An Overview of the President's FY 2024 Budget

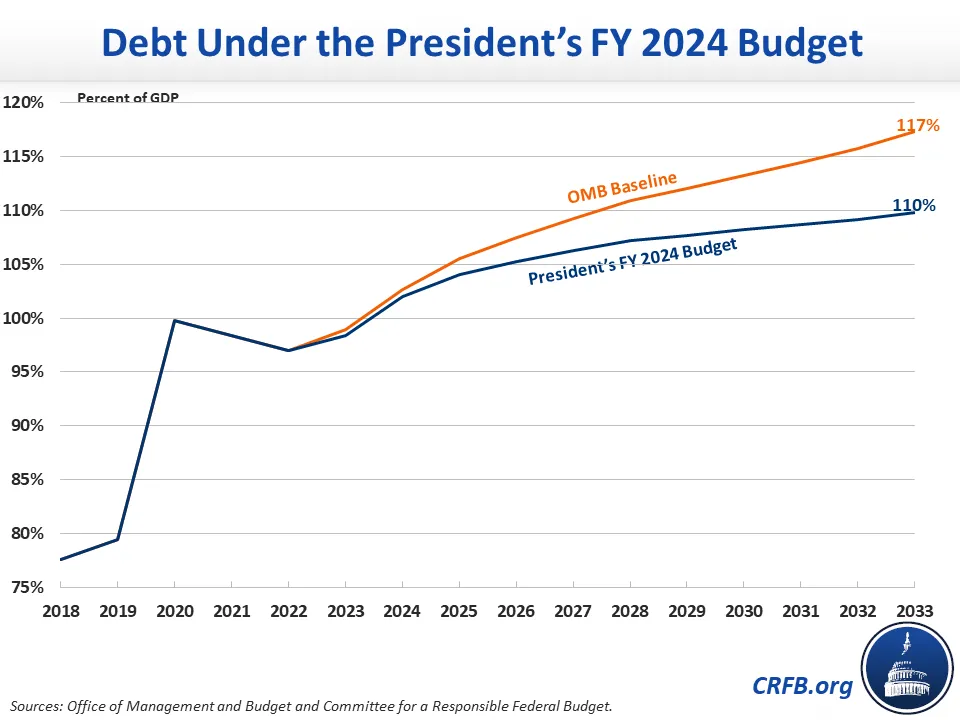

Moments ago, the Biden Administration released its Fiscal Year (FY) 2024 budget proposal, outlining some of the President's tax and spending priorities over the next decade. Under the President's budget, debt would rise at a slower rate than projected under current law but still reach a new record as a share of the economy by 2027. Specifically, federal debt held by the public would rise from 98 percent of Gross Domestic Product (GDP) at the end of FY 2023 to a record 110 percent by the end of 2033, compared to 117 percent of GDP under the Office of Management and Budget's (OMB) baseline.

Under the President's budget, annual budget deficits would remain below the historically high levels seen over the past few years as COVID relief continues to wind down, but still grow over both the short- and long term. The deficit would rise from $1.4 trillion (5.5 percent of GDP) in FY 2022 to $1.6 trillion (6.0 percent of GDP) in 2023 and to $1.8 trillion (6.8 percent of GDP) in 2024. The deficit would hit a low of $1.5 trillion (4.9 percent of GDP) in 2027 before rising to $2.0 trillion (5.1 percent of GDP) by 2033.

More specifically, spending under the budget would decline from 25.1 percent of GDP in FY 2022 to 24.2 of GDP in 2023, before rising to 25.2 percent of GDP by 2033. Revenue – which spiked at 19.6 percent of GDP in 2022 due to high inflation and large capital gains realizations – would fall to 18.2 percent of GDP in 2023 before rising to 20.1 percent of GDP by 2033.

Between 2024 and 2033, spending would total $82.2 trillion (24.8 percent of GDP), revenue would total $65.2 trillion (19.7 percent of GDP), and budget deficits would total $17.1 trillion (5.1 percent of GDP).

Key Figures in the President's FY 2024 Budget

| Trillions | Percent of GDP | |

|---|---|---|

| Revenue | $65.2 trillion | 19.7% |

| Mandatory Spending | $52.2 trillion | 15.8% |

| Discretionary Spending | $19.8 trillion | 6.0% |

| Net Interest | $10.2 trillion | 3.1% |

| Total Spending | $82.2 trillion | 24.8% |

| Deficits | $17.1 trillion | 5.2% |

| Debt (Final Year) | $43.6 trillion | 110% |

Source: Office of Management and Budget. Figures are over the FY 2024 to 2033 period.

While this level of borrowing is unprecedented outside of a war or deep recession, it is roughly $3 trillion lower than under OMB's baseline. In fact, the budget proposes to generate trillions of dollars of new revenue. Along with modest reductions in prescription drug and other spending, this would more than pay for new initiatives in the budget, resulting in $2.7 trillion of primary deficit reduction and roughly $3 trillion of deficit reduction inclusive of $330 billion in interest savings.

Proposals in the President's FY 2024 Budget, As Summarized in the Budget

| Policy | 2023-2033 |

|---|---|

| Deficits Projected in OMB's Baseline | $21,637 billion |

| Reduce costs of child care, early learning, housing, higher education, healthcare, and prescription drugs | $1,100 billion |

| Provide tax breaks to working people and families and increase funding for home care | $1,067 billion |

| Strengthen public health and improve health outcomes | $428 billion |

| Increase taxes on high-income households and corporations | -$1,190 billion |

| Increase Corporate Income Tax Rate from 21% to 28% | -$1,415 billion |

| Close Medicare tax loopholes and increase Medicare tax to restore Medicare solvency | -$678 billion |

| Other investments and reforms | -$1,996 billion |

| Subtotal, Proposals in the FY 2024 Budget | -$2,773 billion |

| Interest | -$330 billion |

| Total, Proposals in FY 2024 Budget | -$3,014 billion |

| Deficits Projected in FY 2024 Budget | $18,624 billion |

Sources: Office of Management and Budget and Committee for a Responsible Federal Budget.

The President's budget is built based off OMB's ten-year economic forecast, which is somewhat rosier than other forecasts. Under the budget, OMB projects 4.3 percent Consumer Price Index (CPI) inflation in calendar year (CY) 2023, 2.4 percent CPI inflation in 2024, and an average of 2.3 percent inflation per year thereafter. The Congressional Budget Office (CBO) projects CPI inflation of 4.8, 3.0, and 2.2 percent, respectively. The budget projects real GDP, on a fourth-quarter-over-fourth-quarter basis, to grow by 0.4 percent in 2023, 2.1 percent in 2024, and by 2.2 percent per year late in the window. CBO projects 0.1, 2.5, and 1.7 percent, respectively.

Additionally, OMB projects the unemployment rate will rise from 3.4 percent today to 4.3 percent in CY 2023, peak at 4.6 percent in 2024, and then fall steadily to 3.8 percent by 2033. CBO projects the unemployment rate to total 4.7 percent in 2023, peak at 4.9 percent in 2024, and then fall to 4.5 percent by 2027 and remain at that level through 2033.

Finally, OMB expects interest rates to peak in 2023, with the ten-year Treasury note yield reaching 3.9 percent in that year before falling to 3.5 percent late in the window. CBO projects 10-year yields will remain at about 3.8 percent throughout the decade.

***

The Committee for a Responsible Federal Budget will later today publish our full analysis of the President's budget. Our analyses of past President's budget requests can be found here.