Treasury: FY 2022 Deficit Was $1.4 Trillion

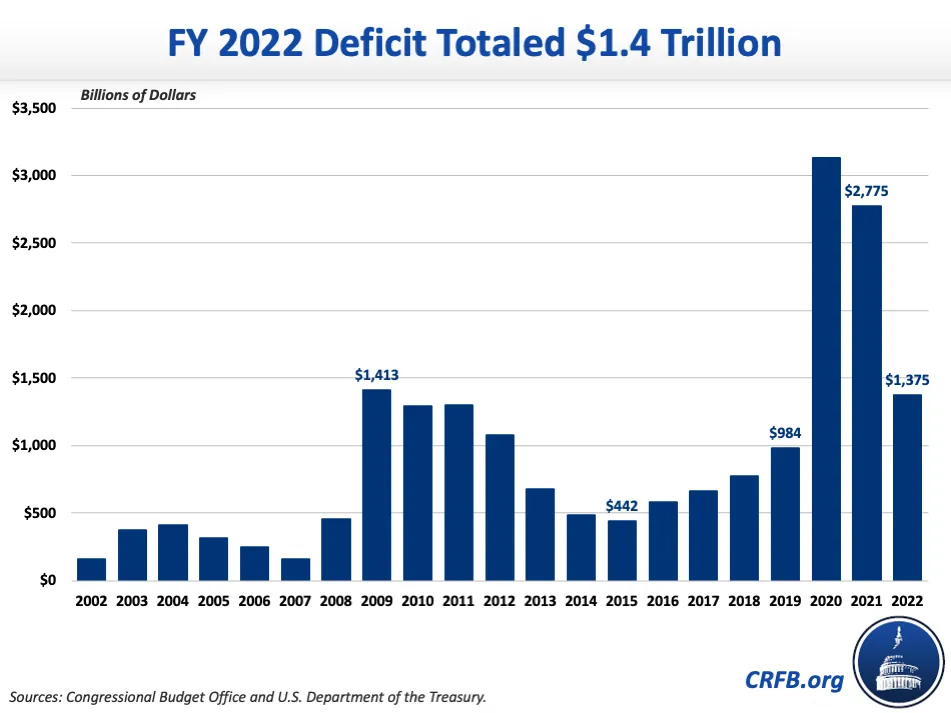

The US Department of the Treasury released its final Monthly Treasury Statement for Fiscal Year (FY) 2022, showing a $1.4 trillion deficit for the year. The actual FY 2022 deficit is $339 billion higher than the $1.0 trillion deficit the Congressional Budget Office (CBO) projected in its May 2022 Budget and Economic Outlook and $1.4 trillion below the FY 2021 deficit of $2.8 trillion.

While the Biden Administration has tried to take credit for this "historic deficit reduction," the fall can be more than fully explained by expiring COVID relief – with improvements from economic changes (which will increase deficits in future years) offset by higher spending from student debt cancellation. The $1.4 trillion FY 2022 deficit represents the fourth-largest nominal dollar deficit in history, and deficits will need to fall substantially further to put the debt on a sustainable path.

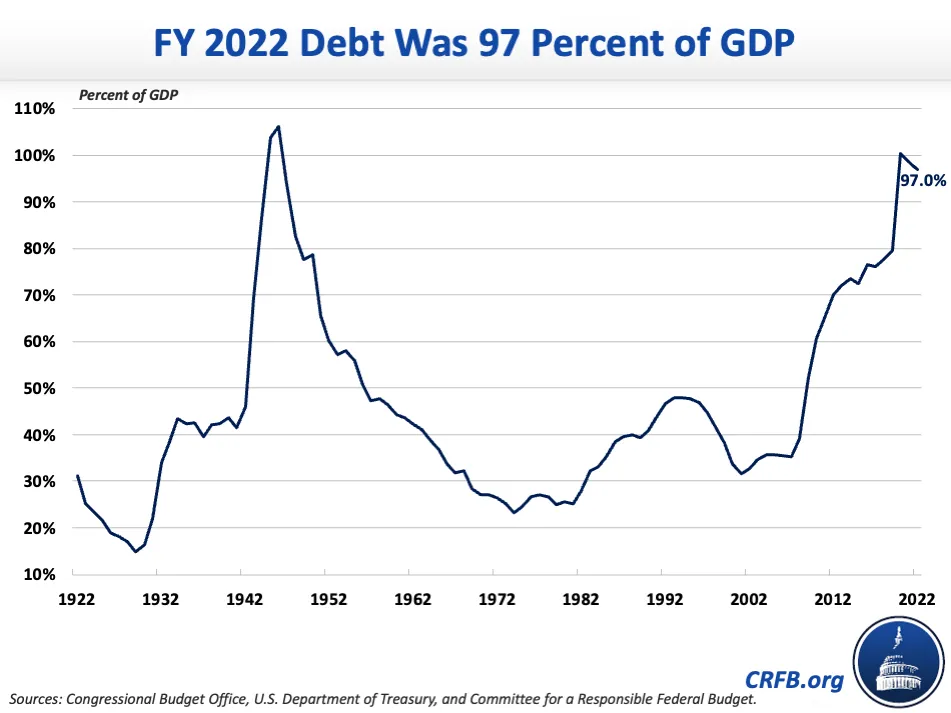

As deficits remain high, debt continues to rise – from $22.3 trillion at the end of FY 2021 to $24.3 trillion a the end of FY 2022. As a share of GDP, the Administration estimates a slight decline from 98.4 percent at the end of FY 2021 to 97.0 percent of GDP at the end of FY 2022. This puts debt at more than twice the 50-year historic average and within a few percentage points of the previous record set just after World War II.

At $1.4 trillion, the FY 2022 deficit is $1.4 trillion less than FY 2021's $2.8 trillion deficit, but $391 billion more than the pre-pandemic deficit of $984 billion recorded in FY 2019 and is the fourth largest nominal deficit in history. At 5.5 percent of GDP, it's the twelfth-largest deficit as a share of the economy. The deficit ended up being $339 billion more than the $1.0 trillion deficit CBO projected in May.

While the deficit fell significantly from its FY 2021 level, that drop can be more than entirely explained by the waning of one-time COVID relief. In total, we estimate declining COVID relief explains roughly $1.45 trillion – or 104 percent – of the deficit drop. That includes most of the $359 billion (90 percent) drop in unemployment benefit spending, the $486 billion (62 percent) reduction in refundable tax credits (including recovery rebates), the $300 billion (93 percent) fall in Small Business Administration spending, and the $138 billion (56 percent) reduction in spending from the Coronavirus Relief Fund.

Revenue also increased substantially – from $4.0 trillion in FY 2021 to $4.9 trillion in 2022. Individual income tax revenue in particular rose by $588 billion (29 percent) while corporate income tax revenue rose by $53 billion (14 percent). These increases are due to a combination of strong economic and labor force growth, very high rates of inflation, large capital gains from asset sales, and changes in tax rules and timing due to various COVID relief bills.

A Closer Look at the FY 2022 Deficit

| Budget Area | FY 2021 | FY 2022 | % Change |

|---|---|---|---|

| Social Security | $1,135 billion | $1,219 billion | +7% |

| Medicare | $696 billion | $755 billion | +8% |

| Medicaid | $521 billion | $592 billion | +14% |

| Refundable Tax Credits | $778 billion | $292 billion | -62% |

| Coronavirus Relief Fund | $243 billion | $106 billion | -56% |

| Unemployment Benefits | $394 billion | $38 billion | -90% |

| Small Business Administration (mostly PPP) | $323 billion | $23 billion | -93% |

| Department of Education | $260 billion | $639 billion | +145% |

| Military | $718 billion | $727 billion | +1% |

| Interest on the Debt | $352 billion | $475 billion | +35% |

| Other | $1,398 billion | $1,406 billion | +1% |

| Total Spending | $6.8 trillion | $6.3 trillion | -8% |

| Individual Income Taxes | $2,044 billion | $2,632 billion | +29% |

| Payroll Taxes | $1,314 billion | $1,484 billion | +13% |

| Corporate Income Taxes | $372 billion | $425 billion | +14% |

| Fed Remittances | $100 billion | $107 billion | +7% |

| Other | $216 billion | $249 billion | +15% |

| Total Revenue | $4.0 trillion | $4.9 trillion | +21% |

| Deficit | -$2.8 trillion | -$1.4 trillion | -50% |

Sources: Congressional Budget Office, U.S. Department of Treasury, and Committee for a Responsible Federal Budget.

Numbers may not sum due to rounding.

Some changes did worsen the overall deficits. The largest increase in non-COVID spending was for the Department of Education, a $379 billion (145 percent increase) driven largely by the $380 billion cancellation of $10,000 to $20,000 per borrower of student debt. Absent that cancellation, the budget deficit would have been roughly $1 trillion. Spending on Social Security was 7 percent higher, largely due to the 5.9 percent cost-of-living adjustment (COLA). And Medicare and Medicaid spending grew by 8 percent and 14 percent, respectively, due to higher payment rates and growing enrollment. Interest costs also grew by a massive 35 percent, largely due to rising rates and the effect of surging inflation on inflation-indexed bonds.

While the deficit did decline significantly between FY 2021 and 2022, it remains far too high, and the decline can be more than completely explained by waning or expiring COVID relief. With inflation surging, interest rates rising, and debt approaching record levels, it is time for Congress and the President to start focusing on deficit reduction.