A Permanent Build Back Better Act Could Cost $4.8 Trillion

UPDATE 12/10: Since this analysis was published, CBO has issued a correction to its initial estimate of H.R. 5376. Instead of adding $160 billion to deficits over ten years, CBO now estimates the bill will add $158 billion to deficits over ten years.

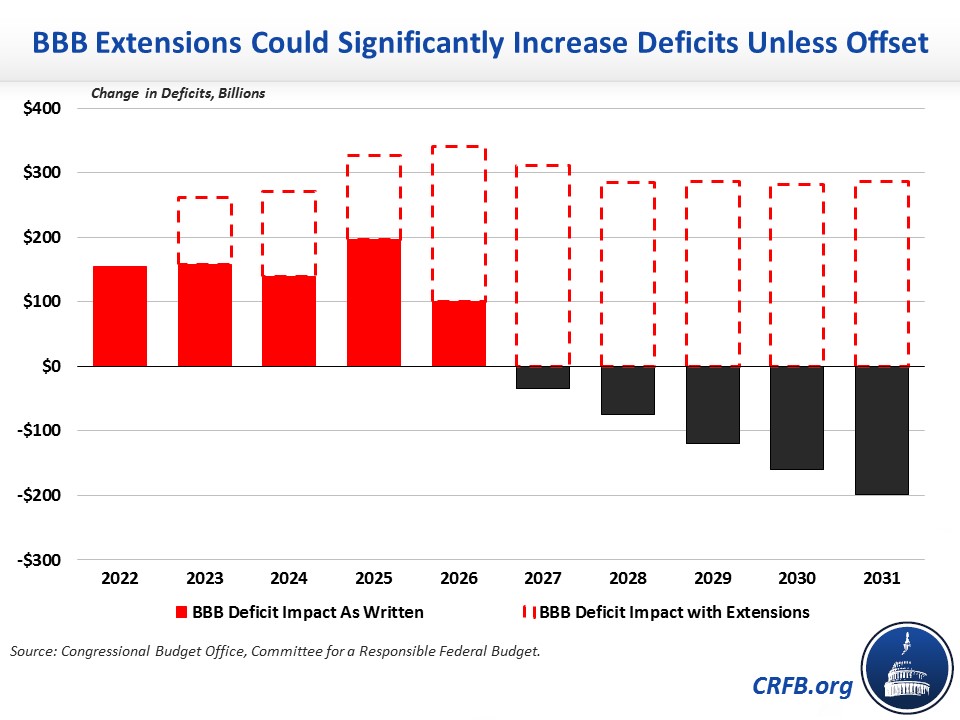

Last month, we estimated the Build Back Better Act in the House of Representatives would cost $4.9 trillion if made permanent and add $3 trillion to the debt if extensions were not offset. Based on CBO's score of the House-passed Build Back Better Act, this update of our prior analysis finds extensions would nearly double the cost of the bill from over $2.4 trillion to nearly $4.8 trillion. If all extensions were enacted without offsets, it would increase the deficit impact of the bill from $158 billion to $2.8 trillion.

The Build Back Better Act relies on a number of arbitrary sunsets and expirations to lower the official cost of the bill. These include extending the American Rescue Plan's Child Tax Credit (CTC) increase and Earned Income Tax Credit (EITC) expansion for a year, setting universal pre-K and child care subsidies to expire after six years, making the Affordable Care Act (ACA) expansions available through 2025, delaying the requirement that businesses amortize research and experimentation (R&E) costs until 2026, and setting several other provisions – including targeted tax credits, increased Pell Grants, and school lunch programs – to expire prematurely.

Excluding changes to the state and local tax (SALT) deduction, we estimate the Build Back Better Act would cost roughly $2.15 trillion as written. We estimate making all of these temporary policies permanent would cost over $2 trillion, nearly doubling the gross cost of the bill excluding SALT changes to $4.2 trillion through 2031.

Gross Cost of Build Back Better Act (2022-2031)

| Policy | Official Cost | Extension Cost | Permanent Cost |

|---|---|---|---|

| Expand the Child Tax Credit, mostly for one year | $190 billion | $1.00 trillion* | $1.19 trillion* |

| Expand the EITC for one year | $15 billion | $120 billion | $135 billion |

| Provide Universal Pre-K for six years | $110 billion | $95 billion | $205 billion |

| Support Affordable Child Care for six years | $275 billion | $185 billion | $460 billion |

| Expand Affordable Care Act through 2025 | $130 billion | $365 billion | $495 billion |

| Delay R&E amortization until 2026 | $5 billion | $145 billion | $150 billion |

| Other spending and tax breaks | $1.43 trillion | $120 billion | $1.55 trillion |

| Gross Cost of Build Back Better Excluding SALT Cap Changes | $2.15 trillion | $2.03 trillion | $4.18 trillion |

| Raise SALT cap to $80,000 through 2025^ | $275 billion | $325 billion* | $600 billion* |

| Gross Cost of Build Back Better with SALT Cap Changes' | $2.43 trillion | $2.36 trillion | $4.78 trillion |

| Memo: Deficit Impact Assuming No Further Offsets | $158 billion | $2.65 trillion^ | $2.81 trillion |

Sources: Congressional Budget Office and Committee for a Responsible Federal Budget.

*These figures assume elements of the Tax Cuts and Jobs Act that expire after 2025 are extended in separate legislation, including the CTC increase and $10,000 SALT deduction cap. Under a stricter interpretation of current law, extending the CTC would cost $1.5 trillion instead of $1 trillion, while extending the SALT deduction cap of $80,000 would cost roughly $50 billion instead of $325 billion from keeping the cap at $80,000 rather than the proposed $10,000 in 2031. 'The Build Back Better Act would also extend the SALT deduction cap (which expires under current law after 2025) through 2031 and raise $290 billion relative to current law; we count this in our offsets in our base scenario and assume this revenue disappears under our "full extension" scenario. ^Includes the $2.36 trillion cost of making provisions permanent and removes $290 billion of offsets from imposing the SALT deduction cap.

The most expensive provision to extend – the one-year, $1,000 increase in the CTC for children six and up and $1,600 increase in the credit for children under six – would cost roughly $1 trillion to make permanent (full refundability is permanent in the underlying bill). We estimate that continuing the ACA expansion, which temporarily extends the American Rescue Plan's insurance subsidy expansions and offers subsidies to those in the Medicaid coverage gap among other changes, would cost another $365 billion to extend beyond 2025. Extending child care subsidies beyond 2027 would cost an estimated $185 billion. We estimate remaining extensions, outside of SALT, would cost a combined $480 billion.

Incorporating proposed SALT cap relief increases these costs further. The legislation already extends its five-year increase in the SALT deduction cap from $10,000 to $80,000 through 2030 (it sets the cap at $10,000 in 2031). However, this actually represents a $290 billion tax increase on paper relative to current law since the SALT deduction cap and other parts of the Tax Cuts and Jobs Act (TCJA) expire after 2025. Assuming the remainder of the TCJA is extended separately – as we did in the case of our CTC estimate – this $290 billion savings would be erased and replaced with an additional $325 billion of costs. Inclusive of this tax change, we estimate extending expiring parts of the Build Back Better Act would cost nearly $2.4 trillion, increasing the total cost of permanent extension of the bill to nearly $4.8 trillion.

Overall, our extension estimates are roughly $165 billion lower than in our prior analysis. The difference is mainly driven by a $130 billion downward revision in the cost of extending child care and pre-K benefit as a result of a slower-than-expected spendout pace.

To be sure, lawmakers may choose not to extend some or all of these provisions. However, if they do, they would need to more than double current offsets in order for the bill and the extensions to be paid for. The alternative would be a substantial increase in the debt.

As written, the Build Back Better Act would increase deficits by $750 billion over the first five years and a total of $160 billion through 2031 (it would reduce deficits by nearly $600 billion in the second five years). If the legislation were made permanent without additional offsets, it would add nearly $1.4 trillion to deficits over five years and increase deficits by $2.8 trillion through 2031.

This $2.8 trillion potential deficit impact includes $158 billion of borrowing from the bill itself, $2.36 trillion from extending expiring provisions, and $290 billion from removing the claimed savings from extending the SALT cap beyond 2025. The estimate effectively assumes remaining parts of the TCJA will be extended on a separate track. If we instead assume large parts of the TCJA are allowed to expire as scheduled, the potential deficit impact of the Build Back Better Act with extensions and without offsets would be less than $2.7 trillion (extending the CTC would be more expensive and SALT cap relief would be less costly).

The Build Back Better Act relies on a substantial amount of short-term policies and arbitrary sunsets to reduce its cost, raising the possibility of deficit-financed extensions in future years. A more robust and fiscally responsible package would not rely on these gimmicks to achieve deficit neutrality.

Read more options and analyses on our Reconciliation Resources page.