Obamacare Replacement Could Save $2 Trillion Over Two Decades

Update (3/23/2017): These numbers are relevant for the original version of the American Health Care Act. An amended version was released on March 20. CBO scored the amended version on March 23.

The Congressional Budget Office's (CBO) estimate of the American Health Care Act (AHCA) finds it will reduce deficits by $337 billion through 2026 (read our analysis here). But what would it mean for the long term?

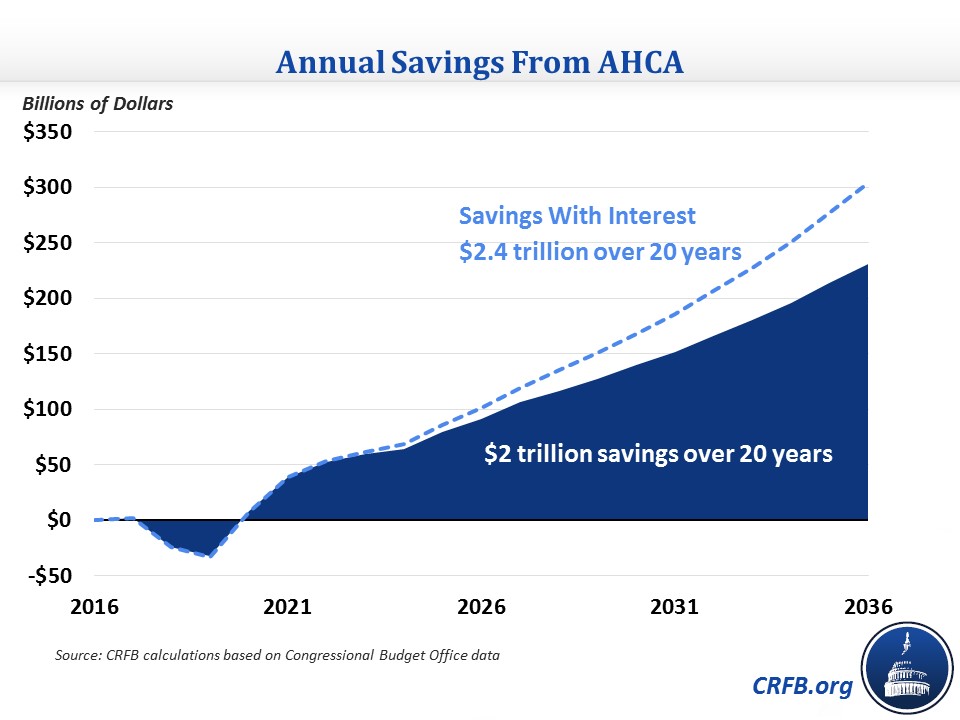

While CBO hasn't yet provided second decade estimates (other than to say the bill would not be deficit-increasing), we estimate – very roughly – that the bill would save $2 trillion over two decades, including $1.6 trillion between 2027 and 2036. Including interest, we estimate 20-year savings of $2.4 trillion. However, the bill also includes several "cliffs" that if addressed could significantly reduce that estimate.

Based on our extrapolations, savings from repealing the Affordable Care Act (ACA) coverage provisions (including mandates) and limiting Medicaid growth would save $3.6 trillion in the second decade (compared to $1.5 trillion in the first), new AHCA tax credits and spending would cost $950 billion in the second decade (compared to $450 billion in the first decade), and repealing various ACA taxes would cost $1.05 trillion in the second decade (compared to $575 billion in the first decade). In other words, savings in the legislation would grow faster than the costs and from a higher starting point.

A few major factors are responsible for this growing deficit reduction. First, new savings are phased in in the first decade and thus don't save as much initially as over time. Second, new spending on the tax credits is likely to grow slower than spending on the ACA credits and subsidies because of the way they are indexed. Third, certain costs like the Patient and State Stability Fund and delay of the Cadillac tax are temporary, so they don't have budgetary effects beyond the first ten years. Finally, the per-capita caps in the Medicaid program will tend to generate increasing savings over time since these caps grow slower than the current Medicaid program.

The result of these factors is that the bill would save $1.6 trillion in the second decade, or $2 trillion including interest. This net deficit reduction is just over one-half a percent of Gross Domestic Product (GDP) over the second ten-year period. Combined with the first decade's savings, the AHCA would save $2.4 trillion over the first 20 years including interest, which would reduce debt in 2036 by 6 percent of GDP (from 117 percent to 111 percent).

20-Year Estimate of American Health Care Act

| Provision | 2017-2026 Cost / Savings (-) | 2027-2036 Cost / Savings (-) |

|---|---|---|

| Repeal ACA Coverage Provisions and Limit Medicaid Growth | -$1.46 trillion | -$3.60 trillion |

| Increase Spending and Tax Subsidies | $542 billion | $950 billion |

| Repeal ACA Taxes | $575 billion | $1.05 trillion |

| Primary Deficit Impact | -$337 billion | -$1.6 trillion |

| Interest | -$21 billion | -$400 billion |

| Total Deficit Impact | -$358 billion | -$2 trillion |

Sources: Congressional Budget Office, CRFB calculations

Our estimates are extremely rough as they are based on broad rules of thumb that may not apply to each piece of the legislation. Estimates are particularly uncertain since we can't anticipate how insurance coverage would change in the second decade given the expiration of the Stability Fund in 2026 and the tightening of the Medicaid per-capita caps over time. Significant changes in any of these areas could affect the savings in Medicaid or the cost of the new subsidies. These estimates represent our best effort to anticipate how these different budgetary effects would grow over time.

It is also worth noting that the AHCA's long-term savings could be significantly lower if various temporary policies were continued. For example, if the Cadillac tax were repealed beyond 2025 (the tax has already been delayed once before and would be again under this legislation) it could cost over $600 billion over 20 years, reducing net savings by over one-quarter. If the Stability Fund were continued beyond 2026 – even without an inflation adjustment – it would cost another $100 billion. Together, these two changes – both of which are likely to occur – would reduce 20-year non-interest savings from $2 trillion down to $1.3 trillion.

Efforts to avoid eroding tax credit and Medicaid payments could further reduce long-term savings. For example, if the tax credits and Medicaid (and Stability Fund) were allowed to grow with health care costs* after 2026, in combination with the changes above, net 20-year savings would drop to below $1 trillion.

In other words, while the AHCA would save significant money over time, it could also create pressure to spend this savings like the ACA did.

We hope that as policymakers amend and adjust the AHCA, they continue to work to generate long-term debt reduction and to do so in a sustainable way that also helps to slow health care cost growth.

*As measured by the current growth rate of ACA and Medicaid spending in CBO's baseline.