IMF: Fiscal Reform Boosts Economic Growth

The IMF has released new research showing that fiscal reforms enhance economic growth. These findings are broadly consistent with other analysis of this topic, including work from the Congressional Budget Office (CBO) that showed that a sensible deficit reduction plan could boost per-person income in 2040 by $4,000 relative to our current course.

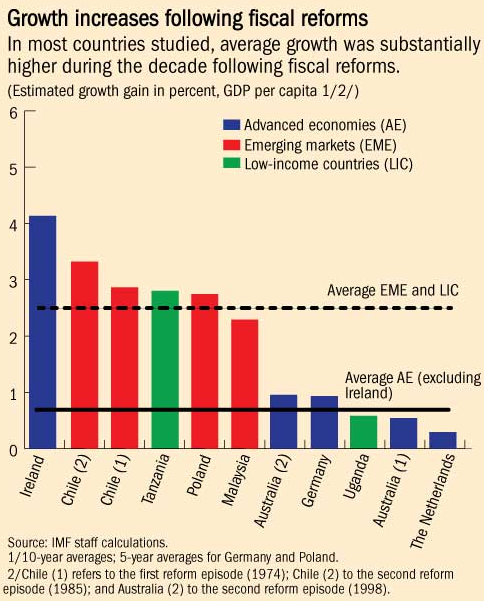

Examining past reform episodes in nine countries, the IMF report finds that economic growth was around 0.75 percentage points higher per year on average in the decade following the reforms for advanced economies, and 2.5 percentage points higher per year for emerging market or low-income countries. Separate analysis of growth acceleration episodes confirms this positive impact, with higher growth more likely to occur following fiscal reform. Packages that included both revenue and spending reforms lead to faster growth in 60 percent of the cases examined and were also more likely to spur growth than ones that changed only one or the other.

The report notes that high public debt hampers economic growth by "increasing uncertainty over future taxation, crowding out private investment, and weakening a country's resilience to shocks"; therefore, deficit reduction should help to alleviate these effects. In addition, the authors find that budget-neutral reforms – for example, lowering tax rates while broadening the tax base – can also help to promote economic growth by improving incentives to work, encouraging investment, increasing human capital, and encouraging innovation. The authors' preferred methods for offsetting deficit-increasing measures include eliminating tax exemptions and preferential tax rates for certain types of income, shifting from direct taxes to indirect and property taxes, introducing environmental taxes (such as a carbon tax) to price negative externalities, and better targeting spending programs to those with the greatest need.

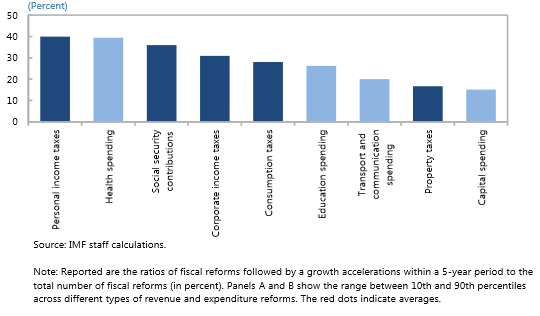

The study also found that the type of reform enacted affected the probability that it would accelerate growth. In particular, reforms to personal income taxes, health spending, and social security contributions were most likely to lead to growth acceleration while reforms to property taxes or capital spending had a low probability of doing so. In addition, the inclusion of fiscal measures in a package with other complementary reforms (such as deregulation) and social dialogue with relevant stakeholders was found to increase the likelihood of success.

Type of Reform and Conditional Probability of Growth Acceleration

The paper also shows that appropriately designed fiscal reforms can increase economic growth without worsening income inequality, for example, by offsetting consumption tax increases with increased health and education spending. In many of the case studies examined, countries were able to achieve big increases in economic growth with no change or only small increases in inequality.

The findings of the paper were presented at the Peterson Institute for International Economics last week, with former CBO Director Doug Elmendorf the main discussant. Elmendorf agreed with the assertion that fiscal reform would help to promote economic growth but expressed skepticism that fiscal reforms could have such a large and prolonged impact on growth in an economy such as the United States. He also expressed some concern that the trade-off between growth and equality was underplayed in the paper.

Whether or not deficit reduction can produce as much growth as the IMF study finds, the paper clearly shows the significant benefit of keeping debt on a sustainable path. By enacting thoughtful deficit reduction – which could include tax reform, entitlement reform, and sequester replacement – the United States could significantly increase its long-term economic prospects.