CBO: Only a Decade Until Social Security Insolvency

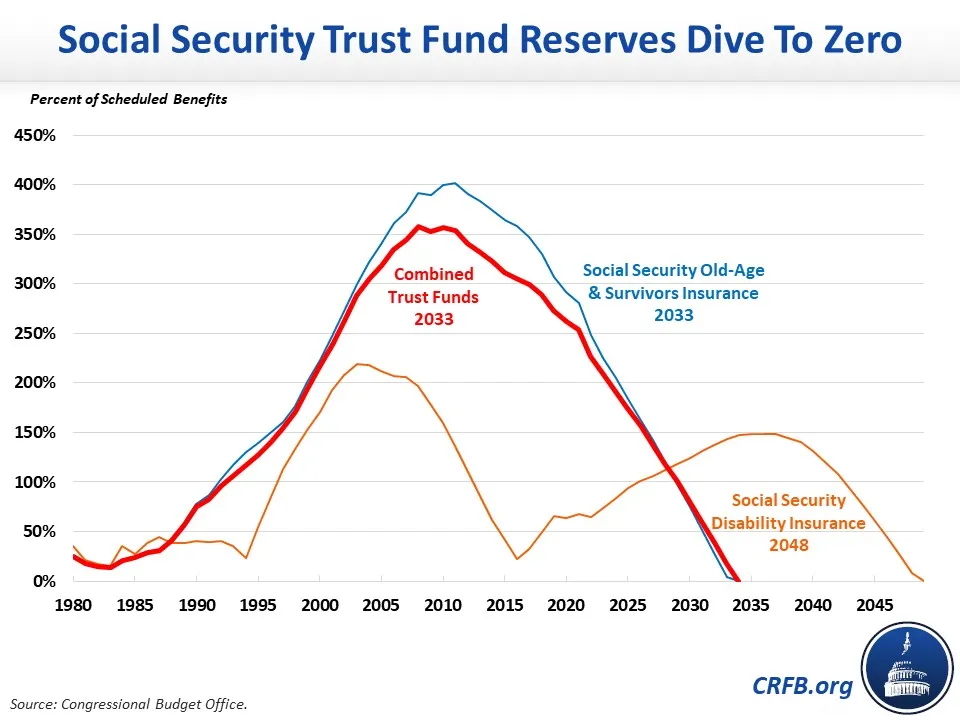

The Congressional Budget Office (CBO) recently released detailed Social Security projections finding that the trust funds are headed for insolvency by 2033 on a theoretically combined basis. Without legislative action, CBO estimates that benefits would be automatically cut by 23 percent across the board upon insolvency.

Over 75 years, CBO projects Social Security will face a shortfall equal to 4.9 percent of taxable payroll, or 1.7 percent of Gross Domestic Product (GDP). This means restoring solvency would require the equivalent of reducing projected benefits immediately and permanently by 26 percent or increasing dedicated taxes by 40 percent. By 2096, the cash shortfall will rise to 7.4 percent of taxable payroll (2.5 percent of GDP), meaning adjustments would need to grow to 35 percent of scheduled benefits or 53 percent of revenue.

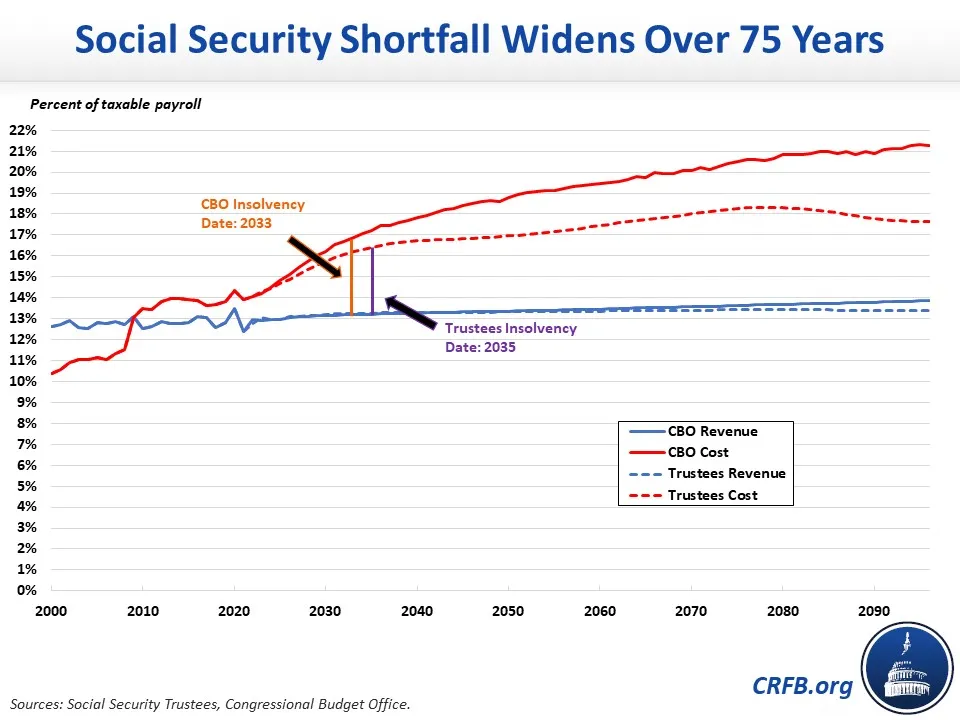

CBO projects an earlier insolvency date and a larger shortfall than the Social Security Trustees. While CBO projects insolvency in 2033 for the combined Old-Age and Survivors Insurance (OASI) and Social Security Disability Insurance (SSDI) trust funds, the Trustees project depletion by 2035. CBO projects the OASI and SSDI trust funds to be depleted by 2033 and 2048, respectively, while the Trustees’ report shows a depletion date of 2034 for OASI and a date beyond the 75-year horizon for SSDI.

Importantly, neither CBO nor the Trustees predicted the near-record 8.7 percent cost-of-living adjustment (COLA) this year, although CBO’s 6.0 percent estimate was closer than the Trustees’ 3.8 percent forecast.

For the 75-year period, CBO’s projected 4.9 percent of taxable payroll (1.7 percent of GDP) shortfall is substantially higher than the Trustees’ projection of 3.4 percent of taxable payroll (1.2 percent of GDP). This difference is more pronounced by 2096 when CBO’s projected shortfall for the year becomes 7.4 percent of taxable payroll (2.5 percent of GDP), while the Trustees’ shortfall increases to 4.3 percent of taxable payroll (1.4 percent of GDP).

Although both CBO and the Trustees project dedicated revenue to remain between 13 and 14 percent of taxable payroll (rising some due to taxation of benefits), CBO’s cost projections are higher. The Trustees projected Social Security spending will grow from 10.4 percent of taxable payroll (4.1 percent of GDP) in 2000 and 14.1 percent of taxable payroll (5.0 percent of GDP) in 2022 to 16.7 percent of taxable payroll (6.0 percent of GDP) by 2040 and to 17.6 percent of taxable payroll (5.9 percent of GDP) by 2096. By comparison, CBO estimated costs will rise to 17.8 percent of taxable payroll (6.2 percent of GDP) in 2040 to 21.3 percent of taxable payroll (7.0 percent of GDP) by 2096.

Key Differences Between CBO and the Trustees

| CBO | Trustees | |

|---|---|---|

| Insolvency Date (combined) | 2033 | 2035 |

| Automatic Benefit Cut at Insolvency | 23% | 20% |

| 75-Year Actuarial Deficit | 1.7% of GDP (4.9% of taxable payroll) |

1.2% of GDP (3.4% of taxable payroll) |

| Deficit in 2096 | 2.5% of GDP (7.4% of taxable payroll) |

1.4% of GDP (4.3% of taxable payroll) |

| Tax Increase Needed for 75-Year Solvency | 40% | 26% |

| Benefit Cut Needed for 75-Year Solvency | 26% | 20% |

| 2023 to 2032 Cash Deficit | -$2.8 trillion | -$2.5 trillion |

| Revenue in 2096 | 4.6% of GDP (13.9% of taxable payroll) |

4.5% of GDP (13.4% of taxable payroll) |

| Cost in 2096 | 7.0% of GDP (21.3% of taxable payroll) |

5.9% of GDP (17.6% of taxable payroll) |

The difference between CBO’s projections and those of the Trustees are likely driven by differences in demographic and economic assumptions. For example, the Trustees project that nominal GDP will be over 40 percent larger in 2096 than CBO predicts.

As the program’s trust funds rapidly deplete, the needed adjustments will become increasingly severe the longer policymakers wait. While putting Social Security on a sustainable path will require tough tradeoffs, there are a variety of options available to policymakers. Lawmakers could also consider a commission or rescue committee to support good-faith negotiations.

Thoughtful reforms can actually improve retirement security, strengthen economic growth, improve U.S. fiscal sustainability, and improve fairness and progressivity.

Enacting trust fund solutions would help prevent abrupt benefit cuts, allow for targeted adjustments to those who can most afford them, share the burden of tax and benefit changes across generations, and give workers more time to plan and adjust for retirement.

How would you fix the Social Security shortfall? Use our tool and see how your choices stack up.