Post-State of the Union Fact Check Roundup

The President's first State of the Union address included several claims related to the recently passed tax legislation, including a few repeat claims. We factchecked two statements made during the speech and from the official White House Twitter account.

- The TCJA is the biggest tax cut in American History. False

- The new tax bill includes $3.2 trillion in cuts for families. Lacks Context

"We enacted the biggest tax cuts and reforms in American history."

The President made his oft-repeated assertion that the Tax Cuts and Jobs Act (TCJA) constitutes the largest tax cut in U.S. history. However, this is not true by any measure.

The tax cuts are among the largest in nominal terms, but even then they are still smaller than tax cuts passed at the beginning of 2013. And this is largely due to inflation and because the economy grows over time, leaving more tax revenue to cut.

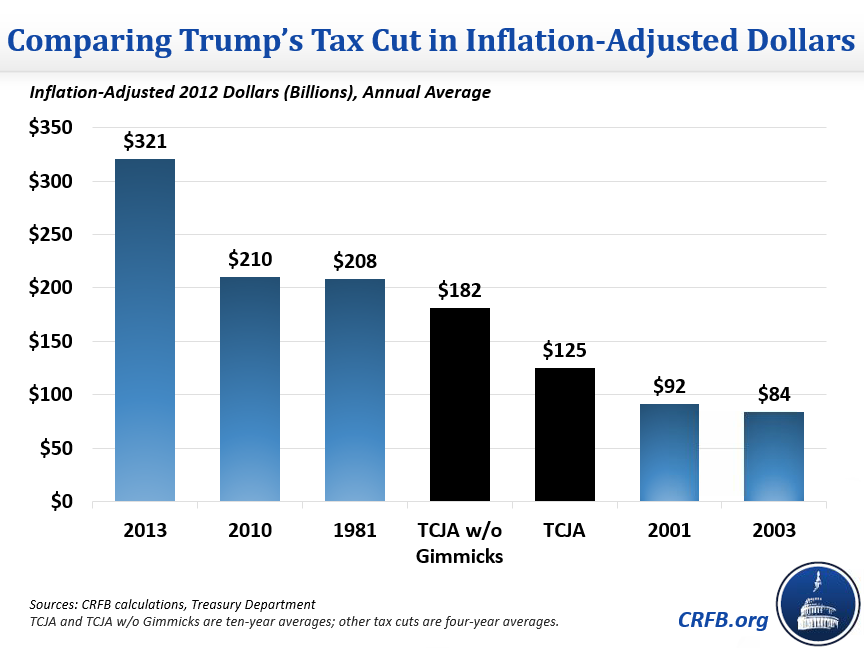

Adjusted for inflation, the TCJA is the fourth largest tax cut in history, behind the tax cuts in 2013, 2010, and 1981. It is the fourth largest whether looking at the official $1.5 trillion cost of the legislation, or our $2.2 trillion estimate excluding the gimmicky use of expirations and delays that artificially reduced the bill's cost.

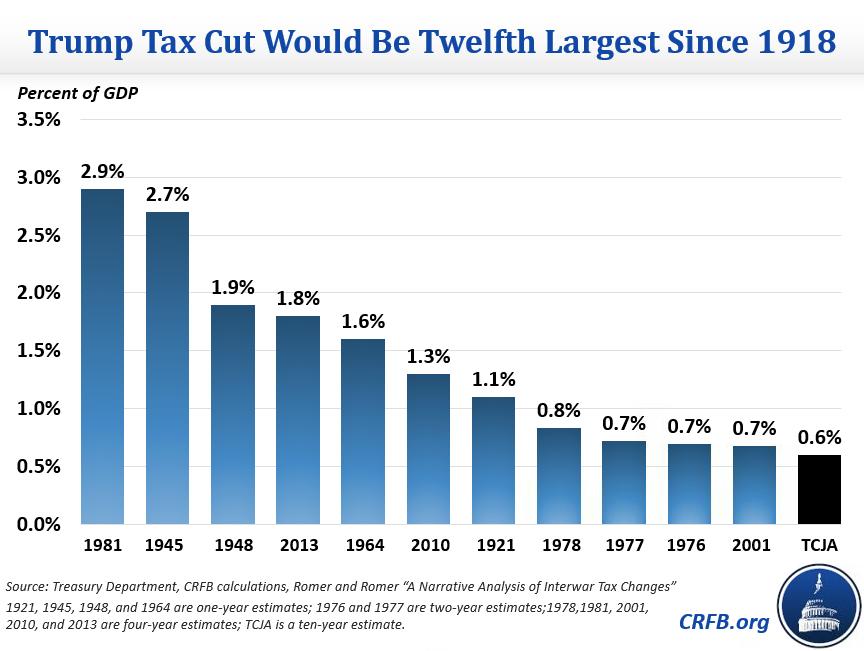

Revenue usually grows faster than inflation, so an inflation-adjusted measure is still biased towards more recent tax cuts. As a share of the economy, the TCJA comes in as the 12th largest tax cut in history at 0.6 percent of GDP. As we have noted previously, in order for the TCJA to exceed the 1981 tax cuts as a share of the economy, it would have needed to cut taxes by $6.8 trillion. This is nearly five times as much as the official cost of the law and over three times as much as the $2.2 trillion "true cost" when gimmicks are removed.

It is a positive thing that the TCJA was not the largest tax cut in history, since adding $6.8 trillion to the debt would worsen our fiscal situation even more than the tax bill already did.

Our Rating: False

The new tax bill includes $3.2 trillion in tax cuts for families

Shortly before the State of the Union address, the White House tweeted that the tax bill cut taxes for families by $3.2 trillion.

President Trump has delivered comprehensive tax cuts and reform to the American people, providing taxpayers and businesses with the tax relief they need. #SOTU pic.twitter.com/D4gW7RiEiK

— The White House (@WhiteHouse) January 31, 2018

This statistic is technically true, but is missing important context and could easily be misconstrued. We previously published a breakdown of the tax cuts. While the bill's gross individual tax cuts total $3.2 trillion over ten years, it also includes gross non-business tax increases of $2.1 trillion, resulting in a net tax cut for individuals of $1.1 trillion. The table below breaks down the tax cuts and increases by category.

Table 1: 10-Year Costs or Savings (-) in the Tax Cuts and Jobs Act by Provision

| Policy | Cost/Savings (-) |

|---|---|

| Individual Tax Cuts | |

| Reduce and/or consolidate individual income tax rates | $1.2 trillion* |

| Roughly double the standard deduction | $720 billion* |

| Repeal or modify the Alternative Minimum Tax (AMT) | $637 billion* |

| Increase the child tax credit and/or create dependent tax credit | $573 billion* |

| Other tax cuts | $11 billion* |

| Subtotal, Individual Tax Cuts | $3.2 trillion |

| Individual Tax Increases | |

| Repeal personal exemptions | -$1.2 trillion* |

| Reform itemized deductions | -$668 billion* |

| Use chained CPI to index tax provisions | -$134 billion |

| Reform higher education tax benefits | N/A |

| Require Social Security number to obtain child tax credit and other changes | -$30 billion* |

| Eliminate certain exclusions | -$5 billion* |

| Other provisions | -$15 billion* |

| Subtotal, Individual Tax Increases | -$2.1 trillion |

| Business Tax Cuts | |

| Reduce corporate tax rate and repeal corporate AMT | $1.4 trillion |

| Reduce taxes for pass-through businesses | $415 billion* |

| Move to territorial system for foreign taxation | $224 billion |

| Reform taxation of intangible property | $64 billion |

| Increase small business write-offs | $56 billion |

| Move to full expensing of investments for five years* | $91 billion* |

| Other provisions | $25 billion |

| Subtotal, Business Tax Cuts | $2.3 trillion |

| Business Tax Increases | |

| Reduce limit on interest expense deductions | -$253 billion^ |

| Enact base erosion or other revenue-raising provisions for foreign taxation | -$279 billion |

| Enact one-time tax on overseas earnings | -$339 billion |

| Limit carryover of net operating losses | -$201 billion |

| Limit pass-through losses to $250K/$500K | -$150 billion |

| Eliminate R&E expensing with delay | -$120 billion^ |

| Eliminate domestic production activities deduction | -$98 billion |

| Reform tax treatment of bonds | -$18 billion |

| Modify orphan drug tax credit | -$33 billion |

| Reform tax treatment of insurance companies | -$40 billion |

| Limit deductions for meals, entertainment, and transportation | -$41billion |

| Limit deferral of gain on like-kind exchanges to real property | -$31 billion |

| Reform tax treatment of banks and financial instruments | -$15 billion |

| Reform tax treatment of executive compensation | -$11 billion |

| Other changes | -$41 billion |

| Subtotal, Business Tax Increases | -$1.7 trillion |

| Reduce and/or Repeal Estate Tax | $83 billion* |

| Eliminate Individual Mandate | -$314 billion |

| Conventional Total | $1.46 trillion |

| Dynamic Feedback | ~-$400 billion |

| Dynamic Total | $1.05 Trillion |

| Extend business expensing | $0-$80 billion |

| Delay R&E amortization | $120 billion |

| Extend individual tax provisions beyond expiration | $315 billion |

| Tighten business interest deduction after four years | $0-$75 billion |

| Other gimmicks | $135 billion |

| Conventional Cost Without Expirations | $2.0-$2.2 trillion |

| Potential Dynamic Feedback | ~-$450 billion |

| Dynamic Cost Without Expirations | ~$1.6-$1.7 trillion |

| Conventional Cost with Interest | ~$1.77 trillion |

| Dynamic Cost with Interest | ~$1.30 trillion |

| Conventional "True" Cost with Interest | ~$2.4-$2.5 trillion |

| Dynamic "True" Cost with Interest | ~$1.9-$2.0 trillion |

Sources: TCJA Conference Report, Joint Committee on Taxation and CRFB calculations. * = Provision is sunset. ^ = Provision is delayed.