Analysis of CBO's June 2023 Long-Term Budget Outlook

Today, the Congressional Budget Office (CBO) released its June 2023 Long-Term Budget Outlook, projecting that the national debt is on an unsustainable long-term path. CBO’s new extended baseline builds off of its recent ten-year budget projections and updates its July 2022 Long-Term Budget Outlook to account for subsequent legislation, executive actions, changes in inflation and interest rates, and other factors. CBO’s extended baseline shows:

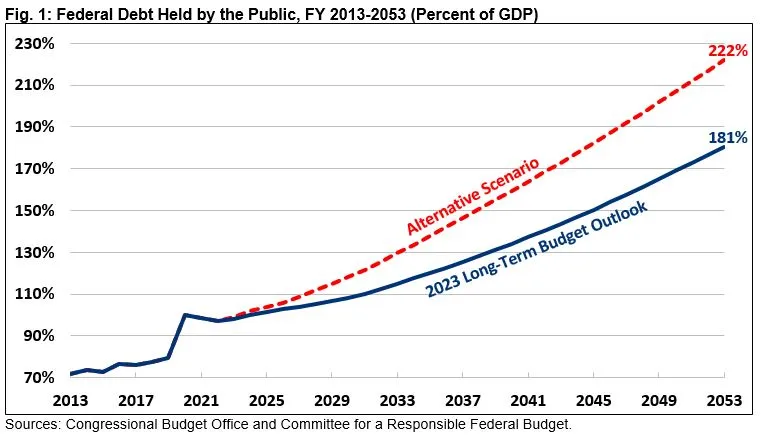

- Debt Will Grow Rapidly as a Share of the Economy. CBO projects that federal debt held by the public will rise from 97 percent of Gross Domestic Product (GDP) at the end of Fiscal Year (FY) 2022 to 181 percent by 2053 under current law. Under our Alternative Scenario, which assumes extension of expiring provisions, faster discretionary spending growth, and incorporates weak revenue collections, debt would reach 222 percent of GDP by the end of 2053.

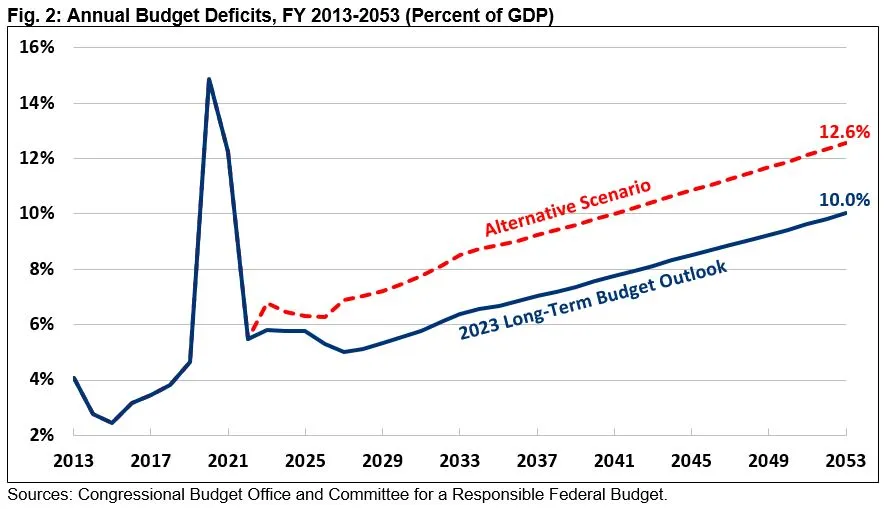

- Deficits Will Explode. Under current law, CBO projects the budget deficit will grow from 5.8 percent of GDP in 2023 to 10.0 percent by 2053. The 2053 deficit will be higher than at any time in modern history outside of World War II and the COVID-19 pandemic. It will be nearly three times as large as the 50-year historical average of 3.6 percent of GDP. Under our Alternative Scenario, the deficit would reach 12.6 percent of GDP by 2053.

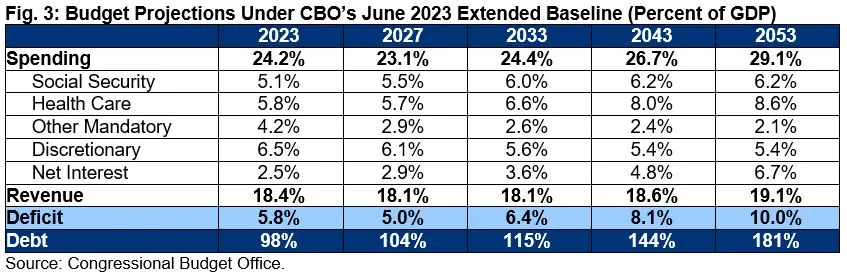

- Spending Will Continuously Outpace Revenue. Under CBO’s extended baseline, spending will drop to 23.1 percent of GDP by 2026 and then grow to 29.1 percent by 2053. After falling to 17.4 percent of GDP by 2025, revenue will grow to 18.1 percent by 2027 and to 19.1 percent by 2053. Projected spending growth is driven by rising retirement, health care, and net interest costs.

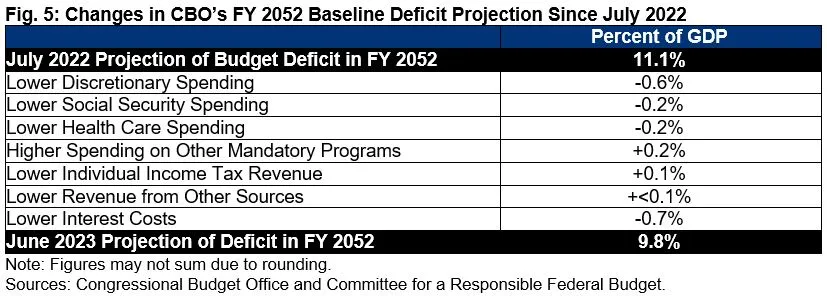

- The Budget Outlook is Better Than Last Year’s, but Still Troubling. CBO projects that debt will total 177 percent of GDP in 2052, more than 8 percentage points of GDP lower than the 185 percent of GDP projection in last year’s extended baseline. CBO expects the 2052 deficit to be 9.8 percent of GDP, compared to 11.1 percent in last year’s long-term outlook. The decrease in debt and deficits as a share of GDP is largely driven by the $1.5 trillion of ten-year savings in the Fiscal Responsibility Act (FRA).

As we’ve explained before, high debt levels slow income and wage growth, increase interest payments on the national debt, reduce the fiscal space available for the nation to respond to a recession or other emergency, place an undue burden on future generations, and increase the risk of a fiscal crisis. Policymakers should focus on long-term deficit reduction and avoid enacting tax cuts or spending increases without paying for them.

Debt Will Grow Rapidly as a Share of the Economy

CBO projects that federal debt held by the public relative to the size of the economy will nearly double within three decades, rising from 97 percent of GDP at the end of FY 2022 to 181 percent of GDP by 2053 under its extended baseline. Projected debt in 2053 will be nearly four times the 50-year historical average of 47 percent of GDP and will put debt on track to be double the size of the previous record of 106 percent of GDP before 2060. In nominal dollars, debt will grow by nearly $120 trillion, from $25 trillion today to nearly $144 trillion by the end of 2053.

Troubling as they are, CBO’s projections may ultimately prove optimistic, as they assume policymakers will allow numerous policy expirations to take effect – including large parts of the Tax Cuts and Jobs Act of 2017 – and contain discretionary spending growth over the next decade.

We recently constructed an Alternative Scenario that assumes expiring provisions are extended, incorporates various side agreements made outside of the FRA, assumes appropriations grow with the economy rather than inflation between FY 2026 and FY 2033, and incorporates the recent decline in tax payments. Under our Alternative Scenario, debt would grow to 222 percent of GDP by 2053.

As CBO notes, rising debt and deficits carry significant risks and threats to the economy and the nation. High debt levels also hinder economic growth, threaten economic vitality, strain the federal budget through rising interest payments, create geopolitical challenges and risks, make responding to new emergencies more challenging, and impose intergenerational unfairness between today’s Americans and future generations.

Deficits Will Explode

CBO expects budget deficits to grow steadily over the next three decades. In nominal dollars, the deficit will grow from $1.4 trillion in FY 2022 to $1.5 trillion in 2023, $2.5 trillion in 2033, $4.6 trillion in 2043, and $8.0 trillion in 2053.

As a share of the economy, the deficit will grow from 5.8 percent of GDP in FY 2023 to 6.4 percent by 2033, to 8.1 percent by 2043, and to 10.0 percent by 2053. Under our Alternative Scenario, the deficit would reach 12.6 percent of GDP by 2053 – about $10 trillion in nominal dollars.

At 10.0 percent of GDP, the deficit in FY 2053 will be higher than at any time in modern history outside of World War II and the COVID-19 pandemic. It will also be nearly three times larger than the 50-year historical average of 3.6 percent of GDP.

Under current law, primary (non-interest) budget deficits will decline from 3.6 percent of GDP in FY 2022 and 3.3 percent in 2023 to 2.1 percent by 2027, before rising back to between 3.3 and 3.4 percent of GDP per year in 2040 and beyond. Interest costs will explode, rising from 1.9 percent of GDP in 2022 and 2.5 percent in 2023 to 4.3 percent by 2040 and to 6.7 percent by 2053.

The 12.6 percent deficit under our Alternative Scenario in 2053 would include a primary deficit of 5.1 percent of GDP and interest costs totaling 7.5 percent of GDP.

Spending Will Continuously Outpace Revenue

Rising deficits and debt levels are driven by a disconnect between spending and revenue. Over the next three decades, CBO expects spending to grow rapidly and revenue to rise gradually.

CBO projects that spending will decline at first, falling from 24.2 percent of GDP in FY 2023 to 23.1 percent in 2026 and 2027, before rising to 24.4 percent by 2033, 26.7 percent by 2043, and 29.1 percent by 2053. Spending has averaged 21.0 percent of GDP over the last half century.

Meanwhile, revenue will decline from a projected (but overestimated) 18.4 percent of GDP in FY 2023 to 17.4 percent by 2025, before rising to 18.2 percent by 2027, 18.6 percent by 2043, and 19.1 percent by 2053. Revenue has averaged 17.4 percent of GDP over the past 50 years.

The projected long-term growth in spending is mostly driven by rising health, Social Security, and net interest costs. CBO expects spending on these three areas to grow from 13.4 percent of GDP in FY 2023 to 21.5 percent by 2053 – a 60 percent increase. Spending on Social Security will increase by one-fifth, from 5.1 percent of GDP to 6.2 percent. Health care spending will grow by nearly half, from 5.8 percent of GDP to 8.6 percent. Interest costs will almost triple, from 2.5 percent of GDP to 6.7 percent. By 2051, interest spending will be the single largest federal program.

CBO also projects four major trust funds will be insolvent within the next 30 years. Specifically, CBO expects the Highway Trust Fund to be exhausted by 2028, the Social Security Old-Age and Survivors Insurance trust fund will become insolvent by 2032, the Medicare Hospital Insurance (Part A) trust fund will become insolvent by 2035, and the Social Security Disability Insurance Trust Fund by 2052. On a theoretically combined basis, the Social Security trust funds will run out by 2033.

Upon insolvency, the law requires spending under these programs to be reduced to revenue collection (though CBO’s baseline assumes continued spending). For Social Security, this means a 25 percent across-the-board benefit cut for all beneficiaries regardless of age, income, or need.

The Budget Outlook is Better Than Last Year's, but Still Troubling

CBO’s June 2023 Long-Term Budget Outlook shows lower debt in FY 2052 than in its July 2022 Long-Term Budget Outlook due in large part to the Fiscal Responsibility Act, which would save $1.5 trillion in the first decade. By FY 2052, CBO projects debt to total 177 percent of GDP and the deficit to be 9.8 percent of GDP, compared to 185 percent of GDP and 11.1 percent of GDP, respectively, in last year’s outlook.

The reduction in the FY 2052 deficit is largely driven by lower projected discretionary spending due to the FRA’s statutory spending caps and other factors, along with lower interest costs driven by lower debt and interest rate projections. CBO also projects somewhat lower spending on Social Security and major health care programs. These factors are partially offset by lower expected tax receipts and higher spending on other mandatory programs, particularly veterans’ programs.

Conclusion

CBO’s 2023 Long-Term Budget Outlook continues to remind us of what we’ve known for some time but our policymakers repeatedly ignore: the federal budget is on an unsustainable long-term path. While the Fiscal Responsibility Act improved the nation’s long-term fiscal outlook, far more must be done to prevent the debt from rising rapidly as a share of the economy.

Under current law, CBO projects that federal debt held by the public relative to the size of the economy will nearly double by FY 2053, growing from 97 percent of GDP at the end of 2022 – already twice the historic average – to 181 percent by 2053. The deficit, meanwhile, will reach 10 percent of GDP in 2053 – higher than at any point outside of World War II and the COVID-19 pandemic, including during the global financial crisis.

Concerningly, the long-term outlook could prove to be far worse than CBO projects. Under our Alternative Scenario where policymakers extend expiring tax cuts and spending policies without offsets, increase discretionary spending to incorporate various “side deals” made outside of the FRA, and maintain 2025 discretionary spending levels as a share of the economy, we find debt would be reach 222 percent of GDP by 2053 and would continue to grow rapidly thereafter. The deficit would grow to 12.6 percent of GDP by 2053 under such a scenario.

Ultimately, high debt and deficits carry significant risks and threats to the economy and the nation. In the near term, continued fiscal pressures could make it more difficult for the Federal Reserve to tamp down inflation without causing a recession. Over time, high and rising debt levels also hinder economic growth, threaten economic vitality, strain the federal budget through rising interest payments, create geopolitical challenges and risks, make responding to new emergencies more challenging, and impose intergenerational unfairness between today’s Americans and future generations. Our current fiscal situation also threatens the solvency of several major trust funds, putting Social Security and Medicare beneficiaries at risk.

To address our long-term budget challenges, lawmakers should build upon the successes of the bipartisan Fiscal Responsibility Act by adopting reforms to lower health care costs, restore solvency to major trust funds, raise revenue, reduce lower priority spending, and promote stronger economic growth. A bipartisan commission can make it easier to achieve these goals.

What's Next

-

Image

-

Image

-

Image