Interest on the Debt to Grow Past $1 Trillion Next Year

The Congressional Budget Office’s (CBO) latest budget and economic outlook includes a troubling projection for net interest payments on the debt, which have grown extensively over the last few years as a result of high interest rates and a high and rising national debt.

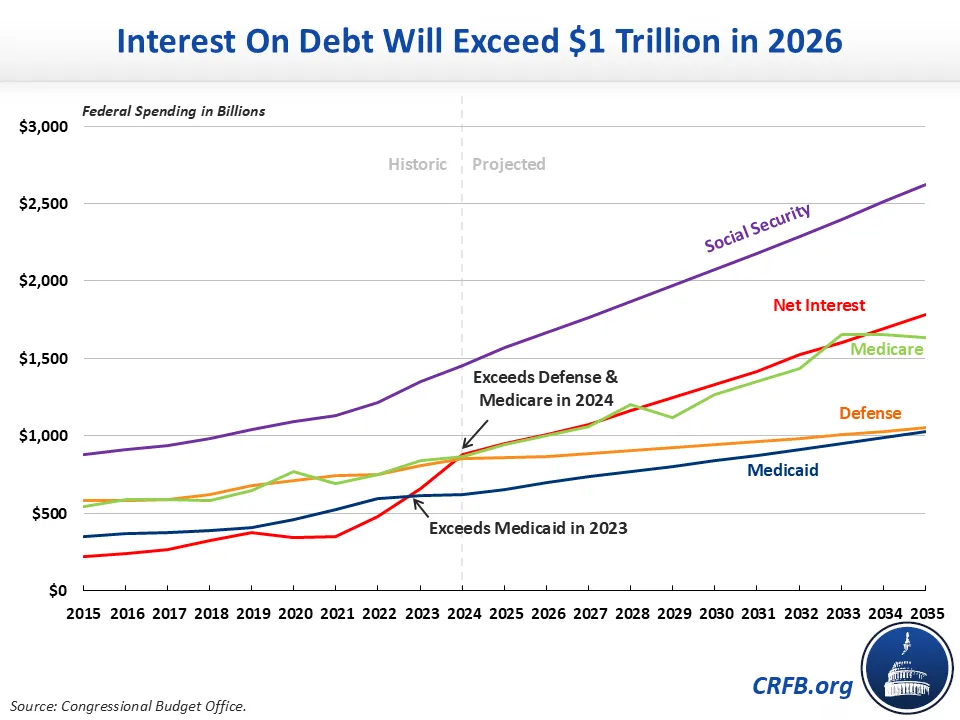

CBO’s latest projections show:

- Net interest payments will total $13.8 trillion from Fiscal Year (FY) 2026 through 2035.

- Interest will rise from $881 billion in FY 2024 to $1 trillion in FY 2026 before climbing further to nearly $1.8 trillion in 2035.

- Interest on the debt is already larger than spending on Medicare and national defense – it is second only to Social Security.

Net interest has been exploding over the past few years, with payments rising from $223 billion in 2015 to $345 billion in 2020 before nearly tripling to $881 billion in 2024. In 2025, CBO projects net interest will total $952 billion, a near-record 3.2 percent of Gross Domestic Product (GDP), and interest will eclipse its record as a share of the economy in 2026.

In 2024, interest payments were so large that they outgrew spending on Medicare – the nation’s largest federal health care program for seniors and people with disabilities – as well as the entirety of spending on national defense. Over the next decade, interest payments will total $4.3 trillion more -- $13.8 trillion total – than we are projected to spend on defense.

The uptick in net interest is due to a combination of higher interest rates and higher debt. Interest rates have skyrocketed over the past few years in efforts to combat inflation and policymakers have added significantly to the debt over the past several years.

Interest payments on the debt and interest rates will continue to rise so long as the national debt continues growing as a share of the economy. Policymakers should ensure any new priorities are paid for with proper offsets and enact other deficit reductions to stabilize the debt and ultimately reduce it as a share of the economy.