The Post-FRA Fiscal Outlook

The nation's fiscal outlook has improved slightly since the last Congressional Budget Office (CBO) baseline in May, thanks to the $1.5 trillion of ten-year savings in the recently-enacted Fiscal Responsibility Act (FRA). The FRA represents the largest deficit reduction package in nearly a dozen years and is an important step forward in fiscal responsibility. Despite this, however, the fiscal outlook is still unsustainable.

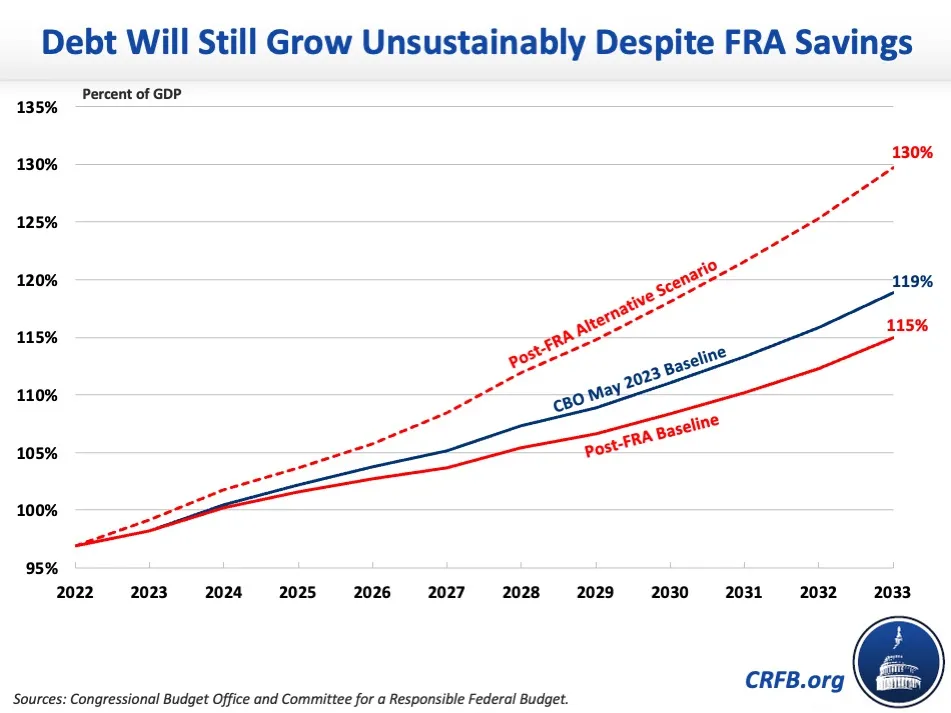

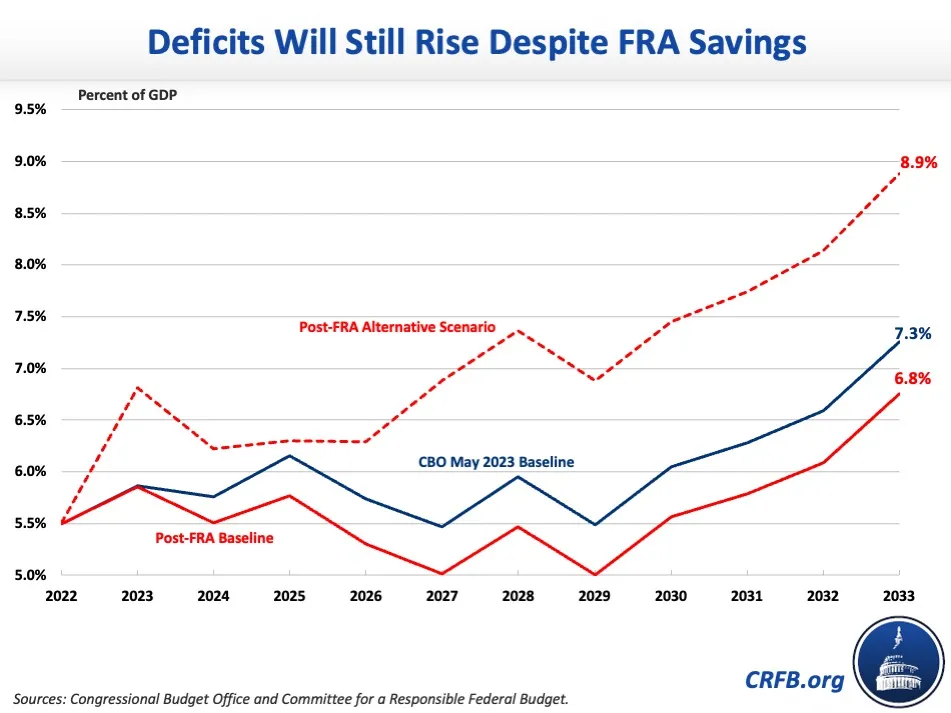

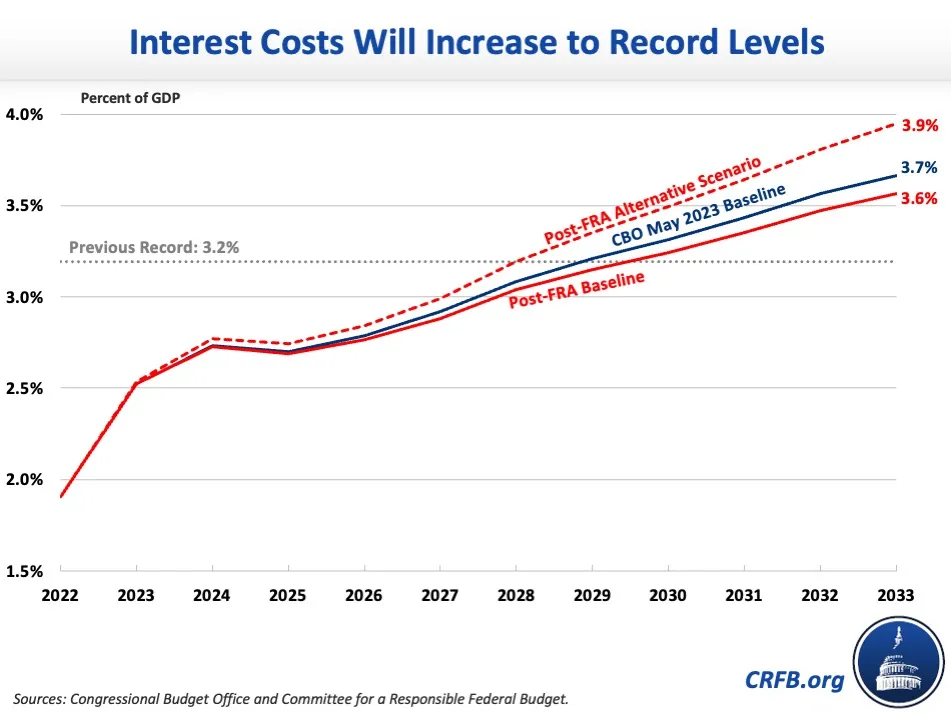

In May, CBO projected that federal debt held by the public would reach a record 119 percent of Gross Domestic Product (GDP) by the end of Fiscal Year (FY) 2033, the deficit would total 7.3 percent of GDP, and interest costs would be a record 3.7 percent of GDP. Under an updated current law baseline that incorporates the fiscal impact of the FRA, debt will reach 115 percent of GDP, the deficit will total 6.8 percent of GDP, and interest costs will reach a record 3.6 percent of GDP. Under a post-FRA Alternative Scenario– which assumes that lawmakers follow through on various appropriations agreements, extend expiring policies without offsets, and other factors described below – we estimate debt in FY 2033 would reach 130 percent of GDP, the deficit would total 8.9 percent of GDP, and interest costs would total 3.9 percent of GDP.

Summary of Budget Projections Under Current Law and Alternative Scenario

| Metric | 2033 Deficit | 2033 Debt | 2033 Interest |

|---|---|---|---|

| Nominal Dollars | |||

| CBO May 2023 Baseline | $2.9 trillion | $46.7 trillion | $1.4 trillion |

| Post-FRA Baseline | $2.7 trillion | $45.2 trillion | $1.4 trillion |

| Post-FRA Alternative Scenario | $3.5 trillion | $50.9 trillion | $1.5 trillion |

| Percent of GDP | |||

| CBO May 2023 Baseline | 7.3% | 119% | 3.7% |

| Post-FRA Baseline | 6.8% | 115% | 3.6% |

| Post-FRA Alternative Scenario | 8.9% | 130% | 3.9% |

Sources: Congressional Budget Office and Committee for a Responsible Federal Budget.

In its May baseline, CBO projected that federal debt held by the public would increase by $21.5 trillion from $25.2 trillion today, to $46.7 trillion by the end of FY 2033. As a share of GDP, debt would grow from 97 percent of GDP at the end of FY 2022 to a record 107 percent by 2028 – exceeding the prior record of 106 percent set just after World War II in 1946 – and would ultimately reach 119 percent of GDP by the end of 2033.

Under the post-FRA baseline, debt held by the public will increase by $20.0 trillion to $45.2 trillion by the end of FY 2033. As a share of the economy, debt will exceed the prior record by 2029, one year later than previously projected, and would increase to 115 percent of GDP by the end of 2033, about four percentage points of GDP lower than CBO projected in May. Despite this slight improvement, however, debt will still grow unsustainably.

Actual debt levels could be much higher in light of the recent drop in revenue collections and if policymakers extend a variety of expiring provisions. Our post-FRA Alternative Scenario incorporates the $250 billion of lower-than-expected tax payments this April and assumes policymakers extend the expired and expiring business and individual income tax cuts in the Tax Cuts and Jobs Act of 2017 and other legislation without offsets. We also assume that policymakers extend the Inflation Reduction Act's enhanced insurance subsidies after they expire, incorporate the side agreements made outside of the FRA to boost appropriations above the official FY 2024 and 2025 cap levels, and grow discretionary appropriations with the economy instead of inflation after the caps expire. Under our post-FRA Alternative Scenario, we estimate debt would increase by an additional $5.7 trillion, to $50.9 trillion or a record 130 percent of GDP by the end of FY 2033.

In its May baseline, CBO projected budget deficits would total $21.9 trillion (6.1 percent of GDP) over the FY 2023 to 2033 period, with the deficit growing from $1.5 trillion (5.9 percent of GDP) in 2023 to $2.9 trillion (7.3 percent of GDP) in 2023. Under the post-FRA baseline, deficits will total $20.3 trillion (5.7 percent of GDP), with the deficit increasing from $1.5 trillion (5.9 percent of GDP) in 2023 to $2.7 trillion (6.8 percent of GDP) in 2033.

The FY 2023 deficit will be $200 billion, or 0.5 percentage points of GDP, lower under the post-FRA baseline than CBO projected in its May baseline.

Under our post-FRA Alternative Scenario, deficits would grow much faster than under current law. We estimate that deficits would total $26.1 trillion (7.3 percent of GDP) over the FY 2023 to 2033 period. Specifically, the deficit would grow from $1.8 trillion (6.8 percent of GDP) in 2023 to $3.5 trillion (8.9 percent of GDP) by 2033. The FY 2023 nominal dollar deficit would be the highest on record under this scenario.

Meanwhile, both CBO's May baseline and the post-FRA baseline expect interest costs to more than double from $663 billion in FY 2023 to $1.4 trillion in 2033. As a share of the economy, interest costs would grow from 2.5 percent of GDP in 2023 to 3.7 percent in 2033 under CBO's May baseline, but instead they will reach 3.6 percent by 2033 under the post-FRA baseline (the post-FRA baseline projects about $40 billion of lower interest costs in FY 2033). Either way, interest in FY 2033 will be above the prior record of 3.2 percent of GDP.

Under our post-FRA Alternative Scenario, interest costs would grow from $665 billion in FY 2023 to $1.6 trillion in 2033. As a share of GDP, interest would grow to a record 3.9 percent of GDP by 2033.

Despite recent enactment of the largest deficit reduction package in nearly a dozen years, the national debt is still unsustainable under current law, and the fiscal outlook could be substantially worse if policymakers engage in a series of irresponsible actions while revenue losses persist. In particular, they should reject any efforts to extend any parts of the Tax Cuts and Jobs Act without offsets and instead work to enact further substantial deficit reduction to put debt on a more sustainable path.

*****

Appendix: Bridge from Current Law to Alternative Scenario

| Assumptions in Alternative Scenario | Billions of Dollars | % of GDP |

|---|---|---|

| Debt in FY 2033 Under Post-FRA Baseline | $45,181 billion | 115.0% |

| Incorporate Weak Revenue Collections | $440 billion | +1.1% |

| Adopt FY 2024 and FY 2025 discretionary spending caps with side agreements and grow with GDP after caps expire | $1,417 billion | +3.6% |

| Remove Certain Extrapolated One-Time Infrastructure Funding | -$228 billion | -0.6% |

| Extend TCJA Individual Rate Cuts | $1,810 billion | +4.6% |

| Extend TCJA Other Individual Provisions | $678 billion | +1.7% |

| Extend TCJA Estate Tax Cuts | $126 billion | +0.3% |

| Extend TCJA Bonus Depreciation | $325 billion | +0.8% |

| Remove Other TCJA Tax Rule Tightening | $150 billion | +0.4% |

| Extend Enhanced ACA Premium Tax Credits | $271 billion | +0.7% |

| Extend Other Temporary Tax Provisions ("Tax Extenders") | $56 billion | +0.1% |

| Extend Trade Promotion Programs | $15 billion | +<0.1% |

| Interest | $670 billion | +1.7% |

| Increase in Debt Under Post-FRA Alternative Scenario | $5,729 billion | +14.6% |

| Debt Under Post-FRA Alternative Scenario | $50,910 billion | 129.6% |

Sources: Congressional Budget Office and Committee for a Responsible Federal Budget. Numbers may not sum due to rounding.