W&M Tax Bill Undermines FRA Savings

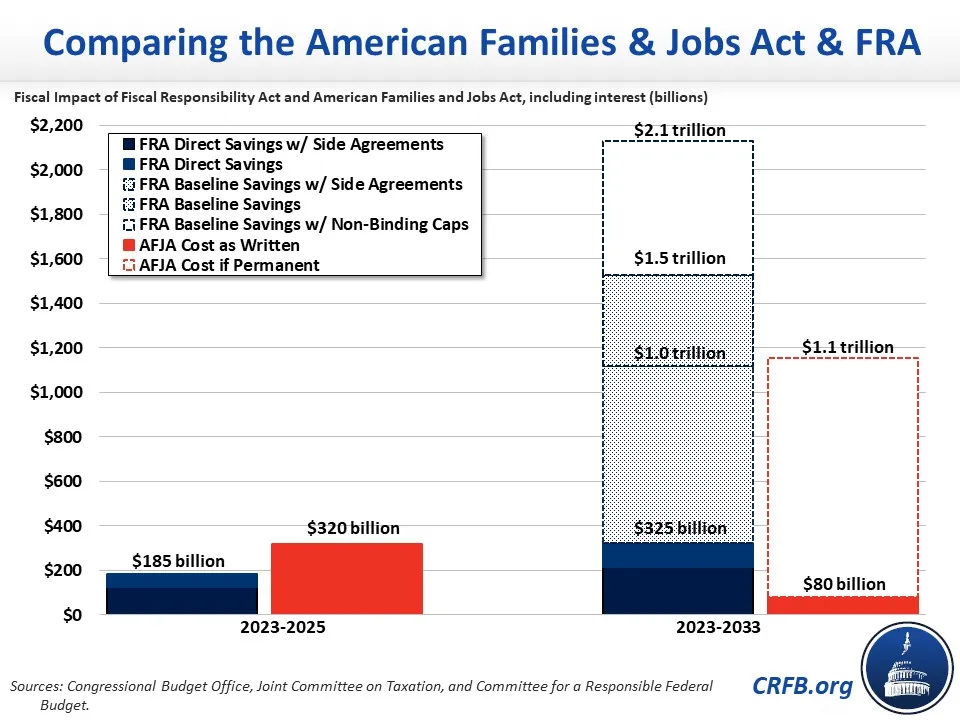

The American Families and Jobs Act (AFJA) that recently passed the House Ways and Means Committee would add $320 billion to the deficit over the next 28 months – wiping away the near-term savings from the Fiscal Responsibility Act (FRA) 1.7 to 2.6 times over. If made permanent, we estimate the AFJA would add over $1.1 trillion to the national debt over a decade, wiping out over three-quarters of the FRA's total deficit reduction as written, more than half of the FRA's savings if non-binding appropriations targets are met, and more than all of the FRA's savings after various "side deals" made outside the FRA are incorporated.

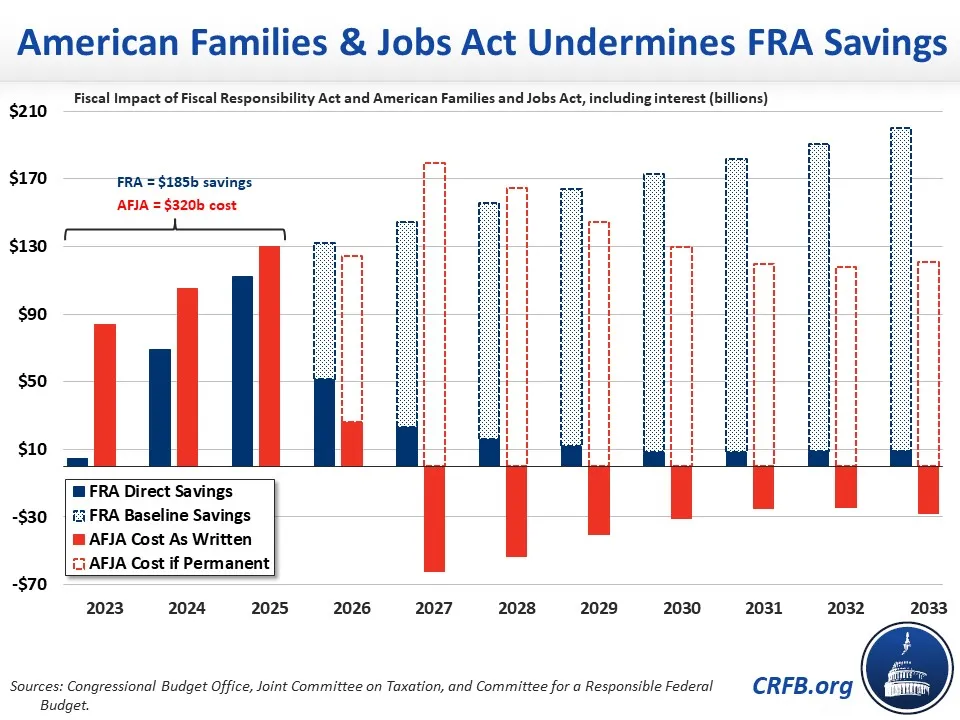

The AFJA tax cuts would add about $80 billion to the debt through Fiscal Year (FY) 2033, but its near-term costs are about four times as large – $320 billion through the end of FY 2025. This is about 72 percent larger than the expected savings from the FRA spending reduction over that period and on par with the total direct savings from the FRA through 2033.

The cost of the tax cut bill as written begins to fade over time, mainly due to a series of arbitrary expirations at the end of calendar year 2025, but also because of the time-specific nature of the policies (especially depreciation rules) and the emergence of offsets later in the budget window. Over that same period, the FRA's discretionary spending caps are expected to generate indirect savings, as scorekeepers assume most discretionary spending will grow with inflation after most caps expire.1

Yet applying a similar treatment to the tax cuts as to the spending levels – assuming both are continued beyond their expiration – the tax cuts would reverse over three-quarters of the FRA's deficit reduction. That is, its $1.1 trillion of ten-year costs would counter most of the FRA's $1.5 trillion of savings.

Should appropriators adhere to the out-year (FY 2026 through FY 2029) discretionary spending targets outlined in the FRA, the bill's ten-year deficit reduction would increase to $2.1 trillion, meaning the over $1.1 trillion cost of the AFJA would eliminate over half of this deficit reduction. On the other hand, if the various "side deals" made outside of the FRA are adopted, the ten-year savings from the bill would fall to $1.0 trillion, meaning a permanent version of the AFJA would eliminate more than all of the FRA's deficit reduction.

Even without accounting for these medium-term effects, the short-term effects of the AFJA's tax cuts would be inflationary, mostly or fully countering the inflation-fighting power of the FRA. In doing so, it could increase the risk of an economic recession.

After taking an important step forward and enacting the Fiscal Responsibility Act – the largest deficit reduction package in almost a dozen years – the unpaid-for tax cuts in the American Families and Jobs Act would be a big step backward. Now is not the time to backtrack on fiscal improvements.

1 Although appropriators will be able to set discretionary spending at any level of their choosing - increasing spending above or below the rate of inflation - they generally set levels based primarily on the prior year, and so it is reasonable to assume a reduction in 2025 levels will carry forward in future years.