RSC Releases FY 2024 Budget Proposal

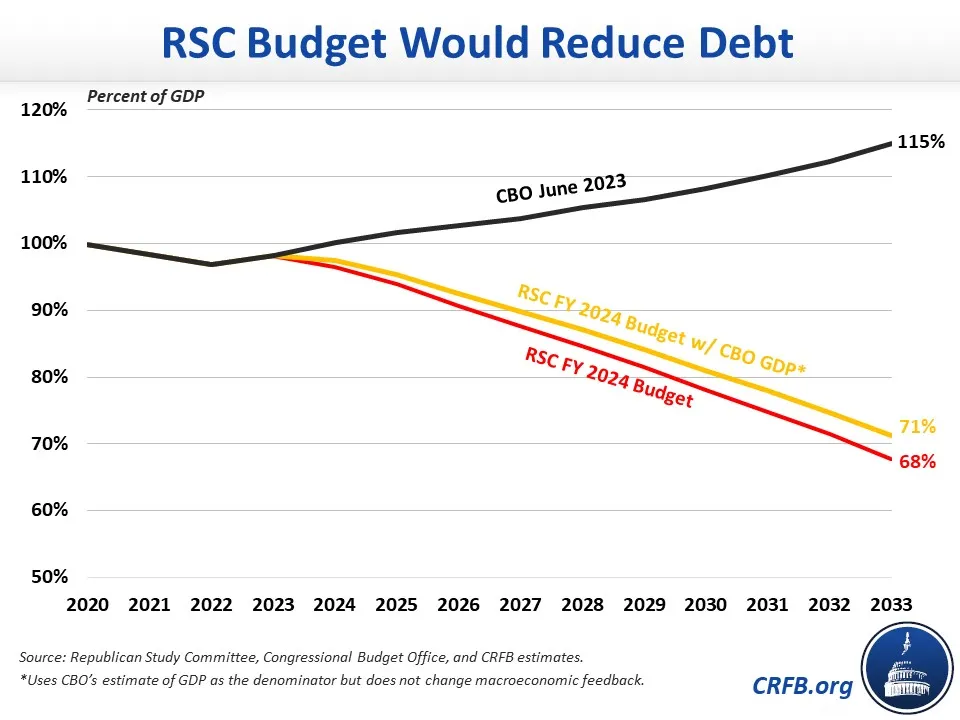

The Republican Study Committee (RSC) recently released its annual budget proposal for Fiscal Year (FY) 2024, covering the upcoming fiscal year and the decade after. The proposal, drafted by the Budget and Spending Task Force of the 175-member caucus, aims to balance the budget by 2030 and reduce debt to 68 percent of the economy by 2033.

According to the budget’s summary tables, the RSC budget calls for $17.1 trillion of deficit reduction over the next decade – which is the net effect of $14.0 trillion of spending cuts; $5.8 trillion of revenue from a combination of tax expenditure reforms, asset sales, and faster assumed economic growth; and $2.3 trillion of interest savings combined with $5.1 trillion of tax cuts and tax cuts extensions.

The budget proposes reducing the deficit in FY 2024 by more than half, with most of the savings coming from repeal of the Affordable Care Act and reductions in Medicaid spending alongside savings in other mandatory programs such as agriculture subsidies, higher education financing, and government employee compensation. The budget would reach primary surplus by 2025 and full surplus by 2030, with the surplus growing to $320 billion by 2033.

Importantly, the economic growth assumptions in the budget are far too rosy, and many of the spending cuts are also unrealistic or at least unspecified.

Still, the budget deserves a great deal of credit for putting a large number of specific spending cuts and reforms on the table, including changes to Medicare and Social Security to prevent painful across-the-board cuts upon insolvency. This is a welcome improvement from the recent bipartisan refusal to even acknowledge the financial challenges these programs face.

As an example, the budget calls for adopting several bipartisan proposals that would lower Medicare costs for the program and its beneficiaries – some of which we’ve proposed in our Health Savers Initiative – including site-neutral payments, reducing payments for uncompensated care, eliminating Medicare’s coverage of bad debt, and reforming the graduate medical education system.

For Social Security, the budget proposes making changes to benefits for future beneficiaries, including by changing the benefit formula to reduce credit for very high earnings, limiting and phasing out spousal and other auxiliary benefits for high-income earners, and raising the retirement age to account for increases in life expectancy. It would also adopt several ideas from the McCrery-Pomeroy SSDI Solutions Initiative aimed at improving the disability insurance program.

While the RSC should be applauded for actually offering a Congressional budget in absence of any others, the budget itself relies on some questionable economic and policy assumptions. The budget claims to increase real economic growth by about 0.5 percentage points annually over the decade, assuming the economy will be about 5 percent larger than CBO projects by the end of the decade. We described the President’s budget as too optimistic for assumptions only one-fifth as bold. It’s hard to imagine the level of growth the RSC is assuming from any slate of policies – at least not in a base case.

Concerningly, these faster growth assumptions are being used to paper over a portion of more than $5 trillion of tax cuts. The budget also proposes more than $5 trillion of discretionary spending savings, almost all of which comes from nondefense discretionary cuts that have some specific proposals but not nearly enough to achieve that total.

At the same time, the budget includes numerous thoughtful and important policies and a helpful framework for one way to achieve deficit reduction. It is good to see the RSC present a budget of how it believes the country should be governed. As Committee for a Responsible Federal Budget President Maya MacGuineas noted:

The RSC deserves credit for putting forward a budget when, unfortunately, few others in Congress are, as both the House and Senate Budget Committees have failed to introduce budgets. Other lawmakers should put forward their budgets to facilitate a healthy public debate, and then policymakers should adopt a budget plan for our country.

We look forward to others proposing their own budgets as well.

Comparing the RSC Budget to CBO’s Current Law Estimates

| Fiscal Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | Ten-Year |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues (% of GDP) | ||||||||||||

| RSC Budget | 18.4% | 17.6% | 17.2% | 17.8% | 17.5% | 17.8% | 18.0% | 18.1% | 17.9% | 17.9% | 18.1% | 17.8% |

| CBO June 2023 | 18.4% | 17.8% | 17.4% | 17.8% | 18.1% | 18.2% | 18.2% | 18.1% | 18.1% | 18.1% | 18.1% | 18.0% |

| Outlays (% of GDP) | ||||||||||||

| RSC Budget | 24.2% | 20.3% | 19.3% | 18.7% | 18.4% | 18.2% | 18.2% | 17.9% | 17.7% | 17.6% | 17.3% | 18.3% |

| CBO June 2023 | 24.2% | 23.3% | 23.1% | 23.1% | 23.1% | 23.7% | 23.2% | 23.7% | 23.9% | 24.2% | 24.8% | 23.7% |

| Deficit(-)/Surplus (% of GDP) | ||||||||||||

| RSC Budget | -5.9% | -2.8% | -2.2% | -0.9% | -0.9% | -0.5% | -0.2% | 0.2% | 0.2% | 0.4% | 0.8% | -0.5% |

| CBO June 2023 | -5.9% | -5.5% | -5.8% | -5.3% | -5.0% | -5.5% | -5.0% | -5.6% | -5.8% | -6.1% | -6.8% | -5.7% |

| Debt (% of GDP) | ||||||||||||

| RSC Budget | 98% | 97% | 94% | 91% | 88% | 85% | 82% | 78% | 75% | 72% | 68% | n/a |

| CBO June 2023 | 98% | 100% | 102% | 103% | 104% | 105% | 107% | 108% | 110% | 112% | 115% | n/a |

Sources: Congressional Budget Office and Republican Study Committee. Note: RSC budget uses a different estimate of GDP for its figures.

Note (6/22/2023): this analysis has been updated to reflect new information on the revenue from economic growth.