Analysis of the President's FY 2024 Budget

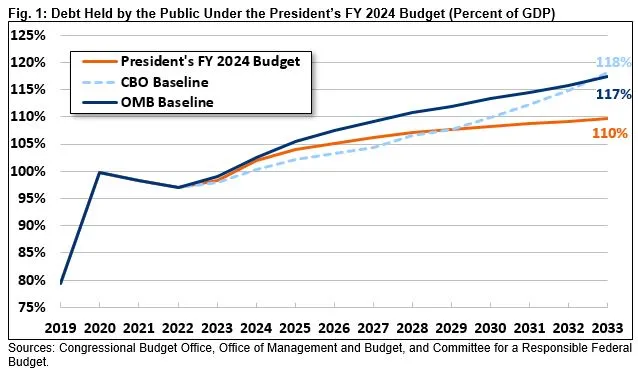

The Biden Administration released its Fiscal Year (FY) 2024 budget proposal today, outlining President Biden’s priorities over the next decade. The budget proposes an estimated $3 trillion of deficit reduction through 2033 and projects debt would grow from 98 percent of Gross Domestic Product (GDP) at the end of this year to 110 percent by the end of 2033, compared to 117 percent of GDP under its baseline.

Based on the Administration’s estimates, our analysis shows that under the budget:

- Debt would hit a new record by 2027, rising from 98 percent of GDP at the end of 2023 to 106 percent by 2027 and 110 percent by 2033. Nominal debt would grow by $19 trillion, from $24.6 trillion today to $43.6 trillion by 2033.

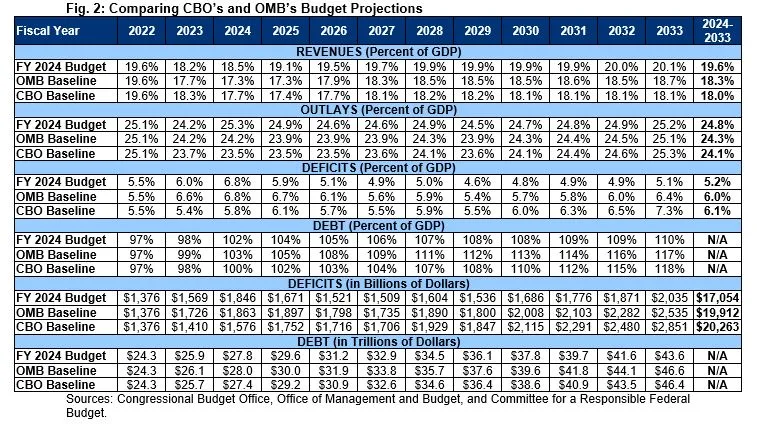

- Deficits would total $17.1 trillion (5.2 percent of GDP) between FY 2024 and 2033, rising to $2.0 trillion, or 5.1 percent of GDP, by 2033.

- Spending and revenue would average 24.8 and 19.7 percent of GDP, respectively, over the next decade, with spending reaching 25.2 percent of GDP and revenue totaling 20.1 percent by 2033. The 50-year historical average is 21.0 percent of GDP for spending and 17.4 percent of GDP for revenue.

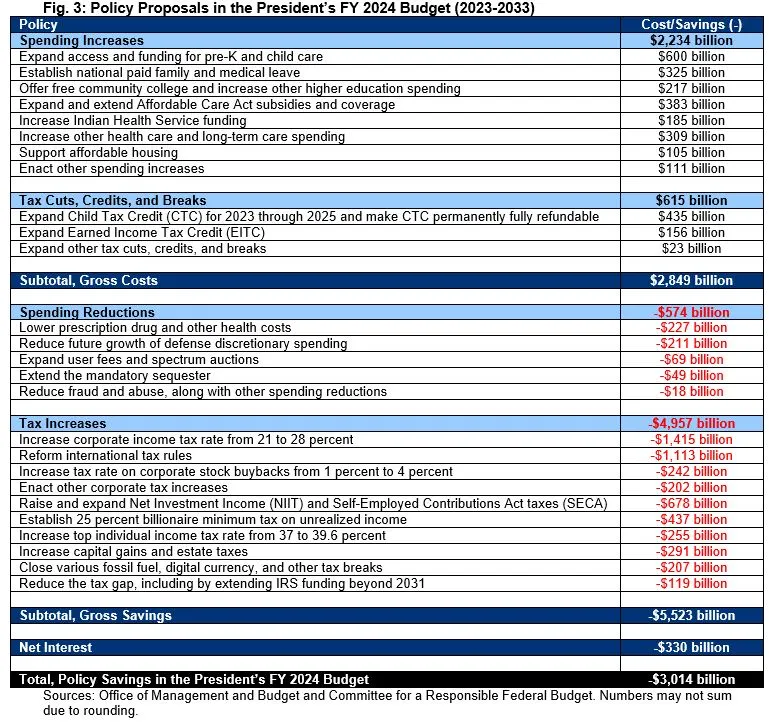

- Proposals in the budget would reduce projected deficits by $3 trillion through 2033, including $400 billion through 2025 when it could help fight inflation. The budget proposes $2.8 trillion of new spending and tax breaks, $5.5 trillion of revenue and savings, and saves $330 billion from interest.

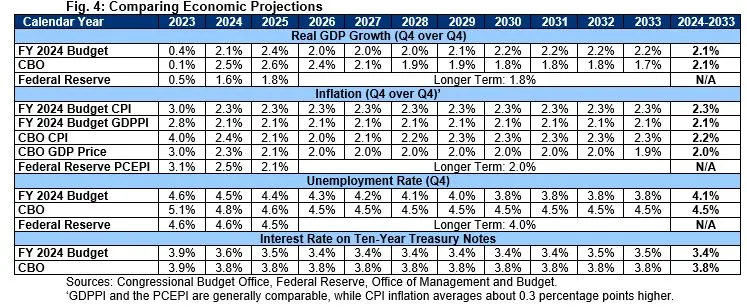

- The budget relies on somewhat optimistic economic assumptions, including stronger long-term growth, lower unemployment, and lower long-term interest rates than the Congressional Budget Office (CBO). The budget assumes 0.4 percent growth this year, 2.1 percent growth next year, and 2.2 percent by the end of the decade – compared to CBO’s 0.1 percent, 2.5 percent, and 1.7 percent, respectively. The budget also assumes ten-year interest rates fall to 3.5 percent by 2033, compared to CBO’s 3.8 percent.

This budget falls well short of the deficit reduction needed to put the nation on a sustainable fiscal path. We are disappointed that the spending cuts in this budget – given the massive spending growth in recent years – amount to less than 1 percent of the budget and are coupled by four times as much in spending increases. We are pleased the budget begins to address Medicare but extremely disappointed it neglects Social Security, putting seniors’ benefits at risk.

The President deserves credit for putting forward $3 trillion of deficit reduction, which could be an achievable near-term bipartisan goal in upcoming negotiations. However, deficit reduction will ultimately need to be nearly three times that large, and it is disappointing the budget has put forward so many costly proposals without first putting the nation’s fiscal house in order.

Debt, Deficits, Spending, and Revenue Under the President’s Budget

Debt under the President’s budget would grow to a new record as a share of the economy over the next decade. Federal debt held by the public would rise from 97 percent of GDP at the end of FY 2022 to 106 percent by 2027 – surpassing the prior record of 106 percent of GDP set just after World War II in 1946. From there, debt would rise further to 110 percent of GDP by the end of 2033. In nominal dollars, debt would grow by $19 trillion, from $24.6 trillion today to $43.6 trillion by the end of 2033.

Although debt would continue to grow as a share of GDP through the entire budget window, it would grow more slowly than under the Office of Management and Budget’s (OMB) baseline. OMB projects debt under current law would reach 117 percent of GDP by the end of FY 2033, which is similar to CBO’s 118 percent of GDP projection.

Annual budget deficits under the President’s budget would rise in nominal dollars and remain high as a share of the economy. Specifically, the deficit would rise from $1.4 trillion in FY 2022 to $1.8 trillion in 2024, then fall to $1.5 trillion in 2027 before rising again to $2.0 trillion by 2033. As a share of GDP, the deficit would grow from 5.5 percent in 2022 to 6.8 percent in 2024, then fall to a low of 4.6 percent of GDP in 2029 before growing to 5.1 percent of GDP by 2033.

Between FY 2024 and 2033, deficits under the President’s budget would total $17.1 trillion (5.2 percent of GDP), nearly $3 trillion (0.8 percent of GDP) less than OMB’s baseline projection of $19.9 trillion (6.0 percent of GDP). In 2033, the deficit would be about half a trillion dollars (1.3 percent of GDP) lower than OMB’s baseline projection of $2.5 trillion (6.4 percent of GDP).

The President’s budget would increase both spending and revenue relative to current law as well as over time. Spending would average 24.8 percent of GDP over the FY 2024 to 2033 period, compared to 24.3 percent under OMB’s baseline. Revenue, meanwhile, would average 19.6 percent of GDP, compared to 18.3 percent under OMB’s baseline.

After falling from 25.1 percent to 24.2 percent of GDP between FY 2022 and 2023, spending would rise to 25.2 percent by 2033 under the President’s budget, driven by growth in Social Security, Medicare, and interest on the debt.

Similarly, after dropping from 19.6 percent to 18.2 percent of GDP between 2022 and 2023, revenue would rise to 19.9 percent by 2028 and to 20.1 percent by 2033. About 0.8 percentage points of this rise are due to assumed expiration (or reversal) of many parts of the 2017 Tax Cuts and Jobs Act, and the rest is driven by policy changes and ‘real bracket creep,’ where incomes rise faster than tax brackets adjust and thus result in more income being taxed at higher rates.

For historical comparison, revenue has averaged 17.4 percent of GDP over the past 50 years while spending has averaged about 21.0 percent of GDP.

Policy Proposals in the President’s FY 2024 Budget

The President’s budget includes policy changes that it estimates would reduce budget deficits by $3.0 trillion over a decade. This deficit reduction is the net effect of over $2.8 trillion of new spending and tax breaks that is more than offset by nearly $5.0 trillion of revenue increases, about $575 billion of spending reductions and savings, and $330 billion of net interest savings. We will publish an in-depth analysis of the policy proposals in the coming days.

Economic Assumptions in the President’s Budget

A budget’s economic assumptions underlie every estimate it provides, and vice versa. Manageable debt levels and smart spending and tax policies can promote economic growth, while strong economic growth can improve the budget outlook. Overall, the economic assumptions in the President’s budget are somewhat more optimistic than consensus, particularly over the long run.

The budget forecasts 0.4 percent real GDP growth in 2023, 2.1 percent growth in 2024, and 2.2 percent annual growth by the end of the decade. By comparison, CBO estimates growth of 0.1 percent in 2023, 2.5 percent in 2024, and 1.7 percent by the end of the decade, and the Federal Reserve forecasts 0.5 percent, 1.6 percent, and 1.8 percent, respectively.

The budget projects inflation will normalize by 2024, with fourth-quarter-over-fourth-quarter Consumer Price Index (CPI) inflation dropping from 7.1 percent last year to 3.0 percent in 2023 and 2.3 percent per year thereafter. This is slightly more optimistic than CBO and the Federal Reserve, both of which expect inflation to normalize around 2025.

OMB expects the unemployment rate to rise from 3.4 percent today to 4.6 percent by the end of 2023 and settle at 3.8 percent by 2030. By comparison, the Federal Reserve expects unemployment to rise to 4.6 percent this year and then settle at 4.0 percent, and CBO expects unemployment to peak at 5.1 percent and then settle at 4.5 percent.

Finally, in terms of interest rates, OMB projects ten-year Treasury yields to fall from 3.9 percent in 2023 to 3.6 percent in 2024 and average 3.4 to 3.5 percent thereafter. By comparison, CBO projects yields will remain around 3.8 percent throughout the projection window.

Conclusion

Debt would continue to rise unsustainably under the President’s budget, reaching a new record of 110 percent of GDP by 2033. This debt level is likely to be even higher under CBO’s forthcoming re-estimate of the budget and would rise even further if various expiring tax cuts are continued without additional offsets. It is disappointing that the President continues to propose trillions of dollars in new spending and tax breaks without a plan to put our debt on a sustainable path.

At the same time, President Biden deserves praise for putting forward a comprehensive budget proposal that not only offsets new spending and tax breaks but would also reduce budget deficits by $3 trillion through 2033 and includes substantial near-term deficit reduction that could help the Federal Reserve tame inflation. These savings are only a third of what is needed to put the debt on a downward path as share of the economy, and it is disappointing the President did not go much further. But it is an achievable target that could be built upon with further deficit reduction in the near future.

As budget negotiations begin, policymakers should target at least $3 trillion of savings over a decade to match the net deficit reduction in the President’s budget. Given surging inflation and rising interest rates, a meaningful share of these savings should be in the first two years in order to help the Federal Reserve fight inflation and reduce the likelihood of a deep recession.

Tags

What's Next

-

Image

-

-

Image