House ACA Plan Will Cost Almost $600 Billion and Cover 4 Million People, CBO Finds

The Congressional Budget Office (CBO) this week released estimates for the health care coverage provisions in the House reconciliation bill. CBO estimates these policies would cost $553 billion over ten years and would provide coverage for an additional 3.9 million people. We estimate the total cost of the bill would be closer to $580 billion including re-insurance provisions.

| Policy | Cost |

|---|---|

| Extend American Rescue Plan (ARP) Expansion of ACA Premium Subsidies | $210 billion |

| Close the "Medicaid Coverage Gap" in States that Didn't Expand Medicaid | $323 billion |

| Temporarily Offer ACA Benefits to Those on Unemployment Insurance | $11 billion |

| Modify Employer Coverage Affordability Test to Extend Subsidy Access | $11 billion |

| Interactions Between Policies | -$1 billion |

| Total Cost of ACA Expansion Proposals (CBO Score) | $553 billion |

| Fund $100 Billion of Re-Insurance (Health Insurance Affordability Fund) | ~$25 billion |

| Total Cost of ACA Expansion Proposals, including Re-Insurance | ~$580 billion |

Note: Figures may not sum due to rounding.

Sources: Congressional Budget Office, Committee for a Responsible Federal Budget

Cost of Coverage Provisions in the House Bill

The coverage provisions in the House reconciliation bill would cost roughly $580 billion over a decade, including approximately $80 billion in 2031. These costs come primarily from three major components.

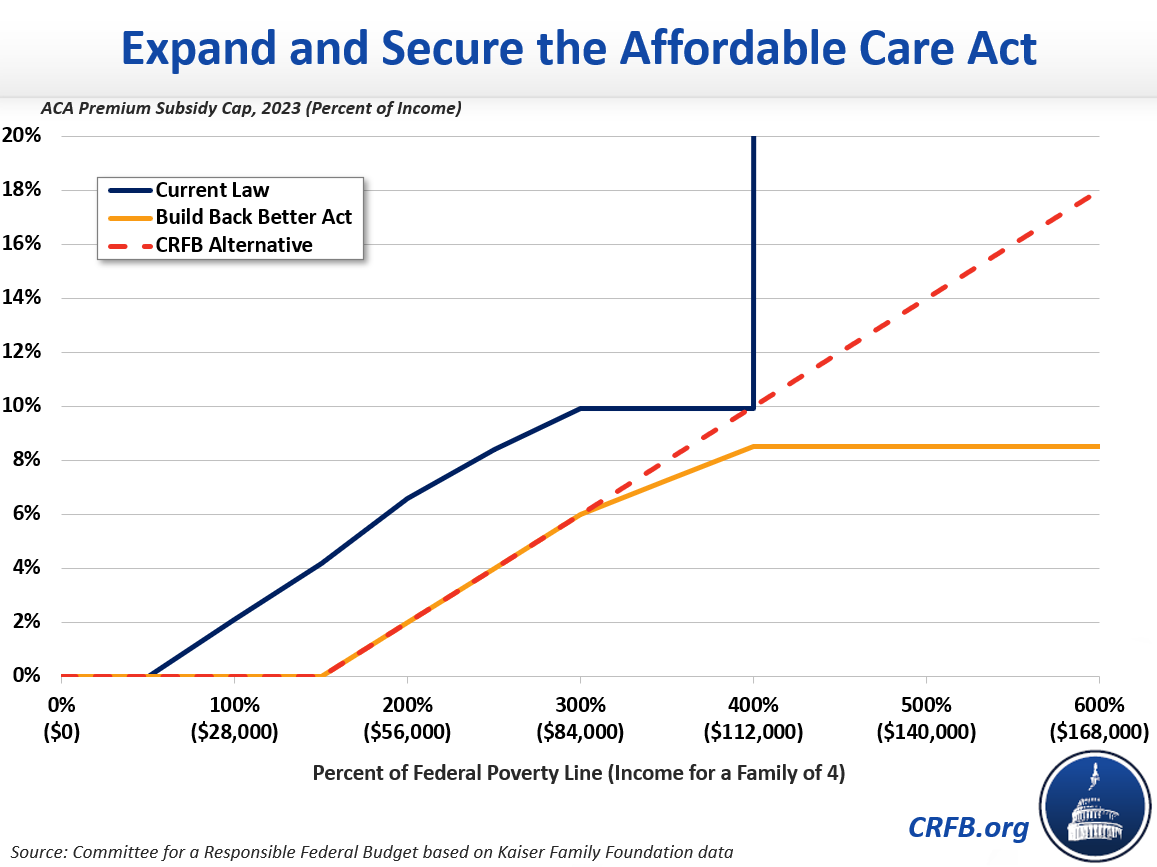

First, the bill would extend the enhanced ACA premium tax credits temporarily enacted by the American Rescue Plan (ARP), at a cost of roughly $210 billion over ten years. These enhanced subsidies would eliminate premiums for a typical household making less than 150 percent of the Federal Poverty Level (FPL) and reduce premiums for others – especially those making above the ACA’s original limit of 400 percent of the FPL.

Second, the legislation would extend premium and cost-sharing subsidies to those below the poverty line in the 12 states that have not expanded Medicaid under the ACA through 2024. Third, the legislation would create a federal Medicaid program – starting in 2025 – to cover those in the Medicaid coverage gap. These policies together would cost $323 billion over ten years, including approximately $50 billion in 2031.

The plan would also increase ACA premium tax credits through 2025 for those collecting unemployment benefits, modify the criteria used to determine an affordable offer of employer-sponsored health insurance for the premium tax credit, and allocate $10 billion per year toward re-insurance. CBO estimates the first two provisions would cost $11 billion each. We estimate the re-insurance provision would cost roughly $25 billion – with nearly $100 billion of new spending mostly offset due to interactions with existing premium subsidies.

Coverage Impact of the House Bill

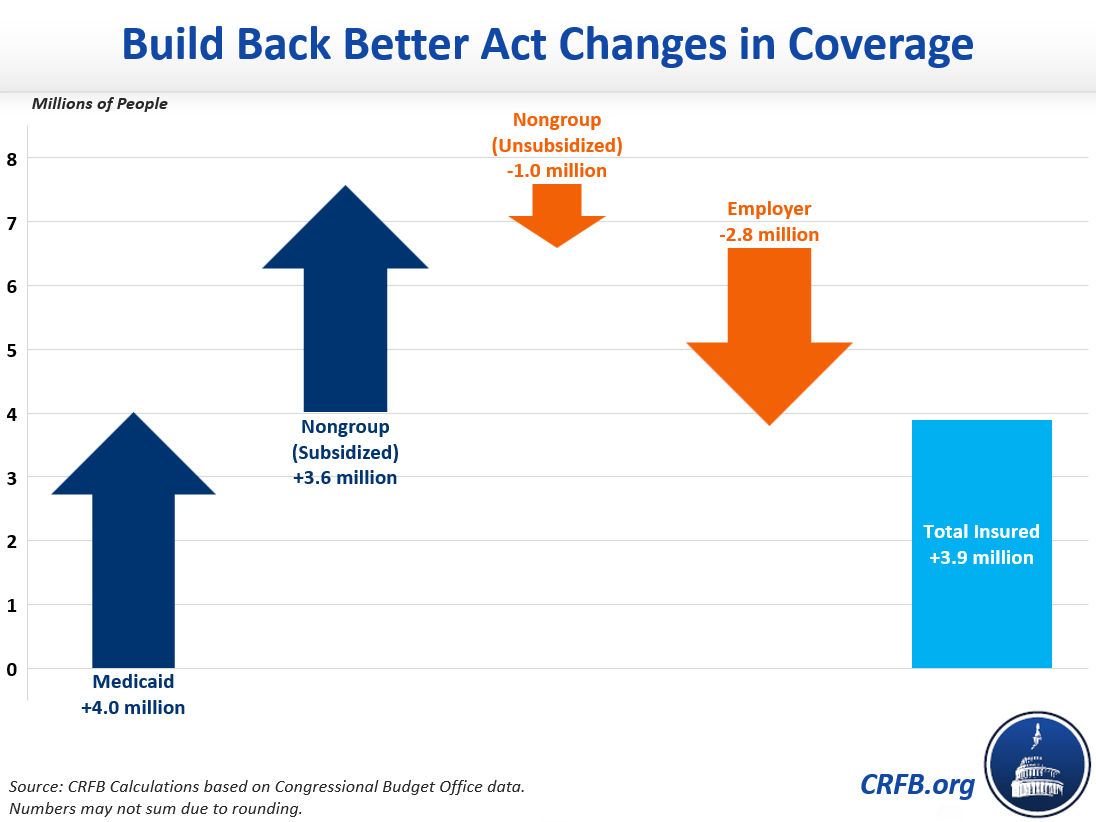

CBO estimates that the House bill would reduce the number of uninsured Americans by an average of 3.9 million, or roughly 15 percent (with re-insurance, we believe that figure would exceed 4 million). Three-quarters of the remaining uninsured would be eligible for Medicaid, subsidized coverage in the exchange, or employer coverage.

The net increase in coverage is driven by a 4 million increase in Medicaid enrollment and a 3.6 million increase in subsidized coverage through the exchanges. At the same time, unsubsidized non-group coverage would fall by 1 million and employer-sponsored coverage would fall by 2.8 million.

Possible Modifications and Improvements

Policymakers are unlikely to spend $580 billion on health insurance coverage provisions in the final reconciliation bill.

One strategy recently floated to reduce the reported cost by two-thirds would involve ending the expansions after only three years. As we recently explained, this strategy would make the policy shorter, not cheaper. It would hide $370 billion of potential future costs while putting the policy itself in jeopardy.

In our recent Build Back Better for Less paper, we suggested smarter ways to reduce the cost of the House ACA proposal. First, policymakers could make the ACA subsidy formula more progressive, mainly for families making six figures. CBO estimates roughly $20 billion of the expanded subsidies would go to those making over 700 percent of the FPL (roughly $200,000 for a family of four), and a much larger amount would go to those making above 350 percent (roughly $100,000 for a family of four). A more progressive formula at the top could generate substantial savings without significantly affecting coverage.

We suggest further limiting the cost of ACA expansion by restoring cost-sharing reduction payments discontinued by the Trump Administration. This would end the costly practice of silver-loading.

Policymakers could consider additional measures or alternatives to further reduce costs. And perhaps most importantly, there are plenty of health savings options to cover the cost of the expansion.

The current House bill spends roughly $580 billion to reduce health expenses paid by individuals and would expand coverage by about 4 million people over a decade. As lawmakers negotiate details of the final reconciliation package, they should work to do more for less – not simply more for fewer years.

*****

Read more options and analyses on our Reconciliation Resources page.