CBO: Social Security is Ten Years from Insolvency

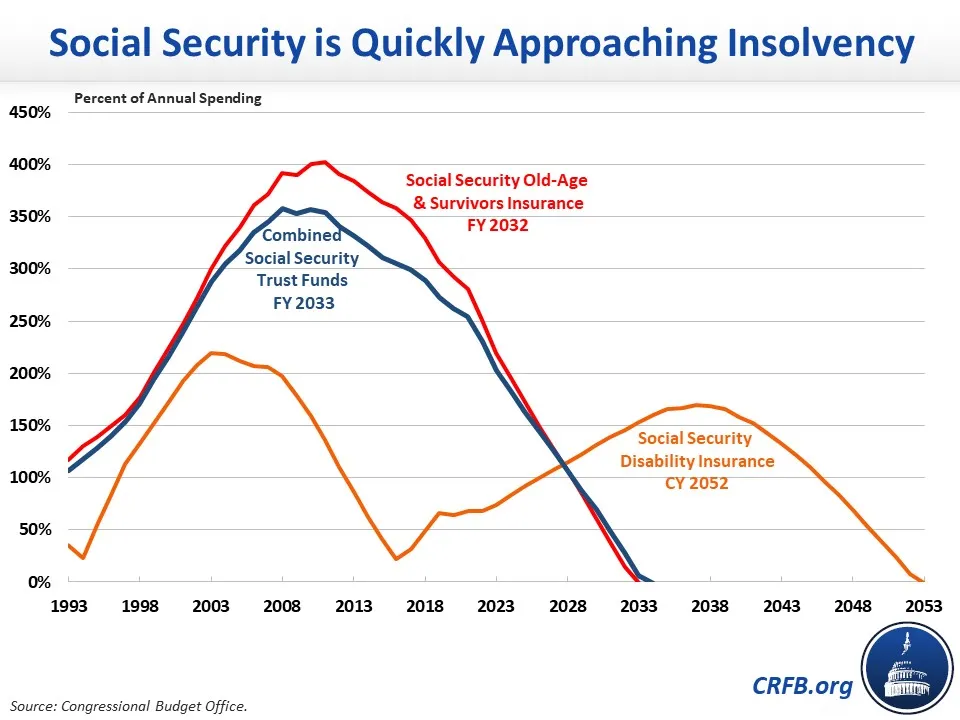

The Congressional Budget Office (CBO) recently published detailed long-term projections for Social Security that project the financial outlook for the program over the next 75 years. Under CBO's projections, the Social Security Old-Age and Survivors Insurance (OASI) trust fund will exhaust its reserves by Fiscal Year (FY) 2032 and the Social Security Disability Insurance (SSDI) trust fund will become insolvent by calendar year 2052 (the Social Security Trustees project OASI insolvency by 2033 and the SSDI trust fund to remain solvent over the next 75 years). On a theoretically combined basis, assuming revenue is reallocated in the years between OASI and SSDI insolvency, the Social Security trust funds will be insolvent by FY 2033, when today's 57-year-olds reach the normal retirement age and today's youngest retirees turn 72. Upon insolvency, all beneficiaries regardless of age, income, or need will see their benefits cut by 25 percent across-the-board.

The analysis below updates our previous analysis of CBO's last set of long-term Social Security projections, which were released in December 2022.

CBO projects that Social Security will run chronic deficits over both the short- and long-term. It will run a cash flow deficit of $154 billion in 2023, which is 1.6 percent of taxable payroll or 0.6 percent of Gross Domestic Product (GDP). Over the subsequent decade, Social Security will run $3.5 trillion (2.9 percent of taxable payroll or 1.0 percent of GDP) of cumulative cash flow deficits.

Over the long term, CBO projects Social Security's cash shortfall (assuming full benefits are paid) will grow to 3.9 percent of taxable payroll (1.4 percent of GDP) by 2033, to 5.1 percent of payroll (1.7 percent of GDP) by 2050, to 6.8 percent of payroll (2.3 percent of GDP) by 2075, and to 7.4 percent of payroll (2.4 percent of GDP) by 2097.

Key Numbers in CBO's Long-Term Social Security Projections

| Trust Fund | Insolvency Year | Deficit in Insolvency Year | Percent Cut at Insolvency |

|---|---|---|---|

| Social Security Old-Age and Survivors Insurance Trust Fund | FY 2032 | $515 billion (1.3% of GDP) | 26% |

| Social Security Disability Insurance Trust Fund | CY 2052 |

$103 billion (0.1% of GDP) |

16% |

| Theoretically Combined Social Security Trust Funds | FY 2033 | $553 billion (1.4% of GDP) | 25% |

Sources: Congressional Budget Office and Committee for a Responsible Federal Budget.

Over 75 years, CBO estimates that Social Security faces an actuarial shortfall of 5.1 percent of taxable payroll, or 1.7 percent of GDP. This means a plan to restore sustainable solvency over the next 75 years would require the equivalent of increasing the 12.4 percent payroll tax rate by 41 percent (5.1 percentage points) or cutting benefits by 27 percent for all beneficiaries.

CBO projects earlier insolvency dates and a larger 75-year actuarial shortfall than the Social Security Trustees estimated in their 2023 report. While CBO projects OASI insolvency in 2032 and SSDI depletion in 2052, the Trustees expect the OASI trust fund to run out by 2033 and the SSDI trust fund to remain solvent over the next 75 years. And while CBO expects the theoretically combined trust funds to deplete their reserves by 2033, the Trustees expect them to run out a year later, in 2034.

In addition, CBO's 75-year imbalance of 5.1 percent of taxable payroll is nearly 1.5 times larger than the Trustees' 3.6 percent of payroll estimate. The difference between CBO's and the Trustees' estimates is driven by differences in underlying assumptions, including assumptions about interest rates, economic growth, disability incidence, and population growth.

While both CBO and the Trustees project Social Security revenue to remain between 13 and 14 percent of taxable payroll over the next 75 years, CBO's projections of Social Security spending are much higher. For example, CBO expects spending to total 14.7 percent of taxable payroll this year while the Trustees expect spending to total 14.5 percent, with the disconnect between CBO's and the Trustees' spending projections growing over time. In 2033, CBO expects spending to total 17.1 percent of taxable payroll (6.1 percent of GDP) while the Trustees expect it to total 16.3 percent (5.9 percent of GDP). 50 years from now, in 2073, CBO expects spending to total 20.3 percent of taxable payroll (6.7 percent of GDP), compared to the Trustees' projection of 18.4 percent (6.3 percent of GDP). 75 years from now, in 2097, CBO projects that Social Security spending will total 21.2 percent of taxable payroll (7.0 percent of GDP) while the Trustees estimate 17.8 percent (6.0 percent of GDP).

Key Differences Between CBO and the Trustees

| Metric | CBO | Trustees |

|---|---|---|

| Insolvency Date (Combined Trust Funds) | 2033 | 2034 |

| Across-the-Board Benefit Cut at Insolvency | 25% | 20% |

| 75-Year Actuarial Shortfall (% of Taxable Payroll) | 5.1% | 3.6% |

| 75-Year Actuarial Shortfall (% of GDP) | 1.7% | 1.3% |

| 75th-Year Deficit (% of Taxable Payroll) | 7.4% | 4.4% |

| 75th-Year Deficit (% of GDP) | 2.4% | 1.6% |

| Payroll Tax Increase Needed for 75-Year Solvency | 41% | 28% |

| Benefit Cut Needed for 75-Year Solvency | 27% | 21% |

| 2024-2033 Cash Deficits | $3.5 trillion | $3.1 trillion |

| 75th-Year Spending (% of Taxable Payroll) | 21.2% | 17.8% |

| 75th-Year Spending (% of GDP) | 7.0% | 8.0% |

| 75th-Year Revenue (% of Taxable Payroll) | 13.9% | 13.4% |

| 75th-Year Revenue (% of GDP) | 4.6% | 6.4% |

Sources: Congressional Budget Office, Social Security Administration, and Committee for a Responsible Federal Budget.

As Social Security's trust funds rapidly approach insolvency, the necessary adjustments to restore solvency will become harder and the burden on beneficiaries more pronounced the longer policymakers wait to act. Enacting trust fund solutions sooner rather than later would help prevent abrupt, across-the-board benefit cuts, allow for targeted adjustments to those who can most afford them, spread the burden of tax and benefit changes across generations, and give today's workers more time to plan for retirement. Restoring solvency would also be pro-growth and would substantially improve the nation's long-term fiscal outlook.

Use our Social Security Reformer interactive tool to design your own comprehensive reform package and our How Old Will You Be? interactive tool to see your age, and what you stand to lose, when Social Security's trust funds become insolvent.