New Projection: Federal Debt Will Reach Record Levels Sooner Than Expected

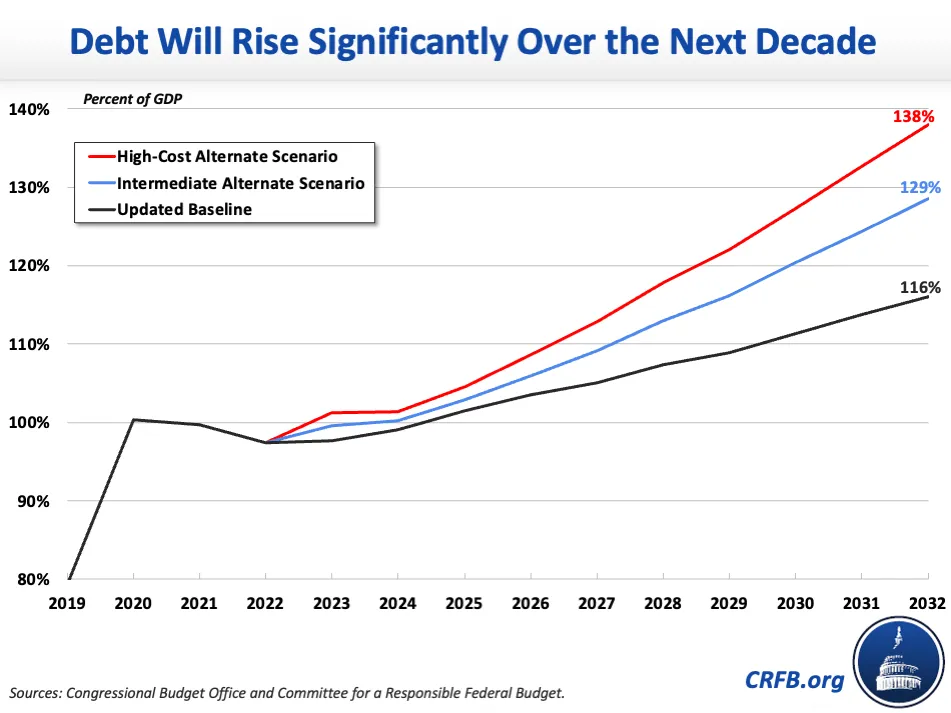

The nation’s fiscal and economic outlook has deteriorated substantially since the last Congressional Budget Office (CBO) baseline in May, when CBO projected debt would reach a record 110 percent of Gross Domestic Product (GDP) by 2032. Under an updated current law baseline, we now project debt in 2032 will reach 116 percent of GDP, deficits will reach 6.6 percent of GDP, and interest will reach a record 3.4 percent of GDP. Under a more pessimistic (and in many ways realistic) scenario, debt in 2032 would reach 138 percent of GDP, deficits would reach 10.1 percent, and interest would total 4.4 percent of GDP. These projections suggest an unsustainable fiscal trajectory.

2032 Fiscal Metrics by Scenario (Percent of GDP)

| Scenario | Debt | Deficit | Interest |

|---|---|---|---|

| CBO May 2022 Baseline | 110% | 6.1% | 3.3% |

| Updated Baseline | 116% | 6.6% | 3.4% |

| Intermediate Alternate Scenario | 129% | 8.6% | 3.9% |

| High-Cost Alternate Scenario | 138% | 10.1% | 4.4% |

Sources: Congressional Budget Office and Committee for a Responsible Federal Budget.

In its May baseline, CBO projected the national debt would reach $40.2 trillion, or 110 percent of GDP, by 2032. Since that time, inflation and interest rates have been higher than CBO projected, economic growth has stagnated, and a swath of costly legislative and executive actions have been enacted.

Specifically, we estimate legislative and administrative changes have added about $1.6 trillion to the debt in total, while economic and technical changes – based on actual economic and fiscal data along with the Federal Reserve's median economic forecast – will add $2.4 trillion to the debt.

Under our updated baseline scenario, which incorporates these factors and also subtracts about $920 billion of borrowing for baseline adjustments related to the infrastructure bill, we find debt would reach a massive 116 percent of GDP by 2032.

We also produce two alternate scenarios that reflect the reality that the actual fiscal outlook could be far worse than our baseline projects.

The intermediate alternate scenario assumes that lawmakers will extend the expiring individual tax cuts in the Tax Cuts and Jobs Act beyond 2025 and that, in light of recent national security and other needs, discretionary spending will grow somewhat faster than inflation and total about half a percent of GDP higher than projected by the end of the decade. This scenario also includes more pessimistic economic assumptions, with interest rates, inflation, and long-term economic growth halfway between the Fed's central and most pessimistic estimates. The result is $4.3 trillion of additional debt by 2032.

The high-cost alternate scenario assumes that several other costly expiring provisions are extended – including various expiring business tax provisions, expanded Affordable Care Act subsidies, and expiring health "extenders" – and assumes discretionary spending grows with output so that it is about 1 percent of GDP higher than projected by 2032. This high-cost scenario also assumes that a recession occurs in 2023 and adopts the Fed's most pessimistic forecasts for inflation, interest rates, and long-term economic growth. The result is $7.4 trillion of additional debt by 2032.

These higher debt levels would also mean higher deficits. While the CBO baseline estimates the deficit will reach 6.1 percent of GDP ($2.25 trillion) in 2032, our updated baseline finds the deficit will reach 6.6 percent of GDP ($2.4 trillion) by 2032. In our intermediate alternate scenario, the deficit would reach 8.6 percent of GDP ($3.2 trillion) by 2032, and in our high-cost scenario it would reach 10.1 percent of GDP ($3.7 trillion) in 2032.

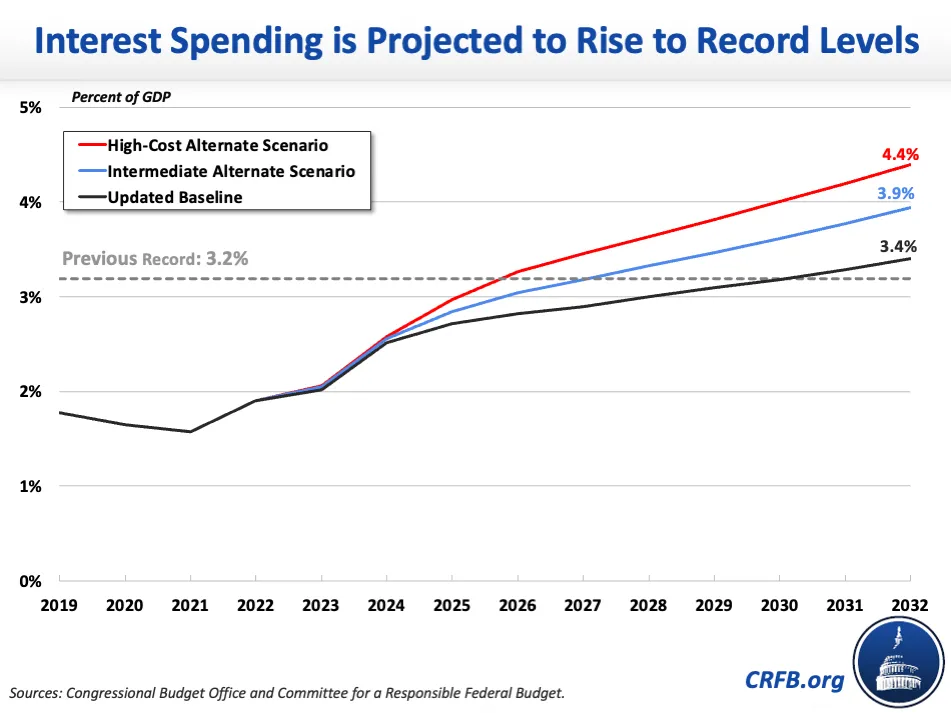

Perhaps most troubling is the effect of these changes on interest spending. Under CBO's baseline, interest costs were already projected to triple from roughly $400 billion in 2022 to $1.2 trillion in 2032. As a result of higher debt and higher interest rates, we now expect them to rise to $1.3 trillion in our baseline scenario, $1.4 trillion in our intermediate scenario, and $1.6 trillion in our high-cost alternate scenario.

As a share of the economy, interest costs would be in uncharted territory. In all of American history, federal interest costs have never exceeded 3.2 percent of GDP. We project interest costs will reach 3.4 percent of GDP by 2032 under our baseline scenario, 3.9 percent under the intermediate alternate scenario, and 4.4 percent under the high-cost alternate scenario.

At the same time as inflation is surging and interest rates are rising, our new projections show that the United States faces an unsustainable fiscal outlook. Policymakers should come together and act quickly to put forward a plan that would help the Federal Reserve fight inflation in the near term while putting deficits and debt on a more sustainable long-term path. The CRFB Fiscal Blueprint for Reducing Debt and Inflation provides a framework to tame inflation, reduce recession risk, address expiring policies, stabilize the national debt as a share of output, grow the economy, secure trust funds, and improve fairness and efficiency in the budget and tax code.

Policymakers need not enact the CRFB Fiscal Blueprint in full, but they should begin taking steps in the right direction. At an absolute minimum, they should commit not to add any more to the debt in the remaining two months of 2022.

Appendix: Bridge from Current Law to Updated Projection and Alternate Scenarios

| Policy | 2032 Debt Effect |

|---|---|

| CBO May 2022 Baseline | $40.2 trillion |

| Legislative Actions | $730 billion |

| Executive Actions | $565 billion |

| Infrastructure Baseline Adjustments | -$920 billion |

| Economic and Technical Changes | $2.3 trillion |

| CRFB Updated Projections | $42.9 trillion |

| Extend TCJA Individual Tax Cuts | $2.4 trillion |

| Assume Interim Rules Are Finalized | $320 billion |

| Grow Discretionary Spending with Avg. of GDP and Inflation | $740 billion |

| More Pessimistic Economic Assumptions | $800 billion |

| Intermediate Alternate Scenario | $47.2 trillion |

| Extend Other Expiring Provisions | $1.5 trillion |

| Grow Discretionary Spending with GDP | $740 billion |

| Fully Pessimistic Economic Assumptions | $915 billion |

| High-Cost Alternate Scenario | $50.3 trillion |

Sources: Congressional Budget Office and Committee for a Responsible Federal Budget. Note: Executive actions that have been announced but not finalized – including student debt cancellation, which was recently ruled illegal in a lower court – are assumed to have a 50 percent chance of going into effect as per current scorekeeping assumptions. We assume they are fully in effect in our alternate scenarios.

Furthermore, the bridge does not account for the effects of changes in inflation and GDP to the denominator of the debt-to-GDP ratio. As an example, $50.3 trillion would total 137 percent of CBO's GDP forecast ($40.2 trillion is 110 percent). Against our updated GDP forecast, it would total 138 percent of GDP.