Student Loan IDR Changes Are Highly Problematic, Report Shows

While much attention has been paid to President Biden's costly and inflationary plan to cancel $10,000 to $20,000 of student debt, his proposed changes to the Income Driven Repayment (IDR) program could be even more troubling.

The proposal would cap undergraduate loan repayments at 5 percent of discretionary income, raise the threshold for defining discretionary income by 50 percent for all borrowers, cancel any unpaid interest accumulation, and forgive balances for those who borrowed less than $12,000 after ten years. A new Brookings Institution report by Adam Looney argues that these changes would substantially damage the higher education financing system and turn the student loan program into a poorly targeted quasi-grant where the average undergraduate borrower enrolled in IDR would pay back about half of what they borrowed -- but with wide and somewhat arbitrary variability.

Looney explains that these changes would lead to:

- Increased borrowing.

- More support for low-quality, low-value programs.

- Greater potential for abuse.

- Arbitrary, unequal, and unfair benefits.

- More tuition inflation.

- Large federal costs.

The analysis is available here. Below we summarize some of the key findings.

New IDR Program Turns Loans into Quasi-Grants for Many

Biden's proposed Income-Driven Repayment plan has a few changes that can dramatically lower payments for many borrowers. It lowers the percentage of "discretionary income" undergraduate borrowers must pay from 10 percent to 5 percent. It also adjusts the calculation of discretionary income for all borrowers, so that payment cap applies to Adjusted Gross Income (AGI) above 225 percent of poverty as opposed to 150 percent -- which means a $33,000 exemption for a single individual and a $79,000 exemption for a family of five. The plan also forgives any unpaid interest each month, which is an important interactive effect since borrowers' payments will be lower, especially in their early years of earning income. Lastly, the plan forgives any remaining balance after 10 years for those who initially borrowed less than $12,000.

Looney shows that for undergraduate borrowers age 25 to 34 who enroll in the new IDR program:

- 85 percent would see a reduction in payments.

- 70 percent should expect to have some debt forgiven after 20 years.

- The average borrower should expect to pay back only about 50 cents of what they borrow, but with wide variation from borrower to borrower.

New IDR Program Will Almost Certainly Lead to Increased Borrowing

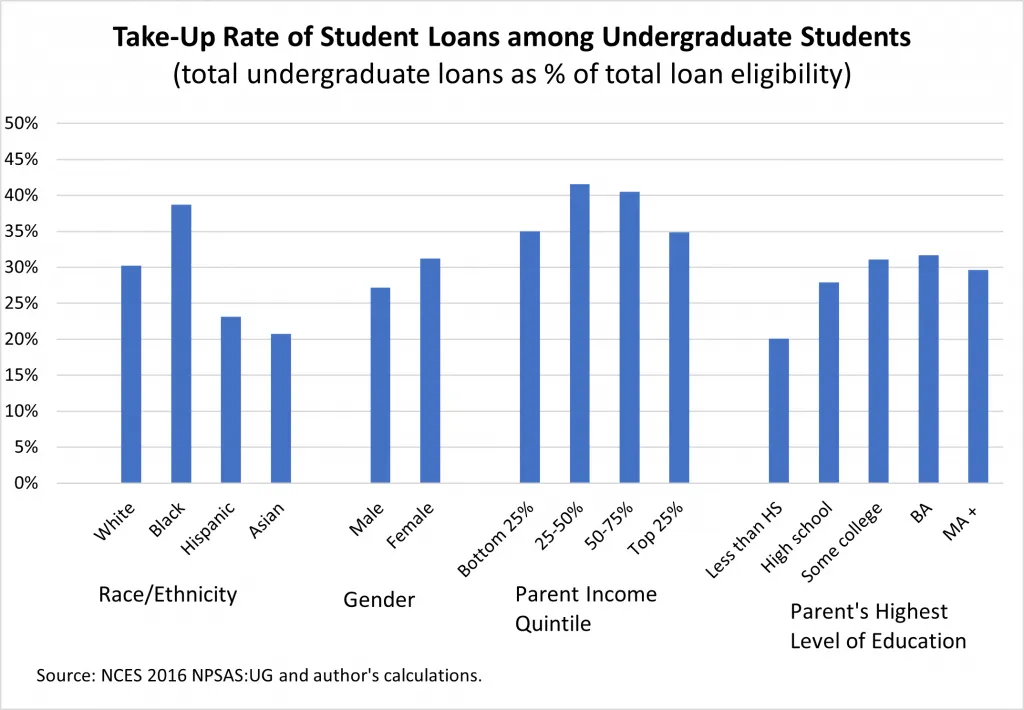

In 2016, undergraduates were eligible to borrow $153 billion, but only borrowed $48 billion. With large new subsidies that make the average undergraduate student likely to only repay half the amount borrowed, there is a strong incentive to borrow some of the remaining $105 billion. For those who would otherwise finance college without borrowing, the high overall subsidy rate on new loans makes borrowing far more attractive. And for those who already borrow, additional borrowing is far more likely to be cancelled under IDR than their initial borrowing -- and so the incentive to borrow more is even stronger.

Source: Brookings Institution

As Looney explains, the new IDR program would also increase the incentive for graduate students to borrow more -- as their high balances would benefit substantially from interest cancellation in the early years of the loans. In 2016, graduate students were eligible to borrow $113 billion, but only borrowed $79 billion.

A related issue not addressed in Looney's analysis was examined in a recent report by Preston Cooper, a research fellow at the Foundation for Research on Equal Opportunity, who shows that, although most community college students do not currently take out loans, under the new system, they may be incentivized to do so. Cooper shows that the average community college student who borrows $10,000 will likely pay around $1,000 over ten years, after which the entire loan will be forgiven.

Increased Borrowing Will Often Likely Be for Non-Tuition Expenses

Frequently lost in the debate around student debt is that much of the borrowing is not for covering tuition, but rather room, board, and other expenses. A large portion of the cost of college is a result of non-tuition expenses, and the majority of borrowers borrow above the cost of tuition. Looney points out that at public colleges and four-year private colleges, the actual tuition charged to students has fallen over fifteen years, and the increased costs are entirely a result of room and board. Living expenses constitute the majority of college expenses for the majority of students.

Looney's point is that any increase in borrowing (the amount that has previously been unborrowed) will likely go to "living expenses" broadly defined, which leads to two problems.

The first issue is fairness. Looney shows that "the federal government will pay twice as much to subsidize the rent of a Columbia [University] graduate student than it will for a low-income individual under the Section 8 housing voucher program" due to the fact that the graduate student can borrow around $31,000 per year for living costs and now expects much of their loan to be forgiven. It is also more than "double what a low-income single mother with two children can expect to get from the Earned Income Tax Credit (EITC) and food stamps combined."

"No doubt that students need room and board," says Looney, "but so do other Americans who aren’t in college, who are not eligible to take out a federal loan for living expenses, and generally don’t expect federal taxpayers to cover those expenses. Is it fair that federal programs help pay the rent of some Americans simply because they are college or graduate students, but not others?"

The second issue is abuse. There are no requirements that loan money be used for student housing or food, and Looney argues that -- often aided by predatory institutions -- many students may treat the program as an unrestricted cash loan. This is particularly problematic when there is an expectation that the loan will not need to be fully repaid.

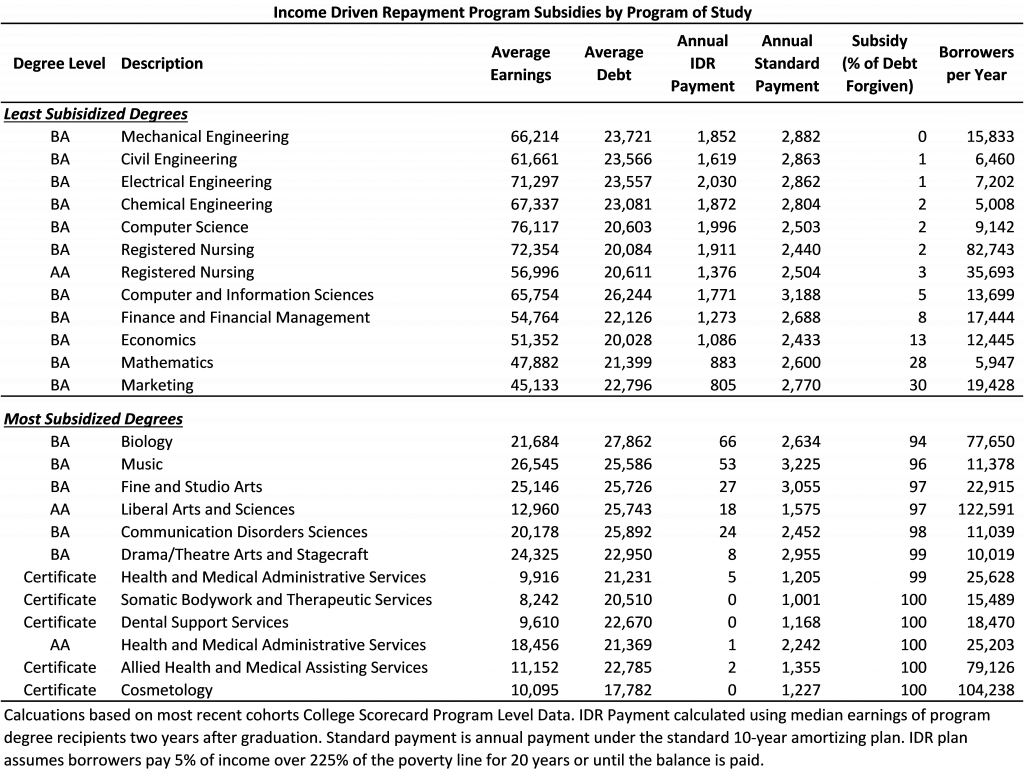

New IDR Will Drive Up Tuition and Provides the Most Subsidy to the Worst Performing Programs

IDR is a debt-to-income ratio, which means that students who have higher debts and lower earnings tend to benefit more from the program. Importantly, this is true to some degree of almost any IDR program -- since IDR is intended to be a safety net for those whose higher education didn't lead to the expected increase in earnings. However, the very low level of expected repayment makes it far more true under the new reforms. In the new system, it's possible that only highly-effective programs see students pay back their loans in full, with the worst-performing programs seeing graduates make virtually no payments.

Source: Brookings Institution

Since there are relatively strict borrowing caps at the undergraduate level, Looney does not predict the new IDR will necessarily lead to tuition inflation at the undergraduate level. Instead, the new IDR plan allows schools to increase enrollment in "valueless" degrees where the earnings potential of the degree does not come close to covering the debt obtained in the degree. The new IDR has the effect of actually encouraging borrowing in the programs with the worst earnings outcomes.

However, Looney does predict tuition inflation at graduate institutions since there is effectively no cap on the amount that graduate students can borrow. One of the issues with IDR is that at a certain point a marginal increase in borrowing does not lead to any increase in payments. This means that as the IDR subsidy increases for graduate students, the point at which borrowing an additional dollar is costless goes down. That will make it very easy for certain programs to charge very high rates of tuition, especially those programs for whom most students will expect to work in the public sector.

New IDR Is Not Progressive

Income-Driven Repayment was designed to be progressive, and in the past, it somewhat achieved those goals. The plan ensured any household earning below 150 percent of the federal poverty level paid nothing and that any dollar above that rate would be charged originally at 15 percent of income and then later amended to 10 percent of income. This ensured a safety net for very low-income borrowers, and the formula charges an increasing effective rate as income increases. For example, under current IDR rules someone earning $35,000 per year pays an effective rate of 3.7 percent of their income per year, while someone earning $100,000 per year pays an effective rate of 7.9 percent of their income per year. What alters this relative progressivity is that as you decrease the overall amount people pay, then people who borrow very large amounts of money might still end up with loan forgiveness even after earning high wages.

Looney points out that because existing IDR was already progressive, exempting more income and charging a lower percentage of total income actually makes the newly proposed changes to IDR less progressive. Since all of the lowest income borrowers already made zero dollar payments, any increase in the exemption necessarily reduces progressivity. Someone making $20,000 was already paying zero dollars, but now someone making $35,000 pays an effective rate of 0.3 percent and someone making $100,000 pays an effective rate of 3.4 percent. The formula clearly compresses the level of progressivity and greatly benefits higher-income borrowers. Looney points out that previous Congressional Budget Office scores demonstrate that graduate students receive about three-times the benefit of increasing the poverty exemption in IDR as undergraduate students in terms of costs to the federal government.

The new formula's feature of forgiving any unpaid interest each month further reduces progressivity in the new IDR plan. As we have shown in the current repayment pause, people with higher debts benefit more from interest forgiveness, and people with higher debts tend to have higher incomes.

One of the ways IDR used to function as a safety net is it would temporarily reduce payments for those experiencing income shocks. The borrower, however, was ultimately expected to pay off their entire loan, and the accrued interest from the period of lower payments would help ensure that. In this new system, doctors who temporarily make $60,000 as residents will have $10,500 of interest forgiven per year, despite the fact they will go on to earn hundreds of thousands of dollars per year. The regressivity of interest forgiveness for future high-income earners with high debt loads is compounded by the fact that IDR is typically calculated based on income from one to two years ago, meaning that doctors will have years of either no income (because they had been in school) or lower incomes from residency programs, even as they are making substantially more in the current year.

A major issue with the new IDR plan is that the benefits are somewhat arbitrary. Those who borrow more and have depressed earnings before going on to be some of the wealthiest people in the country receive outsized benefits.

* * *

President Biden's recent student loan changes will likely cost between $440 and $600 billion and add to inflation. While his proposed plans to change IDR have garnered less attention compared to debt cancellation, in the long-term this plan may have more consequences by fundamentally changing student loans into poorly targetted quasi-grants.

The new IDR program would weaken current limited and imperfect mechanisms that help contain price growth in higher education, while offering tens of thousands of dollars to graduate students for housing and other expenses each year that they often would not have to pay back. Undergraduate students would frequently only pay back half the amount they borrowed and could be encouraged to borrow the maximum amount, since the last marginal dollars would be likely to be unpaid. Couple all of that with possible sporadic debt cancellations from future administrations, and we should expect to see student loan borrowing increase significantly in the coming decade.

The Biden Administration should work to fix the many flaws in their current IDR proposal, or else withdraw the rule altogether and work with Congress on more fundamental higher education reform.

You can read Looney's full report here.