Comparing CBO’s Economic Projections to Other Forecasts

Growth in the economy will slow over the coming year as unemployment rises and inflation eases modestly, according to the Congressional Budget Office’s (CBO) latest baseline. The economic forecast, which was locked in in early December 2022, is overall more pessimistic than the Federal Reserve’s (Fed) mid-December 2022 projections, the Office of Management and Budget’s (OMB) March 2023 projections, and CBO’s May 2022 projections.

However, January inflation and unemployment data as well as end-of-year growth projections suggest that the economy is still growing at a steady pace, employment remains high, and our inflation challenges are persisting. Despite the Fed raising the federal funds rate from near zero to a range of 4.50 and 4.75 percent in less than a year, economic growth has been strong. Real Gross Domestic Product (GDP) increased 2.1 percent in 2022 and consumer spending, wages, and personal income are up. Unemployment was 3.4 percent in January, the lowest rate in over 50 years. Inflation remains historically high but has shown signs of cooling in recent months, with the personal consumption expenditure price index (PCE) down from a year-over-year rate of 6.3 percent in September to 5.4 percent in January despite an uptick in monthly price increases.

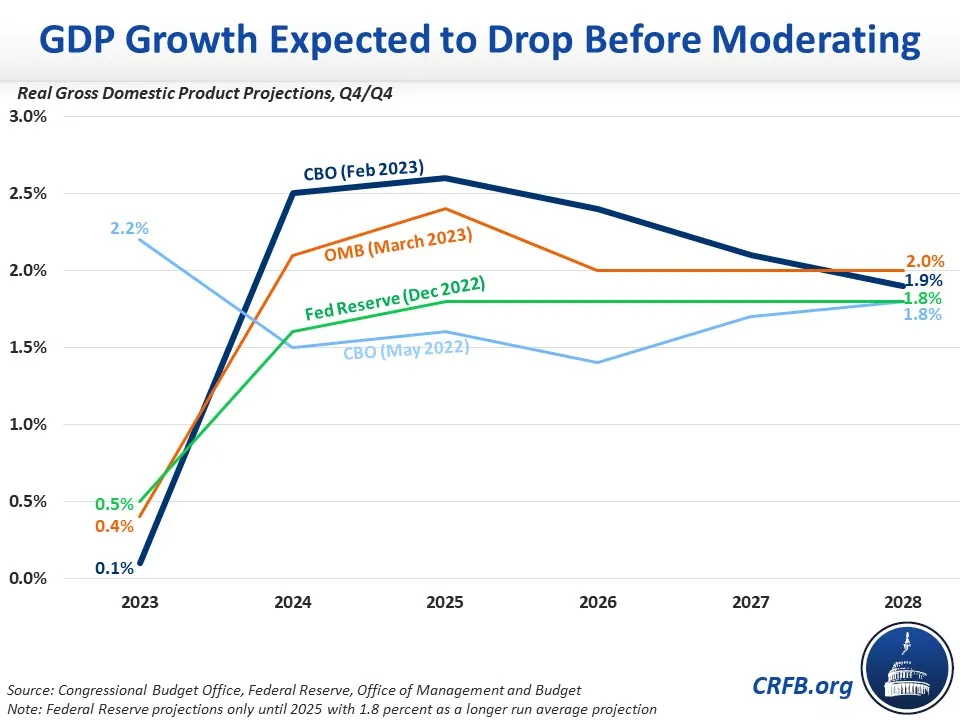

In the time since CBO made its projections in May 2022, the outlook for fourth-quarter-over-fourth-quarter real GDP growth has fallen from 2.2 percent in 2023 to 0.1 percent, while the Fed expects real GDP growth to be 0.5 percent in 2023 and OMB expects 0.4 percent. Between 2024 and 2026, CBO projects faster growth and then expects real GDP growth to stabilize around 1.8 percent thereafter, in line with its previous projections and the Fed’s longer-run projections.

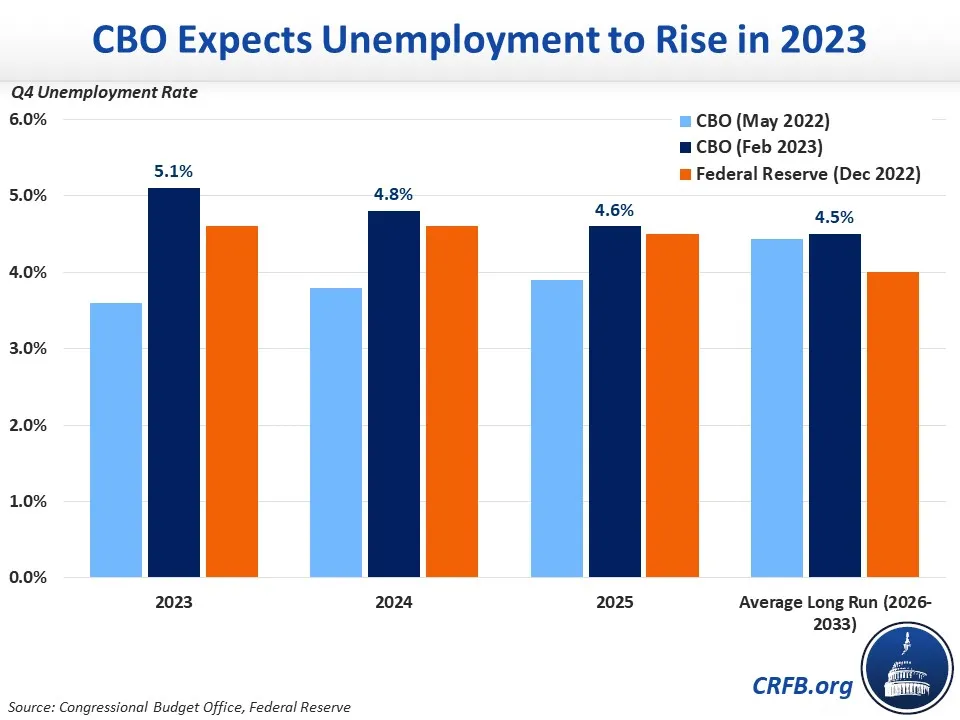

As the economy stagnates in 2023, CBO expects unemployment will rise to 5.1 percent, 1.5 percentage points above the actual 2022 fourth quarter unemployment rate and 1.5 percentage points above CBO’s previous projections. CBO expects unemployment to fall to 4.8 percent in 2024, 4.6 percent in 2025, and then remain at 4.5 percent through 2033. CBO previously projected a similar long-term outlook for the unemployment rate but had more optimistic expectations in the short term. The Federal Reserve expects unemployment to rise to 4.6 percent in 2023 before stabilizing at 4.0 percent through 2033. Similarly, OMB expects unemployment to peak at 4.6 percent in 2023, eventually falling to 3.8 percent by 2030.

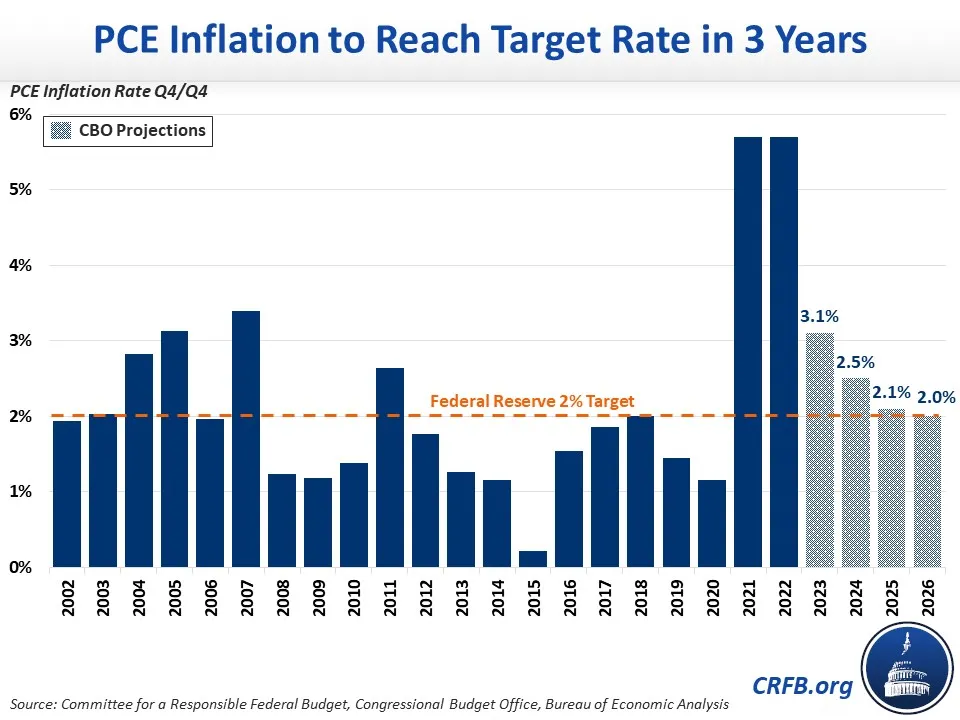

Surging inflation is expected to normalize over the next few years. The PCE inflation rate was 5.7 percent in 2022 on a fourth-quarter-over-fourth-quarter basis - the highest rate since 1981. CBO expects PCE inflation to fall to 3.3 percent by the fourth quarter of 2023 and continue to fall until hitting the Fed’s target of 2.0 percent by 2027. The Fed’s PCE rate for the fourth quarter of 2023 is 3.1 percent, and the Fed expects inflation to average 2.0 percent beginning in 2026.

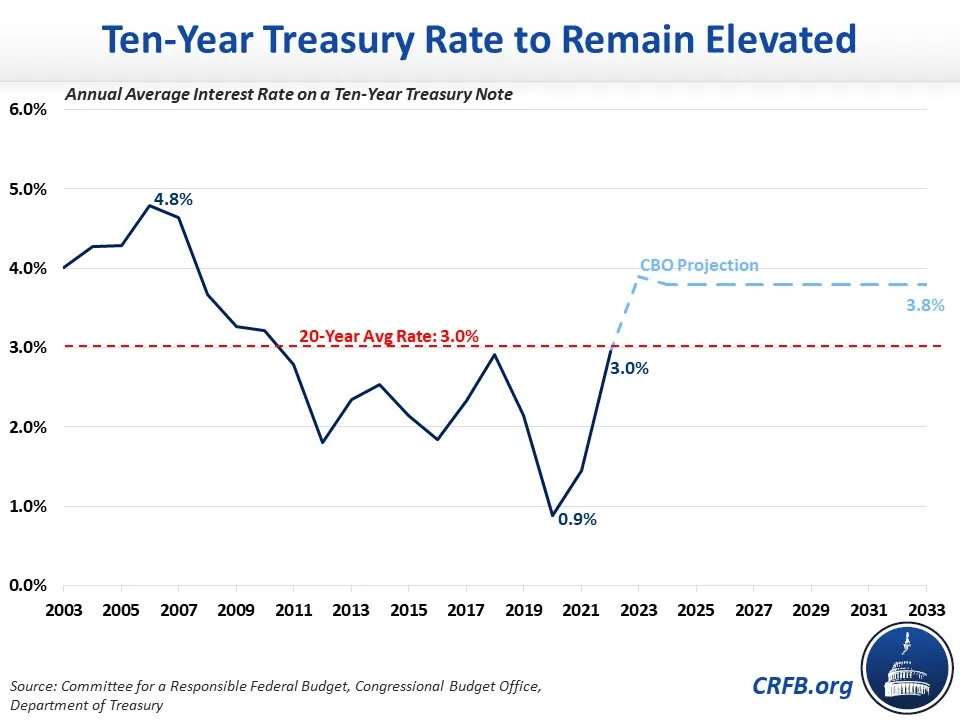

In response to high inflation, the Fed has raised interest rates over the last eight meetings with more rate hikes expected. As a result of higher inflation and interest rates, Treasury bond rates have spiked with the average interest rate on a ten-year Treasury note more than doubling from 1.5 percent at the end of 2021 to 3.8 percent by the end of 2022. CBO expects the interest rate on ten-year Treasuries to remain elevated at 3.8 percent through the decade, above the historic annual average of 3 percent. CBO projects three-month Treasury bills will peak at 4.7 percent in the second quarter of this year before falling gradually to 2.8 percent by the end of 2024 and 2.2 percent by 2026.

These projections, while slightly outdated, suggest that policymakers have a lot of work to do to bring inflation back in line with its target, return to stable and strong economic growth, and prevent interest costs from spiraling over the next decade. Fiscal policy actions can assist the Federal Reserve in these efforts to fight inflation and reduce the likelihood of a deep recession.