VA Bill Will Cost Hundreds of Billions of Dollars

The Senate is expected to vote on the Honoring our PACT Act this week, which would add at least $277 billion to deficits through 2031 and would increase mandatory spending by up to $667 billion. The legislation would expand health and disability benefits to veterans who have (or are presumed to have) been exposed to toxic substances while on their tours of duty and have been diagnosed with health ailments as a result.

However, the bill itself does not include any offsets to pay for these new benefits, which would cost nearly $300 billion over a decade. The bill would also allow policymakers to reclassify nearly $400 billion of projected discretionary spending as mandatory, which would both reduce the pressure to keep those costs under control and make it easier for appropriators to spend more elsewhere in the budget without offsets.

The largest elements of the legislation would expand Veterans Affairs (VA) disability benefits at a cost of $153 billion over a decade and expand access to VA health benefits at a cost of $102 billion. Although VA health benefits are generally accounted for on the discretionary side of the budget, the legislation effectively allows all VA health spending above Fiscal Year (FY) 2021 nominal levels to be funded with mandatory funding. The Congressional Budget Office (CBO) estimates that this could result in up to $390 billion of existing discretionary funding being reclassified as mandatory, which would put it on autopilot and allow it to escape scrutiny during the annual appropriations process.

Deficit Impact of Honoring our Pact Act

| Policy | 2022-2031 Cost |

|---|---|

| Expand veterans disability benefits | $153 billion |

| Expand veterans health benefits | $102 billion |

| Other direct cost increases | $22 billion |

| Total Direct Cost of Bill | $277 billion |

| Reclassified discretionary costs* | $390 billion |

| Total Mandatory Spending Increase | $667 billion |

Source: Congressional Budget Office.

*Assumes appropriators allow the maximum amount.

The ultimate deficit impact of the legislation is difficult to predict because it requires making assumptions about the composition of future appropriations and the behavior of future policymakers. At a minimum, based on CBO’s score, the bill would boost deficits by $277 billion over a decade, including by $55 billion in 2031. However, the legislation would also shift up to $390 billion from discretionary spending to mandatory, resulting in a total mandatory spending increase of $667 billion over a decade, including by $119 billion in 2031.

As a result, the ultimate deficit impact of the legislation will likely fall somewhere between $277 billion and $667 billion, depending largely on how much the bill leads lawmakers to increase appropriations outside of VA health care. In addition, the move from discretionary to mandatory would likely reduce the incentive to hold down the cost of VA health benefits.

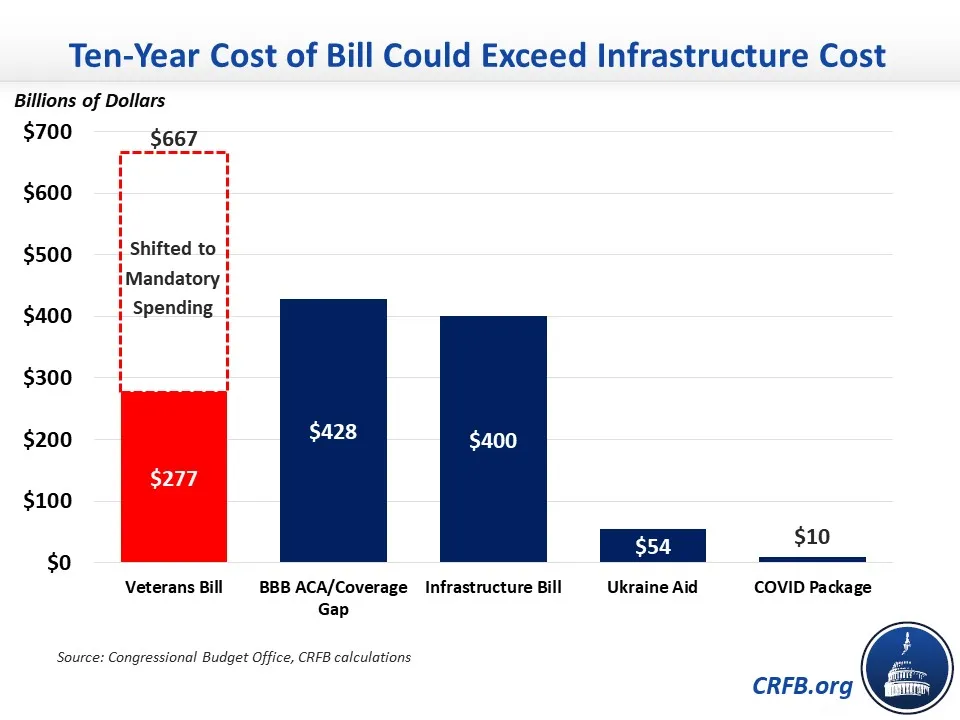

The direct effects of the bill alone would cost more than five times as much as has been appropriated for the crisis in Ukraine and 27 times as much as the COVID vaccine and treatment package currently under consideration. Depending on the ultimate cost of the legislation, it could end up adding more to the debt than the bipartisan infrastructure bill or permanent extension of the House Build Back Better Act's expanded ACA subsidies and its coverage gap proposal. By the end of the decade, this increase could cost more than all spending on Supplemental Security Income or Medicaid spending on children.

Rather than continuing to add to a national debt already headed toward record levels, policymakers should fully offset the cost of this bill. As one illustrative example, they could fund new spending by disallowing the collection of concurrent retirement and disability pay for veterans and treating disability benefits as taxable income. They could also prevent mandatory funds from being used to cover discretionary spending likely to occur under current law, either by providing a fixed mandatory appropriation for new spending or by setting the minimum discretionary funding requirement to continue to grow higher than the FY 2021 level to account for expected growth in costs.

Deficit Impact of Illustrative Package to Enact and Pay For Honoring our PACT Act

| Policy | 2022-2031 Cost/Savings (-) |

|---|---|

| Honoring Our PACT Act | $667 billion |

| Limit mandatory health spending to cover only new costs* | -$390 billion |

| Eliminate concurrent VA retirement and disability benefits | -$200 billion |

| Count VA disability benefits as taxable income | -$100 billion |

| Illustrative Package to Fund Veterans Benefits | -$23 billion |

Source: Committee for a Responsible Federal Budget, based on CBO estimates. Offset estimates rounded.

*This would involve increasing the minimum funding required for discretionary appropriations of VA benefits or replacing the uncapped mandatory expansion of health benefits with a capped mandatory appropriation.

The above package is purely illustrative. Other options could include limiting various concurrent payments between VA disability or unemployability benefits and Social Security disability or retirement benefits, lowering military health care costs, modifying current benefit eligibility rules, or imposing a surtax to cover new costs. In the past, we’ve also discussed many other options to fund veterans spending or provide general offsets.

As Committee President Maya MacGuineas argued recently, “caring for our veterans should be among the highest priorities as a nation.” But with both inflation and debt either at or nearing historic highs, this priority should be funded with tax or spending changes instead of more debt.