Extensions Would Wipe Away President's Deficit Reduction

We were very encouraged by the President’s call for $3 trillion of ten-year deficit reduction in his Fiscal Year (FY) 2024 budget proposal. However, we believe a re-estimate would reduce these savings closer to $2.2 trillion, and policies not fully spelled out in the budget could wipe this remaining deficit reduction away. The budget does not include a plan to address the expiration of most parts of the 2017 tax cuts after 2025, except to say that the President would work with Congress to continue “tax cuts for people earning less than $400,000 in a fiscally responsible manner.”

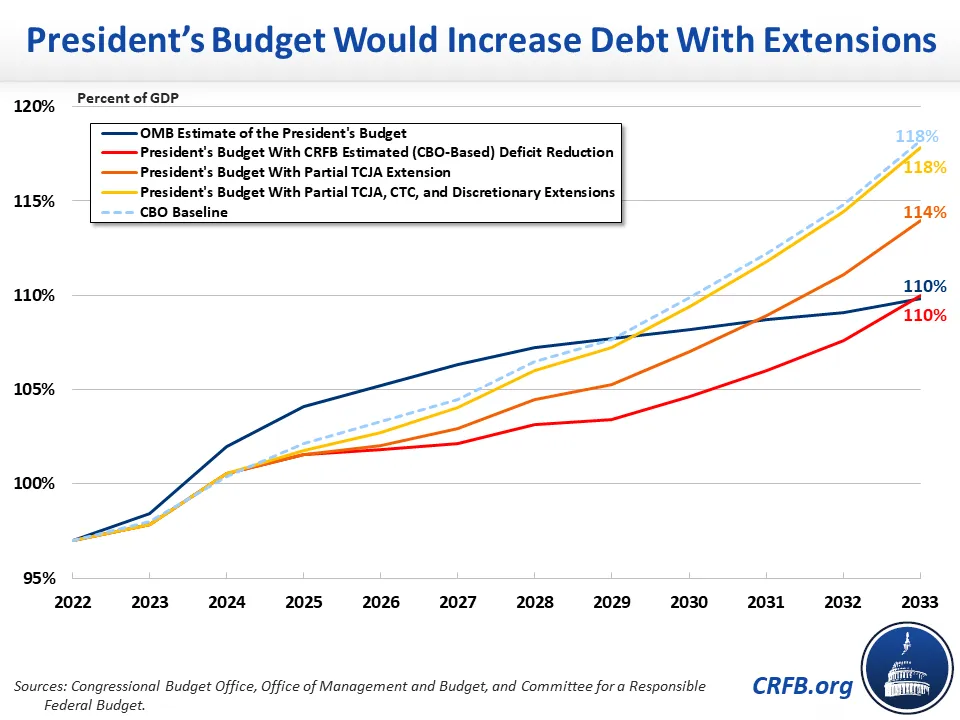

Without additional offsets beyond what is in the budget, we estimate extending the tax cuts for income earners below $400,000 would erase all but $600 billion of the budget’s deficit reduction through FY 2033. If the budget also extended its Child Tax Credit (CTC) expansion and its proposed FY 2024 discretionary spending levels without offsets, it would add $900 billion to the deficit through 2033. Under this scenario, debt would reach 118 percent of GDP by the end of 2033 compared to 110 percent under the Office of Management and Budget's (OMB) estimate of the budget.

*****

As written, OMB estimates the President’s budget would reduce deficits by roughly $3.0 trillion through FY 2033 relative to its baseline. This is the net effect of over $2.8 trillion of new spending and tax breaks, nearly $5.0 trillion of revenue increases, about $575 billion of spending reductions, and $330 billion of net interest savings (details are available here).

However, some of OMB's revenue estimates are likely too high and some of its spending estimates too low, at least compared to what the Congressional Budget Office (CBO) is likely to find when it does its own re-estimate of the President's budget. For example, OMB's previous estimates of raising the corporate tax rate were about 50 percent higher than CBO’s, and its latest estimates for spending on child care, pre-K, and paid family leave are lower than what CBO estimated when analyzing the Build Back Better legislation.

Adjusting for these and a few other policies, we believe the net deficit reduction under the President's budget would be closer to $2.2 trillion than $3.0 trillion. Importantly, this estimate comes with a wide degree of uncertainty and – among other assumptions – makes no adjustments to OMB’s estimates of international tax reform.

The actual effects of the President’s proposals could be much less favorable. Most significantly, the President’s Budget does not detail a plan for how to address the expirations of parts of the 2017 Tax Cuts and Jobs Act (TCJA) at the end of 2025. The budget instead lays out principles declaring that the President “will work with the Congress to address the 2025 expirations,” that he opposes increasing taxes on those making below $400,000 per year or cutting taxes for the wealthy, and that he “supports additional reforms to ensure that wealthy people and big corporations pay their fair share, so that America pays for the continuation of tax cuts for people earning less than $400,000 in a fiscally responsible manner.”

Depending on the exact details, we estimate extending the tax cuts for those making less than $400,000 per year would cost roughly $1.4 trillion through FY 2033. This assumes full extension of the TCJA except for the temporary corporate tax cuts, Estate Tax cuts, Opportunity Zone tax cuts, individual income rate cuts above $400,000, pass-through deduction above $400,000, and elimination of the “Pease” provision above $400,000.1

We welcome the President’s call for additional reforms and his commitment to fully pay for any extensions – which we strongly agree with. However, the President has not explained how he will raise these funds, and it is not clear what additional tax increases he supports (let alone can pass) on top of the nearly $5 trillion already in the budget.

Assuming tax cut extensions are fully paid for with policies from the President’s budget, the $2.2 trillion of net deficit reduction would shrink to only $600 billion through FY 2033, once accounting for interest. The policy proposals could increase deficits by $900 billion under the President’s budget, assuming a broader set of extensions.

Fiscal Impact of the President's FY 2024 Budget Relative to OMB's Baseline

| Policy | 2023-2033 |

|---|---|

| Deficit Reduction Under OMB's Estimate | $3.0 trillion |

| Assume Less Revenue from Corporate Tax Rate Increase | -$450 billion |

| Assume Higher Costs from Pre-K, Child Care, Paid Leave, and Other Spending | -$250 billion |

| Assume Other Adjustments in Cost and Revenue Estimates based on CBO Baseline | $150 billion |

| Change in Debt Service (Includes CBO Interest Assumptions) | -$250 billion |

| Deficit Reduction Under CRFB (CBO-Based) Estimate | $2.2 trillion |

| Extend TCJA Individual Tax Cuts for those Earning Less than $400,000 Per Year | -$1.4 trillion |

| Debt Service | -$150 billion |

| Deficit Reduction With Partial TCJA Extension | $600 billion |

| Extend Child Tax Credit Expansion | -$850 billion |

| Extend FY 2024 Appropriations Levels | -$500 billion |

| Debt Service | -$150 billion |

| Deficit Increase (-) With TCJA, CTC, and Discretionary Extensions | -$900 billion |

| Memo: Deficit Reduction Relative to CBO February 2023 Baseline | |

| Under OMB Estimate | $4.1 trillion |

| Under CRFB (CBO-Based Estimate) | $3.2 trillion |

| With Partial TCJA Extension | $1.7 trillion |

| With TCJA, CTC, and Discretionary Extensions | $160 billion |

Sources: Office of Management and Budget and Committee for a Responsible Federal Budget. Numbers rounded to nearest $50 billion, and may not sum due to rounding.

For example, the budget dramatically expands the CTC, but only through 2025. And after proposing to grow appropriations by 5 percent between FY 2023 and 2024, it limits annual growth to below the rate of inflation -- less than 2 percent per year through FY 2028 and 1.5 percent per year thereafter. Making the CTC expansion permanent on top of extending the TCJA policy would cost over $850 billion through 2033, while maintaining FY 2024 appropriations levels would cost nearly $500 billion.

In all cases, the budget would appear to save roughly $1.1 trillion more relative to CBO’s baseline as compared to OMB's. This is largely because CBO’s baseline, by law and convention, assumes the continuation of one-time disaster, military, and infrastructure funding (partially offsetting these, deficits would be about $230 billion higher due to the Administration’s Income-Driven Repayment rule).

Using CBO-based estimates, we project debt under the President’s Budget as written would reach 110 percent of GDP by the end of FY 2033 and the deficit would total 5.9 percent of GDP. Assuming partial TCJA extension, debt would reach 114 percent of GDP and the deficit would total 6.6 percent of GDP. With broader extensions, debt would reach 118 percent of GDP and the deficit would total 7.2 percent of GDP.

This is in comparison to 110 and 4.8 percent of GDP, respectively, under OMB's estimate of the President's budget and 118 and 7.3 percent of GDP, respectively, under CBO's baseline.

Importantly, these numbers are very rough and may prove to be higher or lower than what CBO would actually estimate. But they help illustrate how additional details and adjustments could affect the fiscal impact of the President’s budget, and how costly extending cuts and elevated discretionary levels may be.

1 We assume very aggressive expirations of various provisions above $400,000, even as policymakers might opt for more gradual phase outs. We do not assume expirations of Alternative Minimum Tax reductions, standard deduction expansions, or Child Tax Credit expansions above $400,000. These policies are intertwined with other proposals and neither proposals from the House Ways & Means Committee nor the Biden presidential campaign suggested they would be phased out. We also assume limits to the state and local tax (SALT) deduction are fully retained, including on those making less than $400,000 per year.