Is Biden's Student Debt Cancellation Plan Still Regressive?

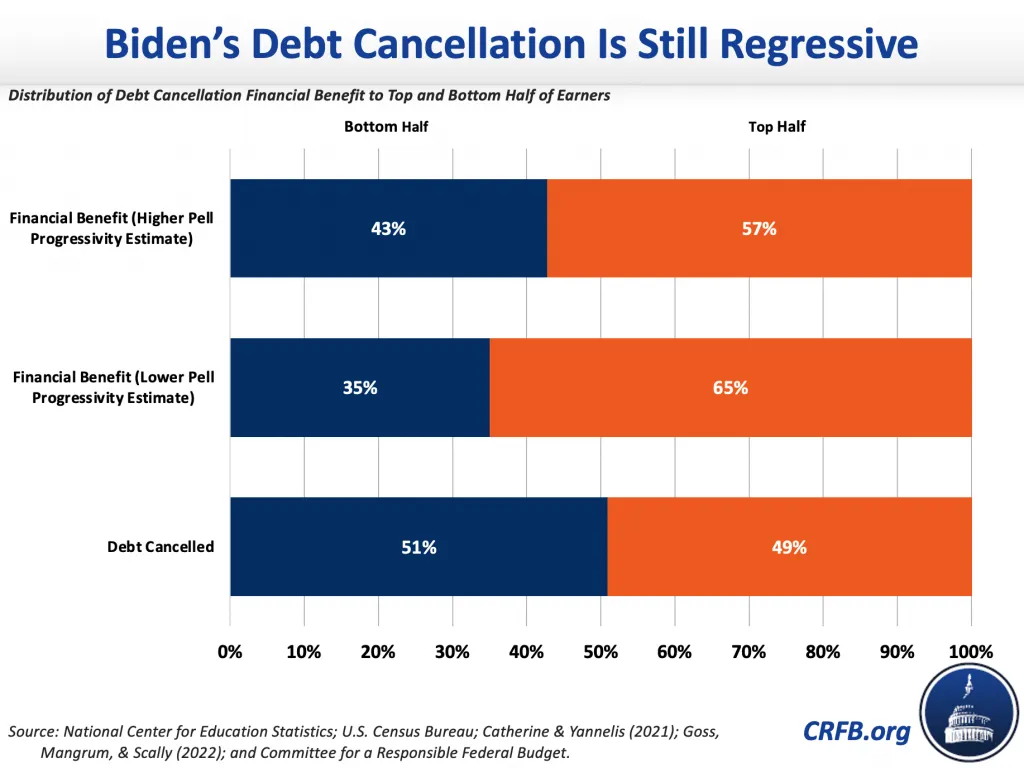

The Biden Administration’s new $420 billion student debt cancellation and repayment pause plan will deliver the majority of the benefits to those in the top half of the income spectrum according to our estimates. Using the methodology put forward by Catherine and Yannelis, we find that 57 percent to 65 percent of the extended pause and cancellation will go to those in the top half of the income spectrum. Other recent estimates also find the cancellation is less progressive than suggested.

Numerous studies have established that simply canceling $10,000 per borrower of student debt would disproportionately benefit those in the top half. However, the Administration’s latest proposal aims to counteract the regressivity by means testing benefits for very high income households and doubling the amount cancelled for those who received Pell Grants.

While these changes do reduce the regressivity of debt cancellation, they don’t appear to reverse it. A new study from Goss, Mangrum, and Scally found that the amount of debt cancelled by neighborhood income is relatively even by decile – with those in the top half receiving roughly half (49 percent) of the debt cancelled. That means those in the top half of earnings receive a much larger share of the financial benefit of debt cancellation, since higher-income borrowers are more likely to pay back their loans in full and face higher average interest rates.1

A 2021 study by Catherine and Yannelis tries to measure the distribution of the actual financial benefit (as opposed to debt cancelled) by estimating the present value of debt forgiveness accounting for different interest rates, existing forgiveness programs, and likelihood of default or forbearance. They also measure distribution within cohorts to adjust for differentials by age.

Using their estimates of $10,000 of across-the-board debt cancellation as a starting point, we find those in the top half of the income spectrum will likely receive 57 to 65 percent of the benefit from the President’s debt cancellation plan – and this may be an underestimate for several reasons.2

The actual benefit is likely to be more regressive for a couple of reasons. The first issue is that debt cancellation requires an application, which is likely to be a more significant barrier to lower-income borrowers with fewer resources, particularly those who have long been in default or forbearance and are thus detached from the system (the Catherine and Yannelis estimate assumes a 100 percent take-up rate). The Congressional Budget Office (CBO) estimates a 90 percent take-up rate, and the Department of Education estimates an 81 percent take-up rate while suggesting it could be even lower. The lower the take-up rate, the more regressive the policy becomes.

Second and more subtly, using income from 2020 and 2021 will blunt the effectiveness of the means testing. Many high-income households had low reported income in 2020 due to the COVID-19 pandemic as a result of temporary job loss, decisions to exit the workforce temporarily for child care, reductions in business income, and the fact that Payroll Protection Program funding does not count toward income. In any year, there is also a group of high-earning professionals (lawyers, doctors, and MBAs) who were in graduate school or temporary lower-income jobs such as medical residency two years earlier.

To be sure, other analyses of the President’s plan may reach different conclusions. The Penn Wharton Budget Model’s (PWBM) analysis, for example, suggests that about half of the benefit goes to the top half. Importantly, PWBM also believes cancellation will cost $469 billion – 17 percent more than CBO and 24 percent more than the Department of Education – with much of the extra cost likely accruing to the bottom half of earners. Even under these estimates, it would be hard to conclude that the Administration’s plan is highly progressive. A large share of the benefit will accrue to those in the top half of the income spectrum.

Importantly, none of these estimates take into account the Administration’s problematic Income-Driven Repayment proposals. And none account for the cost of financing its plan – with resulting increases in inflation disproportionately affecting lower-income households.

In the end, the Administration’s student debt cancellation proposal is costly, inflationary, will drive up higher education costs, and will deliver the majority of the benefits to those in the top half of the income spectrum.

Updated (10/05/2022): Adjusted Penn Wharton Budget Model's distributional estimate in light of a correction to their analysis.

1 Lower-income borrowers, in particular those who are unlikely to pay back their debt under current law, may experience several intangible benefits from debt cancellation. Nevertheless, the direct financial savings and the dollars spent by the government will tilt towards those who earn more.

2 Catherine and Yannelis find that 73 percent of the benefit of $10,000 of across-the-board cancellation would go to the top half, and only 27 percent to the bottom half. To generate our estimates, we calibrate their numbers to the most recent CBO estimate of debt cancellation, adjust them for means-testing and the pause extension, and then add in a range of assumptions for the additional forgiveness for Pell Grant recipients. Using a mix of longitudinal and snapshot survey data from the Department of Education and the U.S. Census Bureau, we estimate that the additional $10,000 of debt cancellation for Pell Grant recipients will distribute between 50 percent to 75 percent of the benefit to the bottom half of the income distribution. Our estimates reflect these book-end assumptions.