Latest Student Loan Payment Pause Brings Total Cost to $155 Billion

The Biden Administration announced another extension of the student loan repayment moratorium through the end of December as part of their larger rollout that we estimate will cost between $440 billion and $600 billion. This four-month payment pause extension will add $20 billion to the deficit.1 The repayment pause has now been extended seven times, lasting 33 months, bringing the total cost of the pause since the beginning of the pandemic through the end of this year to $155 billion.

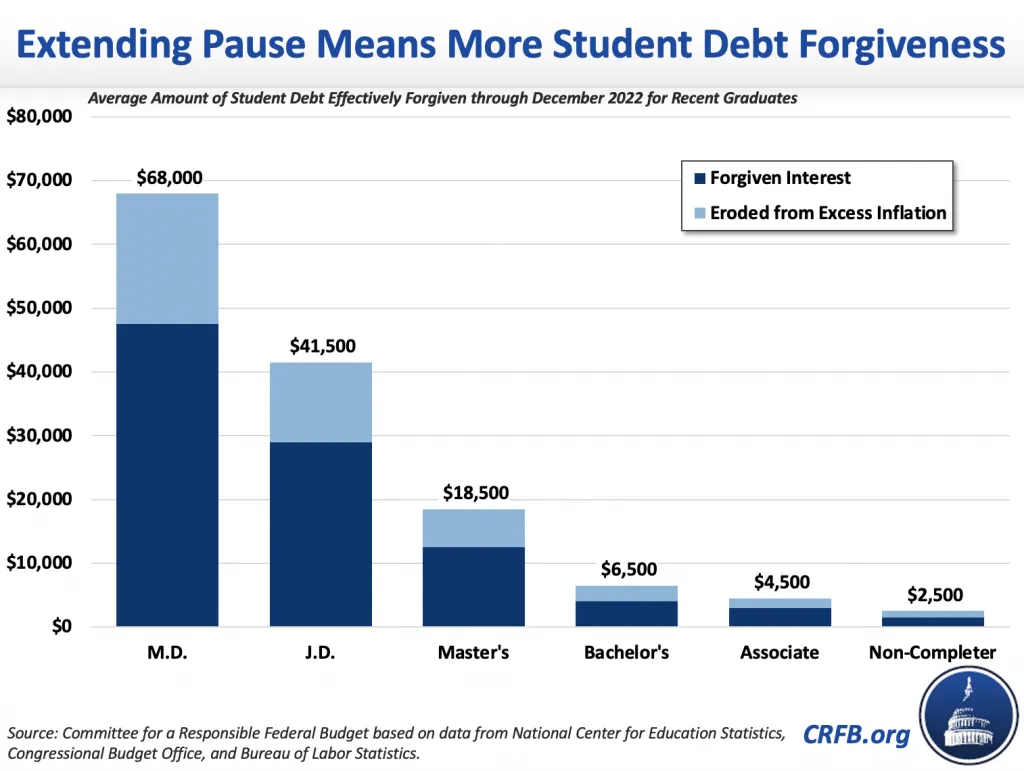

Nearly every borrower has benefited from interest cancellation during the current repayment moratorium while higher-than-expected inflation has eroded current balances. However, benefits have been highly uneven and extremely regressive.

For example, we estimate a typical recent medical school graduate will effectively receive nearly $68,000 of forgiven debt through December, a recent law school graduate will get $41,500 of forgiveness, and a recent master’s degree recipient will get $18,500. At the same time, a recent bachelor’s degree recipient will get $6,500 of forgiven debt, someone who just completed an associate’s degree will receive $4,500, and individuals who did not complete their undergraduate degree will get $2,500. All of these figures exclude the broader debt cancellation policy also announced by the Administration, isolating just the effect of the repayment pause.

Our estimates incorporate the effects of both the repayment pause and higher inflation. We estimate excess inflation will shrink the value of the loans by more than 7.5 percent compared to what was expected at the beginning of the pause.

The pause disproportionately benefits borrowers in higher-paid professions because people in those professions tend to borrow more. They also earn a lot more; eight of the ten highest-paid occupations in America are types of medical doctors and the other two are types of dentists.

A very small percentage of high-debt borrowers (who are almost entirely those with professional degrees) disproportionately benefit from the pause. Although only 7 percent of borrowers have over $100,000 of debt, their debt accounts for almost 40 percent of the amount outstanding in the loan portfolio. Those with over $200,000 of debt account for 2 percent of borrowers and 17 percent of the amount outstanding.

In addition to this forgiveness, many high-debt borrowers in these examples (i.e., recent graduates with professional degrees) will likely also receive a $10,000 or $20,000 reduction in their principal balance as a result of President Biden’s announced debt cancellation plan. Although cancellation is limited to those with family income making less than $250,000 (or $125,000 for individuals), it is based on 2020 or 2021 income – and few brand new doctors and lawyers made above this amount two years ago when in school, residency, or early in their careers.

This estimate also does not include the savings moving forward from the newly proposed changes to income-driven repayment, which will reduce the amount that these borrowers owe per month and forgive any unpaid interest per month. The forgiven interest provision is especially valuable to recent professional degree graduates with high debt loads, who will likely get monthly interest forgiveness for the first few years out of school.

The Biden Administration says this will be the last repayment pause before payments restart in 2023. There is no justification to further extending a policy that has been extremely regressive and costly.

1 Based on the purported timeline and concern from servicers over implementation, we expect most debt cancellation will happen late in December or early January and thus not significantly interact with the cost of the repayment pause.