Means-Testing Student Debt Cancellation is Still Costly and Regressive

Amid criticisms that student debt cancelation would be costly and regressive, the Biden Administration is apparently considering means-testing debt cancellation. Specifically, reports suggest the Administration may cancel $10,000 or more of federal student debt for individual borrowers making less than $125,000 or $150,000 per year and households making less than $250,000 or $300,000 per year. We estimate this would still cost at least $230 billion, with roughly 70 percent of the benefit going to those in the top half of the income spectrum. It would also worsen inflation and increase the cost of higher education.

Based on our previous estimates and adjusting for portfolio growth, we estimate that canceling $10,000 of student debt per borrower would eliminate $380 billion of federal student loan debt, at a cost of roughly $250 billion to taxpayers.

Phasing out debt cancellation between $100,000 and $150,000 of individual income and between $200,000 and $300,000 of household income would reduce the cost of debt cancellation by $15 to $20 billion. This slight reduction in cost would do almost nothing to alleviate the central issues with the policy, namely that it is regressive, inflationary, expensive, and would likely do more to increase the cost of higher education going forward than to reduce it.

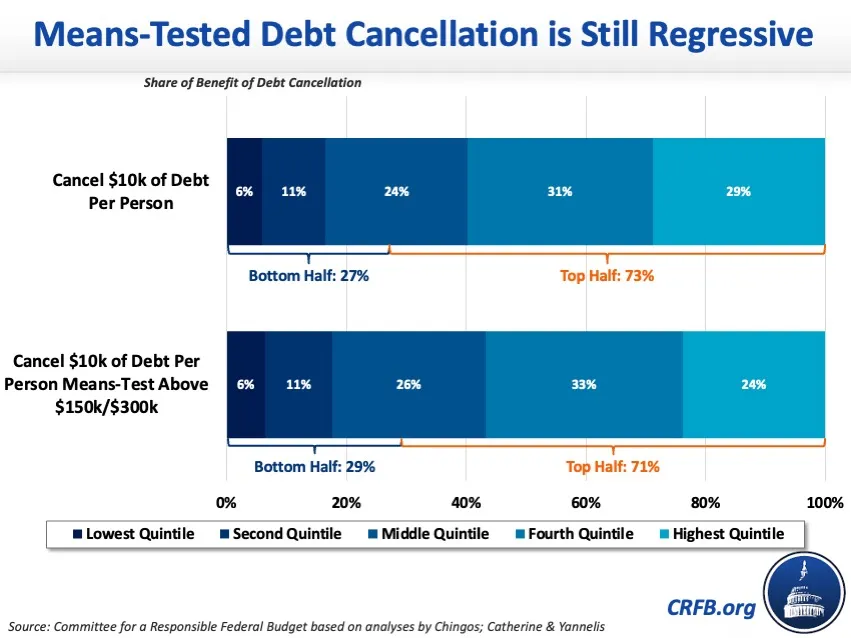

Even with the means-testing being considered by the Biden Administration, most of the benefit of student debt cancellation would go to people with higher incomes. Based on distributional estimates from Catherine and Yanellis, we estimate that cancelling $10,000 of debt with means-testing would deliver 71 percent of the benefit to the top half of the income distribution, including 24 percent to the top income quintile. This is only a modest improvement from the 73 percent and 29 percent, respectively, for debt cancellation without means-testing. 1

Cancelling a larger amount of student debt would be somewhat more regressive. For example, 73 percent of the benefit of cancelling $50,000 of debt with means-testing would go to the top half of the income spectrum, including 26 percent to the top income quintile.

These figures in some ways understate the regressive nature of the policy since much of the forgiveness would go to recent graduates (especially from medical school and law school) who are likely to make substantially more income in future years. On the other hand, the estimates focus on reduced payments rather than reduced balances, and so do not account for the indirect benefit of lower balances for those who would not otherwise make repayments -- including many of the 8.5 million borrowers currently in default. Different methods, assumptions, and data might lead to somewhat different results; however, it is clear means-testing at the very top of the income spectrum won't fundamentally change the distribution of the policy.

Cancelling student debt would also contribute to general inflation and to rising tuition costs. It would worsen inflation by boosting spending and demand in an already overheated economy. In addition, the precedent of cancellation by executive order would likely engender an expectation of future rounds of student debt forgiveness. This would encourage students to borrow more and be less sensitive to prices, which would in turn allow schools to charge higher prices or enroll more students into programs with questionable returns.

Moreover, cancelling $10,000 in student debt for every borrower does nothing to fix underlying issues in the student loan program. Our previous estimates suggest that the student loan portfolio would return to its current size within four years of a cancellation event. That means that in 2026, halfway through the next Presidential term, the student debt balance would be just as high as before any cancellation took place.

The means-testing proposal currently being floated would do little to alter the serious problems with student debt cancellation as a policy. It continues to be a regressive, inflationary, and expensive proposition that would do nothing to fix issues in higher education financing or costs moving forward.

Note: This blog was updated on May 4 to clarify the method used in the distributional analysis.

1 Our estimates rely on a recent preliminary analysis by Matthew Chingos of the Urban Institute and data from a working paper by Sylvain Catherine and Constantine Yanellis.