Fiscal Policy in a Time of High Inflation

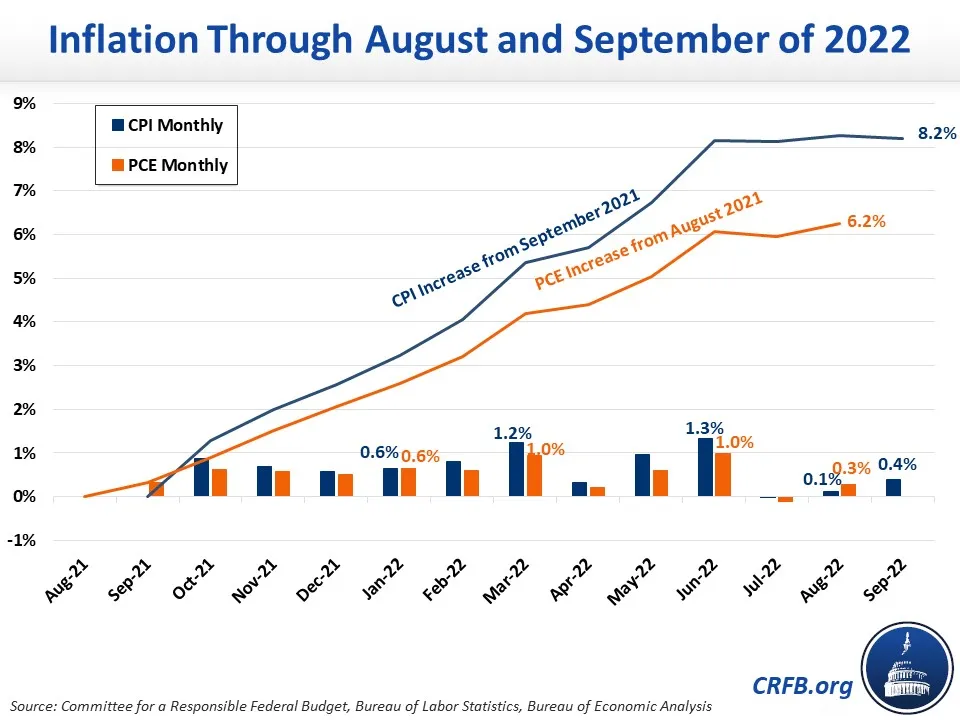

Inflation is currently surging at the fastest rate in more than four decades, with the Consumer Price Index (CPI) up 8.2 percent over the past year and Personal Consumption Expenditure (PCE) price index up 6.2.1 By comparison, the Federal Reserve (“the Fed”) generally targets 2 percent annual PCE inflation.

In general, the federal government has two types of tools available to fight inflation. Monetary policy, conducted by the Federal Reserve, can raise interest rates. Or fiscal policy, controlled by the Congress and President, can adjust taxes and spending.

Monetary policy is usually far better equipped to fight inflation – and manage overall macroeconomic stability – than fiscal policy. The Federal Reserve can react and adjust quickly, largely insulated from political pressures, to fight inflation with higher interest rates and other tools. Given the severity of the current inflation crisis, however, both fiscal and monetary policy may be needed.

Specifically, Congress and the President can use their tools to assist the Federal Reserve in its efforts to fight inflation. Using fiscal policy in this situation can:

- Ensure all federal actions are rowing in the same direction;

- Reduce recessionary pressures and support stronger economic growth;

- Diversify and limit the economic pain from inflation-reducing actions; and

- Reduce the budgetary cost of fighting inflation.

Policymakers have several tools available to assist the Federal Reserve in fighting inflation. Through deficit-reducing tax and spending changes, they can help temper demand, boost supply, and directly or indirectly lower prices in the economy.

Congress and the President should act soon to pass legislation that helps fight inflation on all of these fronts. Key to any legislation will be deficit reduction, which 55 of the nation’s top economists and budget experts recently explained is one tool in helping to ease inflationary pressures. At a minimum, Congress and the President should stop adding to the deficits, so that fiscal policy is not worsening inflation.

In addition to helping contain inflation, thoughtful deficit reduction can also help to grow the economy, reduce geopolitical risks, improve fairness and efficiency of the budget and tax code, and put the national debt on a more sustainable path.

The Federal Reserve Should Lead in Fighting Inflation

Inflation in the United States has been elevated for 22 months and shows few signs of abating. High inflation originated from a mismatch between total demand and supply in the economy – largely as a result of constraints from the COVID-19 pandemic and an aggressive fiscal and monetary policy response. Once inflation begins, it can become hard to control; however, wage-price spirals, indexed spending, and changing expectations can all lead to inflation persistence even as supply and demand converge. Policy action is needed to prevent this persistence.2

The Federal Reserve has already begun to act, raising interest rates by three percentage points since March of 2022, beginning to shrink its balance sheet, and signaling further tightening – with rates headed toward 4.6 percent by the end of 2023 – until inflation is brought under control.3

It is both appropriate and desirable that the Fed is taking the lead in fighting inflation. In their 2008 paper, “If, When, How: A Primer on Fiscal Stimulus,” Doug Elmendorf and Jason Furman explain why the Fed – rather than Congress – should manage macroeconomic stability:

Economists believe that monetary policy should play the lead role in stabilizing the economy because of the Federal Reserve’s ability to act quickly and effectively to adjust interest rates, using its technical expertise and political insulation to balance competing priorities.4

In this case, the Fed can expeditiously and gradually raise interest rates and shrink its balance sheet – based on real-time data – to encourage savings, discourage large purchases, and reduce wealth-driven consumption. The Fed’s actions are arguably more equitable than the fiscal policy alternatives because they largely reduce spending of those with more wealth. The Fed can also use its credibility to set or anchor future expectations, which can help to limit the risk of inflation persistence and keep prices from spiraling out of control.

Yet even as the Fed is better equipped to bring down inflation, doing so is not without its challenges. Higher interest rates put upward pressure on the unemployment rate and can also lead to financial instability – especially when rates are increased well above the long-term neutral rate (believed to be 2.5 to 3.0 percent).

Indeed, some recent research suggests the inverse relationship between inflation and unemployment described under the Phillips curve might be particularly strong now, suggesting a high “sacrifice ratio” whereby reductions in inflation require large increases in unemployment.5

Although the Federal Reserve hopes to navigate a “soft landing,” where inflation falls without much economic damage, Chairman Jerome Powell has acknowledged that there will likely be “some pain” and a “sustained period of below trend growth” in order to bring down inflation.6 Under the Fed’s median forecast, in fact, the unemployment rate will rise by 0.9 percentage points, and it could rise significantly higher. In acting alone to fight inflation, there is a substantial risk and perhaps likelihood the Fed’s actions will spur an economic recession.

Fiscal Policy Can Help the Fed Fight Inflation

Though the Federal Reserve is best suited to fight inflation and support macroeconomic stability, it may not always be desirable for the Fed to act alone. In times of high inflation with high risk of persistence, fiscal policy can play an important role in assisting the Fed and limiting the necessary amount of monetary tightening.

The Federal Reserve has only a limited set of tools to fight inflation, which work by boosting interest rates. While generally effective in reducing inflation, higher interest rates can also impose substantial pain on the housing and labor markets, reduce investments that promote long-term growth, and take a long time to affect the economy.

For these and other reasons, economists and policymakers have long supported supplementing monetary policy with fiscal stimulus to fight recessions.7 Elemendorf and Furman, for example, argue policymakers should sometimes use fiscal policy even though monetary policy is superior.8

By the same token, fiscal policy may also be an appropriate tool to assist the Federal Reserve in containing inflation in some circumstances, particularly when prices are rising and interest rates are already above their long-term neutral level. Below we discuss four reasons why fiscal interventions – tax and spending changes that reduce inflation – may be appropriate.

1) Fiscal policy can ensure all federal actions are rowing in the same direction.

Monetary policy fights inflation through two channels – by reducing demand and by re-anchoring future inflation expectations. Expansionary fiscal policy can undermine both effects, while contractionary fiscal policy can reinforce them.

Specifically, spending increases and tax cuts work to boost demand in the near term, while high levels of projected deficits and debt can boost inflation expectations. This is especially true if markets believe the government will attempt to inflate away a portion of its debt.

By enacting inflation-reducing fiscal adjustments, policymakers can ensure all parts of government are working to temper inflation and signal that both fiscal and monetary policy are taking the inflation threat seriously. Enacting deficit reduction during a period of high inflation can also help to reassure markets that elected officials are committed to responsible policy and won’t attempt to undermine Federal Reserve tightening in the future should inflation persist.

2) Fiscal policy can reduce recessionary pressures and support stronger economic growth.

While higher interest rates help to fight inflation, they also increase the risk of a recession by weakening labor markets and threatening financial stability. High interest rates also discourage personal and business investment, which in turn slows long-term income and economic growth.

Fiscal policy that lowers inflationary pressure allows the Fed to raise rates more slowly and by less. This in turn can reduce the risk that monetary policy will cause a recession, destabilize financial markets, or stunt long-term economic growth. While excessive fiscal consolidation can also increase recessionary risks, the effects are likely smaller than further monetary tightening at current margins – particularly as interest rates continue to rise above their long-term neutral level.

Unlike monetary policy, which shrinks both the demand and supply side of the economy, contractionary fiscal policy can boost the supply side and thus support faster long-term economic growth. Deficit reduction in particular lowers long-term interest rates and reduces the “crowd out” of growth-generating private investments.9

3) Fiscal policy can diversify and limit the economic pain from inflation-reducing actions.

Monetary policy’s effectiveness rests largely on reducing economic activity in a few areas of the economy. Increased interest rates lead to higher borrowing costs and tighter financial conditions; this in turn reduces spending on homes, cars, and expensive durable goods, lowers the value of housing and tradable assets, and reduces business expenditures (including on workers).10 Monetary policy has relatively little direct effect on the service sector of the economy.

Supplementing monetary policy with fiscal policy can help spread demand reduction to more areas of the economy, especially to services. For example, replacing an interest rate hike with a tax rate hike reduces the hit to the housing market by instead leading people to spend less on vacations and restaurants. Replacing an interest rate hike with a reduction in Medicare reimbursements could shift some of the burden to physician pay and hospital profits.

Some fiscal (and regulatory) policy changes can even avoid pain associated with inflation reduction by boosting the supply of goods, services, and labor in the economy. For example, budget-neutral improvements to work incentives would help ease tightness of the labor market, reducing inflationary pressures by bringing supply up toward demand rather than the reverse.

4) Fiscal policy reduces the budgetary cost of fighting inflation.

Federal interest spending is currently the fastest growing part of the budget. The Congressional Budget Office (CBO) recently projected interest costs will total $8.1 trillion over the next decade and reach a record 3.3 percent of Gross Domestic Product (GDP) by 2032. If interest rates average just one percentage point higher than CBO projects, deficits would increase by $2.4 trillion over the next decade and interest costs would rise to 4.4 percent of GDP by 2032.11 In other words, Federal Reserve actions to fight inflation can actually worsen the nation’s overall fiscal outlook.

Fiscal policy can mitigate the budgetary cost of fighting inflation in two ways. First, inflation-reducing fiscal policy reduces the magnitude of needed interest rate hikes, thus reducing the increase in net interest costs. Second, deficit reduction would shrink the overall stock of debt and thus reduce the budgetary cost of any remaining interest rate hike.

Policymakers Can Fight Inflation Through Several Channels

On top of the effects long-term fiscal improvements may have on reducing inflation expectations,12 policymakers have several channels through which they can help the Fed fight inflation. Through tax, spending, and regulatory reforms, Congress and the President can help to temper demand, boost supply, and directly lower prices in the economy:

-

Temper Demand. One key way to reduce inflationary pressures is by lowering demand for goods and services. In layman’s terms, this means discouraging excessive spending in the economy. Fiscal policy is well equipped to achieve this goal and can do so through higher taxes, lower transfer payments, or reductions in direct government spending. For example, limiting tax deductions would reduce take-home pay and thus household spending.

-

Boost Supply. Boosting the supply of labor, capital, and natural resources can also help to right inflation. In other words, policymakers should pursue policies that increase the number of workers and hours worked, support investment, reduce barriers to production and trade, and expand extraction or production of energy and other resources. These policies should also avoid increasing demand in the process. For example, removing work disincentives in the Social Security program can help to increase labor force participation and increase the economy’s productive capacity, thus helping to limit inflation.

-

Lower Prices. Federal policy can sometimes use its micro-economic tools to directly lower the costs of specific goods or services, particularly when the government is already setting the price. They can also reform existing tax, spending, and regulatory policies that currently drive up prices, such as over-subsidizing some activities or creating barriers to competition. These policy changes should focus on reducing overall prices, not just shifting costs onto the government. For example, selectively reducing Medicare provider payments would lower health care prices and thus inflation.

In pursuing inflation reduction, policymakers can focus mainly on policies that would strengthen the nation’s fiscal outlook and represent overall improvements to tax and spending policy while also restraining demand, boosting supply, or lowering prices. These policies should be phased in more quickly in a high-inflation environment compared to other circumstances but need not focus narrowly on achieving the highest “bang for buck” when it comes to fighting inflation.

Thoughtful fiscal policy changes can assist the Federal Reserve in fighting inflation, both by reducing near-term inflationary pressures and anchoring forward-looking expectations. This in turn may allow the Fed to implement fewer interest rate hikes and/or hike rates more slowly.

At the absolute minimum, policymakers should commit to not making the Federal Reserve’s job more difficult. They should avoid policies that would boost net demand, hold back supply, or raise prices, and they should avoid adding to near-term budget deficits. The more policymakers borrow, the higher the risk of persistent inflation or deep recession.

The Time for Deficit Reduction is Now

Inflation is the highest it has been in over forty years and has now been surging for the past 22 months. While inflation so far has largely been the result of excess demand and inadequate supply, there is a risk that it will become increasingly persistent as it is embedded into wage and price setting. Aggressive policy actions are likely needed to bring inflation back under control.

Over the past seven months, the Federal Reserve has taken the lead in fighting inflation, including by raising interest rates, slowly shrinking its balance sheet, and signaling that it will continue to tighten monetary policy until inflation is under control. This is appropriate, as the Federal Reserve is far better suited to fight inflation than Congress or the President.

However, given the extraordinary inflation we are experiencing and the high risk that Federal Reserve actions will lead to a recession, it would be wise for fiscal policy to assist monetary policy by enacting changes to temper demand, boost supply, and lower prices.

As President Biden has remarked and numerous experts have reinforced, “bringing down the deficit is one way to ease inflationary pressures.”

In addition to helping reduce inflationary pressures, deficit reduction can help to put the national debt on a sustainable path, support long-term economic growth, lower federal interest costs, reduce geopolitical risks, leave more resources to respond to future emergencies, and improve fairness to future generations.

Given the risks and threats from deficits and debt, substantial deficit reduction is needed even absent high inflation. Surging prices makes deficit reduction more necessary and urgent while dramatically reducing any macroeconomic risks associated with near-term deficit reduction.

Rather than continuing to enact policies that increase deficits and worsen inflationary pressures, Congress and the President should act swiftly to enact deficit-reducing legislation that would help the Federal Reserve fight inflation today, while putting the national debt on a more sustainable path for years to come.

1 Last year, CPI inflation totaled 6.7% and PCE inflation totaled 5.6%, both the highest in nearly four decades. Over the past 12 months, CPI inflation has grown by 8.2% and PCE inflation by 6.2%, while core CPI and PCE – excluding volatile food and energy costs, has grown by 6.6% and 4.9%, respectively. By the end of 2022, we expect CPI inflation of 6.6% to 7.0% and PCE inflation of 4.7% to 5.9%.

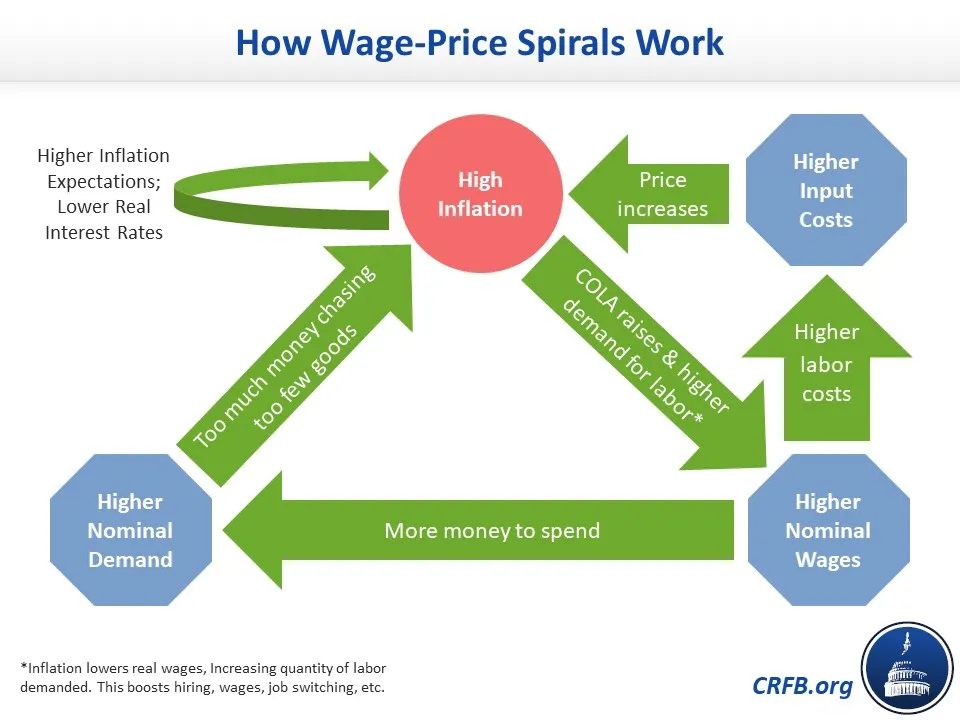

2 One mechanism for persistent inflation is through the expectations channel. For example - when consumers expect higher inflation, they may spend more sooner, push for higher wages, or be more likely to spend at higher prices; and when businesses expect higher inflation, they may be more likely to raise prices based on that expectation. Another mechanism for persistence is wage-price spirals, where higher prices lead to higher wages which lead to higher prices. With anchored inflation expectations, wage-price spirals should peter out over time.

The flow chart below illustrates how a wage-price spiral may work:

3 Board of Governors of the Federal Reserve System, “Summary of Economic Projections” September 21, 2022 https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20220921.pdf

4 Douglas Elmendorf and Jason Furman “If, When, How: A Primer on Fiscal Stimulus” The Brookings Institution, January 10, 2008 https://www.brookings.edu/research/if-when-how-a-primer-on-fiscal-stimulus/

5 See for example Laurence Ball and Daniel Leigh and Prachi Mishra “Understanding U.S. Inflation During the COVID Era” Brookings Papers, September 9, 2022, https://www.brookings.edu/wp-content/uploads/2022/09/Ball-et-al-Conference-Draft-BPEA-FA22.pdf and Alex Domash and Lawrence Summers “A Labor Market View on the Risks of a U.S. Hard Landing” National Bureau of Economic Research, April 2022 https://www.nber.org/system/files/working_papers/w29910/w29910.pdf

6 Remarks by Federal Reserve Chair Jerome Powell “Monetary Policy and Price Stability” at “Reassessing Constraints on the Economy and Policy” economic policy symposium sponsored by the Federal Reserve Bank of Kansas City, August 26, 2022 available at https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm and remarks by Federal Reserve Chair Jerome Powell at “September 20-21, 2022 FOMC Meeting” Federal Open Market Committee, September 21, 2022 available at https://www.federalreserve.gov/monetarypolicy/fomcpresconf20220921.htm

7 See for example Elmendorf and Furman (2008) as well as Alan Blinder and Mark Zandi “The Financial Crisis: Lessons for the Next One” Center on Budget and Policy Priorities, October 15, 2015 https://www.cbpp.org/research/economy/the-financial-crisis-lessons-for-the-next-one; Michael Greenstone and Adam Looney “The Role of Fiscal Stimulus in the Ongoing Recovery” The Hamilton Project, July 6, 2012 https://www.brookings.edu/blog/jobs/2012/07/06/the-role-of-fiscal-stimulus-in-the-ongoing-recovery/; Chad Stone and Kris Cox “Economic Policy in a Weakening Economy: Principles for Fiscal Stimulus” Center on Budget and Policy Priorities, January 17, 2008 https://www.cbpp.org/sites/default/files/archive/1-8-08bud.pdf; Martin Feldstein, “The Case for Fiscal Stimulus” Project Syndicate, January 2009 https://scholar.harvard.edu/feldstein/publications/case-fiscal-stimulus; Valerie Ramey and Sarah Zubairy, “Government Spending Multipliers in Good Times and in Bad: Evidence from U.S. Historical Data” National Bureau of Economic Research, November 2014 https://econweb.ucsd.edu/~vramey/research/RZUS.pdf; Charles Freedman, Michael Kumhof, Douglas Laxton, and Jaewoo Lee, “The Case for Global Fiscal Stimulus” International Monetary Fund, March 6, 2009 https://www.imf.org/external/pubs/ft/spn/2009/spn0903.pdf; Heather Boushey, Ryan Nunn, and Jay Shambaugh, “Recession ready: Fiscal policies to stabilize the American economy” Brookings Institution, May 16, 2019 https://www.brookings.edu/multi-chapter-report/recession-ready-fiscal-policies-to-stabilize-the-american-economy/; Committee for a Responsible Federal Budget, “Comparing Fiscal Multipliers” October 6, 2020, https://www.crfb.org/papers/comparing-fiscal-multipliers

8 Elmendorf and Furman argue that monetary policy is superior to fiscal policy to fight recessions because the Fed can adjust more quickly, because they can better judge the timing and magnitude of needed adjustments, and because they are less likely to do long-term economic harm. However, they argue for fiscal stimulus to reduce uncertainty about the total thrust provided to the economy, to better support the economy when the Federal Funds rate is close to 0 percent, when monetary policy is proving inefficient to spur spending, or if policymakers want to fight a recession with higher overall interest rates. They also point out that fiscal policy has a shorter “outside lag,” meaning it can impact the economy more quickly after the money is spent.

9 The Congressional Budget Office has estimated that each 1 percentage point increase in the debt-to-GDP ratio leads to a 2 to 3 basis point increase in interest rates, and that every $1 increase in deficits reduces private investment by 33 cents. Other analyses have found similar or in some cases larger effects. See for example Edward Gamber and John Seliski, “The Effect of Government Debt on Interest Rates: Working Paper 2019-01,” Congressional Budget Office, March 14, 2019 https://www.cbo.gov/publication/55018; Ernie Tedeschi, “Deficits Are Raising Interest Rates. But Other Factors are Lowering Them.”, Medium, February 19, 2019, https://medium.com/bonothesauro/deficits-are-raising-interest-rates-but-other-factors-are-lowering-them-6d1e68776b7a; Lukasz Rachel and Lawrence H. Summers, “Public boost and private drag: government policy and the equilibrium real interest rate in advanced economies,” Brookings Papers on Economic Activity, Spring, 1-76, https://www.brookings.edu/bpea-articles/on-falling-neutral-real-rates-fiscal-policy-and-the-risk-of-secular-stagnation/; Mark Warshawsky and John Mantus, “An Expanded and Updated Analysis of the Federal Debt’s Effect on Interest Rates” American Enterprise Institute, September 22, 2022 https://www.aei.org/research-products/report/an-expanded-and-updated-analysis-of-the-federal-debts-effect-on-interest-rates/; and Congressional Budget Office, “The Impact of Various Levels of Federal Debt on GNP and GNP per Capita,” August 12, 2019, https://www.cbo.gov/publication/55543. For a short literature review of further crowding out studies, see Jonathan Huntley, “The Long-Run Effects of Federal Budget Deficits on National Saving and Private Domestic Investment: Working Paper 2014-02,” Congressional Budget Office, February 28, 2014, https://www.cbo.gov/publication/45140

10 For a discussion of some mechanisms through which monetary policy works, see Skanda Amarnath and Alex Williams “What Are You Expecting? How The Fed Slows Down Inflation Through The Labor Market” Employ America, February 9, 2022 https://www.employamerica.org/researchreports/how-the-fed-affects-inflation/

11 Congressional Budget Office, “The Budget and Economic Outlook: 2022 to 2032,” May 25, 2022, https://www.cbo.gov/publication/57950; Committee for a Responsible Federal Budget, “What Would Higher Interest Rates Mean for the Debt?” June 14, 2022, https://www.crfb.org/blogs/what-would-higher-interest-rates-mean-debt; Congressional Budget Office, “Workbook for How Changes in Economic Conditions Might Affect the Federal Budget: 2022 to 2032” June 8, 2022 https://www.cbo.gov/publication/57980

12 Under one theory, the Fiscal Theory of the Price level, inflation occurs when the overall amount of government debt is more than the public believes the government can repay. Expectations that government will ultimately inflate away some of the debt lead to higher near-term prices. See John Cochrane “The Fiscal Theory of the Price Level” Princeton University Press, 2021 https://static1.squarespace.com/static/5e6033a4ea02d801f37e15bb/t/62fefb576b3d6451069e88ae/

1660877665863/fiscal_theory.pdf