CBO's First Score of House Reconciliation Bill

The Congressional Budget Office (CBO) released its first comprehensive estimate of the House’s Fiscal Year (FY) 2025 reconciliation bill – the One Big Beautiful Bill Act – finding that before accounting for interactions, the bill would add $2.3 trillion to deficits over the next decade. Incorporating our estimates of interactions and the adjustments announced by House leadership Monday, we estimate the bill would add $3.1 trillion to the debt as written.

Deficit Impact of the House Reconciliation Package

| Committee | FY 2025-2034 Deficit Increase (-)/Decrease |

|---|---|

| Agriculture | $238 billion |

| Armed Services | -$144 billion |

| Education & Workforce | $349 billion |

| Energy & Commerce | $988 billion |

| Financial Services | $5 billion |

| Homeland Security | -$67 billion |

| Judiciary | -$7 billion |

| Natural Resources | $20 billion |

| Oversight & Government Reform | $51 billion |

| Transportation & Infrastructure | $37 billion |

| Ways & Means | -$3,775 billion |

| Subtotal, Reported by CBO | -$2,305 billion |

| Interactions* | -$150 billion |

| Post-Score Adjustments* | -$50 billion |

| Subtotal, Primary Impact | -$2,505 billion |

| Interest | -$550 billion |

| Total | -$3,055 billion |

Source: Congressional Budget Office and CRFB estimates. *Interactions and post-score adjustments reflect CRFB estimates of likely interactions between titles and the Rules Committee print released on May 19, 2025; both may be larger or smaller when fully estimated by CBO.

Importantly, CBO has not yet fully evaluated the interactions among the titles within the bill. It preliminarily estimates $120 billion of reduced savings due to interactions; however, there are likely significant interactions that have not yet been estimated between the Agriculture and Energy & Commerce titles and the health measures in the Ways & Means and Energy & Commerce titles. Given those likely interactions, we preliminarily estimate a $150 billion interaction that would reduce estimated savings.

Additionally, House leadership announced changes to the bill early Monday morning; most significantly, it would eliminate a provision in the Oversight title that would have required higher federal employee retirement contributions, reducing the bill’s savings by at least $30 billion. We roughly estimate that the total changes announced by leadership would reduce the savings in the bill by $50 billion. Our adjustments do not include any potential changes that would increase the cap on the state and local tax (SALT) deduction or reportedly pull forward the phase-in of Medicaid work requirements or the phase-out of Inflation Reduction Act (IRA) credits; it is likely that these changes, on net, would increase the bill's debt effect.

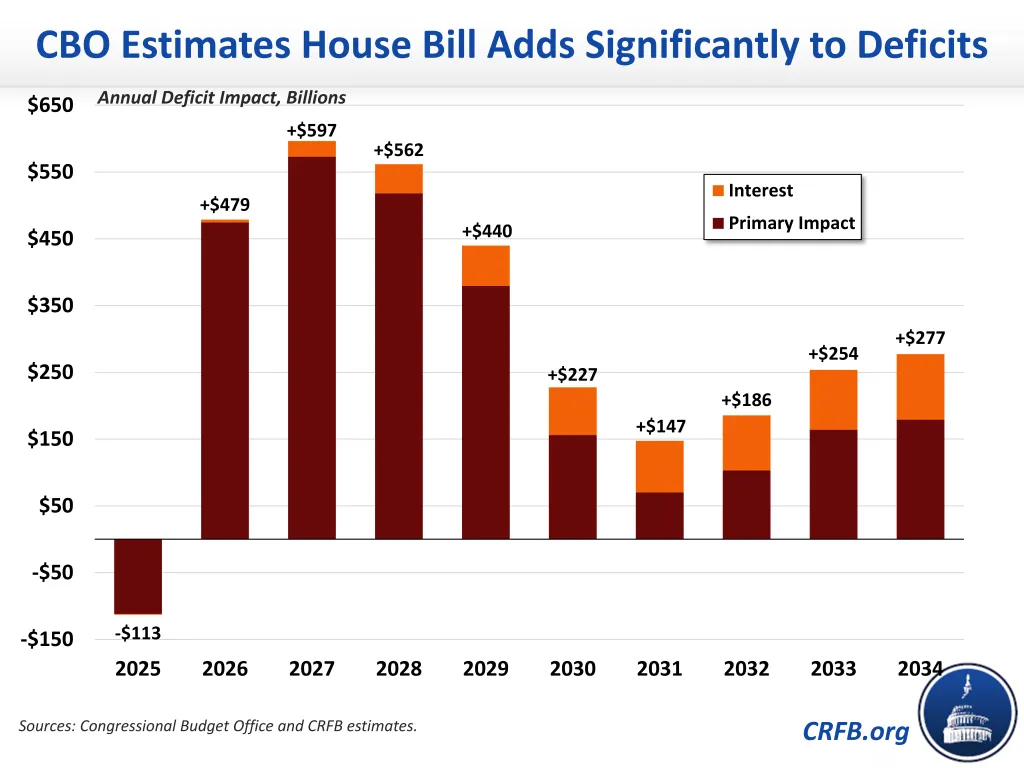

CBO’s score shows that the House reconciliation bill as written would add significantly to deficits over the next decade, peaking around 2027 when the bill’s temporary spending and tax cuts are fully in effect.

Adding more than $3 trillion to the debt when our nation’s finances are already on an unsustainable path would be unwise. Lawmakers should go back to the drawing board and work on a bill that reduces deficits, not adds to them.