Income Growth Would Slow Due to Rising Debt

A new report from the Congressional Budget Office (CBO) finds rising debt will slow economic growth and result in lower incomes than they would be otherwise. Compared to a scenario in which the national debt as a share of Gross Domestic Product (GDP) remains stable, CBO estimates:

- Debt growth under current law will lead average income growth to slow by 10 percent over the next 30 years and by 9 percent annually by Fiscal Year (FY) 2050.

- Rapidly rising debt could slow income growth by 30 percent over the next 30 years and by 38 percent annually by FY 2050.

- Average incomes per person will be around $4,500 lower under the current debt path and could be as much as $14,000 lower under rapidly rising debt.

In 2025, CBO estimates average income, as measured by real Gross National Product (GNP) per person, will total about $90,000. Assuming debt were to remain constant at 100 percent of GDP through 2055, CBO projects average incomes would grow to around $136,500. Rising debt, however, would head off much of this progress.

Under current law, CBO estimates debt as a percent of GDP will rise from 100 percent in 2025 to 156 percent in 2055. As we have discussed before, such increases in debt harm economic growth and as a result lower incomes by, among other things, crowding out private investment and increasing inflation. CBO estimates our current debt trajectory will cause the growth in per-person income to slow by 10 percent through 2055 compared to a stable debt.

If debt were to increase more rapidly, income growth could slow further. CBO projects a scenario in which discretionary spending and revenues return to their 30-year historical averages, which would raise debt to 242 percent of GDP by 2050. Based on CBO’s projections, we estimate such a debt increase would cause per-person income to grow by 30 percent less over 30 years.1

By FY 2055, we estimate per-person income, in 2025 dollars, will be about $14,000 less under the rising debt scenario versus the stable debt scenario. This represents a 10 percent reduction in per-person income. Under CBO’s current law baseline, real income per person would be around $4,500 lower. Under both the rising debt and current law scenarios, these gaps would grow.

In fact, rising debt slows income growth at an increasing pace over time.

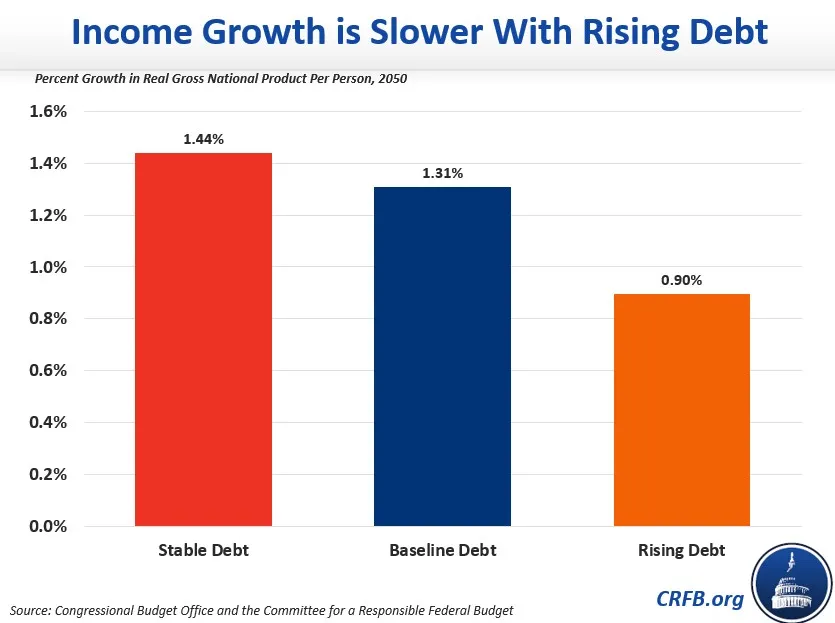

In a stable debt scenario, CBO projects annual per-person income growth would equal 1.4 percent by FY 2050. Under a current law baseline, however, income growth falls by nine percent to 1.3 percent. And under a scenario in which debt rises rapidly, income growth falls further to 0.9 percent. In that event, income growth will be 38 percent slower in that year than it would be in a scenario with stable debt.

CBO projects that rising debt will also slow economic growth and boost interest rates. Over the long term, we estimate based on CBO figures that real GDP growth will slow to about 1.1 percent per year with rapidly rising debt by FY 2050, compared to 1.5 percent per year with stable debt – leading to a 6 percent reduction in output by FY 2050.

Meanwhile, the average interest rate on federal debt is projected to rise to 4.2 percent with rising debt compared to 3.4 percent with stable debt. The gap for interest rates on new debt is likely to be significantly higher than that, flowing through to higher mortgage, car loan, and business loan interest rates.

To secure strong income and economic growth, and to keep interest rates low, policymakers should work to reduce deficits and to stabilize debt.

1In this scenario, CBO only projects GNP per person through FY 2050 due to the very high levels of debt after that period. We extrapolate the final five years.