Reaching Fiscal Goals Under the Latest Baseline

The Congressional Budget Office’s (CBO) latest baseline projects that federal debt held by the public will rise to a record 110 percent of Gross Domestic Product (GDP) by the end of Fiscal Year (FY) 2032 under current law and higher if current policies are extended without offsets. As a result, the necessary changes to reach various fiscal goals have grown over the last year.

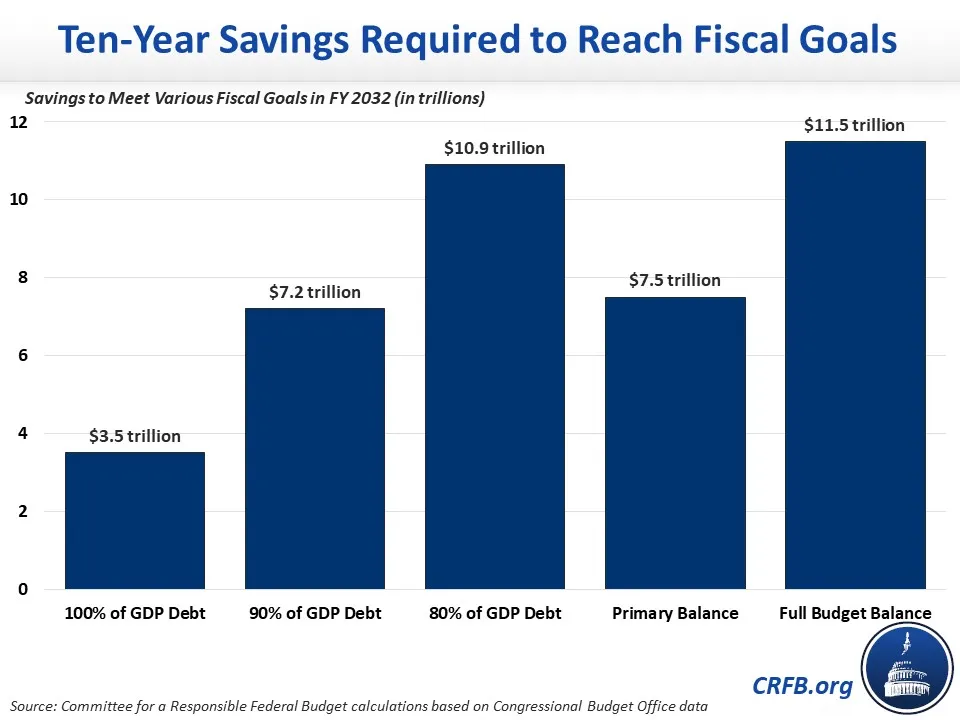

Although there is not a specific fiscal goal that would solve our nation’s financial problems, we’ve identified various goals that policymakers should keep in mind when assessing the changes they need to put the national debt on a downward sustainable path. For example, policymakers may want to choose a specific level of debt to target over the next decade. Stabilizing the debt at the size of the economy – 100 percent of GDP – would require $3.5 trillion of savings through FY 2032. To stabilize the debt at its pre-pandemic level of 80 percent of GDP, $10.9 trillion of savings would be required.

Another way to target the nation’s finances is through budget balance. In order to achieve primary balance – where noninterest spending equals revenue – we would need roughly $7.5 trillion of savings over the next decade (depending on the savings path). Achieving full balance would be substantially more difficult, with a required $11.5 trillion of savings over a decade.

While these fiscal goals seem hefty, they are achievable. For example, President Biden’s FY 2023 budget includes $2.6 trillion of gross savings largely through revenue increases, and former President Trump’s FY 2021 budget included over $3.5 trillion of gross savings. In addition, there are many offsets available to policymakers.

The national debt is on track to reach unprecedented levels over the next decade. It is time for policymakers to come together around a fiscal goal and enact policies to reach that goal, including by putting in place trust fund solutions, raising revenue, cutting wasteful spending, and paying for any new priorities.