Analysis of the President's FY 2023 Budget

The Biden Administration released its Fiscal Year (FY) 2023 budget proposal today, outlining some of President Biden’s tax and spending priorities over the next decade. The budget relies on an unspecified budget-neutral placeholder reflecting the President’s “Build Back Better” agenda to spend on climate and social programs while lowering prescription drug costs and raising revenue. The budget also includes substantial tax and spending increases.

Based on the Administration’s own estimates and assuming the Build Back Better agenda is indeed budget neutral, under the President’s budget:

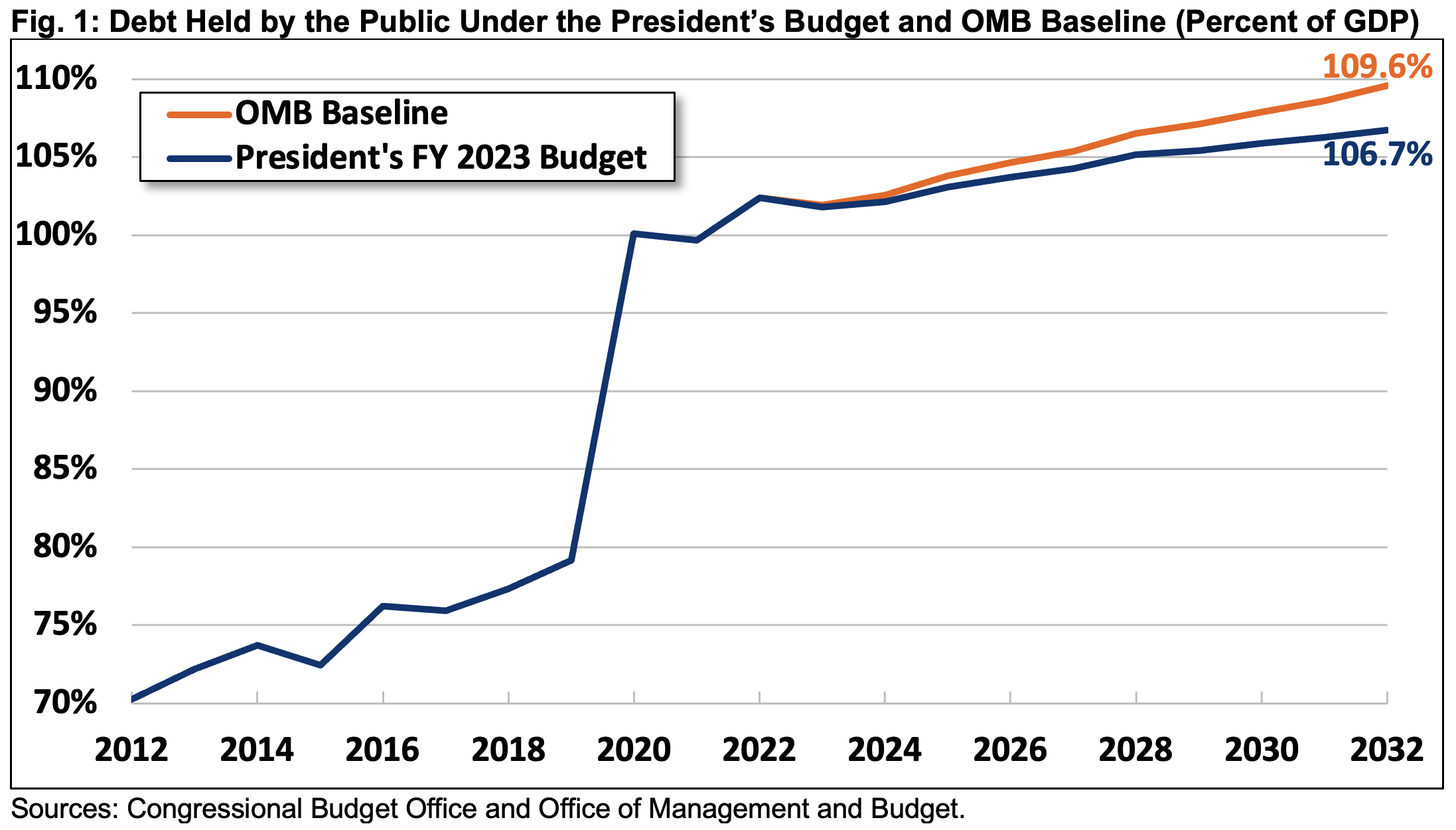

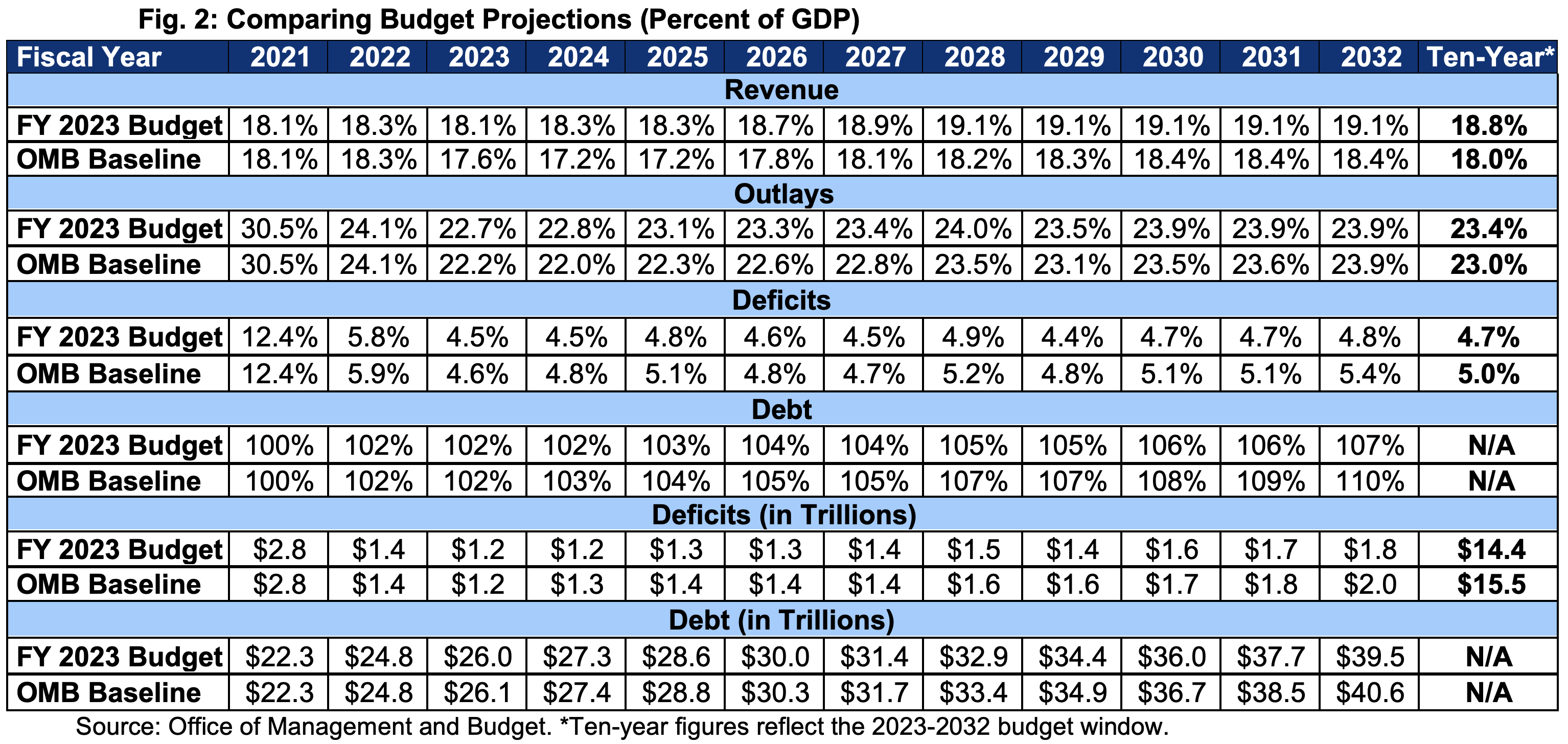

- Debt would rise to record levels within a decade, from 102.4 percent of Gross Domestic Product (GDP) at the end of FY 2022 to 106.7 percent by 2032. Prior to the pandemic, debt was less than 80 percent of GDP. Nominal debt would grow from $24.8 trillion at the end of FY 2022 to $39.5 trillion by 2032.

- Deficits would total $14.4 trillion (4.7 percent of GDP) over the next decade. Though expiring COVID relief will cause annual deficits to decline from $2.8 trillion (12.4 percent of GDP) in FY 2021 to below $1.2 trillion (4.5 percent of GDP) in 2023, they would never fall below $1 trillion and would grow back to $1.8 trillion (4.8 percent of GDP) by 2032.

- Excluding Build Back Better, spending and revenue would average 23.4 and 18.8 percent of GDP, respectively, over the next decade. This would be higher than the Administration’s baseline projection of 23.0 and 18.0 percent of GDP, respectively, and above the 50-year averages of 20.9 and 17.3 percent. Inclusive of Build Back Better, spending and revenue would be even higher.

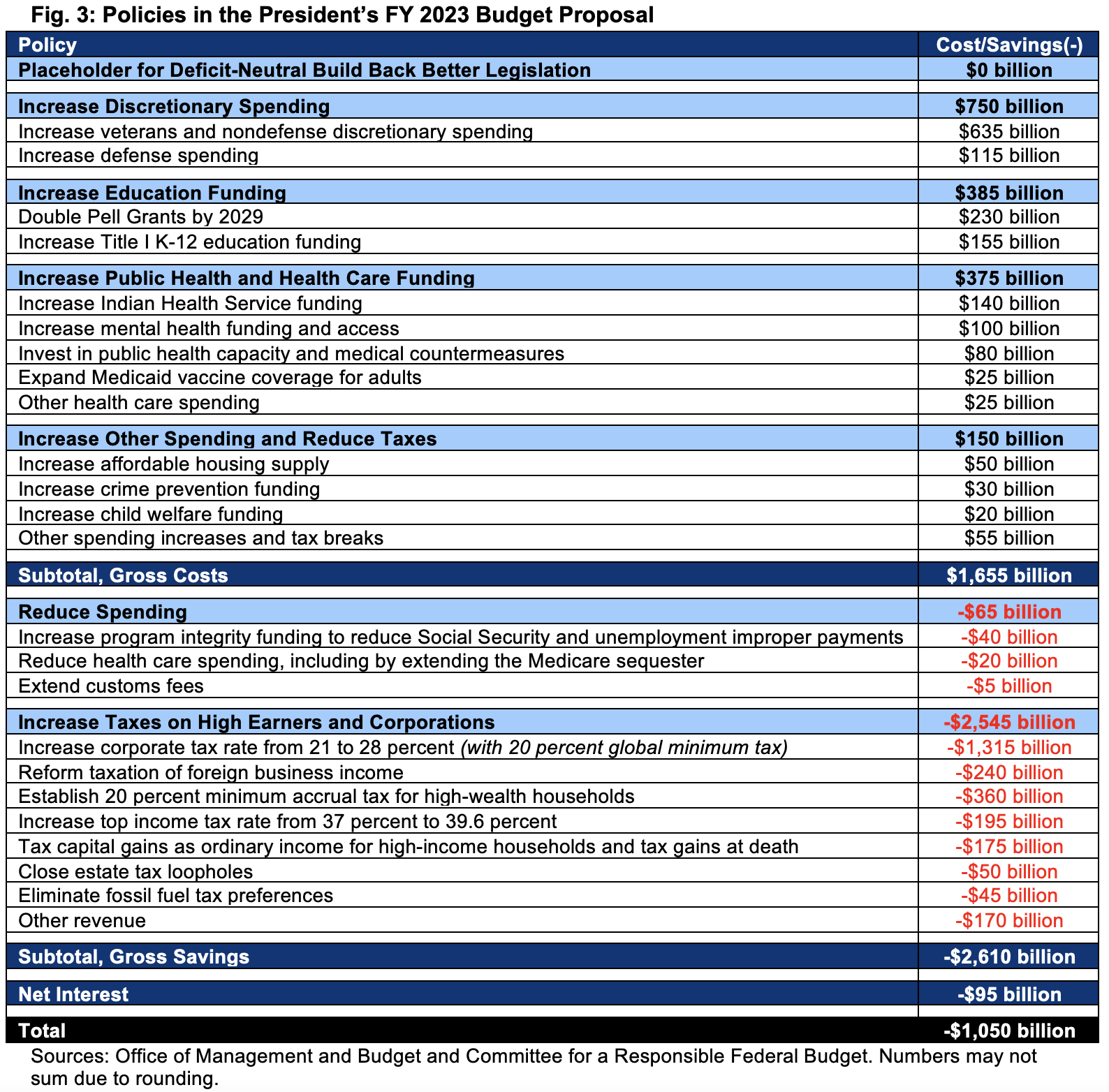

- Deficits would be about $1 trillion lower over a decade. This includes $1.66 trillion of new spending and tax breaks offset by $2.61 trillion of tax increases and spending reductions and $95 billion of interest savings. This assumes a deficit-neutral Build Back Better agenda.

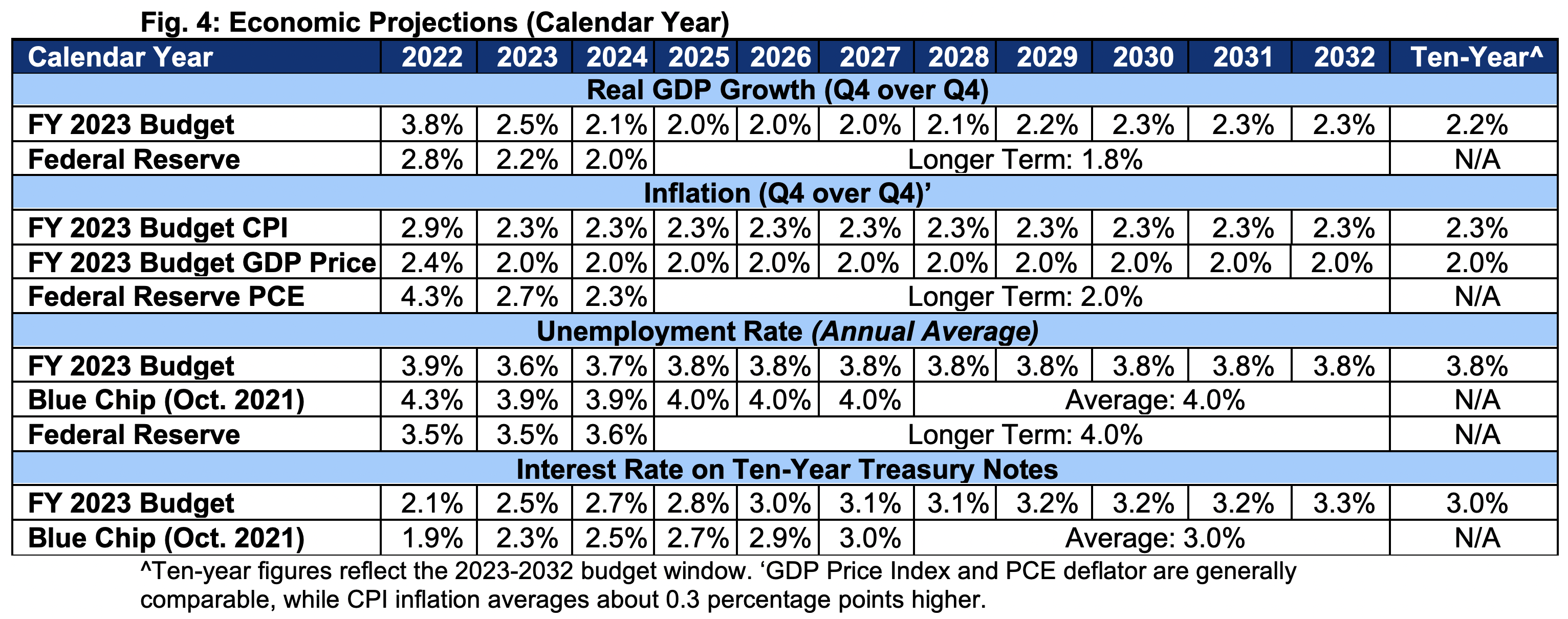

- The budget relies on somewhat optimistic and outdated economic assumptions. Like other forecasters, the budget assumes high near-term inflation, low unemployment, and rising interest rates. However, its long-term real GDP growth assumption is 0.4 percentage points above the Blue Chip consensus, 0.5 points above the Federal Reserve, and 0.6 points above CBO.

President Biden should be commended for putting forward a budget that calls for deficit reduction. Unfortunately, the budget is short on details and does too little – and in some cases nothing – to tackle inflation, lower health care costs, secure trust funds, or put the debt on a sustainable downward path over the long term.

Debt, Deficits, Revenue, and Spending in the President’s Budget

Debt under the President’s budget would grow to a new record as a share of the economy by the end of the decade. According to estimates within the budget – which assumes the Build Back Better agenda is budget-neutral – federal debt held by the public would grow by $14.7 trillion from the end of FY 2022 to 2032, from $24.8 trillion to $39.5 trillion. Relative to the economy, debt would grow from 102.4 percent of GDP at the end of FY 2022 to a record 106.7 percent by 2032.

At 106.7 percent of GDP, debt in FY 2032 would be below the Office of Management and Budget’s (OMB) baseline projection of 109.6 percent of GDP but well above pre-pandemic levels of 79.2 percent in FY 2019 or the 50-year average of 45.6 percent of GDP.

Annual deficits, according to the budget, would fall in the near term as COVID relief expires, then rise over time. Specifically, deficits would fall from $3.1 trillion in FY 2020 and $2.8 trillion in 2021 to $1.4 trillion in 2022, but they would stay above $1 trillion throughout the decade while rising to $1.8 trillion by 2032. Deficits would fall from 14.9 percent of GDP in FY 2020 and 12.4 percent in 2021 to 5.8 percent in 2022 and 4.5 percent in 2023 before rising to 4.8 percent by 2032.

Between FY 2023 and 2032, deficits under the budget would total $14.4 trillion (4.7 percent of GDP), a bit more than $1 trillion lower than OMB’s baseline deficits of $15.5 trillion (5.0 percent of GDP). In FY 2032, the deficit would be $229 billion lower than the baseline deficit of $2.0 trillion.

Because the budget excludes the spending and revenue impact of the Build Back Better agenda, its outlay and revenue projections are of limited value. Still, both would rise over time and relative to current law. Spending would average 23.4 percent of GDP over the 2023-2032 budget window, compared to 23.0 percent in OMB’s baseline. Revenue would average 18.8 percent of GDP, compared to 18.0 percent in OMB’s baseline.

Spending would decline from 30.5 percent of GDP in FY 2021 to 24.1 percent in 2022 and 22.7 percent in 2023 as COVID relief wanes and GDP grows. It would then rise to 23.9 percent of GDP by 2032. By comparison, spending averaged 20.9 percent of GDP over the past 50 years.

Revenue, meanwhile, would rise from 18.1 percent of GDP in FY 2021 to 18.3 percent in 2022 and 19.1 percent by 2032. By comparison, revenue averaged 17.3 percent of GDP over the past 50 years and would reach 18.4 percent in 2032 under OMB’s baseline.

As mentioned above, these figures do not account for the Build Back Better agenda. As an illustrative example, if Build Back Better increased revenue and spending each by $1 trillion each over a decade, outlays would average 23.8 percent of GDP (up from 23.4 percent of GDP) and revenue would average 19.1 percent of GDP (up from 18.8 percent of GDP). If the agenda increased spending and revenue by $2 trillion each, spending would average 24.1 percent of GDP and revenue would average 19.5 percent of GDP.

Proposals in the President’s FY 2023 Budget

Much of the President’s agenda is captured in his Build Back Better agenda, which is discussed but not specified in the budget. The budget also includes an additional $1.66 trillion of spending increases, $2.61 trillion of offsets, and $95 billion of interest savings. Much of this spending is on veterans, public health, and education. The offsets come almost entirely from revenue increases – mainly on corporations and high-income, high-wealth households. Overall, these policies would reduce deficits by a combined $1.05 trillion.

Economic Assumptions in the President’s Budget

A budget’s economic assumptions underlie its budget projections, and the economic assumptions in the President’s budget are of particular interest in light of tremendous economic uncertainty. This budget’s long-term economic assumptions are somewhat optimistic. Its near-term assumptions are outdated, however, as they were locked in largely based on data from October 2021, before the last few months of very high inflation or the Russian invasion of Ukraine.

For calendar year 2022, the budget forecasts Consumer Price Index (CPI) inflation of 2.9 percent and GDP price index inflation of 2.4 percent. By comparison, the Federal Reserve is forecasting 4.3 percent Personal Consumption Expenditure (PCE) inflation. The budget projects inflation will normalize by 2023 at 2.3 percent per year for CPI and 2.0 percent for the GDP price index; the Federal Reserve projects inflation to remain somewhat elevated until at least 2025.

The budget projects real (inflation-adjusted) GDP growth of 3.8 percent in 2022, 2.5 percent in 2023, and 2.1 percent in 2024. This is substantially higher than the latest Federal Reserve forecast of 2.8 percent, 2.2 percent, and 2.0 percent, respectively, but relatively similar to other projections at the time. By 2030, the budget assumes real GDP growth will pick up to 2.3 percent per year, substantially above the Federal Reserve’s 1.8 percent or the Blue Chip consensus of 1.9 percent.

In terms of interest rates, the budget projects ten-year Treasury yields will rise from an average of 2.1 percent in 2022 to 2.5 percent by 2023, 2.7 percent by 2024, and 3.3 percent by 2032. This is in line with the Blue Chip consensus at the time, though it may be on the low end today.

Finally, the budget expects the unemployment rate to fall from 3.8 percent today to 3.6 percent by 2023 and ultimately settle at about 3.8 percent by 2025. By comparison, the Federal Reserve predicts unemployment to hit a low of 3.5 percent this year and settle at 4.0 percent; the Blue Chip consensus predicts a low of 3.9 percent in 2023 and an ultimate unemployment rate of 4.0 percent.

Conclusion

We are pleased that President Biden has put forward a budget that calls for offsetting new spending and reducing budget deficits. Reducing near- and long-term deficits can help to bring rapid inflation under control and will be key to putting the national debt on a sustainable path. The President also deserves credit for putting forward a number of new revenue proposals, which could be used to fund new initiatives or reduce deficits going forward.

However, we are disappointed about the lack of detail in the President’s budget and that the debt would continue to rise to record levels under the budget. It would be far preferable to first put in place a plan to significantly improve our fiscal position, before implementing new policies that would absorb any new revenues.

While we understand the sensitivity of ongoing negotiations over the President’s Build Back Better agenda, they represent the core of the President’s policy priorities, so it is impossible to understand the true impact of his budget or agenda without knowing how these tax and spending changes fit into it. The budget is also, disappointingly, silent on how it will address various expiring provisions that could substantially worsen the fiscal outlook.

Even assuming these provisions are allowed to expire and the Build Back Better agenda is truly budget neutral, without relying on arbitrary expirations or other budget gimmicks, the budget does too little to help bring inflation under control or reduce long-term deficits.

Under the budget’s own estimates, debt would rise to a new record as a share of the economy. Meanwhile, the budget would do next to nothing to address the looming insolvency of the Social Security, Medicare, and Highway Trust Funds. Nor does it include measures outside of Build Back Better to slow health care cost growth, which is a key driver of rising long-term debt.

Failure to make our entitlement programs sustainable and put the debt on a clear downward path over the long run will ultimately slow economic growth, increase the cost of living, reduce the nation’s flexibility to address future needs, leave benefit levels of important support programs in jeopardy, increase the ultimate risk of a fiscal crisis, and leave us more vulnerable to future economic and geopolitical emergencies.

We appreciate the President’s call to not only pay for new initiatives, but also to reduce the deficit, and we hope Congress builds on this example by combining the best parts of the President’s budget with other reforms in order to truly restore the country’s fiscal and economic health.

What's Next

-

Image

-

Image

-