2022 Inflation Hit a 41 Year Record

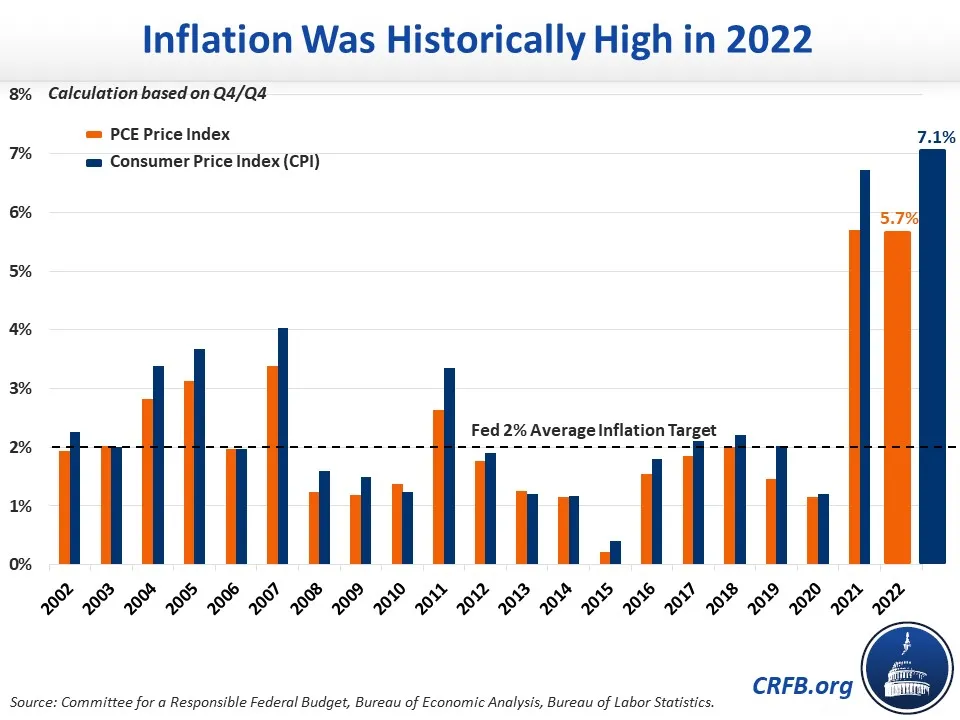

Inflation surged at the fastest pace since 1981 last year, based on the final Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) figures released by the Bureau of Labor Statistics and the Bureau of Economic Affairs. Specifically, CPI inflation totaled 7.1 percent in 2022 and PCE inflation totaled 5.7 percent on a fourth-quarter-to-fourth-quarter basis.

With the exception of 2021 - which had similarly high inflation - inflation has not come close to these levels in over 40 years. The Federal Reserve’s target is 2 percent for PCE inflation, which is the equivalent of roughly 2.2 to 2.4 percent for CPI inflation.

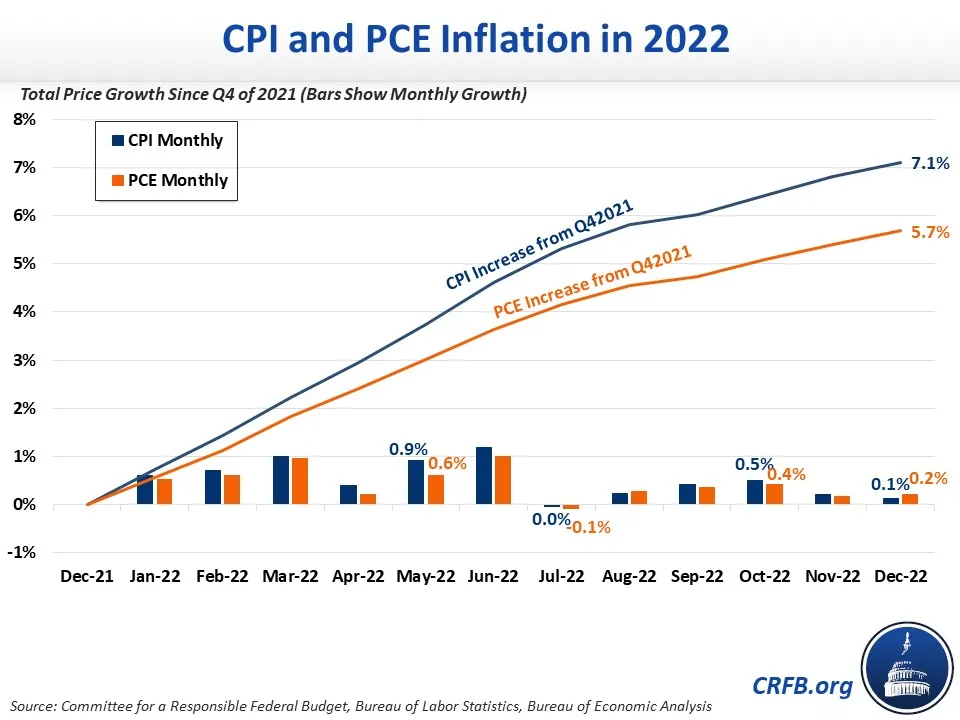

These latest estimates of inflation are higher than the preliminary estimates, particularly for PCE inflation which was previously estimated to be 5.5 percent. That is mainly because they consider recent seasonal adjustments, a standard practice used by the government to strip out the effects of recurring seasonal influences that can change the price of goods and services. The new seasonally adjusted price indices were slightly higher over the long term and showed that prices over the last few months ticked up more than previously reported.

Even incorporating these adjustments, inflation spiked in the first half of 2022 with lower month-to-month increases in the second half. On a year-over-year basis, the peak in June reached 8.9 percent for the CPI and 7.0 percent for the PCE, both the highest since 1981. But even if inflation is falling, it remains elevated. January’s 0.5 percent monthly CPI inflation and 0.6 percent monthly PCE inflation suggest it could remain well above target in 2023.

The Federal Reserve has raised interest rates from a target range of 0.0 percent to 0.25 percent before March to between 4.50 percent and 4.75 today and is expected to continue raising until there are clear signs that inflation is coming down. The Federal Reserve has expressed concern over inflation of core services, which have exceeded or been nearly even with headline inflation over the last few months.

Inflation will continue to be a top economic issue of 2023. Congress and the President should act to help the Federal Reserve fight inflation by enacting deficit reducing fiscal policies that temper demand, boost supply, or directly lower prices. They should avoid any actions that will add to deficits, inflation, and our unsustainable debt.