additional savings). Lower assumed emergency spending, which CBO also extrapolates forward, saves nearly $900 billion more. With interest, these legislative changes and related assumptions reduced projected deficits by $2.6 trillion through 2033.

Technical changes partially offset these legislative improvements, adding $1.1 trillion to deficits. This is due in part to regulations and executive actions around student debt, interpretation of rules for the Inflation Reduction Act tax credits, and proposed limits on vehicle emissions. These actions help explain nearly $485 billion of additional borrowing, while other technical changes added a further $427 billion, mostly due to revisions of Medicare and Social Security enrollment.

Economic changes increased deficits by a further $121 billion. Changes to output, inflation, and employment – especially due to a large boost in immigration and an ultimate 5-million-person increase in the size of the labor force – reduced primary deficits by over $1 trillion. Higher interest rates, on the other hand, widened projected deficits by nearly $1.2 trillion.

In addition to the $1.4 trillion reduction in deficits, CBO projects around a 2 percent increase in nominal GDP in FY 2033, compared to previous estimates. These two factors explain the five percentage point reduction in debt-to-GDP from 119 to 114 percent of GDP in 2033.

The Economy Will Normalize With Strong Growth and High Interest Rates

CBO expects the recent surge in inflation to fade this year, with Consumer Price Index (CPI) inflation falling to 2.5 percent in 2024 and 2025 and about 2.2 percent per year thereafter. Personal Consumption Expenditures (PCE) inflation will fall to 2.1 percent this year and average 2.0 percent in future years.

CBO expects the inflation slowdown to be accompanied by a modest near-term increase in the unemployment rate, up from 3.7 percent today to 4.4 percent in 2024 and beyond.

After a strong 2.5 percent growth in real GDP in 2023, CBO expects a slowdown to 1.5 percent growth this year, growth of 2.1 to 2.2 percent per year through 2029, and sub-2.0 percent growth after 2030. CBO now expects nominal GDP to be about 2 percent higher in 2033 than previously estimated, largely as a result of greater levels of immigration and, to a lesser extent, stronger productivity growth.

Although CBO expects strong economic growth, they are also projecting interest rates to remain relatively high. CBO projects the ten-year Treasury yield to peak at 4.6 percent this year, fall to 3.8 percent by 2027, and rise to 4.1 percent by 2031. For context, the average ten-year yield was below 3 percent for most of the 2010s. CBO believes the three-month bill yield to have peaked at 5.1 percent in 2023 and projects it will fall to about 2.8 percent per year by 2027.

Conclusion

CBO’s latest baseline shows that, despite policymakers enacting substantial net deficit reduction in 2023, the fiscal outlook remains dire. As a result, interest spending will exceed defense and Medicare spending this year, deficits will total $20 trillion over the next decade, and debt will reach a record share of the economy by FY 2028. Meanwhile, the Highway, Medicare, and Social Security trust funds are all on course to run out of reserves, resulting in automatic, across-the-board cuts without changes to the law.

Substantial deficit reduction is needed to put the national debt on a sustainable path. A thoughtful fiscal package could help hold down interest rates, restore solvency to our major trust funds, lower health care costs, reduce global and domestic risks, and promote strong and durable economic growth.

Policymakers should work together on a deficit reduction plan that puts everything on the table. Passing a budget and establishing a bipartisan fiscal commission could serve as important first steps. The sooner we act, the better.

Appendix

What's Next

-

-

Image

-

Image