Student Loan Pause Could Cost $275 Billion

Note: (11/22/2022): The Department of Education announced it would extend the pause to the sooner of 60 days after resolution of the student debt cancellation litigation or 60 days after June 30, 2023 (which would be the end of August, based on our understanding). An extension to the end of August 2023 would cost $40 billion, bringing the total cost of the pause to $195 billion.

Recent reports suggest the Biden Administration plans to once again extend the federal student loan payment moratorium – currently set to expire on December 31, 2022 – in light of court rulings against the Administration’s unilateral student debt cancellation plan. As we’ve shown several times before, extending the pause is costly, inflationary, regressive, and economically unjustified.

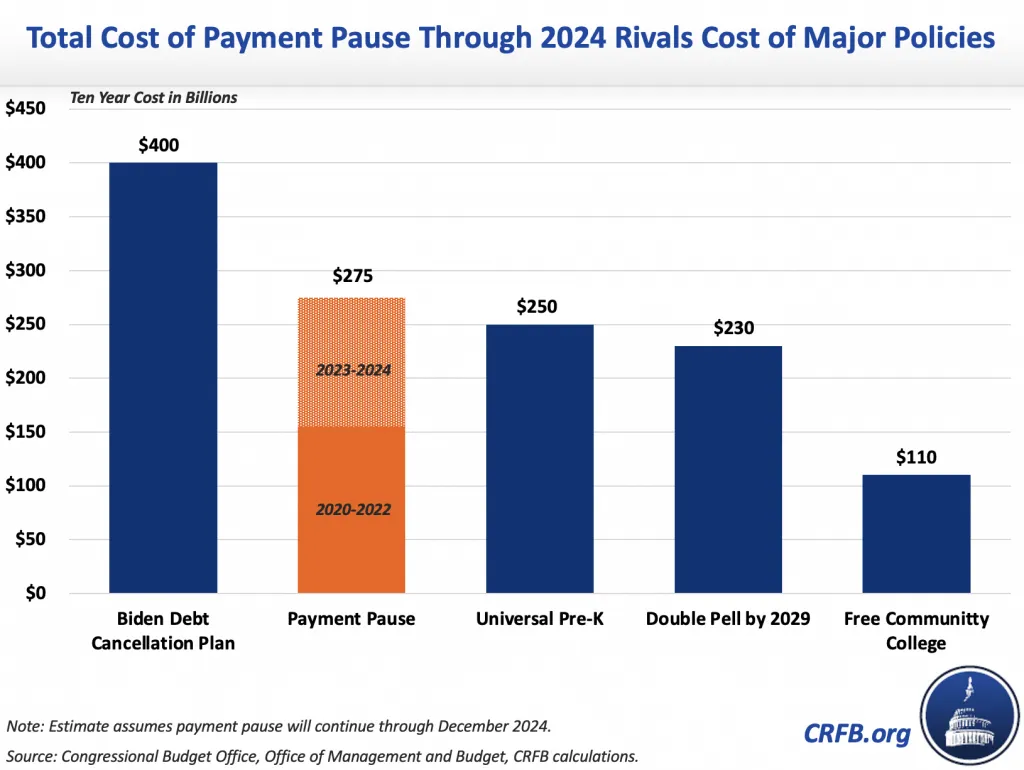

The pause costs over $5 billion per month and extending it through the end of 2024 would cost at least $120 billion. This would bring the total cost since Spring of 2020 to $275 billion. This represents about 70 percent of the cost of the President’s announced debt cancellation plan and is higher than the ten-year cost of President Biden’s proposal to double the maximum Pell Grant by 2029.

Extending the pause would also worsen inflation. We previously estimated the pause could add up to 20 basis points to inflationary pressures, which could lead the Federal Reserve to further raise interest rates and increase the risk of a deeper recession.

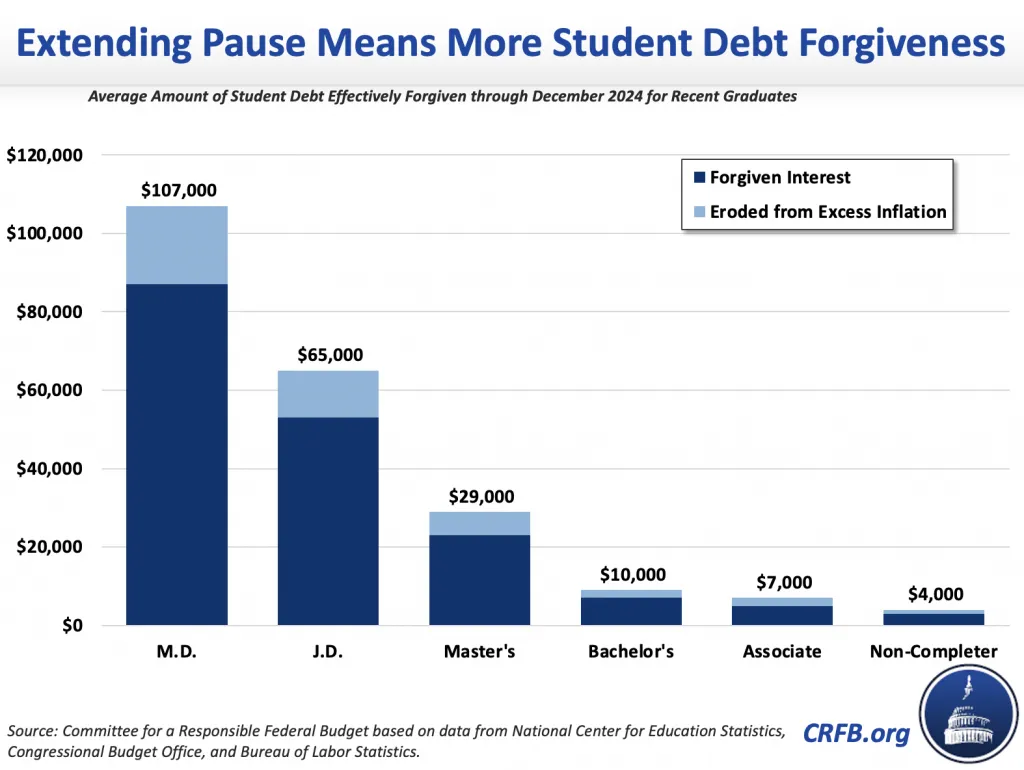

As we’ve shown before, the benefit of the pause accrues disproportionately to those with advanced degrees. Should the President extend the policy through the end of 2024, the nearly five-year long pause would mean that a typical medical student who graduated in 2019 would effectively have $107,000 forgiven and a law school graduate would have $65,000 forgiven. That’s compared to the average borrower receiving $11,000 of forgiveness. Between 75 to 80 percent of the forgiveness would be from the pause itself and the rest from the effects of higher inflation on eroding debt. New doctors receive almost ten times the benefit of the average borrower and $107,000 more than someone who never attended college.

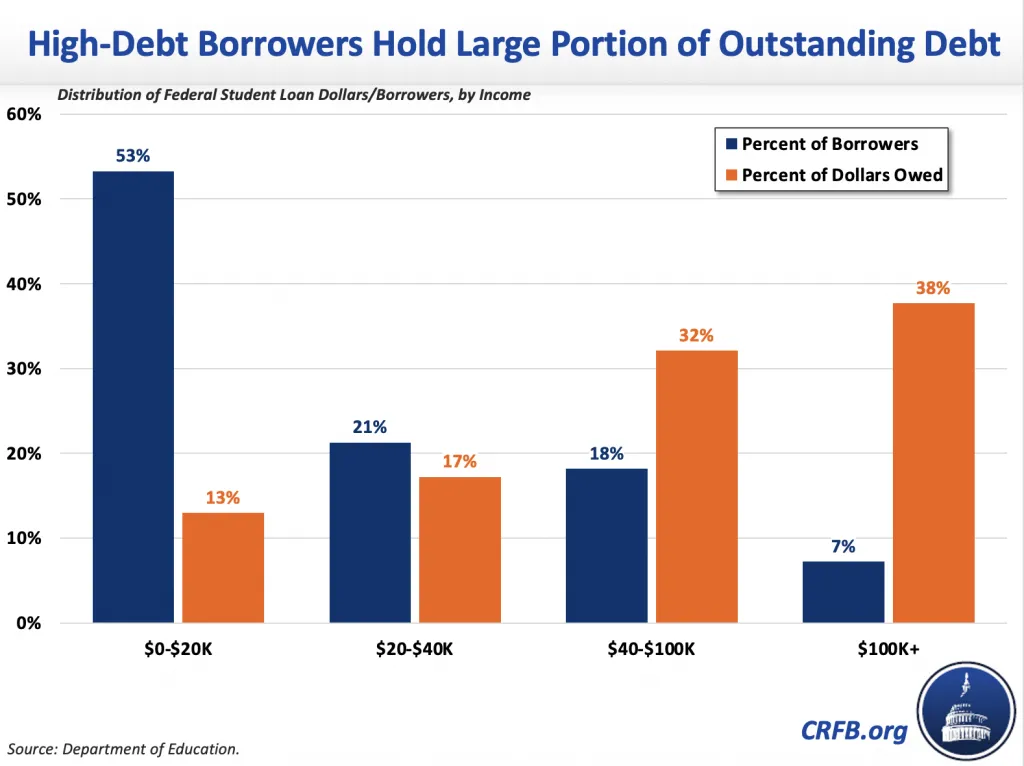

The pause disproportionately benefits borrowers in higher-paid professions because people in those professions tend to borrow more and pay higher interest rates. Indeed, roughly 40 percent of debt is held by the 7 percent of borrowers that have over $100,000 of debt and 17 percent is held by the 2 percent of borrowers with over $200,000 of debt. Most of these borrowers have advanced degrees that lead to very high lifetime earnings; 16 of the 18 highest paying occupations in America are types of medical doctors and the other two are types of dentists.1

Overall, the student debt pause is far more regressive than the President’s announced cancellation of $10,000 to $20,000 of debt. While we’ve estimated 57 to 65 percent of the President’s debt cancellation plan would go to those in the top half, it’s likely that well over three-quarters of the benefit of the pause goes to the top half (73 percent of repayments come from the top two income quintiles).

It is also completely unjustified under current economic conditions. The pause began as an emergency when the economy was in free fall, the country was largely shut down because of the pandemic, and the unemployment rate was surging toward 15 percent. The unemployment rate is only 3.7 percent today and only 1.9 percent among college graduates. The emergency phase of the pandemic has long since passed, and most borrowers are actually financially better off than they were before the pandemic. The biggest threat to the economy is now inflation – which extending the pause would exacerbate.

Ultimately, continuing the pause would be expensive, regressive, inflationary, and unjustified. The pause has already been extended seven times – and the Administration has announced twice that it would come to an end. Reneging on this again will undermine the Administration’s credibility to cancel future debt, especially from the $250 billion of new federal student loans issued over the course of the pause.

Regardless of what the court decides on the legality of debt cancellation itself, it’s time to restart payments.

1 These borrowers would also see a reduction in their principal balance as a result of President Biden’s announced debt cancellation plan, assuming the courts allow it to go into effect. Although cancellation is limited to those with family incomes making less than $250,000 (or $125,000 for individuals), it is based on 2020 or 2021 income and few new doctors and lawyers made about this amount when in school, residency, or early in their careers. The estimate also does not include the savings moving forward from the newly proposed changes to income-driven repayment, which will reduce the amount that these borrowers owe per month and forgive any unpaid interest per month. The forgiven interest provision is especially valuable to recent professional degree graduates with high debt loads, who will likely get monthly interest forgiveness for the first few years out of school.