Analysis of the 2025 Social Security Trustees' Report

The Social Security and Medicare Trustees released their annual reports today on the financial status of the programs. The Trustees find that both Social Security and Medicare are within a decade of insolvency and face large imbalances, necessitating trust fund solutions. In particular, the 2025 Social Security Trustees Report projects:

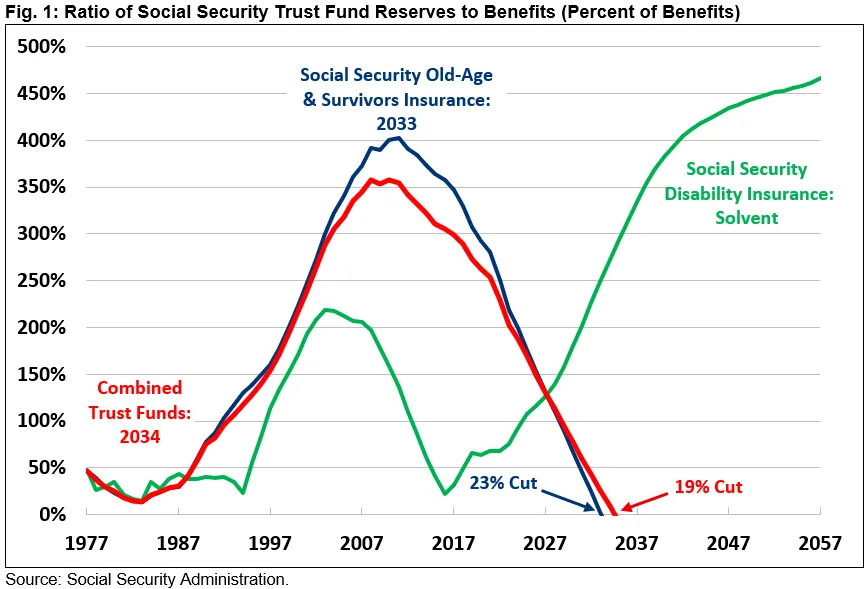

- Social Security is only eight years from insolvency. The Old-Age and Survivors Insurance (OASI) trust fund is projected to go insolvent in 2033, when today’s 59-year-olds reach their full retirement age and today’s youngest retirees turn 70. At that point, retirees will face an automatic 23 percent benefit cut under the law. If the OASI trust fund borrows from the disability fund, the trust funds would be depleted by 2034, leading to a 19 percent benefit cut.

- Social Security faces large and growing imbalances. Social Security faces cash deficits totaling $3.6 trillion over the next decade, the equivalent of 2.7 percent of taxable payroll or 0.9 percent of Gross Domestic Product (GDP). Annual cash deficits will grow to 3.6 percent of payroll (1.3 percent of GDP) by 2050 and to 4.9 percent of payroll (1.6 percent of GDP) by 2099.

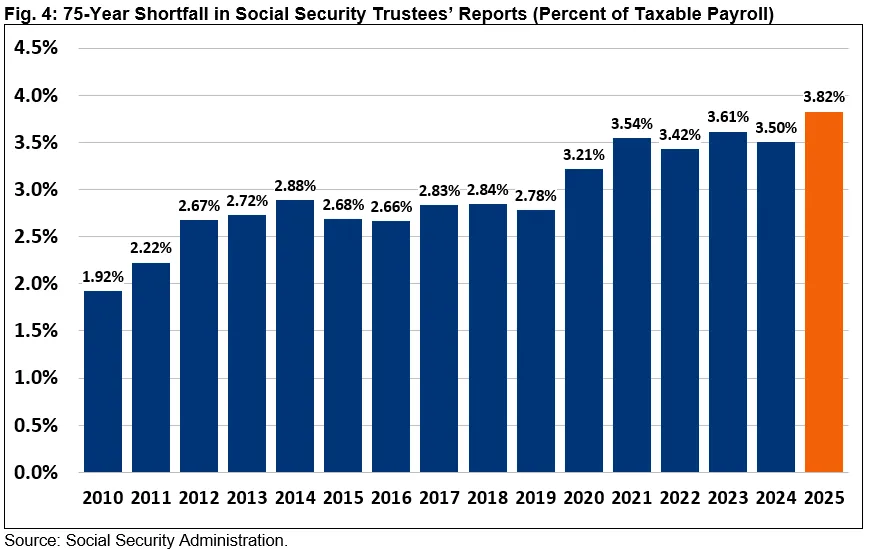

- Social Security faces a large actuarial deficit. Over 75 years, Social Security faces a 3.82 percent of taxable payroll (1.3 percent of GDP) actuarial deficit, the equivalent of $26 trillion on a present value basis. This shortfall is the largest in almost 50 years, and nearly twice as large as it was back in 2010.

- Social Security’s finances have further deteriorated. Social Security’s 75-year solvency gap increased relative to last year’s projections, from 3.50 percent of payroll to 3.82 percent of payroll. Half the deterioration is due to the passage of the “Social Security Fairness Act,” which allows some workers to partially double-dip between Social Security benefits and state or local alternatives.

- Time is running out to fix Social Security. Policymakers are running out of time to enact necessary fixes to head off trust fund insolvency. The longer they wait, the fewer policy options will be available, and the harder it will be to avoid abrupt changes to taxes or benefits or to phase in changes that give workers and retirees time to prepare.

Social Security is barreling towards insolvency. If policymakers fail to act, they will effectively be supporting a 23 percent across-the-board benefit cut for all retirees in just eight years. Fortunately, there is still time for policymakers to enact pro-growth solutions that protect the long-term viability of the program and that give participants time to plan and adjust.

Social Security is Rapidly Approaching Insolvency

Social Security’s Old-Age and Survivors Insurance (OASI) trust fund will become insolvent in just eight years – 2033 – when today’s 59-year-olds reach their full retirement age and today’s youngest retirees turn 70. If funds are reallocated from the Social Security’s Disability Insurance trust fund (SSDI), the theoretically combined trust funds will be exhausted in 2034, a year sooner than predicted in last year's report.

Upon insolvency, Social Security is legally required to reduce outlays to match revenues, which would result in an across-the-board 23 percent cut in retirement benefits. This cut would grow to 31 percent by the end of the 75-year projection window. We previously estimated the impact of such a cut, finding that a typical couple retiring in the year of insolvency would face a $16,500 reduction to their annual benefits. If the OASI and SSDI trust funds were combined, beneficiaries would instead experience a 19 percent benefit cut in 2034, growing to 28 percent by 2099.

The projections of the Social Security Trustees are like those issued by the Congressional Budget Office (CBO) late last year, which found the retirement fund would run out in fiscal year 2033 and the theoretically combined trust funds in fiscal year 2034.

Action is urgently needed to prevent an across-the-board benefit cut for both current and future beneficiaries.

Social Security Faces Large and Growing Imbalances

The Trustees project Social Security will run large – and growing – cash deficits. This year, they estimate the combined programs will face a shortfall of $250 billion, the equivalent of 2.35 percent of taxable payroll or 0.8 percent of GDP. Over the next decade, Social Security’s deficits will total $3.6 trillion, the equivalent of 2.7 percent of taxable payroll or 0.9 percent of GDP.

In the following decades, Social Security’s deficits will grow, rising to nearly 3.0 percent of payroll (over 1.0 percent of GDP) by 2035 and 5.4 percent of payroll (1.8 percent of GDP) in 2080, before declining to 4.9 percent of payroll (1.6 percent of GDP) by 2099.

Social Security’s chronic deficits are largely the result of rising costs, which are driven by the aging of the population. Total Social Security costs increased from 11.0 percent of taxable payroll in 2004 to 14.7 percent in 2024. Costs are projected to rise further to 17.0 percent of taxable payroll in 2050 and then to 18.3 percent in 2099. Revenues, meanwhile, will fail to keep up, increasing from about 13 percent of taxable payroll in recent years to 13.5 percent in 2099.

Over the next 75 years, the combined Social Security trust funds face an actuarial imbalance of 3.82 percent of payroll, or 1.3 percent of GDP, the largest since 1977. A plan to restore solvency will require the equivalent of at least a 22 percent reduction in benefits for current and future beneficiaries, a 29 percent increase in payroll taxes, or some combination of the two. Because lawmakers have waited so long to act, neither eliminating the cap on wages subject to the payroll tax nor price-indexing the growth in initial benefits would be enough to restore solvency.

Social Security's Finances Have Worsened

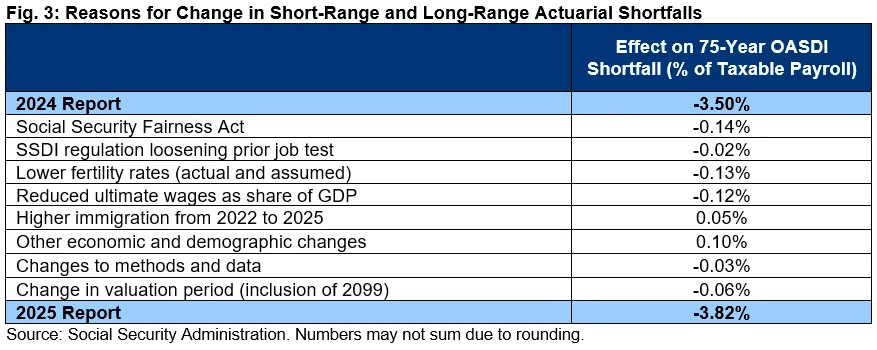

Social Security’s long-term outlook has significantly worsened relative to last year’s projection and its financial challenges have increased. The 2024 Social Security Trustees’ Report estimated a 75-year actuarial imbalance of 3.50 percent of taxable payroll, which has increased to 3.82 percent in this year’s report. The insolvency date for the theoretically combined trust funds has also moved one year earlier, to 2034 from 2035. In total, updates in this report worsened Social Security’s 75-year shortfall by 0.32 percent of payroll.

The biggest driver of the worsened outlook – accounting for nearly half of the total – was the passage of the Social Security Fairness Act last year. That law essentially allows state and local workers with years not covered by Social Security to partially ‘double dip’ between their Social Security and alternative state or local pension benefits. The Trustees estimate it added 0.14 percent to Social Security’s shortfall.

A regulatory change that made it easier to qualify for disability (SSDI) benefits by considering if an applicant is able to work at a job similar to what they’ve done in the past five as opposed to 15 years worsened Social Security’s actuarial balance by an additional 0.02 percentage points of payroll over 75 years.

Outside of policy changes, lower actual and expected fertility rates worsened the actuarial balance by 0.13 percent of payroll. Levels of illegal immigration since 2022 were also determined to be higher than previously estimated, increasing the number of people paying payroll taxes and improving the actuarial balance by 0.05 percent of payroll. Additional updated data on mortality, immigration, marriage and divorce improved the balance by another 0.05 percent of payroll.

On the economic side, the Trustees now project wages will ultimately constitute a smaller share of the economy than previously estimated (61.2 percent of GDP versus 62.8 percent), worsening the actuarial balance by 0.12 percentage points of payroll. This was partially offset by higher covered employment, educational attainment, and assumed real interest rates, which improved the actuarial balance by 0.06 percentage points of payroll.

There were several methodological and data changes that together worsened the actuarial balance by 0.03 percentage points of payroll. The four changes that worsened the actuarial balance were related to projecting illegal immigration, decreased labor force participation of workers 75 years and older, taxation of benefits revenue, and modeling average benefit levels. Taken together, these changes did not affect the 10-year deficit. The Trustees also made a small improvement in disability data and assumptions.

Finally, the new projection window worsened Social Security’s 75-year actuarial imbalance by 0.06 percent of payroll – thanks to the inclusion of 2099 into the estimates.

The long range 75-year imbalance is now the highest it has been in nearly half a century, having nearly doubled over the past 15 years from 1.92 percent of payroll in 2010 to 3.82 percent of payroll today.

On the encouraging side, Social Security Disability Insurance’s finances have improved significantly in recent years. As recently as 2015, the SSDI program faced a 0.31 percent of payroll shortfall; today it faces a 0.12 percent surplus. Nonetheless, policymakers should continue to support changes to the disability program to improve the fairness and administration of benefits while supporting individuals with disabilities who want to remain in or return to the workforce.

Time is Running Out to Fix Social Security

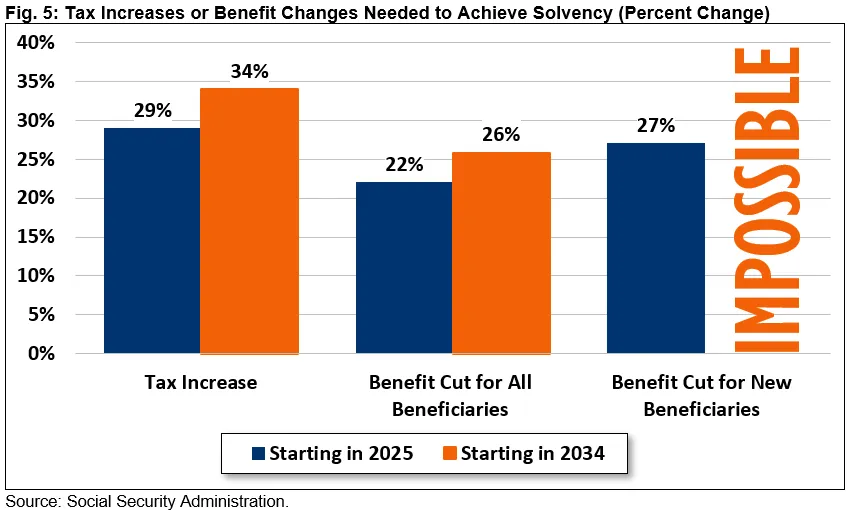

The Social Security Trustees recommend “lawmakers address the projected trust fund shortfalls in a timely way in order to phase in necessary changes gradually and give workers and beneficiaries time to adjust.” Timely action would broaden the options available to policymakers, including targeted adjustments and pro-growth reforms.

According to the Trustees, lawmakers could restore 75-year solvency with the equivalent of a 29 percent (3.65 percentage point) payroll tax increase, a 22 percent reduction in total benefits, or a 27 percent reduction in benefits for new beneficiaries if they act today.

Delaying action until 2034 would increase the size of necessary adjustments by 15 percent. In that year, taxes would need to be raised by 34 percent (4.27 percentage points), benefits cut for all beneficiaries by 26 percent, or some combination. Changes to benefits for new beneficiaries alone would be insufficient to restore solvency to the program, even if benefits were eliminated entirely.

Thoughtful trust fund solutions would not only prevent deep across-the-board benefit cuts, but improve the protections offered by the program, bolster economic growth, strengthen retirement security, and improve the nation’s fiscal outlook. CBO recently published several options to improve Social Security solvency – including a number of benefit and revenue changes – and we will soon begin publishing additional options for lawmakers to consider. Other solvency proposals can be designed with our Social Security Reformer tool. The closer we get to insolvency, the fewer of these options remain available.

Conclusion

The Social Security Trustees revealed Social Security faces the largest financial shortfall in nearly half a century and repeated their warnings that the program is heading towards insolvency. In just eight years, all retired beneficiaries, regardless of age or need, will face an across-the-board 23 percent benefit cut unless necessary reforms are enacted. In that same year, under current projections, their access to health care will be compromised by the insolvency of the Medicare Hospital Insurance trust fund.

By failing to act to reform Social Security and Medicare, policymakers are implicitly endorsing deep across-the-board cuts to most current and future beneficiaries.

With each year that action is delayed, the worse Social Security’s finances become, and the harder it will be to enact reforms that avoid abrupt changes to taxes or benefits and that give workers and retirees time to plan. Inaction over the past thirty years has already taken many options off the table. For example, 75-year solvency can no longer be restored by ‘price indexing’ the growth in new benefits or by eliminating the cap on wages subject to the payroll tax.

In the context of an insolvency date just eight years away, all options need to be on the table on both the revenue and benefit side of the equation.

Fortunately, many solutions to shore up Social Security’s finances exist. Our own Social Security Reformer Tool allows anyone to design a plan of their own. And our Trust Fund Solutions Initiative is working to develop new ideas to help restore solvency while also improving retirement security, bolstering economic growth, making the program more efficient, and strengthening the nation’s finances.

Policymakers should enact thoughtful Social Security reforms as soon as possible.

Tags

What's Next

-

Image

-

Image

-

Image