The Case for Trust Fund Solutions

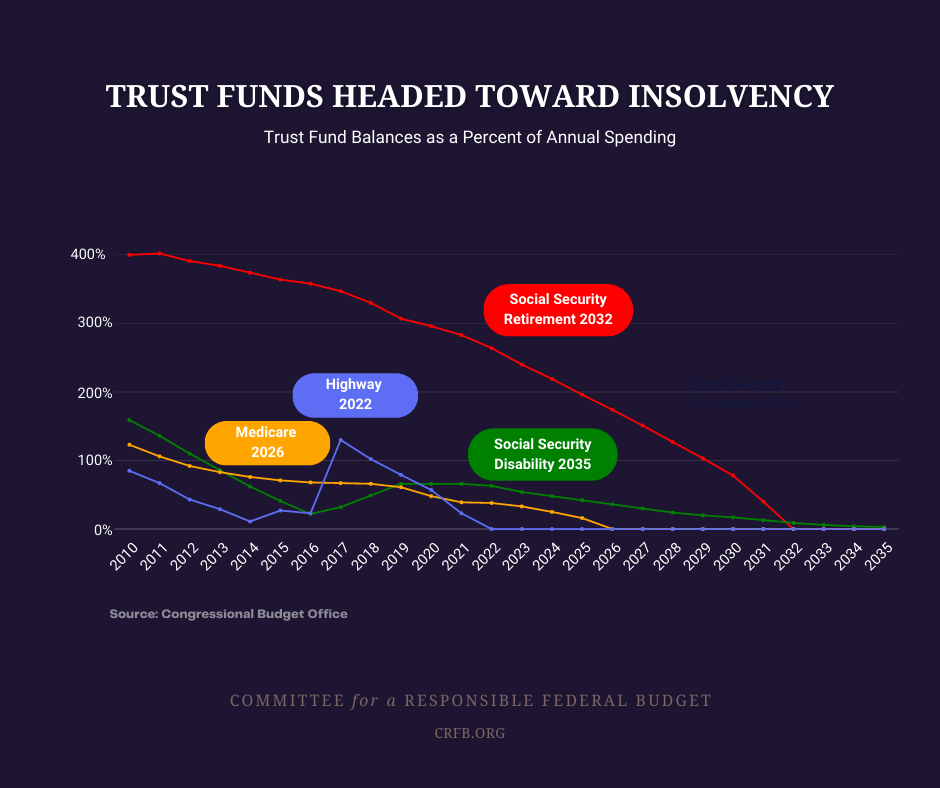

Some of the nation’s most important government programs are financed with dedicated revenue sources using federal trust funds. Four of those programs are within 14 years of insolvency. CBO projects the following insolvency dates:

- FY 2022: Highway Trust Fund (HTF)

- FY 2026: Medicare Hospital Insurance (HI) Trust Fund

- CY 2032: Social Security Old Age and Survivors Insurance (OASI) Trust Fund

- CY 2035 Social Security Disability Insurance (SSDI) Trust Fund

Policymakers will need to act sooner rather than later to secure these trust funds by increasing revenues, reducing costs, or some combination. The longer we wait to address trust fund solvency, the fewer choices will be available and the harsher any eventual adjustments will be. In this paper, we show:

- All four major trust funds are projected to run out of money in the next 14 years, with the Highway Trust Fund likely to run out next year

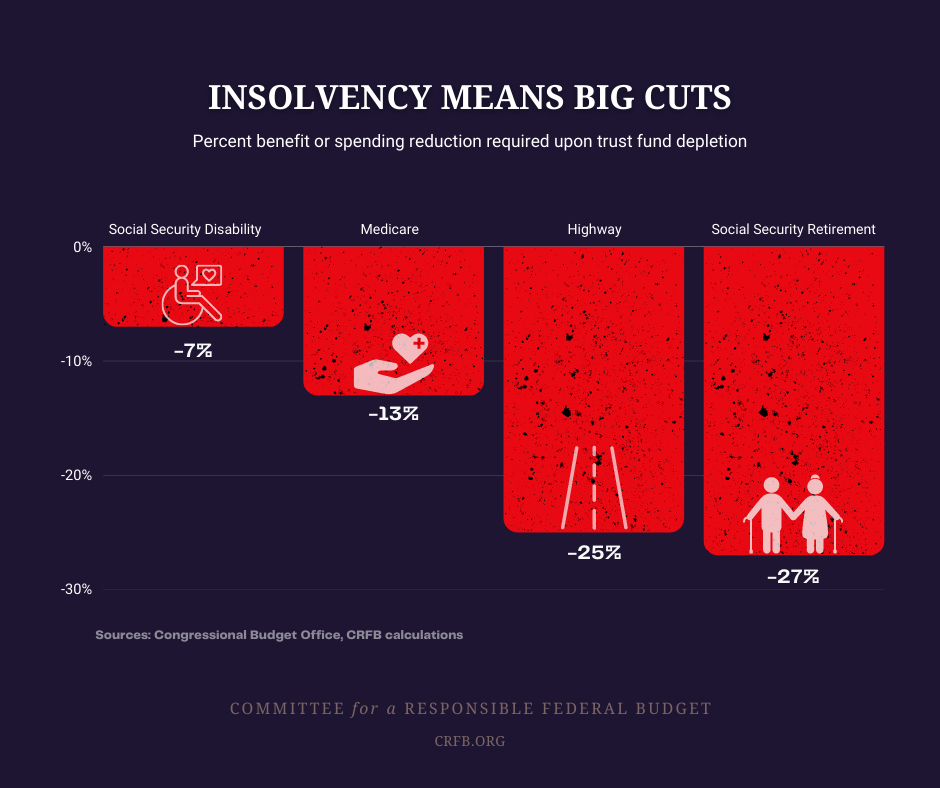

- By law, trust fund spending cannot exceed revenue once reserves are depleted. Insolvency would trigger a 7 percent cut to disability benefits, a 13 percent cut in Medicare payments, a 25 percent cut in highway spending, and an abrupt across-the-board 27 percent cut in Social Security retirement benefits.

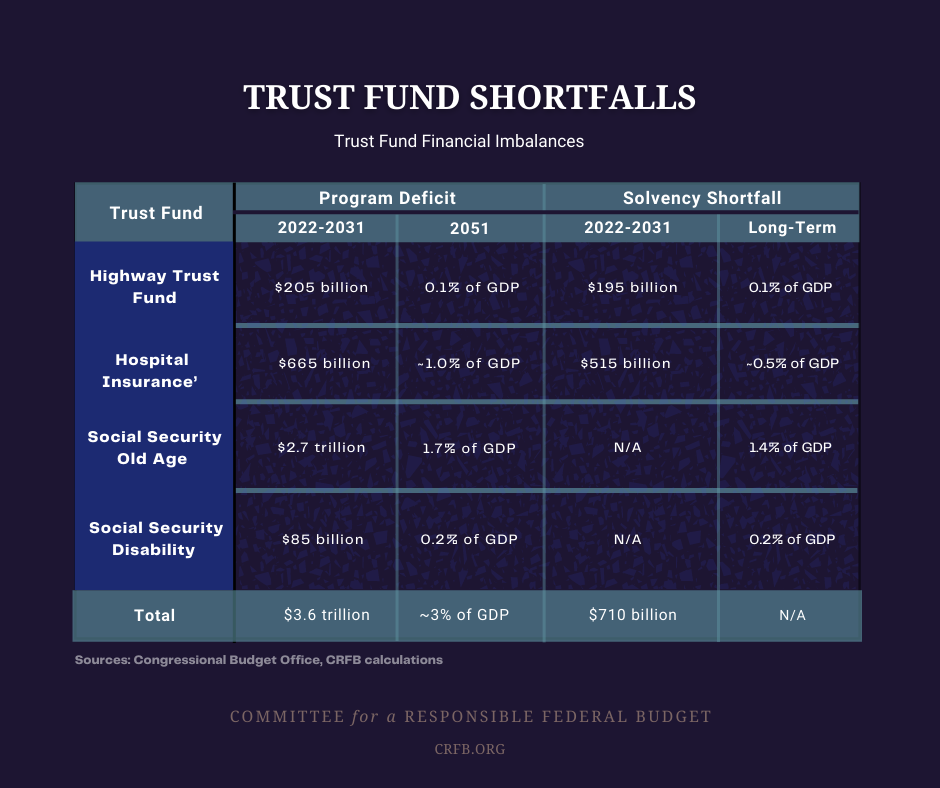

- Total spending from these trust funds will exceed revenue by roughly $3.6 trillion over the next decade. By 2051, the programs will face a combined shortfall of more than 3 percent of Gross Domestic Product (GDP).

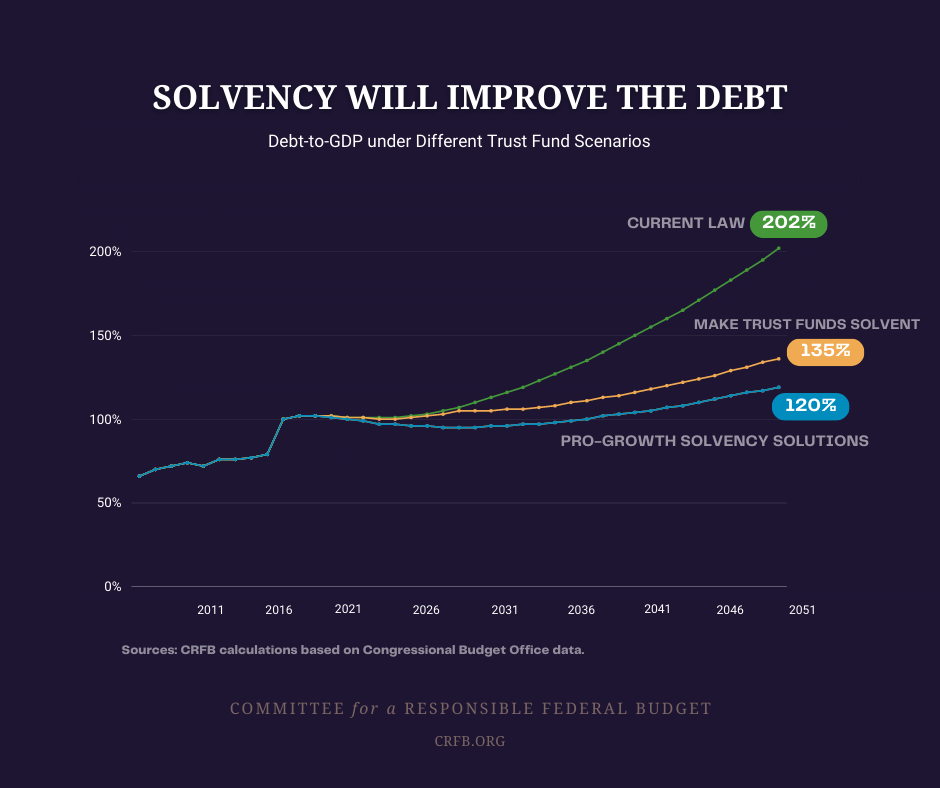

- Restoring trust fund solvency would improve the fiscal outlook, reducing debt in 2051 from about 200 percent of GDP to between 120 and 135 percent of GDP.

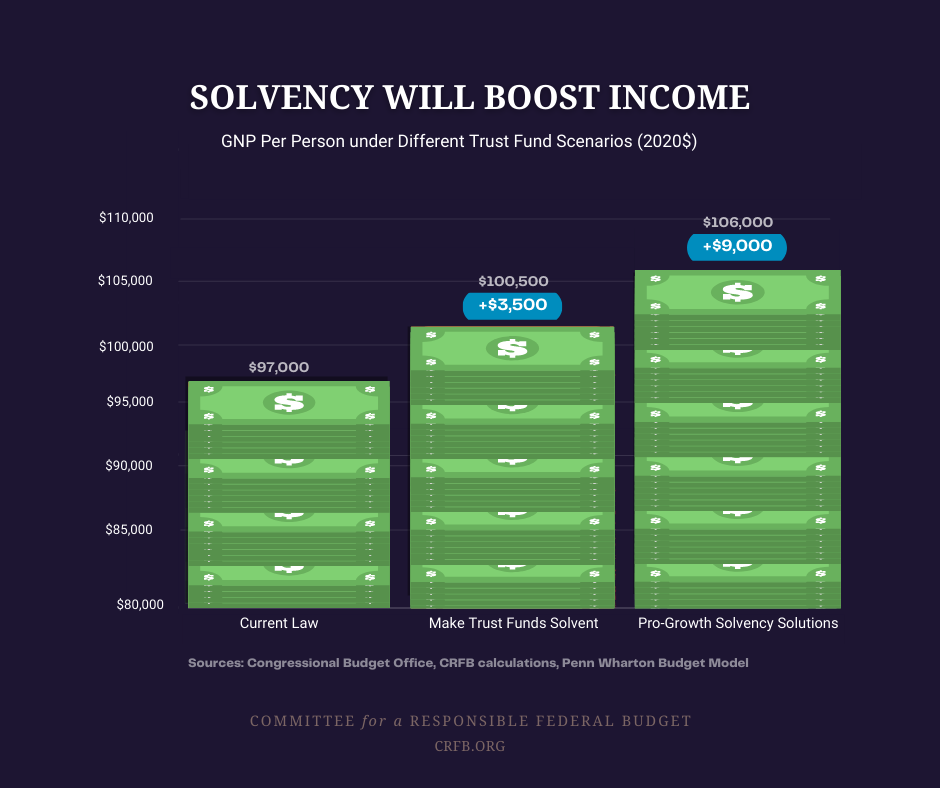

- Solvency could also boost economic and income growth, raising gross national product by 3.5 to 9.0 percent, or $3,500 to $9,000 per person.

- Solvency packages also offer an opportunity to strengthen retirement security, support disabled workers, lower health care costs, improve infrastructure spending and financing, reduce income inequality, and reform taxes.

Many options are available to secure and improve these programs for future generations. In two companion pieces, we put forward options to restore solvency to the Highway Trust Fund and Medicare Hospital Insurance trust fund.

Policymakers should seize the opportunity and enact trust fund solutions.

Major Trust Funds Are Headed Toward Insolvency

All four major trust funds are projected to be insolvent in the next 14 years. The Congressional Budget Office (CBO) projects the Highway Trust Fund will run out in Fiscal Year (FY) 2022, the Medicare HI trust fund in FY 2026, the Social Security OASI trust fund in calendar year (CY) 2032, and the SSDI trust fund in CY 2035. The Social Security and Medicare Trustees and Chief Actuaries have similar projections: they estimate the HI trust fund will be insolvent in CY 2026 and Social Security’s theoretically combined trust funds in CY 2034.

That means today’s youngest retirees will be 67 when the Medicare trust fund runs out and 73 when Social Security’s retirement program is insolvent based on CBO’s projections. All four trust funds will be insolvent by the time today’s 53-year-olds reach the normal retirement age.

Under the law, trust fund programs cannot spend in excess of their dedicated funding sources. Once the trust funds are depleted, the programs may only spend incoming revenue. For the Highway Trust Fund, this means new projects will be immediately halted and spending ultimately reduced by one-quarter. For Medicare, all payments will be cut by 13 percent or delayed by an equivalent amount upon insolvency.

In the case of Social Security, benefits will be cut immediately and across-the-board upon insolvency. SSDI benefits will be cut by 7 percent when its trust fund runs out, while Social Security retirement benefits will be slashed by 27 percent. For a typical new retiree, that would mean an immediate $7,000 cut in annual benefits, from roughly $26,500 to $19,500 in today’s dollars. For a couple, the cut could be as much as twice as large.

Current Status of Major Trust Funds

Each trust fund program is different and faces unique challenges.

The Highway Trust Fund (HTF), which funds surface transportation projects and is financed by various transportation-related taxes such as the gas tax, is set to run out in fiscal year 2022. The highway bill that authorizes highway and transit spending expires on October 1, 2021. Over the next decade, the Highway Trust Fund faces a shortfall of about $195 billion, or about 0.1 percent of GDP. The gap is the equivalent to nearly one third of total spending, almost half of revenue, or a 14-cent gas tax increase. See ten options to secure the Highway Trust Fund here.

The Medicare Hospital Insurance (HI) trust fund, also known as Medicare Part A, provides inpatient hospital payments and is financed mainly by a 2.9 percent payroll tax. It is projected to be insolvent in FY 2026, at which point payments will be cut by 13 percent. The trust fund faces a net shortfall of roughly $515 billion over the next decade, according to CBO, and well over 0.5 percent of GDP over 30 years by our estimates (prior to the pandemic, the Trustees estimated a 25-year shortfall of 0.3 percent of GDP). Closing that gap would require the equivalent of reducing spending by one-third or increasing revenue by about 40 percent or more. See ten options to secure the HI Trust Fund here.

All Four Trust Funds Face Large Long-Term Shortfalls

Over the next decade, the Highway, Medicare HI, and Social Security trust funds face a combined $3.6 trillion deficit, the equivalent of 1.3 percent of GDP. We estimate that deficit will rise to nearly 2 percent of GDP by 2031, over 2.5 percent by 2041, and over 3 percent by 2051.

The Highway Trust Fund faces $205 billion of deficits through 2031, with a shortfall of about $195 billion net of current holdings. Annual deficits are projected to grow from $13 billion in 2022 to $28 billion by 2031. The total gap is roughly 0.1 percent of GDP.

The Medicare Hospital Insurance trust fund faces a deficit of $665 billion and shortfall of $515 billion net of reserves through 2031, with annual deficits growing from $7 billion (0.03 percent of GDP) in 2022 to $128 billion (0.4 percent of GDP) by 2031. Based on CBO’s overall Medicare projections, we estimate the Part A program will face a shortfall of more than 1 percent of GDP by 2051. The Medicare Trustees project the trust fund will face a shortfall of 0.4 percent of GDP in that year under their base scenario or 0.7 percent of GDP under their alternative scenario.

Lastly, the Social Security programs will run a combined cash deficit of $2.8 trillion over the next decade, with $2.7 trillion attributable to the retirement program. While both trust funds have sufficient reserves to remain solvent through the decade, they face massive long-term shortfalls.

Total Social Security costs will exceed revenue by 1.3 percent of GDP ($450 billion) in 2031 alone, by 1.9 percent of GDP in 2051, and by 2.2 percent of GDP in 2095. Over the next 75 years, Social Security faces an actuarial shortfall of 1.6 percent of GDP. That includes a 1.4 percent of GDP shortfall for the retirement program and a 0.2 percent of GDP shortfall for the disability program.

Trust Fund Solvency Will Improve the Fiscal and Economic Outlook

Policymakers must restore solvency to the major trust funds to avoid abrupt across-the-board benefit and spending cuts. However, solvency solutions can also improve the sustainability of the national debt, increase economic output and income, and improve policy outcomes.

CBO’s budget projections generally assume trust fund programs continue spending as scheduled after insolvency, as if lawmakers used general revenues to support the funds. Under CBO’s baseline, debt will double from a near-record 100 percent of GDP in 2020 to over 200 percent of GDP by 2051.

If all trust funds are restored to solvency as assumed in our TRUSTGO scenario, debt would instead rise to about 135 percent of GDP by 2051. With well-constructed pro-growth solvency packages,i we estimate debt would rise to only about 120 percent of GDP. In other words, restoring trust fund solvency could reduce debt by 65 to 80 percent of GDP within three decades.

We assume a combination of revenue and benefit adjustments beginning in 2022 and phased in gradually, including pro-growth Social Security reforms and other measures generally designed to boost the rate of GDP growth.

Solvency packages could also improve economic growth and increase income.

Estimates from the Congressional Budget Office, Penn Wharton Budget Model, and Committee for a Responsible Federal Budget find Social Security reform could substantially increase output by reducing debt and increasing overall savings, investment, and labor force participation. Securing the other trust funds could generate additional growth, including by supporting stronger labor force attachment, encouraging more efficient use of infrastructure, slowing the effects of climate change, or freeing economic capacity currently consumed by health care costs.

Current Status of Major Trust Funds, Continued

The Social Security Old Age and Survivors Insurance (OASI) trust fund pays retirement and survivor benefits and is funded mainly from a 10.6 percent (12.4 percent including SSDI) payroll tax on wages up to $142,800. The trust fund is projected to run out of reserves by 2032 (or 2034 according to the program’s Chief Actuary), at which point benefits would be immediately cut by 27 percent. Over the next 75 years, according to CBO, the program faces a shortfall of 1.4 percent of GDP (the Trustees estimate a 75-year shortfall of 1.1 percent of GDP) – the equivalent of roughly one-quarter of benefits, one-third of revenue, or 4.1 percent of taxable payroll. Design your own plan to restore long-term solvency here.

The Social Security Disability Insurance (SSDI) trust fund pays benefits to workers with permanent or long-term disabilities, funded primarily from a 1.8 percent (12.4 percent including OASI) payroll tax on wages up to $142,800. CBO projects the SSDI trust fund will run out of reserves in 2035, at which point all beneficiaries will face an immediate 7 percent benefit cut. Over the next 75 years, the program faces a shortfall of about 0.2 percent of GDP – the equivalent of roughly one-fifth of benefits, one-quarter of revenue, or 0.6 percent of taxable payroll. Read options to improve SSDI Solvency here.

Extrapolating from recent CBO estimates, we find a generic set of solvency packages could increase the growth of gross national product (GNP) by about 0.1 percent per year over the next 30 years. Based on other recent analyses and estimates, we believe solvency packages specifically designed to promote economic growth could boost GNP growth nearly three times as much.

This suggests that trust fund solvency packages could boost annual per-person income by 3.5 to 9 percent after three decades, or $3,500 to $9,000 in today’s dollars.

Solvency Provides Opportunity for Improvements and Reforms

Policymakers must restore solvency to the major trust funds in order to prevent deep across-the-board cuts, improve the fiscal outlook, and strengthen the economy. However, trust fund deadlines also provide opportunities for program and revenue improvements and reform.

The depletion of the Highway Trust Fund presents an opportunity to make new investments in surface transportation infrastructure and improve financing. Ideas like vehicle miles traveled (VMT) fees and congestion prices can encourage better use of roads and other forms of transit, while changes in the gas tax or carbon taxes can help reduce greenhouse gas emissions.

The need for a Medicare solvency package offers the opportunity to reduce overall health care costs, promote better delivery systems and care coordination, and improve the value of care. As we have demonstrated through our Health Savers Initiative, a number of reforms to lower Medicare costs can also reduce premiums and out-of-pocket costs for ordinary Americans.

The SSDI trust fund exhaustion also offers opportunities to enact policies to help disabled workers. In our SSDI Solutions Initiative, we put forward a number of ideas to improve the determination and adjudication process, address interactions between SSDI and other programs, and support disabled workers who want to remain in or return to the workforce. While a few have been enacted in recent years, more work remains.

Finally, a Social Security solvency package can accomplish many important goals, from strengthening retirement security to promoting economic growth. Social Security reform can boost retirement income for those in need, promote work and investment, reduce inequities in the program, and improve the progressivity of Social Security’s tax and benefit structures.

In general, acting sooner rather than later leaves policymakers with more options and opportunities, allows adjustments to be spread across more people and over a longer period of time, gives those affected by changes more warning and time to adjust, and allows for more gradual implementation of any changes.

While solvency packages must assure revenue and spending are brought in line, thoughtful reform packages should look well beyond simply making the numbers add up. Trust Fund Solutions can do far more to improve overall public policy and the lives of those who rely on these programs.

Time for Trust Funds Solutions

With four major trust funds headed for insolvency in the next 14 years, including the Highway Trust Fund next year and Medicare Hospital Insurance trust fund within five years, policymakers must act soon on trust fund solutions. Securing these trust funds would prevent abrupt across-the-board benefits cuts, assure a more sustainable debt path, promote faster economic growth, and provide the opportunity to achieve a number of important policy goals.

In our companion piece, Ten Options to Secure the Highway Trust Fund, we put forward several options to better spend or fund transportation infrastructure.

A second companion piece, Ten Options to Secure the Medicare Trust Fund, discusses options to lower Medicare costs or increase revenue coming into the Hospital Insurance trust fund.

Numerous options also exist to restore SSDI solvency and improve policies for Americans with disabilities, as put forward in our SSDI Solutions books and proposals.

And the broader Social Security program can be kept solvent through changes to the tax rate, tax base, benefit formula, retirement age, or other parameters. Our Social Security Reformer allows users to design their own plan.

Upcoming trust fund deadlines represent challenges but also opportunities.

The time to act on trust fund solutions is now.

i We assume a combination of revenue and benefit adjustments beginning in 2022 and phased in gradually, including pro-growth Social Security reforms and other measures generally designed to boost the rate of GDP growth.

Tags

What's Next

-

Image

-

Image

-

Image