Retirees Face a $17,400 Cut if Social Security Isn't Saved

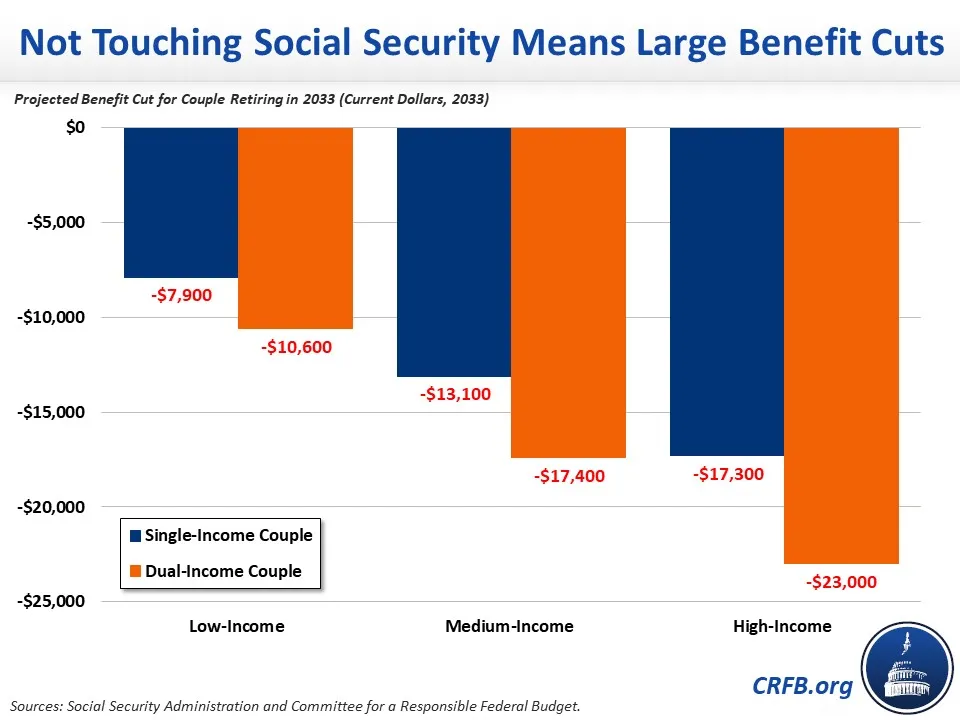

As the 2024 presidential campaign ramps up, candidates are facing pressure to pledge not to touch Social Security. While this pledge is framed as ‘protecting benefits,’ it is – in reality – an implicit endorsement of a 23 percent across-the-board benefit cut in 2033, when the Social Security retirement fund becomes insolvent. In that year, annual benefits would be cut by $17,400 for a typical newly retired dual-income couple.

US Budget Watch 2024 is a project of the nonpartisan Committee for a Responsible Federal Budget designed to educate the public on the fiscal impact of presidential candidates’ proposals and platforms. Through the election, we will issue policy explainers, fact checks, budget scores, and other analyses. We do not support or oppose any candidate for public office.

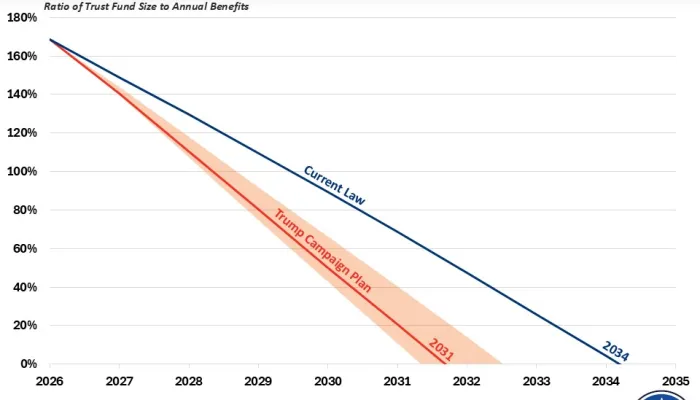

The winner of the 2024 presidential election will face a Social Security trust fund rapidly approaching insolvency. The program’s Trustees project that the Old-Age and Survivors Insurance (OASI) trust fund will deplete its reserves by 2033, when today’s 57-year-olds reach the normal retirement age and today’s youngest retirees turn 72.

Upon insolvency, the law mandates that the OASI trust fund can only spend in amounts equal to incoming trust fund revenue, which means that all 70 million retirees, dependents, and survivors – regardless of age, income, or need – will see their benefits cut by 23 percent.

For a typical dual-income couple retiring in 2033, we estimate this would represent an immediate $17,400 cut in current dollar annual benefits and an immediate $13,100 cut for a typical single-income couple.

The cuts would differ for couples at different income levels. A low-income, dual-income couple retiring in 2033 would see a $10,600 cut while a high-income, dual-income couple retiring in 2033 would see their annual benefits slashed by $23,000. Although the cut for a low-income couple would be smaller, it would represent a larger share of their income – and so senior poverty would rise significantly upon insolvency.

Importantly, the figures above are in current (nominal) dollars, consistent with ten-year budget scoring practices and how benefit cuts would be seen in real time. Adjusted for inflation, we estimate a typical dual-income couple would face a $14,000 cut, while low-income couples would face a $8,500 cut and high-income couples would face a $18,500 cut.

Any 2024 presidential candidate who pledges not to touch Social Security is implicitly endorsing a 23 percent across-the-board benefit cut for the 70 million retirees when the Social Security retirement trust fund reaches insolvency in just a decade.

*****

Throughout the 2024 presidential election cycle, US Budget Watch 2024 will bring information and accountability to the campaign by analyzing candidates’ proposals, fact-checking their claims, and scoring the fiscal cost of their agendas.

By injecting an impartial, fact-based approach into the national conversation, US Budget Watch 2024 will help voters better understand the nuances of the candidates’ policy proposals and what they would mean for the country’s economic and fiscal future.

You can find more US Budget Watch 2024 content here.