CBO Releases its Estimate of the President's FY 2023 Budget

Yesterday, the Congressional Budget Office (CBO) released its estimate of the President's Fiscal Year (FY) 2023 budget. CBO finds that debt and deficits under the President's budget would be lower than what the Office of Management and Budget (OMB) projects, due almost entirely to the differences in CBO's and OMB's baselines, particularly for mandatory programs. Importantly, CBO's estimates do not account for the economic and fiscal impacts of the Inflation Reduction Act, as well as other legislation and executive actions enacted since the Biden Administration released its FY 2023 budget proposal in March.

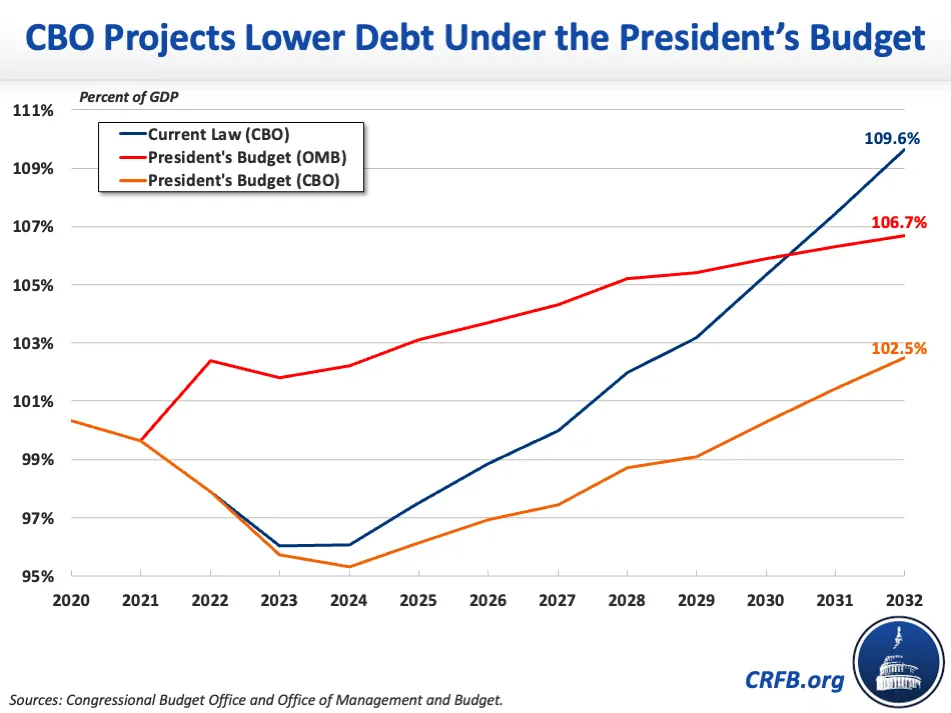

CBO estimates that, under the President's budget, debt would fall from 98 percent of Gross Domestic Product (GDP) at the end of FY 2022 to a low of 95 percent in 2024 before growing steadily to 103 percent by 2032. For comparison, OMB estimated debt would remain around 102 percent of GDP in 2022, 2023, and 2024 before rising to a new record of 107 percent by 2032. Though CBO's estimates of debt-to-GDP are lower than OMB's, both CBO and OMB find that the President's budget would slow the growth of debt relative to CBO's baseline, which has debt reaching 110 percent of GDP by 2032.

CBO projects that budget deficits would total $13.1 trillion over the next decade under the President's budget, which is $1.3 trillion lower than OMB's estimate of $14.4 trillion and $2.6 trillion less than the $15.7 trillion projected in CBO's baseline. Specifically, CBO estimates the deficit would fall from $1.0 trillion in FY 2022 to $908 billion in 2023 and $921 billion in 2024. Starting in 2025, the deficit would again rise above $1.0 trillion annually, ultimately reaching $1.8 trillion by 2032. As a share of GDP, deficits would average 4.2 percent of GDP over the coming decade. CBO predicts deficits would fall from 4.2 percent of GDP in 2022 to a low of 3.4 percent in 2024, then rise above 4.0 percent starting in 2025 until reaching 4.8 percent in 2032.

By comparison, OMB projected the deficit would fall under the President's budget, from $1.4 trillion in FY 2022 to a low of $1.2 trillion in 2023 and 2024 before rising steadily to $1.8 trillion by 2032. As a share of GDP, OMB projected the deficit would fall from 5.8 percent of GDP in 2022 to 4.8 percent of GDP in 2032. CBO's and OMB's estimates are similar in that they both project a $1.8 trillion budget deficit in 2032.

The $1.3 trillion gap between CBO's and OMB's estimates of deficits under the President's budget is largely driven by the differences between CBO's and OMB's projections of spending relative to CBO's baseline.

CBO estimates that mandatory spending under the President's budget would be $1.3 trillion less over the next decade than OMB projects. This is largely because CBO's estimates of spending for Medicare, Medicaid, and veterans' compensation are lower than OMB's. CBO also expects discretionary spending to be $347 billion lower over the coming decade than does OMB due to a slower expected spend out of discretionary budget authority over the next decade. Meanwhile, CBO projects net interest costs to be $251 billion higher than does OMB, in large part due to its higher projections of interest rates and inflation in its economic forecast compared to OMB's forecast – though the lower debt service costs needed to finance the lower deficits in CBO's estimate of the President's budget somewhat offset the projected increase in net interest.

Differences Between CBO's and OMB's Estimates of the President's Budget

| Difference | 2023-2032 Deficit Effect |

|---|---|

| OMB Estimate | $14,421 billion |

| Revenue | $51 billion |

| Mandatory Spending | -$1,268 billion |

| Discretionary Spending | -$347 billion |

| Interest | $251 billion |

| CBO Estimate | $13,108 billion |

Sources: Congressional Budget Office and Office of Management and Budget. Positive numbers reflect deficit increases and negative numbers reflect deficit decreases.

On the revenue side, CBO estimates $51 billion less of revenue over the next decade than OMB for several reasons. CBO anticipates slower average annual growth in real GDP over the next decade than OMB (1.7 percent compared to 2.2 percent) and slower growth in nominal wages and salaries ($2 trillion less than OMB), which leads to lower projections of individual and payroll tax revenue in CBO's forecast relative to OMB's. Also, CBO was unable to estimate the fiscal impact of several of the proposals in the President's budget due to a lack of specificity, the most significant being the proposal to impose a minimum tax on the wealthiest taxpayers. Another factor was timing – CBO's estimate was prepared more recently than OMB's, meaning it could capture the strong tax collections observed this spring in its estimates.

While CBO was able to score many of the proposals in the President's budget, it was unable to score some due to a lack of specificity (for those it was unable to score, CBO used OMB's estimate as a placeholder). CBO finds that a number of the President's policy proposals would cost less or save more than OMB estimates. As a result, CBO projects non-interest spending under the President's budget to be $1.6 trillion lower over the next decade than OMB.

The analysis put forward by CBO shows that the President's budget would slow the growth of debt as a share of GDP relative to current law. Nevertheless, as the U.S. faces 40-year high inflation, the President's budget does put forward a number of proposals that would save money and could be used to pay for new spending or reduce budget deficits going forward.

The Committee for a Responsible Federal Budget will publish our full analysis of CBO's estimate of the President's FY 2023 budget in the coming weeks.