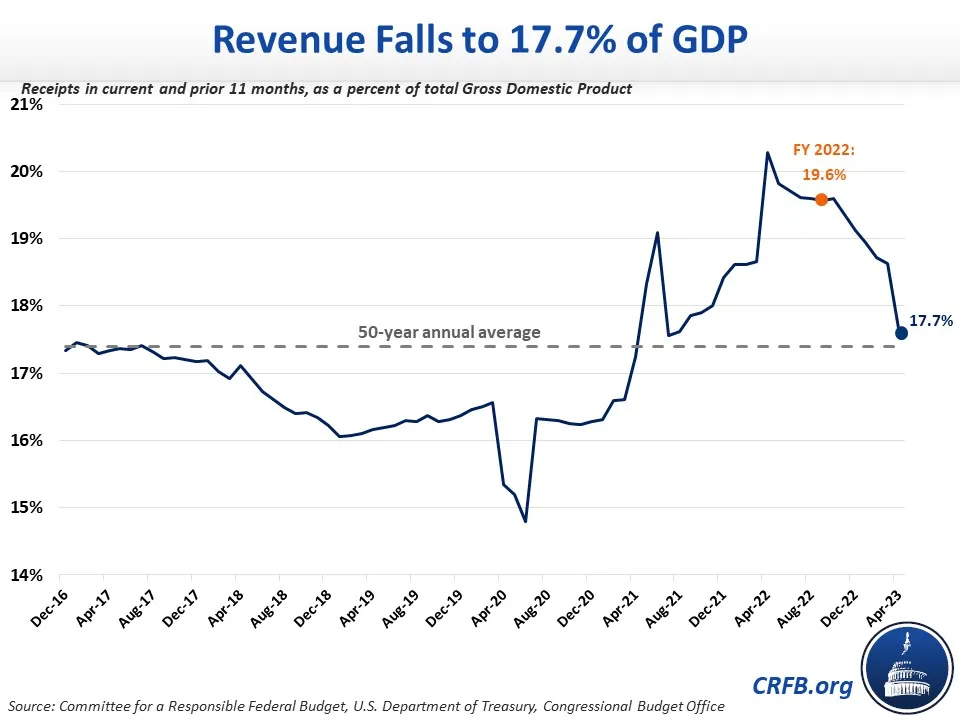

Revenue Surge Comes to an End

After surging to a near-record 19.6 percent of Gross Domestic Product (GDP) last fiscal year, revenue has fallen to 17.7 percent of GDP over the past year, near its historical average of 17.4 percent, and is continuing to fall. Receipts this April were particularly weak, coming in $225 billion, or 26 percent, below last year's levels.

Although advocates on the left and right attributed the recent surge in revenue to strong economic and pandemic policies or the delayed effect of pro-growth tax cuts, these explanations seem unlikely given the very temporary nature of the surge. The more likely explanation is that high capital gains realizations in 2021 and the recent spike in inflation combined to produce the one-time revenue boost. Most tax provisions are indexed to inflation on a lag, and so one-time inflation gains have now largely disappeared.

Along with a rapid rise in spending, this fall in revenue has caused the 12-month rolling deficit to surge to nearly $2 trillion as of April. As structural deficits continue to trend upward and revenue stabilizes, lawmakers should work to restrain spending and enact policies that put our debt on a more sustainable path.